Price forecast from 27 to 31 May 2024

27 May 2024, 10:48

-

Grain market:

Budget losses for 2023 from the import of illegal cigarettes amounted to 130 billion rubles. I wonder how much was lost on the importation of alcohol and medicines. We need to stop smoking and drinking, then we will not need medicines! And then there will be no reason to talk about budget losses. Have a healthy summer! Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

IGC has published its next gross harvest forecast. It should be noted that during the month expectations for wheat decreased by only 3 million tons to 795, for corn by 6 million tons to 1220 million tons. The indicators are more than good. And if some regions of the world follow the example of China and introduce a program of one family — one child, there will be enough for everyone.

Russia is expected to export 53.1 million tons of wheat in the 23/24 season. This is 26% of all foreign trade. This is a very positive result. It will not be possible to repeat it next season, most likely, but still we will be somewhere close. Control over food is much more important than control over resources. In the end, you can get to work by horseback or cycle rickshaw, but it is desirable to periodically load a bun in your stomach. To make life more cheerful.

Note the continuing rise in beef prices on the world market, which may lead people to go more and more into poultry and pork, and they consume a lot of grain. Free pasture is a luxury in some regions, so you have to give grain instead of grass, and that’s also an expensive story. Assuming feed grains go up, even if not this season, it will raise poultry and pork prices, but where beef, which is already going for 190 cents a pound live weight, will go is hard to even guess.

Energy market:

On the eve of the OPEC+ meeting, oil prices are in no hurry to pamper princes and other stakeholders. It is not excluded that not only the current levels of production reduction will have to be adhered to, but the participants of the collusion will be forced to reduce them even more. For Brent, we cannot rule out a descent to 77.00.

Russia has fallen in love with China and India, you could write «in love», but in love looks somehow more joyful and somewhere mutual. Arabs sell to Europe and Asia, we sell only to Asia. The situation is so-so, but the standoff between India and China, somewhere in there and Pakistan and Japan dangling between our legs, and the tail of Korea, all of which can be used to regulate the pressure from the faucet. Some more, some less, it is not only for the Chinese to tell us that we will no longer buy from you, because we are in favor of diversification of supplies. So we are in favor of diversification, we will pour more for some and less for others. Asia is like that, it is murky, but you can catch fish in it too. There is also Indonesia, Malaysia, Vietnam. If you dig there, you can find healthy worms.

USD/RUB:

Most likely, in June we will see the rate increase by 1% to 17%. These expectations, as well as the fall in demand for the currency due to the fall in imports, give the pair an opportunity to fall to 89.00, which, in fact, has already happened, and we can also expect a move to 86.00.

At the same time, the RGBI index continues to fall down, which indicates that bankers do not see the bottom of the current situation. Market professionals want higher rates from the government for money in debt. It is good that so far the government wants to receive from the market only 1 trillion rubles per quarter, not 3 trillion.

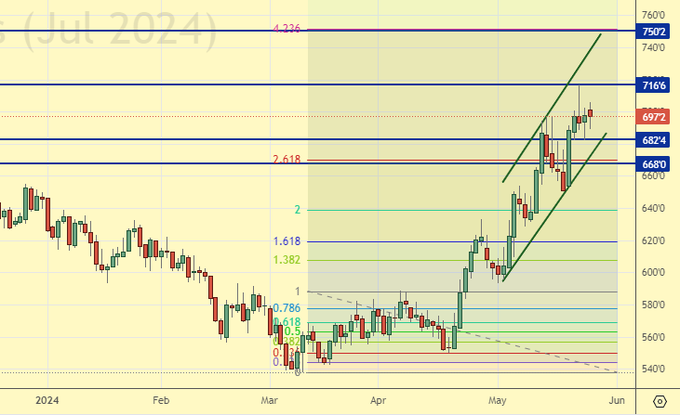

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 3.3 th. contracts. Speculators were inactive. Bears risk losing control in the long run.

Growth scenario: we consider July futures, expiration date July 12. Refrain from buying.

Downside scenario: shorting from 750.0 would be a good decision, given that the current rise has weak fundamental support.

Recommendations for the wheat market:

Buy: no.

Sell: when approaching 750.0. Stop: 770.0 Target: 600.0.

Support — 682.4. Resistance — 716.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 54.4 thousand contracts. The change is significant. Sellers came in, buyers fled the market. Bears consolidated their control.

Growth scenario: we consider July futures, expiration date July 12. We will continue to hold longs, while understanding the shakiness of the whole bullish structure.

Downside scenario: it would be interesting to sell from 550.0. It cannot be ruled out that we went to 360.0, so we will have to work off the short now.

Recommendations for the corn market:

Buy: no. Those in position from 442.0, keep stop at 446.0. Target: 550.0.

Sell: Now (464.6). Stop: 469.0. Target: 360.0. Or when approaching 550.0. Stop: 570.0. Target: 360.0?!

Support — 450.6. Resistance — 467.0.

Soybeans No. 1. CME Group

Growth scenario: we consider July futures, expiration date July 12. We keep longing for now. Soybeans promise a lot, but the market is stubbornly looking up.

