Price forecast weekly from 2 to 6 of November 2020

02 November 2020, 12:22

-

Grain market:

In the United States next week, there will be a US presidential election. Candidates with more than a solid age for such a position: Trump 74, Biden 77, will try to earn the trust of Americans.

If Biden wins, one can count on more active foreign trade and fewer trade wars, which should lead to a more efficient distribution of produced goods and resources, and, possibly, a softer confrontation along the Washington-Beijing line.

Going forward, easing international trade tensions and reducing American protectionism will allow the agricultural market to function more efficiently.

The grain market is likely to welcome Biden’s victory with slight optimism. Wheat and corn prices will receive some support.

In the event of Trump’s victory in the market, the tendency to high volatility will remain, trading will go on at a nervous ragged pace.

Reading our forecasts, you could make money on the fall in the RTS index futures from 112500 to 108000.

Energy market:

Next week we will undoubtedly have the main event of the four-year period — the US presidential election. The title will be defended by the current President Trump Donald, 74, Republican. The challenger, Joe Biden, who turns 78 in November, a Democrat, will try to prevent an opponent from re-taking the highest elected office in the country.

Democrats are more focused on green energy, which in the long term will increase the pressure on the oil market. For example, 65% of oil consumption is transportation. In developed countries, this figure is even higher. Currently, the share of electric vehicles is 3% of all new cars sold in the world. However, by the end of next year, the share of new electric vehicles will reach 6%. Given the zeal with which automakers rushed into battle, by 2030 it may happen that new gasoline-powered cars on sale will be in a clear minority. There is no doubt that in the event of a victory for the Democrats, Tesla, Nikola and less visible projects for the commissioning of autonomous electric transport will receive active support from the US government.

Europe closes on lockdown. Germany, following the UK, introduces restrictive measures from November 2 for a month. The losses to the economy are tentatively estimated at 20 billion euros. It will not be surprising that oil prices will continue to fall against such a background. We can see the 35.00 Brent level by Friday.

USD/RUB:

What will happen to the ruble if Biden wins next week? This is the basic question that everyone wants an answer to.

It is difficult to say what a 77-year-old person can think of. The main thing is to have someone to correct and suggest.

The West still has options for introducing additional sanctions against the Russian Federation, however, against the background of problems with the virus, it is unlikely that anyone will want to implement something in practice, since any action, for example, limiting the purchase of raw materials, blocking correspondent dollar accounts of Russian banks , the nomination of any ultimatums, for example, in the Donbass. All this will only lead to a freeze of contacts at the level of diplomats. The economic damage from all these actions will be tangible, but it will be possible to survive. While we are communicating with Berlin and Beijing, nothing terrible can happen.

In case of Biden’s victory, the ruble on emotions may go up to 87.00, however, further growth is still in question.

The ruble will be much more affected by the fall in oil prices than the change in the White House owner.

