Price forecast from 23 to 27 of October 2023

23 October 2023, 12:56

-

Grain market:

The conflict in the Middle East will increase demand for grain. Those countries that did not expand storage capacity during the pandemic will do so now. Since we are emerging from global quarantine very poorly, both from a political and economic point of view.

IGC forecasts that total global grain production (wheat and coarse grains) in 2023/24 will increase by 27 million tonnes year-on-year to 2,292 million tonnes. Higher corn and sorghum yields will outweigh lower production of wheat, barley and oats.

Total consumption will reach a new high of 2,305 million tonnes (+2%), including increases for feed, food and industrial uses. Total ending stocks are estimated at 582 million tonnes, down 2% from the previous season and the lowest in nine years.

This once again proves that the grain market is still far from saturation. In many countries around the world, poverty is the norm; as we emerge from poverty, the demand for grain will only grow.

By reading our forecasts, you could take a move down in the soybean market from 1370 to 1312 cents per bushel.

Energy market:

The issuance of tourist visas to Europeans has increased by 57% compared to last year. And even though this is 10 times less than in 1919, what is the dynamics? Let them go, we have something to show. Not just “Kuzka’s mother.” There is much more.

They say that the Germans reached out to us for a residence permit. They throw away their colorful valuables. We even have cities for them: Engels and Marx. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The oil market continues to be impressed by the conflict in the Middle East, and this impression is negative. Prices are rising. The experience of 1973 has not been forgotten. The Arabs could again raise prices sky high if the US openly enters into conflict.

Türkiye stopped fussing and indicated support for Palestine, which strengthens the position of the countries of the global south. Europe began to sluggishly crawl away from the mess, especially since the situation in its own countries began to heat up. Jews are not recommended to openly display their symbols, as this is associated with a risk to life. Today we have an analysis of the oil market, right?!

What can happen? The most aggressive option: if Israel does not stop, and so far it does not seem likely, then a total embargo on oil supplies is possible. Without these supplies, Europe’s economy will collapse, but exporting countries will also have a hard time. This will be a real economic massacre, without a single shot being fired. The price of oil will rise to $500 per barrel. Gold will go to 20,000 (twenty thousand) dollars per troy ounce. And Russia will have to build several dozen more factories for the production of firecrackers.

Biden’s already open aggression is noteworthy, which does not make what is happening fun.

USD/RUB:

Pulled down at the end of the week. This paved the way for us to 93.00.

States will continue to borrow large amounts, which is unlikely to increase confidence in the dollar. Every year the situation becomes more and more subtle. And stress, including the current one, makes you draw money. At this rate, you will soon have to borrow at 10% per annum, and then… then that’s it. Great Depression 2.0.

A decline to 90.00 after reaching 93.00 looks quite possible. A move to 87.00 is less likely, but also fits into the wave theory.

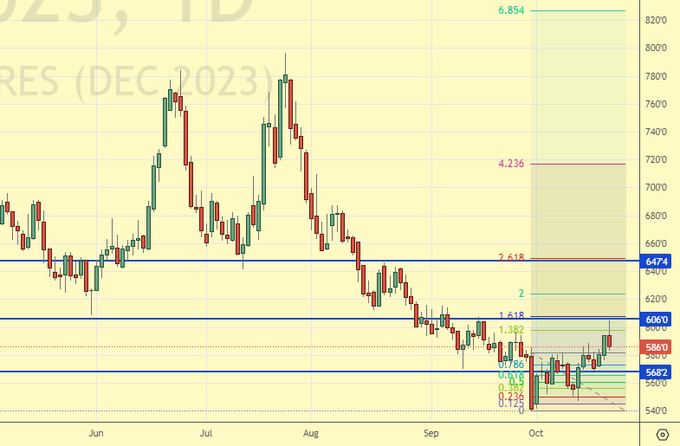

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 0.7 thousand contracts. In fact, there were no capital movements during the week. The advantage remains with the sellers.

Growth scenario: we are considering December futures, expiration date is December 14. Let’s continue to insist on purchases. The situation around Israel is nervous and there may be consequences.

Fall scenario: we refuse to sell. There will now be no new grain until next year.

Recommendations for the wheat market:

Purchase: when approaching 515.0. Stop: 497.0. Target: 650.0 (710.0). If you are in a position from 580.0, move your stop to 567.0. Target: 647.0 (710.0).

Sale: no.

Support – 568.2. Resistance – 606.0.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers decreased by 4.9 thousand contracts. Almost no one. Both buyers and sellers took a wait-and-see attitude. Bears continue to control the market.

Growth scenario: we are considering December futures, expiration date is December 14. The growth is not impressive. We hold a long position and press our stop.

Fall scenario: we will not sell. Although the fall cannot be denied, it is better to work it out at hourly intervals.

Recommendations for the corn market:

Purchase: no. Anyone in position from 494.0, move the stop to 486.0. Goal: 600.0.

Sale: no.

Support – 487.5. Resistance – 509.5.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date January 12. We won’t buy for now. Note that growth attracts attention.

Fall scenario: very unfortunate. We were knocked out by a trailing stop order at 1312. Out of the market.

Recommendations for the soybean market:

Purchase: no.

Sale: no.

Support – 1293.0. Resistance – 1334.2.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers increased by 66.6 thousand contracts. Buyers came, sellers fled. Sudden change of mood. The buyers’ advantage has increased.

Growth scenario: we are considering November futures, expiration date is November 30. The bulls could push the market above 95.00, leading to a move to 100.00. The levels for purchases are bad, but if it rises above 96.00, you will have to go long.

