Price forecast from 30 of October to 3 of November 2023

30 October 2023, 14:37

-

Grain market:

Wheat prices cannot rise above 600.0 cents per bushel and tend to settle around 550.0. This fits the mind, since supply volumes are at high levels, fortunately the harvest was a success.

The Middle Eastern thriller is unlikely to cause major shocks in the grain market, since there is not much agricultural land in that region where grains are grown.

Europe is unlikely to let in new flows of refugees, since the previous waves have not yet calmed down, but they will need to eat something in the camps, and someone will have to give them food. Let us note that the Arab states are mentally strong to carry out military operations. This won’t surprise anyone there. No one in a hot bath will get a heart attack from negative news from the receiver.

Within Russia, grain prices continue to remain at low levels. Many would like to see prices rise by spring, but at this rate, and it is now 15%, some farmers will prefer to get rid of the goods now at the current price and put the money in the bank at interest. However, there cannot be a universal recipe here.

Energy market:

The Moscow Exchange will launch futures for indices of the Turkish, Indian and Brazilian stock exchanges. Right. Put as much horror on traders’ screens as possible to make trading more fun. What is still missing is the Argentine stock exchange, and some Albanian or Madagascar, if there are such.

Well, for a strong ruble! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Apparently, Jews have entered the Gaza Strip. So far, apparently only on the outskirts, but they are terribly bombing. An extremely unpleasant thing is brewing for Tel Aviv: the Arabs will unite, forgetting who is Sunni and who is Shiite. You know, Syria will allow Turkish troops to pass through its territory without hindrance. Only this already says something.

We are not expecting a drop in prices for either black or yellow gold. There may be a gap up on Monday. While there are no reports that the entire Israeli Army has begun to move, some chances for a local solution to the issue remain. Or maybe this is due to the fact that not all the Yankees sailed.

There are more and more analogies with 1973. If the conflict becomes global, then we will face an increase in oil prices two to three times, but there, in distant America, it will be quite accessible to friendly states. The Chinese comrades are already preparing empty buckets.

USD/RUB:

So, tram-param-pam-pam, Elvira Sakhipzadovna raised the rate to 15% per annum. Apparently this is exactly what 1 pound of dash is worth now.

It is striking that favorable conditions are being created for commercial banks, which will be happy to give to the state, to lend, meaning, at 15% per annum. It is not clear how these bonds will then be serviced and repaid. We are moving at full speed towards a new round of privatization, which will be no less unscrupulous than in the 90s.

There is a scenario in which the state, when it borrows, will mortgage the enterprises it owns, or shares of enterprises that will pass into the hands of new owners for 1/10 or 1/100 of their market value. Why? Because in the 24th year we need to find somewhere around 10 trillion, which don’t exist yet. And they will search.

The ruble will reach the level of 90.00. What’s next? And then, in order for it to remain there, you will have to increase the rate by 1% every month.

November 1st Fed meeting. We are watching and worrying about USA. Cheer for them.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers decreased by 13.2 thousand contracts. 8,000 contracts from the bulls came in, 5,000 contracts from the bears left the market. The advantage remains with the sellers.

Growth scenario: we are considering December futures, expiration date is December 14. Not the easiest situation. We still insist on shopping.

Fall scenario: as before, we refuse to sell. There will now be no new grain until next year.

Recommendations for the wheat market:

Purchase: when approaching 515.0. Stop: 497.0. Target: 647.0 (710.0). Or now. Stop: 562.0. Target: 647.0 (710.0).

Sale: no.

Support – 563.6. Resistance – 605.0.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers decreased by 6.1 thousand contracts. Both buyers and sellers left the market. Sellers left in greater numbers. Bears continue to control the market.

Growth scenario: we are considering December futures, expiration date is December 14. Fell. Not on the market yet.

Fall scenario: we still refuse to sell, although we do not deny the possibility of a fall to 400.0.

Recommendations for the corn market:

Purchase: no.

Sale: no.

Support – 476.6. Resistance – 509.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date January 12. Equilibrium situation. There seems to be a lot of soybeans, but we claim growth. This is weird.

Fall scenario: out of market. The green Friday candle looks aggressive.

Recommendations for the soybean market:

Purchase: no.

Sale: no.

Support – 1293.0. Resistance – 1334.2.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 0.1 thousand contracts. Both sides sluggishly increased their positions, betting on the development of the situation in the Middle East. Buyers retain the advantage.

Growth scenario: we are considering November futures, expiration date is November 30. We will always have time to buy at 95.00. But it’s better to buy at 75.00. We’re not in a rush to make purchases.

Fall scenario: we have no reason to recommend sales.

Recommendations for the Brent oil market:

Purchase: in case of growth above 95.00. Stop: 89.00. Goal: 150.00?! When approaching 75.00. Stop:72.00. Goal: 150.00.

Sale: no.

Support – 85.82. Resistance – 92.26.

WTI. CME Group

US fundamentals: the number of active drilling rigs increased by 2 to 504.

