Price forecast from 5 to 9 of June 2023

05 June 2023, 11:55

-

Grain market:

Erdogan won the elections, and the Kremlin helped him. As much as I could, I helped. The coming to power of a rival Recep could lead to the fact that Turkey would cease to occupy a balanced policy at the moment, equidistant from everyone.

While we eat Turkish tomatoes. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Russian agrarians stopped supplying grain to exporters, counting on an increase in purchase prices. Reducing the export duty by 1,000 rubles per ton could really give impetus to a revision of the pricing policy on the part of buyers, but the «trouble» is that there is a lot of grain. And exporters understand that now this is their market. They can also, like farmers, go into standby mode. The financial situation will force farmers to make concessions. Yes, many will sell at cost, but this is the market. A new crop is on the way. June has begun.

Most likely, prices in the domestic market will remain low. This year, the peasants will not be able to take a good profit. Carryover stocks are too high. The forecasts for other countries are too good.

With Erdogan’s victory, one can talk about the extension in the future (revision in the present) of the grain deal. Inflation in Turkey is declining, but remains extremely high (50% per year), while the lira is falling. In such a situation, the President of Turkey cannot allow the price of bread to rise.

Energy market:

Information appeared on the network that Tokayev, on behalf of the entire people of Kazakhstan, offered Germany to replace Russian oil. And you know he can do it. If the Germans believe that they are not on the same path with Russia, but they know how to believe, and with fanaticism, then it will be extremely difficult for our exporters to return to the German market in a couple of years, or five.

The Americans finally agreed on a ceiling on the national debt, which relieved tension in the markets. Oil should have received a positive boost from what happened, but it looks like it will start to rise only after OPEC cuts in production. As of Sunday evening, there are rumors that the cartel’s production will be cut by 1 million bpd.

USD/RUB:

Ruble fans were left disappointed. While we were under 80.00, we could talk about options, for example, about falling to 73.00, now we have nothing left but to guess about the timing of when we will come to 90.00. It’s terrible, but it’s true. The ruble risks losing 12% of its purchasing power by the end of June.

With the adoption of the law on the ceiling of the national debt in the US, we will now hear nothing about the revision of the level of borrowing until the year 25, which should liberate the market public. In the medium term, this will remove the anxiety for the dollar and the markets will return to more measured work.

June 9 meeting of the Central Bank of the Russian Federation on rates. Even if the rate is raised by 0.5%, this will not help the ruble. He is likely to continue to lose ground against the US dollar.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between the long and short positions of managers increased by 6,000 contracts. Buyers left the market, sellers entered it in insignificant volumes. The spread between short and long positions widened. Sellers hold the edge.

Growth scenario: we are considering the July futures, the expiration date is July 15. And again, we are forced to stay out of the market for the third week in a row due to the lack of any clarity. We don’t buy.

Fall scenario: we refuse to sell at current prices. Market below.

Recommendations for the wheat market:

Purchase: no.

Sale: no.

Support — 573.2. Resistance — 624.2.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more asset managers open short positions than long positions. Last week the difference between short and long positions of managers decreased by 50.8 thousand contracts. Vendors fled the market in very large numbers. There is a feeling that trade is artificial. Someone got hurt.

Growth scenario: we are considering the July futures, the expiration date is July 15. The entire growth is built on the disruption of sellers’ stop orders. Corn with such positive forecasts cannot go up. We don’t buy.

Fall scenario: we continue to believe that the current rise in corn is a bluff. You can sell from current levels.

Recommendations for the corn market:

Purchase: no.

Sale: now. Stop: 627.0. Target: 500.0. Count the risks!!!

Support — 577.4. Resistance — 611.4.

Soybeans No. 1. CME Group

Growth scenario: we are considering the July futures, the expiration date is July 15. We found the level 1270 and bounced up from it. For now, we will refrain from buying, as the forecasts for soybeans are very good.

Fall scenario: we must hold positions. A descent to 1230 is likely, after which a full-fledged upward correction will follow.

Recommendations for the soybean market:

Purchase: no.

