Price forecast from 6 to 10 of November 2023

07 November 2023, 14:35

-

Grain market:

Cries that the Arabs need to be bombed with nuclear bombs will quickly lead to an increase in the cost of grain. The reason is simple: even one exploded munition will contaminate vast areas and make cultivation in contaminated areas unsuitable. The country that is the first to use nuclear weapons after 1945 will be completely blocked and dismantled into pieces by the world community (at least one would hope so).

It is possible that after a successful 23rd year and the harvest in the main areas, we will experience some price increases. However, you should not count on a strong increase in quotes, for example, by 50%; rather, prices will rise by 10–15 percent.

In Russia, wheat prices continue to remain at low levels, although in the last week there have been signs of stabilization and an upward reversal. Everyone who needed to sell urgently did so, the rest of the farmers took a wait-and-see attitude, which is generally true, given the low level of purchase prices on the part of the grain trading cartel (foreigners have left, now you can do whatever you want with farmers, right?) . With the advent of a normally functioning grain exchange, price pressure will be eliminated. In the meantime, it’s gone, everyone goes to the IDK.ru site.

Energy market:

Judging by the way oilseeds have started to grow, we won’t see baboons, that is, orangutans (orange shaggy monkeys like that), in all sorts of Cambodia they are cutting down the jungle and planting oil palms. The poor monkeys have nowhere to live. Stop eating the cookies, they contain palm oil. No to monkey genocide.

One of the influential Jews suddenly said that the Gaza Strip should be attacked with a nuclear weapon. They hid it away here. But guys! Those who are sitting in Washington, if you are reading us: your horse has gone to hell with the furrow! The phrase has a continuation. Linguists in adidas sweatpants will tell you how it ends.

Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Well… war. Jews climb inside the enclave. If everyone remains silent, then this matter will not last long. The oil market is in equilibrium, it likes general inaction. We’re not growing yet.

Judging by the forecasts of respected agencies, oil demand will continue to grow and will reach a peak by the 30th year. At current supply levels, we have a deficit of 1.5 million barrels per day, which means that storage is dwindling, but reserves remain significant.

We will continue to be in a situation where we could see a sharp rise in oil prices at any moment as a result of Iran directly entering the conflict. If this happens, the Persian losses will be enormous, but we must understand that the West, which is relatively poor in resources, will not be able to endure a long-term confrontation with the East. A barrel of Brent will quickly go to 150.00.

USD/RUB:

During the week, the ruble behaved not as badly as one might imagine. We stabilized at 94.00 and at the end of the week the national currency attempted to strengthen, which may lead us to move to 87.00.

A rate of 15% should help remove excess money supply from the economy and send it to accounts. This is already an extremely tempting story for investors. At the same time, a number of types of businesses can simply be closed and the money sent to a deposit, which will harm the medium-term development of the economy, but the current situation is clearly more important.

Let us note that if the demand for imports does not fall, then we should not count on the national currency returning to 60.00 or 70.00, since the inflow of currency into the country will remain limited due to sanctions. The trade balance will most likely be positive, but there is no talk of any surplus of $10 billion per month, as was the case in previous years. 2 — 3 billion dollars plus, this is our new reality.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 11.1 thousand contracts. Sellers came running, it’s not clear whether they were in the right place. Buyers retreated. The advantage remains with the sellers.

Growth scenario: we are considering December futures, expiration date is December 14. If it rises above 580.0, we will buy. The market may become nervous about the carnage in the Middle East.

Fall scenario: as before, we refuse to sell. There will now be no new grain until next year.

Recommendations for the wheat market:

Purchase: when approaching 515.0. Stop: 497.0. Target: 647.0 (710.0). Or in case of growth above 580.0. Stop: 570.0. Target: 647.0 (710.0).

Sale: no.

Support – 553.5. Resistance – 577.1.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers increased by 47.6 thousand contracts. Sellers came to the market, but in fact they failed to push through support. Bears continue to control the market.

Growth scenario: we are considering December futures, expiration date is December 14. We will think about buying if the market rises above 500.0.

Fall scenario: we still refuse to sell, although we do not deny the possibility of a fall to 400.0.

Recommendations for the corn market:

Purchase: no.

Sale: no.

Support – 466.7. Resistance – 487.6.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date January 12. Our suspicions from last week were confirmed. We are growing. We are out of the market. It’s all strange. Very.

Fall scenario: out of market. The current green candle on Friday looks even more aggressive than the green candle from a week ago. You can think about shorts in the area of 1380.0.

Recommendations for the soybean market:

Purchase: no.

Sale: no.

Support – 1334.2. Resistance – 1419.7.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 8.4 thousand contracts. We see an outflow of money; buyers left the market a little more actively, while they retain their advantage.

Growth scenario: we are considering November futures, expiration date is November 30. They couldn’t go below 85.00. For now, we continue to take a wait-and-see attitude.

Fall scenario: there is no point in selling. The entire Middle East could explode at any moment.

