|

|

Price forecast from 19 to 24 of June 2023

19 June 2023, 13:13

-

Grain market:

Apparently, the grain deal will cease to exist on July 17th. Accepting the fact that Europe will not rush to purchase Ukrainian grain, we will get a situation where a significant amount of grain will be concentrated on Ukrainian territory, and this will be the subject of bargaining in the fall. There will be the UN, there will be African countries, there will be individual personalities — the powers that be. And the market will follow what will happen to the Ukrainian harvest.

At the moment, the grain market quickly turned to growth, which may lead us to rise to 700.0 in wheat, and possibly to 750.0 cents per bushel. For corn, it is possible to reach the level of 650.0. Bring down the bullish impulse should be the first batch of new grain in mid-July.

It is noteworthy that Russia’s trade with other countries is becoming less elastic due to the inability to pay in dollars or euros and is moving into the mode of one-time transactions. When the trading fabric turns into patches, this will create problems with providing the population with goods. The first sign: bananas are now a strategic commodity and prices for it should be at low levels. Yes, just like palm oil.

Energy market:

There are rumors that Bank of China has stopped accepting payments in yuan from Russian banks to Western countries since June 13. It’s okay, then we will pay only to the countries of the East.

It’s good that the ball is round. You can move anywhere from anywhere. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Riyadh needs oil to stay above $80 a barrel or else the prince’s giant city project will be underfunded and the former pearl divers won’t be able to have a beautiful tomorrow for the foreseeable future. Therefore, KSA, by reducing production, will play both on its own side and on the side of Russia, which also needs oil revenues like air.

The Americans are working Iran with the promise of some cookies and buns in exchange for loyalty. After the Armenian president attended Erdogan’s inauguration, literally a week after he gave the disputed territories to Azerbaijan, there is nothing to be surprised about. The world is changing. Iran will now be offered so much that it may not resist. Washington can take not one million barrels of oil per day, but two or three (that is, in fact, everything that is, for the benefit of an example of oil supplies by barges to India from Russia before our eyes). And you can also build your own mega-city. The loss of Tehran is now extremely undesirable for Moscow. You will also have to offer something.

USD/RUB:

The Fed left the rate at 5.25%, but there was a comment that the increase could continue. This creates fundamental support for the dollar.

At the St. Petersburg, including economic, forum, we were told that it is very dangerous to keep savings in other currencies. Fine. We will not. We all enter the bonds of the Russian government, comrades. And we never leave them.

The exchange rate of the national currency remains under pressure. It will be extremely difficult to get back under 80.00. The outlook for the pair remains bullish with a target at 90.00. The current increase in spending will be offset by the depreciation, among other things. It’s already clear.

Note that with a 99% probability we will soon see privatization deals. Smells like the 90s.

The United States celebrates Juneteenth. Monday is a day off.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 5.7 thousand contracts. Buyers entered the market in small quantities, sellers left it. The spread between short and long positions narrowed. Sellers hold the edge.

Growth scenario: we are considering the July futures, the expiration date is July 15. The purchase was correct. We hold longs. Cancellation of the grain deal will warm up the market. A move to 770.0 is not ruled out.

Fall scenario: we will not sell. We quickly flew up.

Recommendations for the wheat market:

Purchase: no. Who is in position from 640.0, move the stop to 634.0. Target: 770.0.

Sale: no.

Support — 647.6. Resistance — 717.2.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more asset managers open short positions than long positions. Over the past week, the difference between short and long positions of managers increased by 46.4 thousand contracts. Vendors are fleeing the market in large numbers. The initiative goes to the buyers.

Growth scenario: we are considering the July futures, the expiration date is July 15. Very fast growth. There are no good levels to go long. Out of the market. We are looking for other opportunities.

Fall scenario: Admittedly, we didn’t see room for growth. And he did. Out of the market.

Recommendations for the corn market:

Purchase: no.

Sale: no.

Support — 613.6. Resistance is 648.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the July futures, the expiration date is July 15. We went up very high. Perhaps 1470 is the last level that will hold back the bulls. There are no interesting levels to buy. Out of the market.

Fall scenario: very high. Who would have thought that soy would shoot like that … This is a provocation. There will be a lot of this culture.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1490. Target: 1000.0. It can be aggressive.

Support — 1392.2. Resistance — 1500.6.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers decreased by 7.8 thousand contracts. Both buyers and sellers left the market, buyers did it a little more actively. The spread between long and short positions has narrowed, the bulls continue to control the situation.

Growth scenario: we consider the June futures, the expiration date is June 30. Let’s buy. However, capital risks should be halved. After rising above 77.90, it will be possible to add to the longs.