Sale: no. Who is in position from 1520.0, 1510.0 and 1445.0, keep the stop at 1430.0. Target: 1000.0.

Support — 1299.4. Resistance — 1383.2.

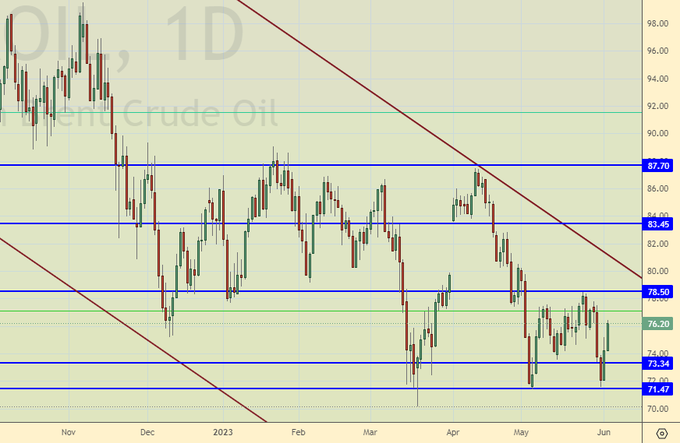

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 29.7 thousand contracts. Sellers actively left the market, a small number of buyers entered it. The spread between long and short positions widened, and the bulls strengthened their lead.

Growth scenario: we consider the June futures, the expiration date is June 30. Continued growth is questionable. We are taking a break from shopping for one week.

Fall scenario: in the face of uncertainty, we will have to abandon sales as well. Note that even if OPEC+ cuts production by 1 million barrels per day, this will not necessarily lead to higher prices.

Recommendations for the Brent oil market:

Purchase: no.

Sale: no.

Support — 73.34. Resistance is 78.50.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 15 units and now stands at 555 units.

Commercial oil reserves in the US increased by 4.489 to 459.657 million barrels, while the forecast was -1.101 million barrels. Inventories of gasoline fell by -0.207 to 216.07 million barrels. Distillate inventories rose by 0.985 to 106.657 million barrels. Inventories at Cushing rose by 1.628 to 38.858 million barrels.

Oil production fell by -0.1 to 12.2 million barrels per day. Oil imports rose by 1.367 to 7.217 million barrels per day. Oil exports rose by 0.366 to 4.915 million barrels per day. Thus, net oil imports rose by 1.001 to 2.302 million barrels per day. Oil refining increased by 1.4 to 93.1 percent.

Gasoline demand fell by -0.339 to 9.098 million bpd. Gasoline production fell -0.344 to 9.971 million barrels per day. Gasoline imports rose by 0.07 to 0.833 million barrels per day. Gasoline exports rose by 0.24 to 0.951 million barrels per day.

Demand for distillates fell by -0.552 to 3.646 million barrels. Distillate production increased by 0.165 to 5.04 million barrels. Distillate imports rose by 0.043 to 0.199 million barrels. Exports of distillates rose by 0.027 to 0.216 million barrels per day.

Demand for petroleum products fell by -1.259 to 19.442 million barrels. Oil products production fell by -0.649 to 21.937 million barrels. Imports of petroleum products increased by 0.082 to 2.096 million barrels. The export of petroleum products increased by 0.728 to 6.279 million barrels per day.

Propane demand fell by -0.131 to 0.687 million barrels. Propane production increased by 0.049 to 2.519 million barrels. Propane imports fell -0.016 to 0.072 million barrels. Propane exports rose by 0.01 to 0.169 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers decreased by 41.2 thousand contracts. Buyers left the market, sellers entered it. Someone is actively betting on the narrowing of the spread between Brent and WTI. The spread between long and short positions narrowed. The advantage of the bulls has shrunk.

Growth scenario: we are considering the July futures, the expiration date is June 20. We sank very hard. Our stop orders have been triggered. We take a break for one week.

Fall scenario: since we are not knocked out of the short, we will continue to hold it. Not the fact that the bulls will be able to turn the market up.

Recommendations for WTI oil:

Purchase: no.