Recommendations for the Brent oil market:

Purchase: in case of growth above 95.00. Stop: 89.00. Goal: 150.00?! When approaching 75.00. Stop:72.00. Goal: 150.00.

Sale: no.

Support – ??? Resistance – 89.41.

WTI. CME Group

US fundamentals: the number of active drilling rigs fell by 8 units to 496 units.

Commercial oil reserves in the United States increased by 0.773 to 421.893 million barrels, with a forecast of +1.261 million barrels. Gasoline inventories increased by 0.065 to 223.522 million barrels. Distillate inventories fell by -0.792 to 111.295 million barrels. Inventories at the Cushing storage facility increased by 0.272 to 21.498 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports increased by 0.412 to 6.425 million barrels per day. Oil exports increased by 0.064 to 4.897 million barrels per day. Thus, net oil imports increased by 0.348 to 1.528 million barrels per day. Oil refining fell by -0.2 to 85.4 percent.

Gasoline demand fell by -0.167 to 8.697 million barrels per day. Gasoline production fell by -0.33 to 9.494 million barrels per day. Gasoline imports fell by -0.096 to 0.557 million barrels per day. Gasoline exports increased by 0.002 to 0.835 million barrels per day.

Demand for distillates fell by -0.387 to 3.682 million barrels. Distillate production fell by -0.153 to 4.58 million barrels. Imports of distillates fell by -0.045 to 0.071 million barrels. Exports of distillates fell by -0.095 to 0.13 million barrels per day.

Demand for petroleum products fell by -0.233 to 19.869 million barrels. Production of petroleum products fell by -0.264 to 21.504 million barrels. Imports of petroleum products fell by -0.222 to 1.481 million barrels. Exports of petroleum products increased by 0.37 to 6.389 million barrels per day.

Demand for propane increased by 0.111 to 0.937 million barrels. Propane production fell by -0.029 to 2.552 million barrels. Propane imports fell -0.002 to 0.102 million barrels. Propane exports rose 0.1 to 0.136 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 59.9 thousand contracts. Sellers entered the market, while buyers fled. The advantage of the bulls has decreased significantly, which is somewhat strange for this situation.

Growth scenario: we are considering December futures, expiration date November 20. We refuse to make purchases. You need either a strong fall or strong growth.

Fall scenario: we continue to hold the shorts opened the week before last. A move towards 75.00 cannot be ruled out.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.70. Target: 83.00.

Sale: no. If you are in a position from 88.00, move your stop to 85.30. Target: 76.30.

Support – 80.10. Resistance – 83.66.

Gas-Oil. ICE

Growth scenario: we are considering November futures, expiration date is December 12. If there is a rise above 950.0, you will have to buy. Let’s also take from 700.0. We do nothing at current prices.

Fall scenario: we do not go short. It is unlikely that prices will decrease amid the growing conflict in the Middle East.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00. Or in case of growth above 950.00. Stop: 910.00. Goal: 1500.00?!

Sale: no.

Support – 836.00. Resistance – 879.75.

Natural Gas. CME Group

Growth scenario: switched to December futures, expiration date November 28. Europe has filled its storage facilities. There is no big horror yet. There are also no supply problems within the US. Not on the market yet, but if it grows we will buy.

Fall scenario: out of market. Prices are low.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 3.317. Resistance – 3.642.

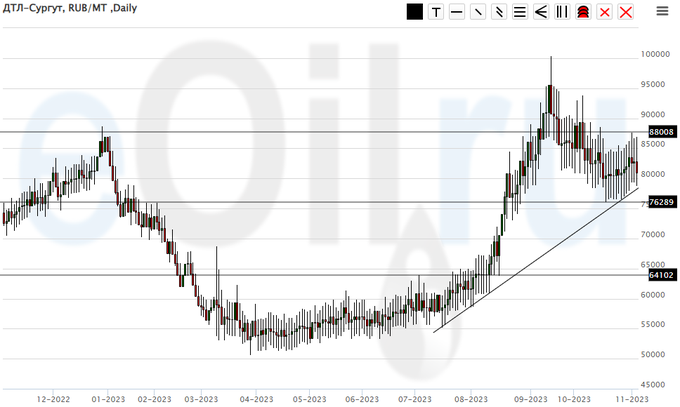

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 65,000. It will be possible to buy there.

Fall scenario: also no change. Let’s continue to stay short. Let’s set a deeper goal below.

Recommendations for the diesel market:

Purchase: when approaching 65,000. Stop: 58,000. Target: 85,000.

Sale: no. If you are in a position from 85000, keep your stop at 91000. Target: 66000.

Support – 76289. Resistance – 88808.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: too aggressive growth. We don’t buy.

Fall scenario: shorts from 31000 can give some profit. Let’s hold him.

Recommendations for the PBT market:

Purchase: no.

Sale: no. For those in positions between 30,000 and 31,000, keep your stop at 33,000. Target: 20,000.