Commercial oil reserves in the United States increased by 1.372 to 421.12 million barrels, with a forecast of +0.239 million barrels. Gasoline inventories increased by 0.156 to 223.457 million barrels. Distillate inventories fell by -1.686 to 112.087 million barrels. Inventories at the Cushing storage facility increased by 0.213 to 21.226 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports increased by 0.071 to 6.013 million barrels per day. Oil exports fell by -0.468 to 4.833 million barrels per day. Thus, net oil imports increased by 0.539 to 1.18 million barrels per day. Oil refining fell by -0.5 to 85.6 percent.

Gasoline demand fell by -0.079 to 8.864 million barrels per day. Gasoline production increased by 0.063 to 9.824 million barrels per day. Gasoline imports fell by -0.053 to 0.653 million barrels per day. Gasoline exports fell by -0.248 to 0.833 million barrels per day.

Demand for distillates fell by -0.347 to 4.069 million barrels. Distillate production increased by 0.039 to 4.733 million barrels. Imports of distillates increased by 0.039 to 0.116 million barrels. Exports of distillates increased by 0.081 to 0.225 million barrels per day.

Demand for petroleum products fell by -1.795 to 20.102 million barrels. Production of petroleum products fell by -0.814 to 21.768 million barrels. Imports of petroleum products fell by -0.126 to 1.703 million barrels. Exports of petroleum products increased by 0.664 to 6.019 million barrels per day.

Propane demand fell by -0.667 to 0.826 million barrels. Propane production fell by -0.068 to 2.581 million barrels. Propane imports fell -0.001 to 0.104 million barrels. Propane exports fell -0.121 to 0.036 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 7.2 thousand contracts. Slightly more sellers entered the market than buyers. The bulls’ advantage narrowed slightly.

Growth scenario: we are considering December futures, expiration date November 20. We will not take at current levels. We need either growth or decline. More certainty is needed.

Fall scenario: the short opened last week survived. Let it stand, before the rise in oil prices, which is most likely to happen, the puppet masters may lower prices.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.70. Target: 83.00. Anyone in position from 83.50, keep a stop at 81.00. Goal: 91.00.

Sale: no. If you are in a position from 88.00, keep your stop at 90.30. Target: 76.30.

Support – 82.05. Resistance – 89.81.

Gas-Oil. ICE

Growth scenario: we are considering November futures, expiration date is November 10. I would like to see a rollback to 700.0, but it may not happen. If there is growth above 950.0 – buy.

Fall scenario: we do not go short. It is unlikely that prices will decrease amid the growing conflict in the Middle East.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00. Or in case of growth above 950.00. Stop: 910.00. Goal: 1500.00?!

Sale: no.

Support – 858.50. Resistance – 1054.00.

Natural Gas. CME Group

Growth scenario: switched to December futures, expiration date November 28. America. We see speculation with an attempt to knock people out of the long position. Not on the market yet.

Fall scenario: out of market. We are waiting for developments.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 3.211. Resistance – 3.642.

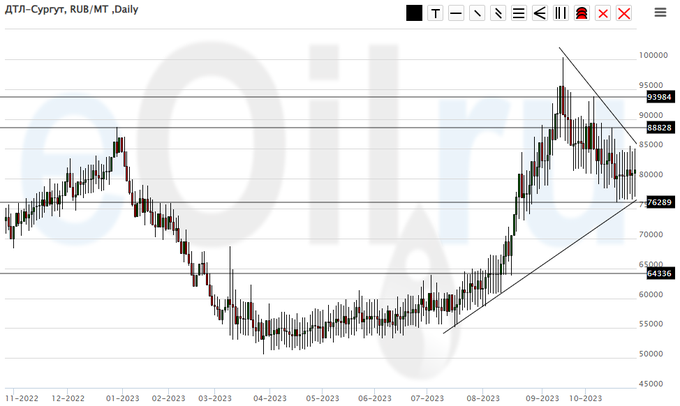

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 65,000. It will be possible to buy there.

Fall scenario: we will continue to hold shorts. Let’s set a deeper goal below.

Recommendations for the diesel market:

Purchase: when approaching 65,000. Stop: 58,000. Target: 85,000.

Sale: no. If you are in a position from 85000, keep your stop at 91000. Target: 66000.

Support – 76289. Resistance – 88828.

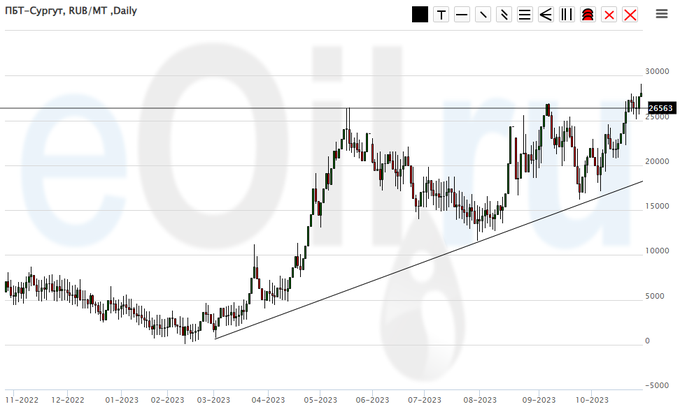

Propane butane (Surgut), ETP eOil.ru

Growth scenario: too aggressive growth. We don’t buy.

