Price forecast from 9 to 13 January 2023

09 January 2023, 14:04

-

Grain market:

We will celebrate the Old New Year from the 13th to the 14th of January. January 13 is Friday for us. No matter what happens to the ruble or the Russian stock market. On such a day, it is better not to trade.

Don’t run out of goodies in your fridge. Hello everybody!

Wheat started the year with a fall. Preliminary forecasts for future harvest volumes are favorable. In particular, the growth of the gross harvest is expected in Europe, which will reduce the risks in the Black Sea and Mediterranean regions. The EU plans to harvest 143 million tons of soft wheat, against 140 million tons last year. It cannot be ruled out that on the current positive expectations FOB prices for milling wheat in the Black Sea region will fall below $300 per ton by the end of January.

As a result of the grain deal, 17 million tons of grain were exported from the territory of Ukraine, which helped to reduce nervousness and stabilize the market. It should be noted that according to official data, the decline in Ukraine’s GDP for the 22nd year amounted to 30.5%, which calls into question the normal passage of the sowing season this year. There is a high probability that the 23rd year for Ukrainian agriculture will be a failure. Awareness of this fact closer to the summer will not allow prices for wheat and corn to fall sharply.

Both on the physical market and on the exchange, grain prices will be adjusted by 10-12% from current levels. A deeper drop is unlikely to occur.

Energy market:

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

The oil market pretends not to be afraid of anything. As if there is no such problem as underfunding of exploration of new deposits, and there are no problems with capital investments in infrastructure after the pandemic, but in fact they are. Not now, but in a few months this factor will create a shortage of supply in the market.

The number of COVID-19 cases in the world is on the rise again. This can lead to problems in Asia, which will reduce the demand for raw materials. If the figures of mournful statistics continue to grow, then one cannot exclude the fall of Brent oil below the level of 70.00 dollars per barrel in the coming days.

Europe is frankly lucky with the weather. Winter is warm. Berlin +8, London +9. Gas prices have gone down to $700 per 1,000 cubic meters. The cost remains significant, but it is several times lower than what it was in the fall of 22. There is no more panic.

Trades were not held on the electronic trading platform eOil.ru due to the holidays. We continue to note that from February 5, Europe will impose an embargo on the supply of Russian oil products, which should lead to an increase in supply and a fall in prices on the domestic market. To support the national economy, cheap fuel will be very useful.

And more on the current situation. Moscow will have to come to terms with the fact that the windfall profits that made it comfortable for 20 years will now end up in the pockets of foreigners who are not afraid to trade oil, gas and coal with Moscow amid Western sanctions. This is a new reality, one might even say that this is a new world.

USD/RUB:

Without any doubt, in 1923, Russia will face an increase in the budget deficit to at least 4 trillion rubles against the backdrop of a reduction in revenues from the sale of hydrocarbons. All companies capable of generating profits will be subject to additional fees. GAZPROM and ALROSA are just the beginning.

The external background is very disturbing. Western restrictions are already making themselves felt. The Iranian scenario of living under sanctions with inflation of 20-30 percent per year is considered optimistic at the moment. Why? Because Iran is geographically far from the Danube River. And he does not need to measure his strength every second with the center of civilization, whose non-poor population is 700 million people.

For the dollar/ruble pair, we perceive the hike to the level of 82.00 as a working scenario. The Bank of Russia can only delay visiting this mark, but it is not able to achieve growth in the national currency against the backdrop of a falling economy. Except with the help of magic.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 3.4 thousand contracts. Both buyers and sellers left the market, but sellers did it more actively. The spread between short and long positions narrowed. Sellers keep the edge.

Growth scenario: we consider the March futures, the expiration date is March 14. Unfortunately, we did not go to the level of 840.0. Nevertheless, we keep open long positions. We open new buy positions only when we approach the level of 650.0 cents per bushel.

Fall scenario: if you are stopped out of a short position, you need to sell again. The market is able to fall to the level of 650.0.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 620.0. Target: 800.0. Who is in position from 760.0, keep the stop at 730.0. Target: 800.0.

Sale: now. Stop: 772.0. Target: 650.0.

Support — 722.6. Resistance is 758.0.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 36.3 thousand contracts. The change is significant. Buyers actively entered the market, sellers also actively left it. The spread between longs and shorts has widened and the bulls’ lead has increased.