Sale: no. Who is in position from 72.00, keep the stop at 75.30. Target: 62.00?!

Support — 67.01. Resistance — 74.74.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, the expiration date is July 12. As before, we continue to wait for the fall to 600.0. When this happens, it will be available for purchase.

Fall scenario: you can sell when you approach 750.0. Short from current levels looks underestimated.

Gasoil recommendations:

Purchase: when approaching 600.0. Stop: 570.0. Target: 800.0.

Sale: when approaching 750.0. Stop: 780.0. Target: 550.0?!

Support — 645.75. Resistance is 702.00.

Natural Gas. CME Group

Growth scenario: we are considering the July futures, the expiration date is June 28. The market gave an unpleasant surprise: we continued to fall. Here you can increase purchases, since the stop order did not work, but the picture as a whole looks very sad.

Fall scenario: we will not sell from current levels. Out of the market.

Recommendations for natural gas:

Purchase: no. Who is in position between 2.137 and 2.223, keep the stop at 2.100. Target: 3.340.

Sale: no.

Support — 2.000. Resistance — 2.233.

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: sluggish ascending channel. No one is going anywhere, under one pretext or another, prices in the country will rise. Why did all the processing plants simultaneously stand on the cap. repair. Why? In order to create an artificial shortage of fuel. However, the rise in prices will be without these tricks.

Fall scenario: for sales, we need growth to at least 70,000. In the meantime, we will be out of the market.

Diesel market recommendations:

Purchase: now. Stop: 49000. Target: 65000 (70000). Count the risks. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 50566. Resistance — 61504.

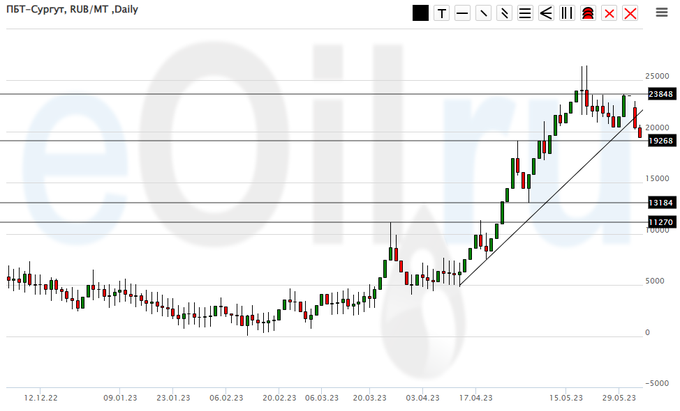

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we see that sales have begun. We are waiting for 15000 in order to buy.

Fall scenario: we will sell based on a rollback to 15,000.

Recommendations for the PBT market:

Purchase: when approaching 15000. Stop: 12000. Target: 25000.

Sale: now. Stop: 23000. Target: 15000.

Support — 19268. Resistance — 23848.

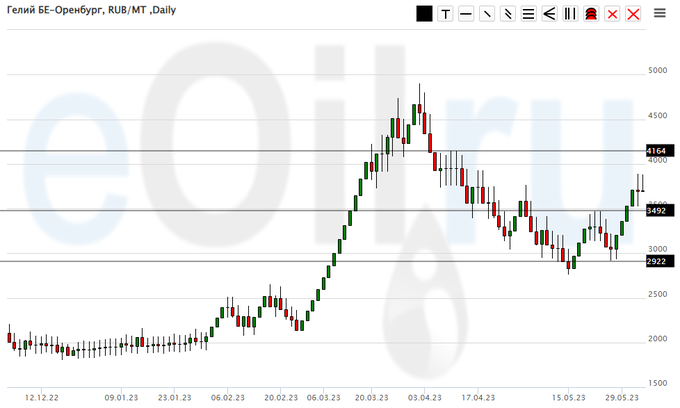

Helium (Orenburg), ETP eOil.ru

Growth scenario: keep longs. We want to see level 5000 again.

Fall scenario: This is where you can start thinking about shorts. Marks 4000 and 5000 are more interesting, but the current levels can also be worked out.