Fall scenario: let’s wait a little while with sales. The mood of Saudi Arabia remains militant. So it’s more up than down.

Recommendations for the Brent oil market:

Purchase: now. Stop: 72.90. Target: 90.00.

Sale: no.

Support — 72.97. Resistance is 77.81.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 4 units to 552 units.

Commercial oil reserves in the US increased by 7.919 to 467.124 million barrels, with the forecast of +1.482 million barrels. Inventories of gasoline rose by 2.108 to 220.923 million barrels. Distillate inventories rose by 2.123 to 113.854 million barrels. Inventories at Cushing rose by 1.554 to 42.133 million barrels.

Oil production has not changed and stands at 12.4 million barrels per day. Oil imports fell by -0.019 to 6.381 million bpd. Oil exports rose by 0.795 to 3.27 million barrels per day. Thus, net oil imports fell by -0.814 to 3.111 million barrels per day. Oil refining fell by -2.1 to 93.7 percent.

Gasoline demand fell by -0.025 to 9.193 million bpd. Gasoline production increased by 0.106 to 10.171 million barrels per day. Gasoline imports rose by 0.081 to 1.054 million barrels per day. Gasoline exports fell -0.031 to 0.957 million barrels per day.

Demand for distillates fell by -0.24 to 3.574 million barrels. Distillate production fell -0.255 to 4.988 million barrels. Distillate imports fell -0.036 to 0.136 million barrels. Exports of distillates rose by 0.029 to 0.216 million barrels per day.

Demand for petroleum products rose by 1.187 to 20.408 million barrels. Production of petroleum products increased by 1.587 to 23.359 million barrels. Imports of petroleum products fell by -0.082 to 2.062 million barrels. The export of petroleum products increased by 0.214 to 6.391 million barrels per day.

Propane demand fell by -0.35 to 0.57 million barrels. Propane production increased by 0.025 to 2.588 million barrels. Propane imports fell -0.026 to 0.076 million barrels. Propane exports fell -0.018 to 0.178 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers decreased by 10.3 thousand contracts. Both buyers and sellers entered the market, but more sellers came. The spread between long and short positions narrowed. The advantage in the market remains with the bulls.

Growth scenario: we are considering the August futures, the expiration date is July 20. Can buy. The 67.00 area marked itself as a good support.

Fall scenario: switched to a new contract. We stay in shorts.

Recommendations for WTI oil:

Purchase: now. Stop: 69.30. Target: 90.00.

Sale: no. Who is in position from 72.00, move the stop to 74.40. Target: 62.00?!

Support — 66.96. Resistance is 75.70.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, the expiration date is July 12. Went up. We will buy at current prices.

Fall scenario: we will refrain from sales for now. The Arabs keep the market.

Gasoil recommendations:

Purchase: now. Stop: 678.0. Target: 800.0.

Sale: no.

Support — 711.75. Resistance is 786.50.

Natural Gas. CME Group

Growth scenario: we are considering the July futures, the expiration date is June 28. Following the European market, the American market also went up. We hold longs.

Fall scenario: we will not sell yet. We need higher levels.

Recommendations for natural gas:

Purchase: no. Who is in position between 2.137 and 2.223, move the stop to 2.200. Target: 3.340.

Sale: no.

Support — 2.383. Resistance is 2.830.

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: we continue to be in a range. Support at 50,000 looks strong. We keep longs counting on the resumption of price growth.

Fall scenario: after the St. Petersburg forum, we will remove the recommendation for sale. The rise in fuel prices could be significant. We need to fill the budget.

Diesel market recommendations:

Purchase: no. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 50664. Resistance — 61504.

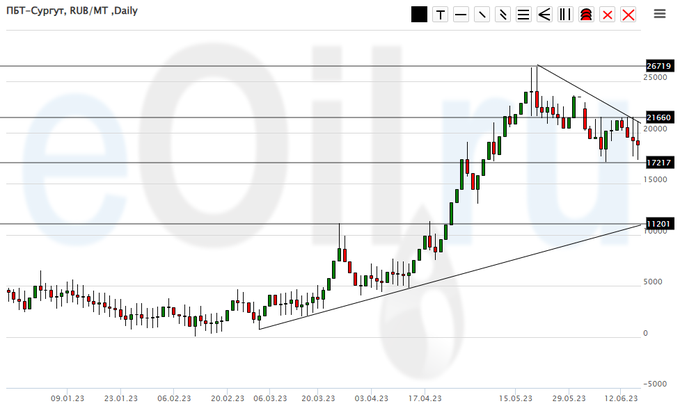

Propane butane (Surgut), ETP eOil.ru

Growth scenario: buy here, but keep in mind the possibility of falling to 15000.