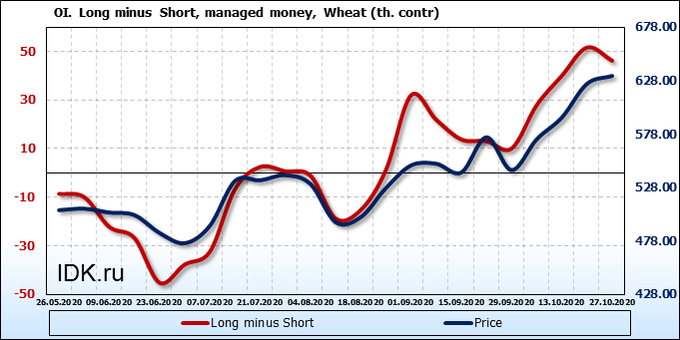

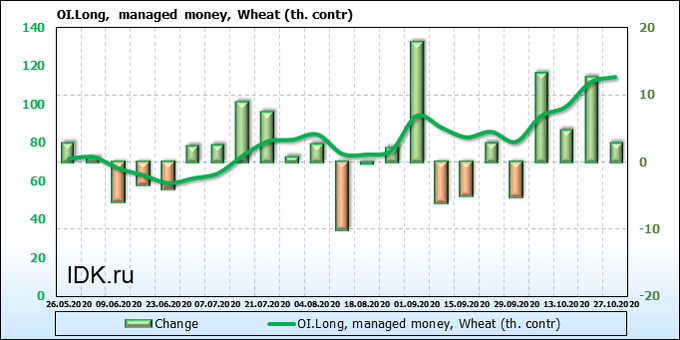

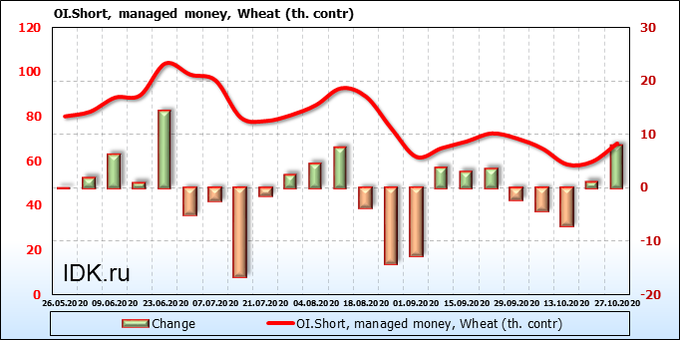

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Along with the rains in the south of the United States and Russia, sellers appeared on the market. In addition, the excitement for buying grain from the new harvest subsided, which led to a correction. We can hardly expect a global decline in wheat prices, but another 4 — 5 percent drop is very likely.

Growth scenario: December futures, expiration date December 14. Finally, the rollback began. We are waiting for a fall to the 580.0 area, after which we will buy. A more interesting level for purchases is 560.0. Leaving below 540.0 will break the growing trend.

Falling scenario: we continue to believe that it makes sense to sell only when approaching 670.0. The current pullback is unlikely to lead to a change in market sentiment.

Recommendation:

Purchase: on touch 580.0 and 560.0. Stop: 540.0. Target: 670.0.

Sale: when approaching 670.0. Stop: 687.0. Target: 610.0.

Support — 577.4. Resistance — 618.6.

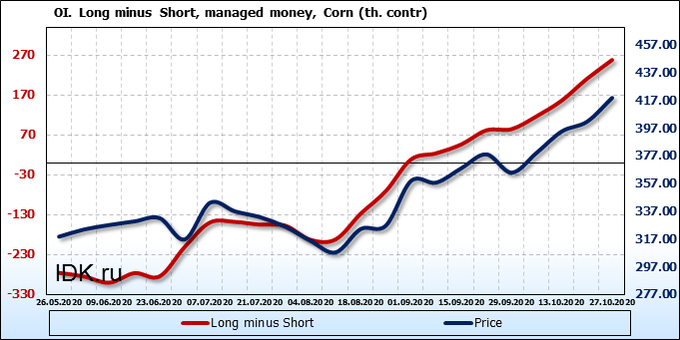

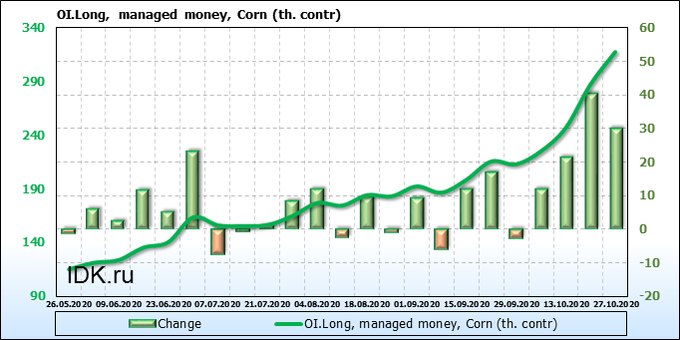

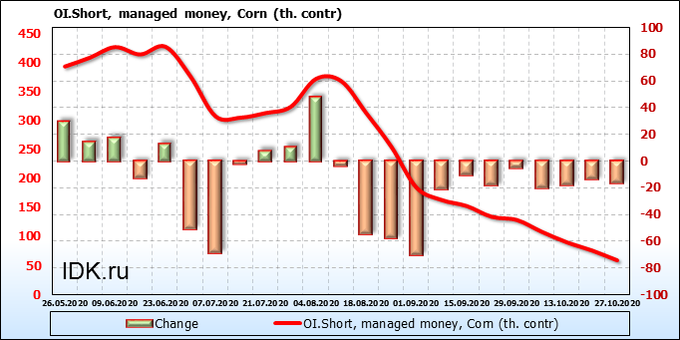

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Buyers hold the situation firmly. Money comes to the market within 4 weeks, that creates serious prerequisites for reaching the level of 430.0. The current rollback to the area of 400.0. we explain by profit-taking, not by sellers appearing on the market.