Growth scenario: we consider the March futures, the expiration date is March 14. it is extremely likely that the current area will not stand. Most likely we will fall to 590.0. And that’s where you can buy.

Fall scenario: you can sell here. A move down to 590.0 looks very likely.

Recommendations for the corn market:

Purchase: when approaching 590.0. Stop: 570.0. Target: 645.0.

Sale: now. Stop: 672.0. Target: 590.0 (550.0) cents per bushel.

Support — 643.2. Resistance — 659.6.

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. Given the decline in the grain market, there are few chances for growth, but so far there are no clear reversal signals, we will continue to hold longs from 1425.0.

Fall scenario: failed to gain a foothold above 1500. We sell from current levels.

Recommendations for the soybean market:

Purchase: no. Who is in position from 1425.0, keep a stop at 1438.0. Target: 1600.0.

Sale: now. Stop: 1512.0. Target: 1000.0.

Support — 1431.2. Resistance is 1538.0.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 16.8 thousand contracts. Buyers actively increased their positions, sellers did not take active steps. The spread between long and short positions widened. Bulls continue to control the situation.

Growth scenario: consider the January futures, the expiration date is January 31. You can buy. However, the stop order is placed close to the entry point. If the market falls below 77.00, then the bulls will not stand a chance.

Fall scenario: in case of another attempt to rise to 85.00, you can sell. If the market continues to fall without a rollback up, then we will sell after falling below the level of 77.00.

Recommendations for the Brent oil market:

Purchase: now. Stop: 77.20. Target: 95.00.

Sale: in case of growth to 85.00. Stop: 87.00. Target: 67.00. Or after falling below 77.00. Stop: 82.00. Target: 55.00 (45.00?!!!).

Support — 72.13. Resistance — 87.25.

WTI. CME Group

Fundamental US data: the number of active drilling rigs decreased by 3 units and now stands at 618 units.

Commercial oil reserves in the US rose by 1.694 to 420.646 million barrels, with the forecast of +1.154 million barrels. Inventories of gasoline fell -0.346 to 222.662 million barrels. Distillate inventories fell -1.427 to 118.785 million barrels. Inventories at Cushing rose 0.244 to 25.27 million barrels.

Oil production increased by 0.1 to 12.1 million barrels per day. Oil imports fell by -0.54 to 5.712 million barrels per day. Oil exports rose by 0.742 to 4.207 million barrels per day. Thus, net oil imports fell by -1.282 to 1.505 million barrels per day. Oil refining fell by -12.4 to 79.6 percent.

Gasoline demand fell by -1.813 to 7.514 million barrels per day. Gasoline production fell by -1.678 to 8.466 million barrels per day. Gasoline imports rose by 0.015 to 0.551 million barrels per day. Gasoline exports rose by 0.201 to 1.057 million barrels per day.

Demand for distillates fell by -1.081 to 2.799 million barrels. Distillate production fell -1.05 to 4.035 million barrels. Distillate imports fell -0.047 to 0.113 million barrels. Distillate exports rose by 0.229 to 1.553 million barrels per day.

Demand for petroleum products fell by -4.632 to 18.19 million barrels. Production of petroleum products fell -4.519 to 19.695 million barrels. Imports of petroleum products fell by -0.421 to 1.755 million barrels. The export of oil products increased by 0.591 to 6.347 million barrels per day.

Propane demand fell by -0.547 to 1.145 million barrels. Propane production fell -0.504 to 1.899 million barrels. Propane imports rose by 0.002 to 0.119 million barrels. Propane exports rose by 0.154 to 1.409 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers decreased by 30.2 thousand contracts. The change is significant. Sellers increased their positions, while buyers preferred to flee the market. The spread between long and short positions has narrowed, however, the bulls continue to control the situation.

Growth scenario: we consider the February futures, the expiration date is January 20. Long entry from 65.00 remains possible. The current levels are also of interest. We put a stop order nearby.

Fall scenario: sellers control the market. Keep open shorts. Whoever built up the short from 81.50, well done. We continue to note that the target may be extremely low, for example, at the level of $40.00 per barrel.

Recommendations for WTI oil:

Purchase: now. Stop: 72.20. Target: 90.00. Also, when approaching 65.00. Stop: 64.00. Target: 90.00.