Fall scenario: it is necessary to hold the previously opened shorts with the target at 15000, we do not open new positions.

Recommendations for the PBT market:

Purchase: now. Stop: 16800. Target: 30000. Also when approaching 15000. Stop: 14700. Target: 25000.

Sale: no. Who is in position from 21000, move the stop to 22700. Target: 15000.

Support — 17217. Resistance — 21660.

Helium (Orenburg), ETP eOil.ru

Growth scenario: It makes sense to rest a little on the current levels. Let’s buy.

Fall scenario: let’s move the stop orders to the current place of events for the shorts we have. We are not opening new positions.

Recommendations for the helium market:

Purchase: now. Stop: 3000. Target: 5000.

Sale: no. Who is in position from 3700, move the stop to 3600. Target: 2700.

Support — 2766. Resistance — 3906.

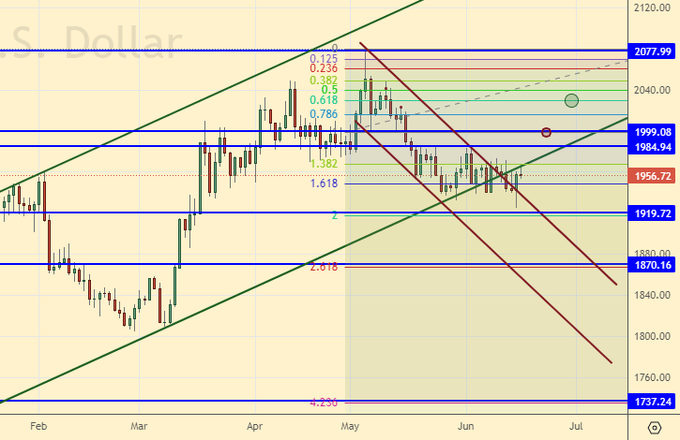

Gold. CME Group

Growth scenario: we continue to believe that only after growth above 2030 does it make sense to buy. While out of the market.

Fall scenario: holding shorts. We expect the market to fall 1850 (1700).

Recommendations for the gold market:

Purchase: think after rising above 2030.

Sale: approaching 2000. Stop: 2037. Target: 1850 (1700). Who is in position from 2020, keep the stop at 2037. Target: 1850 (1700).

Support — 1919. Resistance — 1984.

EUR/USD

Growth scenario: we hold longs, especially since the ECB raised the rate to 4%, while the Fed did not. Pullbacks are not ruled out, but overall sentiment is bullish.

Fall scenario: we will not go short yet. The euro has not yet won back the reduction in the spread between the rates of the Fed and the ECB.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position from 1.0720, move the stop to 1.0770. Target: 1.1900.

Sale: no.

Support — 1.0780. Resistance is 1.1007.

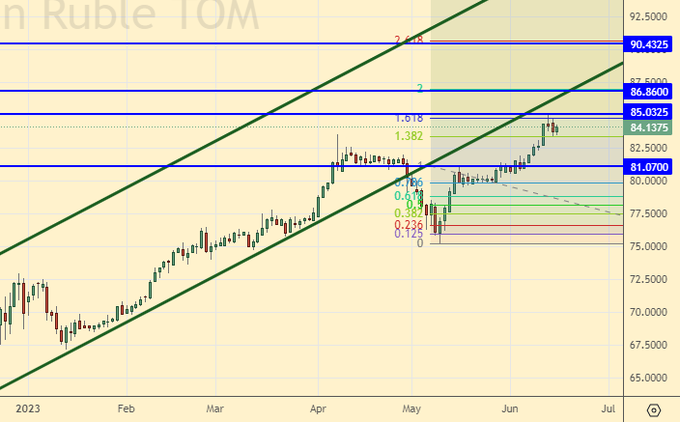

USD/RUB

Growth scenario: to re-enter long, a rollback to 81.00 is needed. We keep open longs.

Fall scenario: the market is not visible below 81.00. A rollback to this level can be worked out on the “watch”.

Recommendations for the dollar/ruble pair:

Purchase: not yet. Who is in position from 81.00, move the stop to 83.90. Target: 90.40.

Sale: no.

Support — 81.07. Resistance — 85.03.

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. We continue to hold long. The stock market is going crazy. Rather from hopelessness than from prospects. But we are growing. We take into account that the bulls can take the market to the 112000 area.

Fall scenario: we hold short with a stop order at 106700 (switched to a new contract).

Recommendations for the RTS index:

Purchase: no. Who is in position from 100000, keep stop at 101000. Target: 112000.

Sale: no. Who is in position from 104000, keep stop at 106700. Target: 90000.

Support — 103940. Resistance — 105900.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|