Growth scenario: December futures, expiration date December 14. Domestic corn prices are rising in China and Europe, supporting the market. We have the right to expect a resumption of growth after a rollback.

Falling scenario: you can try to sell only when approaching 430.0. It is unlikely that the bull market will break now. So far, the demand for forage crops remains high.

Recommendation:

Purchase: now and on touch 376.0. Stop: 344.0. Target: 430.0.

Sale: on touch 430.0. Stop: 437.0. Target: 396.0.

Support — 389.2. Resistance — 429.6.

Soybeans No. 1. CME Group

Growth scenario: January futures, expiration date January 14. We see a slight pullback. It can be used to buy with the target at 1170. In case of a deeper fall, meet the market when approaching 1000.0.

Falling scenario: we continue to wait for prices to approach the 1170 area. We do not believe in a reversal from current levels.

Recommendation:

Purchase: now. Stop: 1038.0. Target: 1170.0. Those who are in the position from 1050.0, move the stop to 1038.0. Target: 1170.0. The second option is to buy when approaching 1000.0.

Sale: when approaching 1170.0. Stop: 1183.0. Target: 1066.0.

Support — 1043.6. Resistance — 1089.6.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date February 26. We keep longs. The target at 15.95 remains. We continue to aggressively move the stop along the trend.

Falling scenario: we will sell when we approach the area of 16.00, not earlier. Apparently, people ease stress from the pandemic by eating sweeties. You cannot drink, you cannot smoke, you only have to eat pastries.

Recommendation:

Purchase: no. Those who are in the position from 14.10, move the stop to 13.90. Target: 15.90.

Sale: when approaching 16.00. Stop: 16.17. Target: 14.10.

Support — 13.79. Resistance — 15.95.

Сoffee С, ICE

Growth scenario: December futures, expiration date December 18. We continue to refuse to buy, as the move below 105.0 led the bulls into great confusion. We see no attempts to grow.

Falling scenario: selling from current levels is scary. Those interested can go short with a short stop order. A dip by 80.00 cannot be ruled out.

Recommendation:

Purchase: no.

Sale: now. Stop: 109.00. Target: 80.00.

Support — 103.05. Resistance — 108.00.