Sale: when approaching 78.00. Stop: 80.60. Target: 66.00 (40.00). Who is in position from 86.80, move the stop to 80.60. Target: 66.00 (40.00) dollars per barrel.

Support — 70.03. Resistance is 81.44.

Gas-Oil. ICE

Growth scenario: switched to February futures, expiration date February 10th. We will continue to stop shopping. The levels are not bad, but there are doubts about the ability of the market to go up.

Fall scenario: while we insist on sales. We enter short from the current levels.

Gasoil recommendations:

Purchase: when approaching 750.0. Stop: 720.0. Target: 1200.0.

Sale: now and on the rise to 900.0. Stop: 926.0. Target: 750.0.

Support — 822.50. Resistance is 921.75.

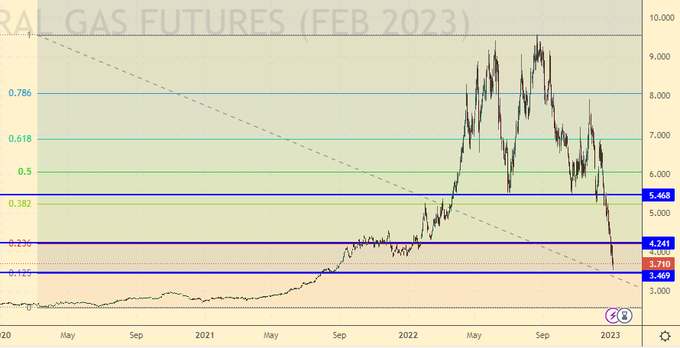

Natural Gas. CME Group

Growth scenario: we are considering the February futures, the expiration date is January 27th. Warm winter confused us all the cards. Went extremely low. We take a break.

Fall scenario: it makes no sense to sell from current levels. Everything that could happen has already happened.

Recommendations for natural gas:

Purchase: no.

Sale: no.

Support — 3.469. Resistance — 4.241.

Winter diesel (Surgut), ETP eOil

Growth scenario: we are still able to approach the level of 90,000. However, it cannot be ruled out that market participants have already begun to bet on falling prices. We don’t buy.

Fall scenario: as before, it makes sense to look for options for sales. We are at the maximum values, the market is overheated.

Diesel market recommendations:

Purchase: no.

Sale: now. Stop: 88300. Target: 60,000. Or when approaching 92,000. Stop: 96,000. Target: 70,000 rubles per ton.

Support — 84063. Resistance — 88906.

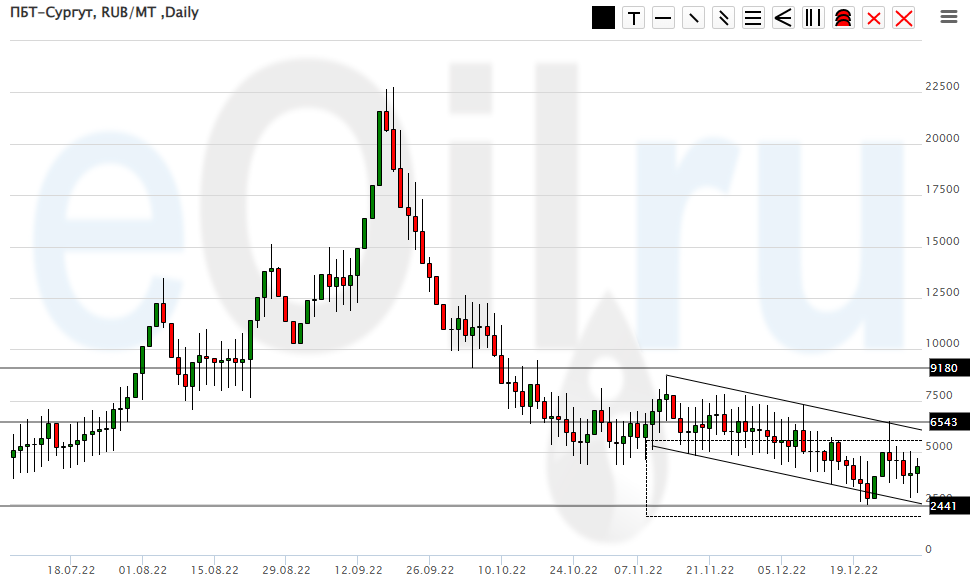

Propane butane (Surgut), ETP eOil

Growth scenario: prices remain at their lowest levels. It makes sense to look for buying opportunities. The market is able to recover up to 8,000 rubles per ton.