Support – 16328. Resistance – 31172

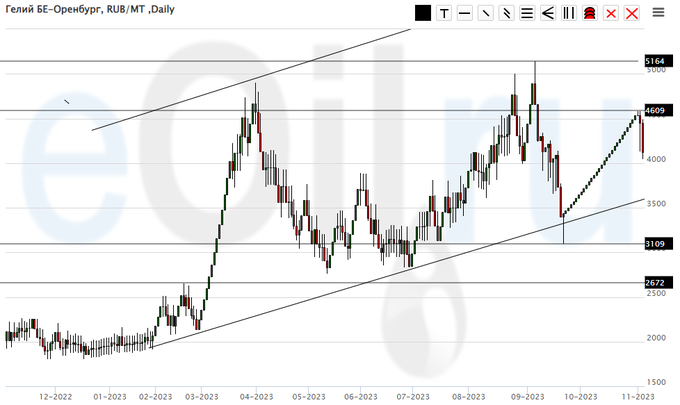

Helium (Orenburg), ETP eOil.ru

Growth scenario: after a long rise in prices, supply has appeared on the market. In fact, what is happening will make trading easier in the future. In the meantime, let’s take a break.

Fall scenario: we continue to remain out of the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 3109. Resistance – 4609.

Gold. CME Group

Growth scenario: it is worth holding the long position from 1840. We could be thrown to 2400 if the Jews use tactical nuclear weapons. Although this is stupid, it looks like they will get the territory. But if it’s clear that they won’t get it, then they can.

Fall scenario: stuck at 2010. It’s too early to draw global conclusions. It is better to practice tactical shorts on a watch. We don’t sell on day-to-day basis.

Recommendations for the gold market:

Purchase: when approaching 1920. Stop: 1910. Target: 2400. If you are in a position from 1840, keep your stop at 1910. Target: 2400.

Sale: no.

Support – 1953. Resistance – 2010.

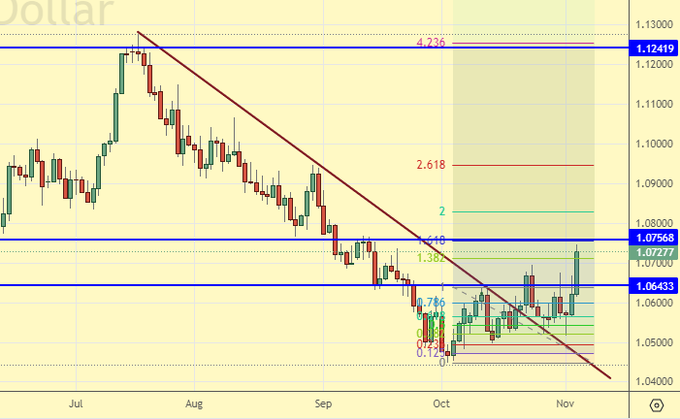

EUR/USD

Growth scenario: rose above 1.0700 and entered long again. We will keep the purchase. At the top we have a lot of interesting things: both 1.1200 and 1.2000.

Fall scenario: we will not sell, although we do not deny that the dollar may rise against the background of the war.

Recommendations for the euro/dollar pair:

Purchase: no. If you are in a position from 1.0700, keep your stop at 1.0600. Target: 1.2000.

Sale: no.

Support – 1.0643. Resistance – 1.0756.

USD/RUB

Growth scenario: buying from 87.50 — this is an interesting thought. There is nothing else on the market for the bulls at the moment.

Fall scenario: we wanted a rollback to 97.00, but they didn’t give it to us. We will sell at current levels.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: now. Stop: 94.10. Target: 87.60.

Support – 87.61. Resistance – 93.72.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. I would like to buy from 103,000, but they won’t let us yet. It is better to work out purchases from current levels on the clock.

Fall scenario: we continue to refuse sales. Technically, the situation is in favor of the bulls.

Recommendations for the RTS Index:

Purchase: when approaching 103,000. Stop: 102,000. Target: 116,000.

Sale: no.

Support – 105940. Resistance – 109650.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Brent, WTI, Gasoil, Natural Gas, Wheat, Corn, Soybean, Gold, EUR, USD, RUB, RTSI, eOil.ru

Wheat, Corn, Soybean, Brent, WTI, Gasoil, Natural Gas, Gold, EUR, USD, RUB, RTSI, IDK.ru

#Brent, #WTI, #Gasoil, #NaturalGas, #Wheat, #Corn, #Soybean,

#Gold, #EUR, #USD, #RUB, #RTSI, #eOil

https://www.oilexp.ru/oilstat/report/price-forecast-from-30-of-october-to-3-of-november-2023/305603/

Previous forecast

#Wheat, #Corn, #Soybean, #Brent, #WTI, #Gasoil, #NaturalGas,

#Gold, #EUR, #USD, #RUB, #RTSI, #IDK

https://exp.idk.ru/analytics/report/price-forecast-from-30-of-october-to-3-of-november-2023/631259/

Previous forecast

Ваш комментарий

|

|

|