Brent. ICE

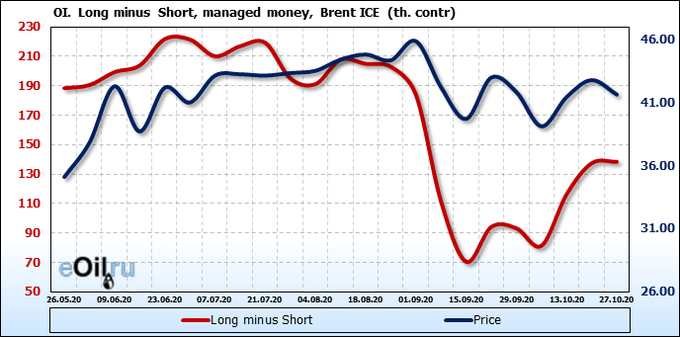

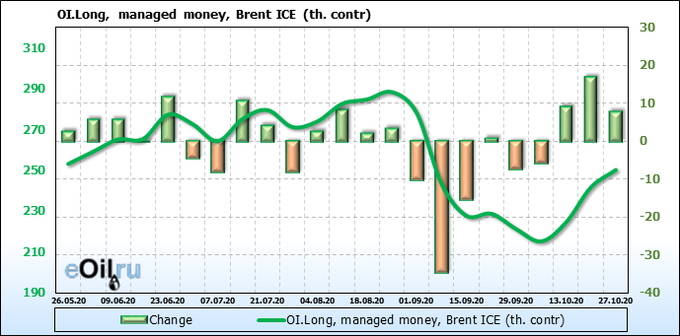

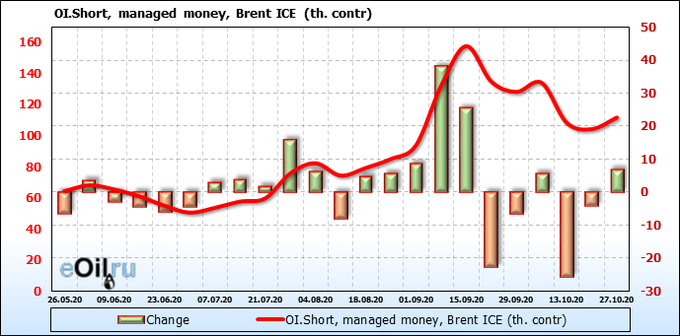

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Due to the increase in the number of cases of the Chinese virus, sellers found themselves in a comfortable situation. Note that money from both buyers and sellers is entering the market, which may cause sharp movements in the future, since one of the parties may be in a big loss.

Growth scenario: November futures, expiration date November 30. The fall in quotes creates attractive opportunities to enter long. But the fundamental background due to the virus is extremely bad. Note that it is better to carry out all actions on the market after the results of the US presidential elections.

Falling scenario: on the breakdown of the 40.30 level, you should have been pulled short in accordance with our recommendation a week earlier. Here it is worth continuing to hold the shorts. We set the goal far away, at 30.00. Move the stop order closer to the entry level.

Recommendation:

Purchase: think when approaching 36.00.

Sale: no. If you are in position, move your stop to 40.60. Target: 30.00.

Support — 36.46. Resistance — 40.36.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 10 units to 221 units.

Commercial oil reserves in the US rose by 4.32 to 492.427 million barrels. Gasoline inventories fell by -0.892 to 226.124 million barrels. Distillate stocks fell by -4.491 to 156.228 million barrels. Cushing’s stocks fell -0.422 to 59.995 million barrels.

Oil production increased by 1.2 to 11.1 million barrels per day. Oil imports increased by 0.546 to 5.664 million barrels per day. Oil exports rose by 0.424 to 3.46 million barrels per day. Thus, net oil imports rose by 0.122 to 2.204 million barrels per day. Refining increased by 1.7 to 74.6 percent.

Gasoline demand rose 0.256 to 8.545 million barrels per day. Gasoline production rose 0.162 to 9.095 million barrels per day. Gasoline imports fell by -0.049 to 0.46 million barrels per day. Gasoline exports fell by -0.169 to 0.53 million barrels per day.

Distillate demand rose 0.652 to 4.24 million barrels. Distillate production fell by -0.005 to 4.126 million barrels. Distillate imports rose 0.192 to 0.344 million barrels. Distillate exports fell by -0.372 to 0.871 million barrels per day.

The demand for petroleum products increased by 1.519 to 19.631 million barrels. Distillate production rose 0.782 to 20.649 million barrels. Distillate imports increased by 0.453 to 2.303 million barrels. Gasoline exports fell by -0.37 to 4.622 million barrels per day.

Propane demand fell by -0.352 to 1.121 million barrels. Propane production rose 0.04 to 2.197 million barrels. Propane imports increased by 0.015 to 0.134 million barrels. Propane exports rose 0.174 to 1.201 million barrels per day.