Fall scenario: It’s unlikely that we have any reason to recommend selling at the moment.

Recommendations for the Brent oil market:

Purchase: in case of growth above 96.00. Stop: 89.00. Goal: 104.00.

Sale: no.

Support – 88.91. Resistance – 93.82.

WTI. CME Group

US fundamentals: the number of active drilling rigs increased by 1 to 502.

Commercial oil reserves in the US fell by -4.491 to 419.748 million barrels, with the forecast of -0.3 million barrels. Gasoline inventories fell by -2.37 to 223.301 million barrels. Distillate inventories fell by -3.185 to 113.773 million barrels. Inventories at the Cushing storage facility fell by -0.758 to 21.013 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports fell by -0.387 to 5.942 million barrels per day. Oil exports increased by 2.234 to 5.301 million barrels per day. Thus, net oil imports fell by -2.621 to 0.641 million barrels per day. Oil refining increased by 0.4 to 86.1 percent.

Demand for gasoline increased by 0.362 to 8.943 million barrels per day. Gasoline production increased by 0.077 to 9.761 million barrels per day. Gasoline imports increased by 0.117 to 0.706 million barrels per day. Gasoline exports fell by -0.097 to 1.081 million barrels per day.

Demand for distillates increased by 0.746 to 4.416 million barrels. Distillate production fell by -0.033 to 4.694 million barrels. Imports of distillates fell by -0.043 to 0.077 million barrels. Exports of distillates fell by -0.016 to 0.144 million barrels per day.

Demand for petroleum products increased by 2.231 to 21.897 million barrels. Production of petroleum products increased by 0.214 to 22.582 million barrels. Imports of petroleum products fell by -0.171 to 1.829 million barrels. Exports of petroleum products fell by -1.664 to 5.355 million barrels per day.

Propane demand increased by 0.906 to 1.493 million barrels. Propane production increased by 0.018 to 2.649 million barrels. Propane imports increased by 0.004 to 0.105 million barrels. Propane exports increased by 0.09 to 0.157 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 51.4 thousand contracts. Buyers for WTI left the market. At the same time, a small number of sellers appeared. They don’t really believe in continued growth in the oil market yet. The bulls’ advantage has narrowed.

Growth scenario: we are considering December futures, expiration date November 20. We will continue to wait for the descent to 76.00. We will not take at current levels. We hold the previously opened long.

Fall scenario: technically the level is interesting for entering shorts. You can work it out, but with a risk to capital that is half that of the standard one.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.70. Target: 83.00. Anyone in position from 83.50, keep a stop at 81.00. Goal: 91.00.

Sale: now. Stop: 90.30. Target: 76.30.

Support – 85.50. Resistance – 89.81.

Gas-Oil. ICE

Growth scenario: we are considering November futures, expiration date is November 10. We do not buy at current prices. We are waiting for a rollback to 700.0.

Fall scenario: we do not go short due to the extremely uncertain situation.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sale: no.

Support – 886.25. Resistance – 1038.75.

Natural Gas. CME Group

Growth scenario: switched to December futures, expiration date November 28. An unpleasant surprise. What is this? They knock the bulls out of an obvious position. Let’s close all longs. Off the market.

Fall scenario: we will not sell. Prices are low.

Natural gas recommendations:

Purchase: no.

Sale: no.

Support – 3.211. Resistance – 3.541.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 70,000. It will be possible to buy there.

Fall scenario: our sell position is still alive. We will sit in it. As always: either we’ll make money, or we’ll hit the stop.

Recommendations for the diesel market:

Purchase: think when approaching 70,000.

Sale: no. If you are in a position from 85000, keep your stop at 91000. Target: 71000.

Support – 76289. Resistance – 85195.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: and we are growing. Which was not so obvious. There are no good levels for purchases. Off the market.

Fall scenario: we see a new high. We won’t sell.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support – 20918. Resistance – 27266.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see that there are no sellers at current prices. We are waiting for deals.

Fall scenario: we continue to remain out of the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 4000. Resistance – 5160.

Gold. CME Group

Growth scenario: we will continue to hold long. We were asked to go down from 2000, but the rollback is unlikely to be deep given the disgusting situation in the world.

Fall scenario: we will not sell. The situation is such that we are very far from detente. The countries have reached irreconcilable differences.

Recommendations for the gold market:

Purchase: no. Anyone in position from 1840, move the stop to 1890. Target: 2400.

Sale: no.

Support – 1962. Resistance – 2000.

EUR/USD

Growth scenario: we did not go above 1.0650, so our long did not open. But we are waiting. We wait.

Fall scenario: slowly making our way up. For now we forget about sales.

Recommendations for the euro/dollar pair:

Purchase: in case of growth above 1.0650. Stop: 1.0530. Target: 1.2000. Or when touching 1.0220. Stop: 1.0120. Goal: 1.2000?!

Sale: no.

Support – 1.0494. Resistance – 1.0640.

USD/RUB

Growth scenario: on Friday we saw the implementation of the presidential decree, albeit belatedly. Off the market.

Fall scenario: selling at the end of last week at current prices was risky, now it’s too late. Either we are out of the market, or we are waiting for a pullback to 97.00, but it is unlikely to happen.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: when rising by 97.00. Stop: 98.00. Target: 87.00.

Support – 93.13. Resistance – 97.58.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. We continue to grow. There are no good levels to enter. Off the market.

Fall scenario: we continue to refuse sales. Technically, the situation is in favor of the bulls.

Recommendations for the RTS Index:

Purchase: no.

Sale: no.

Support – 105830. Resistance – 109740.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|