Fall scenario: it makes no sense to sell. Prices are extremely low.

Recommendations for the PBT market:

Purchase: now. Stop: 2400. Target: 8000 rubles per ton.

Sale: no.

Support — 2441. Resistance — 6543.

Helium (Orenburg), ETP eOil

Growth scenario: at current price levels, you can buy based on the growth of quotes. Recovery to level 3000 is possible.

Fall scenario: do not sell. Prices are extremely low.

Recommendations for the helium market:

Purchase: now. Stop: 1820. Target: 3000. Whoever is in position from 1900, keep the stop at 1820. Target: 3000 rubles per cubic meter.

Sale: no.

Support — 1822. Resistance — 2291.

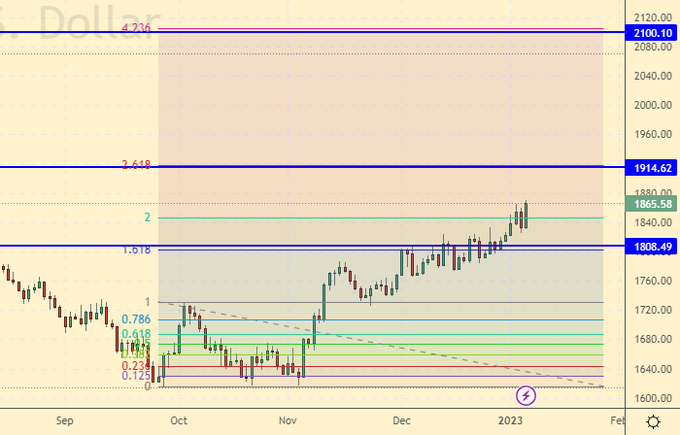

Gold. CME Group

Growth scenario: bulls have seized the initiative and continue to push prices up. Targets at the top are 1910 and 2100.

Fall scenario: we will not sell. Even a move to 2100 will not force us to go short. Gold has a good chance for a long rise.

Recommendations for the gold market:

Purchase: no. Who is in position between 1675 and 1780, keep the stop at 1759. Target: 2100 (2400) dollars per troy ounce.

Sale: no.

Support — 1808. Resistance — 1914.

EUR/USD

Growth scenario: if we pass above 1.0800, we will go to 1.1500. It makes sense to buy after the breakdown of 1.0800.

Fall scenario: for now, let’s put aside all the arguments about entering the short. A fast move of the pair up is possible.

Recommendations for the EUR/USD pair:

Purchase: in case of growth above 1.0800. Stop: 1.0570. Target: 1.1500.

Sale: no.

Support — 1.0468. Resistance is 1.0783.

USD/RUB

Growth scenario: we are trying to pass above the level of 73.00. If this succeeds, then we will go to 83.00, and very quickly. If a miracle happens, namely: there will be a rollback to 65.00, then when approaching this level, it is necessary to buy.

Fall scenario: can be sold. The technical picture allows you to place a stop order at a small distance from the entry point. The chances of success are low, but the profit / risk ratio is about 6 (six), which gives us the right to open a short.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 65.00. Stop: 63.00. Target: 83.00. In case of growth above 73.00. Stop: 71.00. Target: 83.00.

Sale: now. Stop: 73.30. Target: 65.60.

Support — 65.15. Resistance is 72.85.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. There is a post-New Year feeling that the story about the RTS index will be much sadder than the story about a certain Romeo and a certain Juliet. If the level of 90000 fails and we go lower, then we may remember about purchases only at the level of 50000. Or maybe we won’t remember at all.

Fall scenario: we are not pulling back up. I would like to see at least a slight increase, at least to 101,000, but there is none. There are no interesting levels for new sales. The one who holds the shorts that were open earlier is well done.

Recommendations for the RTS index:

Purchase: no.

Sale: when approaching 101000. Stop: 104300. Target: 80000 (50000, then 20000) points. Who is in position from 106000, move the stop to 104300. Target: 80000 (50000, then 20000) points.

Support — 91160. Resistance — 96060.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|