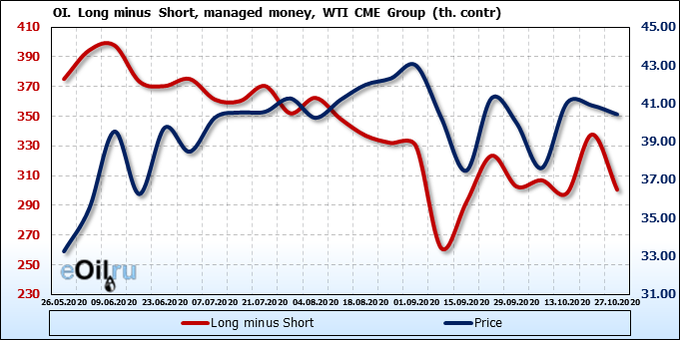

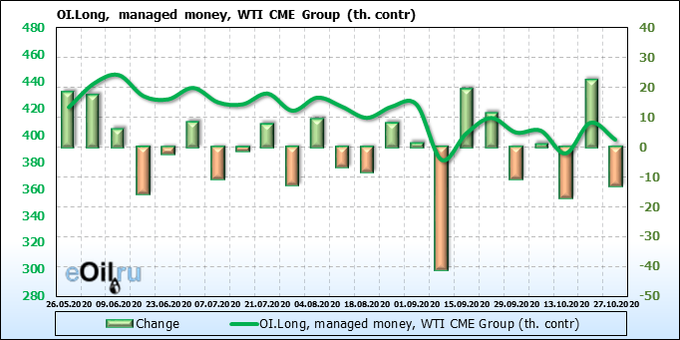

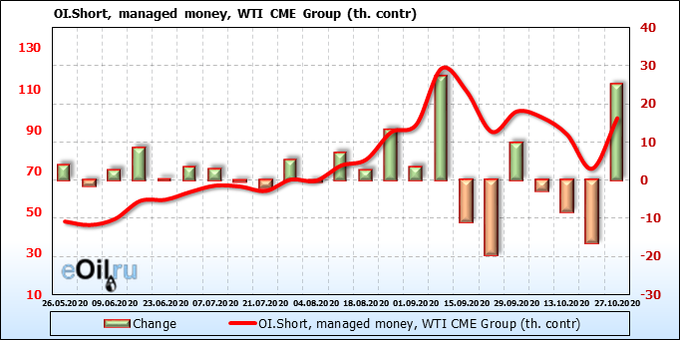

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

The number of sellers has grown dramatically. Amid the pandemic, 25,000 contracts were sold, which led to a sharp drop in prices. It is unlikely that market sentiment will change dramatically after the US presidential election. Almost all of Europe will go into quarantine from Monday. This is not a background against which growth is possible.

Growth scenario: December futures, expiration date November 20. When approaching the 33.00 level, one can think about buying. However, it is better to carry out all actions after the announcement of the results of the US elections. We follow the news. Note that verbal intervention by OPEC is possible.

Falling scenario: we broke through 39.00 and fell by $ 3.5. This is hardly the end of the story. We are counting on a deeper move. We keep the shorts open earlier.

Recommendation:

Purchase: think when approaching 33.00. Follow the news.

Sale: no. Those who are in the position from 39.00, move the stop to 39.20. Target: 28.00.

Support — 32.78. Resistance — 36.92

Gas-Oil. ICE

Growth scenario: November futures, expiration date November 12. We don’t see an upward reversal. Oil certainly continues to influence fuel. Buying from current levels is attractive, but risks must be considered.

Falling scenario: we will keep the shorts counting on a deeper market fall. A fight is possible at the current levels, but the bulls are unlikely to be able to easily turn the market up.

Recommendation:

Purchase: now. Stop: 293.0. Target: 360.0.

Sale: no. Those who are in positions between 335.00 and 330.0, move the stop to 337.00. Target: 280.00 (260.0).

Support — 294.75. Resistance — 312.00.

Natural Gas. CME Group

Growth scenario: December futures, expiration date November 25. Growth can be halted at 3.530, provided that oil prices continue to decline. We keep the positions opened earlier, we don’t open new ones.

Falling scenario: if oil does not turn up, then from 3.53. can be sold. The target will be at 3.110, a deeper decline is possible in the event of a warm November in Europe and the US.

Recommendation:

Purchase: no. Those who are in position from 2.450, move the stop to 3.080. Target: 3.500.

Sale: possible at touching 3.530. Stop: 3.580. Target: 3.110.

Support — 3.081. Resistance — 3.530.

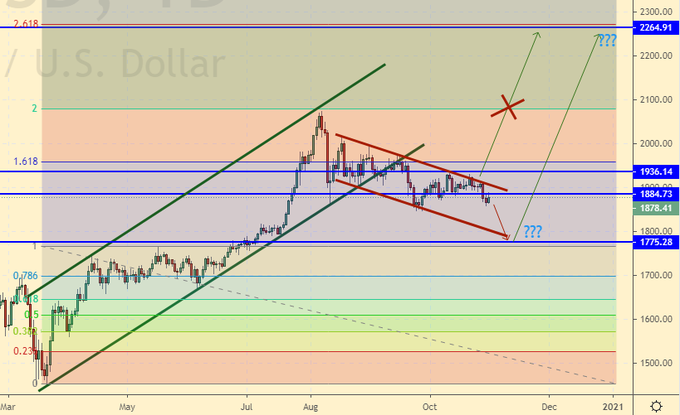

Gold. CME Group

Growth scenario: keep failing. If the market rises above 1936, we will buy. Biden’s victory could lead to a rise in gold, as Democrats are inclined towards stronger stimulus programs.