Fall scenario: from current levels and touching 31,000 you can sell.

Recommendations for the PBT market:

Purchase: no.

Sale: now and when you touch 31000. Stop: 33000. Target: 20000.

Support – 26563. Resistance – ?????

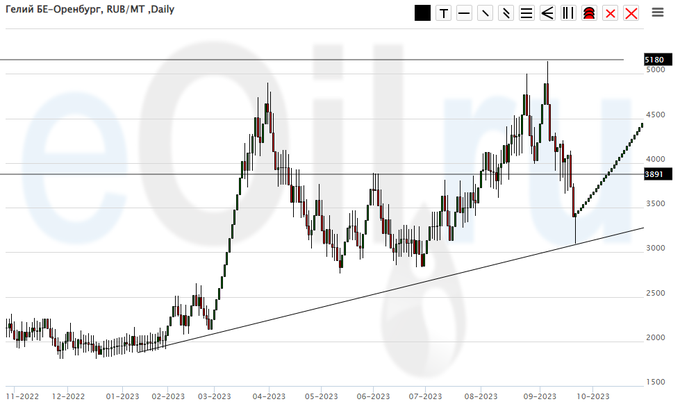

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see that there are no sellers at current prices. We are waiting for deals.

Fall scenario: we continue to remain out of the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 3891. Resistance – 5180.

Gold. CME Group

Growth scenario: Friday evening pulled up against the backdrop of news about Israel’s entry into the Gaza Strip. We hold long.

Fall scenario: we will not sell. There is a feeling that we will not go short for a very long time.

Recommendations for the gold market:

Purchase: no. Anyone in position from 1840, move the stop to 1910. Target: 2400.

Sale: no.

Support – 1954. Resistance – 2108.

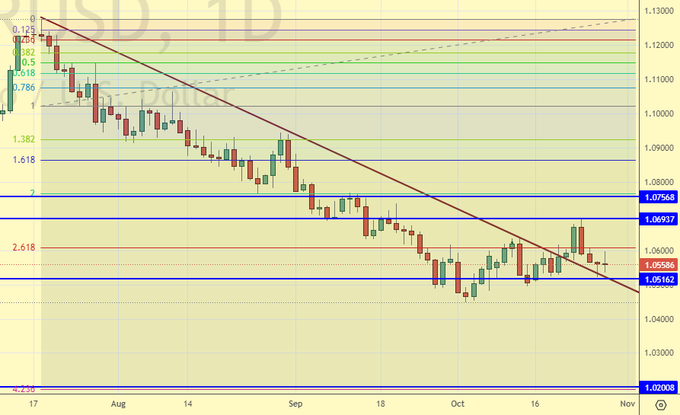

EUR/USD

Growth scenario: received an insidious loss from 1.0650 to 1.0530. For a new long we expect growth above 1.0700.

Fall scenario: we will not sell, although we do not deny that the dollar may rise against the background of the war.

Recommendations for the euro/dollar pair:

Purchase: in case of growth above 1.0700. Stop: 1.0600. Target: 1.2000. Or when touching 1.0220. Stop: 1.0120. Goal: 1.2000?!

Sale: no.

Support – 1.0516. Resistance – 1.0693.

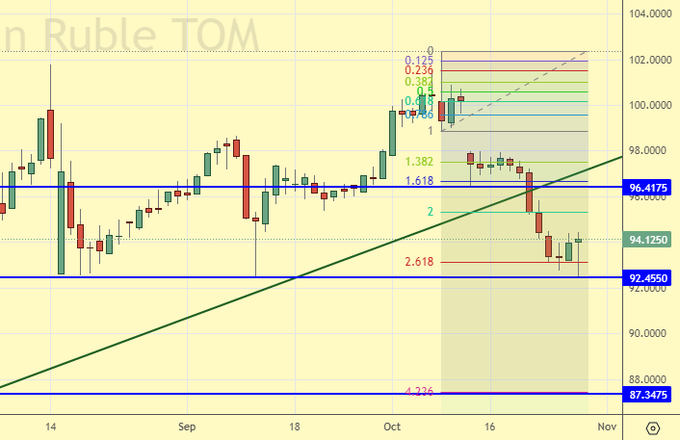

USD/RUB

Growth scenario: we won’t buy for now. We’re taking a break for a week. Only one thing is clear: nothing is clear.

Fall scenario: we are waiting for a pullback up to 97.00, there we can try our luck, that is, bet on the ruble.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: when rising by 97.00. Stop: 98.00. Target: 87.00.

Support – 92.45. Resistance – 96.41.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. You know, you can buy from 103,000. The prospect is that there will be money in the country, there will be a lot of it, and it will be cheap. If the dollar loses ground in the world, well, what if, then the RTS index has a chance.

Fall scenario: we continue to refuse sales. Technically, the situation is in favor of the bulls.

Recommendations for the RTS Index:

Purchase: when approaching 103,000. Stop: 102,000. Target: 116,000.

Sale: no.

Support – 102820. Resistance – 109750.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|