Recommendations for the helium market:

Purchase: no. Who is in position 2800, move the stop to 3100. Target: 5000.

Sale: now. Stop: 4400. Target: 2700. Also think when approaching 5000.

Support — 3492. Resistance — 4164.

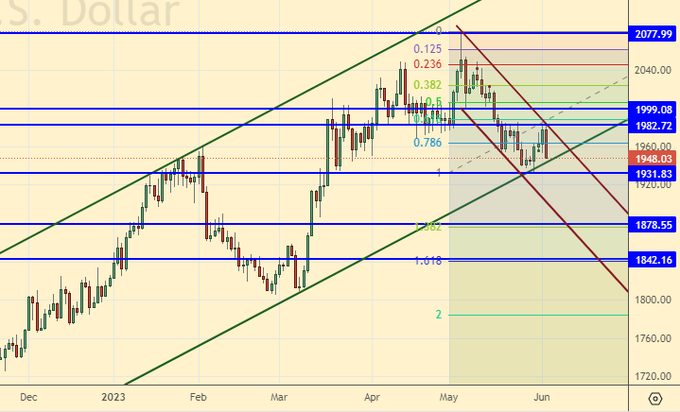

Gold. CME Group

Growth scenario: We widened the falling channel somewhat, with Red Friday so scary that we won’t be thinking about buying all week.

Fall scenario: holding shorts. We expect the market to fall 1850 (1700). Drop targets revised.

Recommendations for the gold market:

Purchase: no.

Sale: no. Who is in position from 2020, keep the stop at 2010. Target: 1850 (1700).

Support — 1931. Resistance — 1982.

EUR/USD

Growth scenario: we will fight. We will buy again. The euro may get a good reason to rise if the rate is raised in Europe, but not in the US.

Fall scenario: we must continue to hold the shorts. There are many support levels below, but we are able to pass them if the ECB does not raise rates on the 15th.

Recommendations for the EUR/USD pair:

Purchase: now. Stop: 1.0660. Target: 1.1900. It can be aggressive.

Sale: no. Who is in position from 1.1000, keep the stop at 1.0860. Target: 1.0100?!

Support — 1.0633. Resistance is 1.0781.

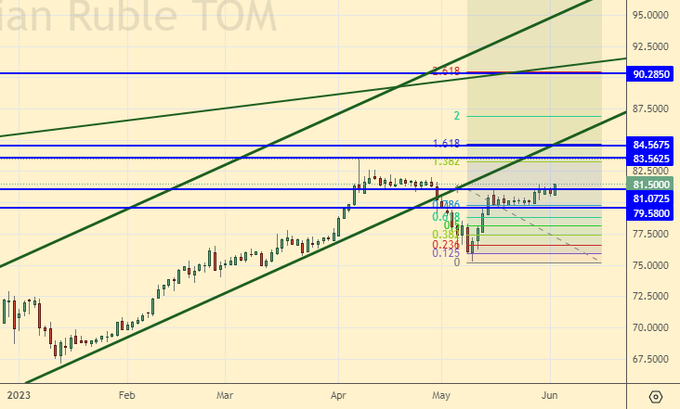

USD/RUB

Growth scenario: the picture looks good, but only for bulls. Too bad we’ll have to buy at current prices. We see the target 90.00. And so I wanted to see a rollback … Sorry for the emotion.

Fall scenario: nothing happened. The fall is postponed until better times. Out of the market.

Recommendations for the dollar/ruble pair:

Purchase: now. Stop: 80.80. Target: 90.20.

Sale: no.

Support — 79.58. Resistance — 83.56.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. There are signs that bull fanaticism is coming to an end. We will keep the old longs, we do not open new ones.

Fall scenario: given the complex, probably corrective structure, it is possible to sell from current levels.

Recommendations for the RTS index:

Purchase: no. Who is in position from 100000, keep stop at 101000. Target: 112000.

Sale: now and on approach to 106000. Stop: 106700. Target: 90000.

Support — 100910. Resistance — 105440.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|