Falling scenario: they could not consolidate below 1875. Sellers have an advantage, but it is insignificant. We keep shorts, but do not expect to fall below 1780.

Recommendations:

Purchase: in case of growth above 1936. Stop: 1912. Target: 2260.

Sale: no. Anyone in the position between 1950 and 1900, move the stop to 1936. Target: 1780.

Support — 1775. Resistance — 1884.

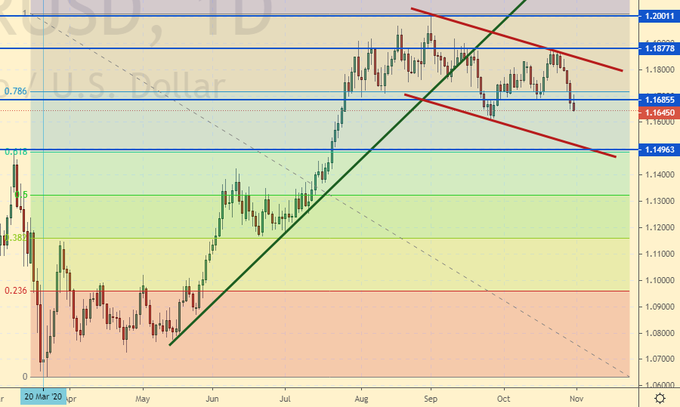

EUR/USD

Growth scenario: pandemic press down on euro. Despite the fact that the ECB did not begin to expand assistance to countries affected by the virus, everyone understands that in the current situation it is only a matter of time. Europe will definitely be quarantined all November. It may be interesting to buy from 1.1500.

Falling scenario: if there is a rollback to 1.1800, it makes sense to sell. On the 5th of the Fed meeting, most likely we will not see any strong movements in the pair until this moment.

Recommendations:

Purchase: think when approaching 1.1500.

Sale: on a rollback to 1.1800. Stop: 1.1840. Target: 1.1500.

Support — 1.1496. Resistance — 1.1685 (1.1877).

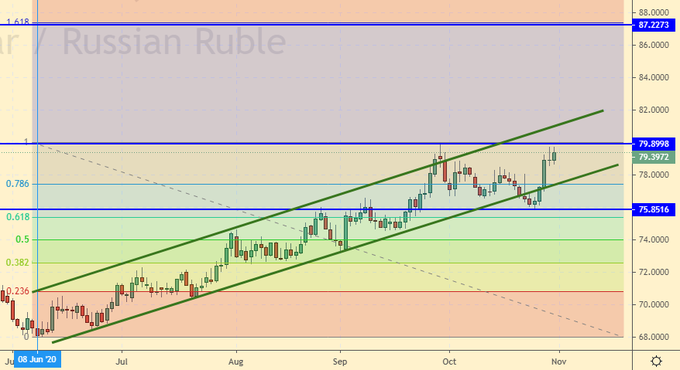

USD/RUB

Growth scenario: polls about a possible Biden victory last week turned sharply upwards. It is unlikely that we will take 80.00 before the announcement of the results of the US elections. But if this level is taken, then you will have to buy at current prices with targets at 87.00. Note that it is best to carry out all actions on the market after the announcement of the election results.

Falling scenario: if Trump wins, the ruble should return to a strengthening path. Only weakening oil will interfere, but until the black gold dropped below 35.00 the situation looks bearable, especially since gas prices in Europe have risen.

Please note that on November 4, the MOEX does not work. It’s National Unity Day.

Purchase: think if it rises above 80.00.

Sale: not yet.

Support — 75.85. Resistance — 79.89.

RTSI

Growth scenario: December futures, expiration date December 17. Following the falling ruble, the futures on the RTS index went down. If Biden wins, the mood on the Russian stock market will turn bad. It is possible that the fall will be strong, we do not buy.

Falling scenario: until we rise above 112,000, it makes sense to bet on the collapse. Therefore, in case of a possible rollback to this level, we will sell. Basically, you can use any lift up for the shorts.

Recommendations:

Purchase: think after a rise above 112,000.

Sale: now and as it grows to 112000. Stop: 114000. Target: 75000? Consider the risks carefully.

Support — 104610 (98590). Resistance — 111690 (117290).

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|