Downside scenario: from 1310 we will definitely go short. While out of the market.

Recommendations for the soybean market:

Buy: No. Who is in position from 1215, move stop to 1220. Target: 1310 (revised).

Sell: when approaching 1310.0. Stop: 1330.0. Target: 960.0.

Support — 1191.0. Resistance — 1258.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 66.6 thousand contracts. The change is significant. Bulls fled, sellers entered the market in commensurate volumes. Buyers risk losing control over the situation.

Growth scenario: we switched to July futures, expiration date June 28. We went below the lows of the previous week. Still out of the market.

Downside scenario: hold shorts. A stronger dive is possible.

Recommendations for the Brent oil market:

Buy: no.

Sell: no. Who is in the position from 87.50 (taking into account the transition to a new contract), move the stop to 84.30. Target: 77.80.

Support — 80.12. Resistance — 84.18.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 497.

U.S. commercial oil inventories rose 1.825 to 458.845 million barrels, with a forecast of -2.4 million barrels. Gasoline inventories fell -0.945 to 226.822 million barrels. Distillate stocks rose 0.379 to 116.744 million barrels. Cushing storage stocks rose 1.325 to 36.32 million barrels.

Oil production is unchanged at 13.1 million barrels per day. Oil imports fell by -0.081 to 6.663 million barrels per day. Oil exports rose by 0.595 to 4.73 million barrels per day. Thus, net oil imports fell -0.676 to 1.933 million barrels per day. Oil refining rose by 1.3 to 91.7 percent.

Gasoline demand increased by 0.44 to 9.315 million barrels per day. Gasoline production increased by 0.351 to 10.049 million barrels per day. Gasoline imports rose 0.047 to 0.773 million barrels per day. Gasoline exports fell -0.127 to 0.77 million barrels per day.

Distillate demand increased by 0.052 to 3.883 million barrels. Distillate production increased by 0.26 to 5.064 million barrels. Distillate imports rose 0.009 to 0.098 million barrels. Distillate exports increased by 0.155 to 1.224 million barrels per day.

Demand for petroleum products fell by -0.026 to 20.03 million barrels. Petroleum products production fell by -0.053 to 22.145 million barrels. Imports of refined petroleum products rose by 0.215 to 2.079 million barrels. Exports of refined products rose by 0.494 to 6.646 million barrels per day.

Propane demand increased by 0.258 to 0.806 million barrels. Propane production increased by 0.001 to 2.786 million barrels. Propane imports rose 0.037 to 0.11 million barrels. Propane exports fell -0.131 to 1.769 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

Growth scenario: moved to July futures, expiration date June 20. We can buy. A move down to 73.50 is possible, but we are not afraid of anything.

Downside scenario: do nothing for now.

Recommendations for WTI crude oil:

Buy: now (77.72). Stop: 75.90. Target: 97.00.

Sale: no.

Support — 75.92. Resistance — 79.94.

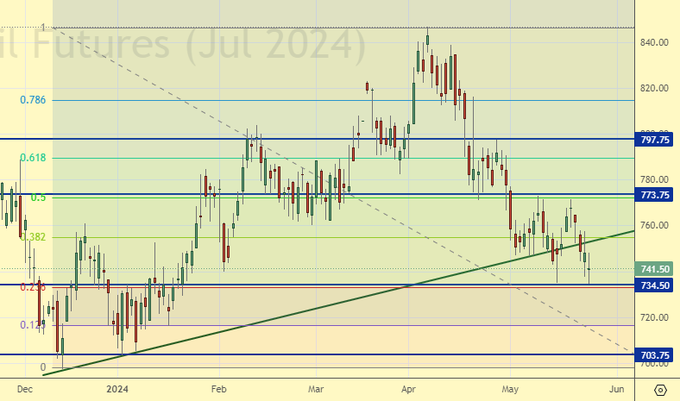

Gas-Oil. ICE

Growth scenario: we consider the June May futures, expiration date June 12. We will fight for the long, open the position again. So far the bears have failed to break the market.

Downside scenario: there are no interesting levels for selling.

Gasoil Recommendations:

Buy: now (741.50). Stop: 732.00. Target: 880.00.

Sale: no.

Support — 734.50. Resistance — 773.75.

Natural Gas. CME Group

Growth scenario: switched to July futures, expiration date June 26. Worked out 2.0 Fibonacci. Descent to 2.654 opens opportunities for additions. We hold the long.

Downside scenario: when approaching 3.500 we will think about selling. Out of the market for now.

Natural Gas Recommendations:

Buy: no. Who is in the position from 2.300, (taking into account the transition to a new contract), move the stop to 2.400. Target: 3.400.

Sale: not yet.

Support — 2.654. Resistance — 3.153.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 76000, we don’t think about buying. At the same time: purchases from 62000 are welcome.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: on approach to 62000. Stop: 58000. Target: 100000!

Sale: no.

Support — 64072. Resistance — 75352.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will buy, but only after growth above 11500.

Downside scenario: we stay out of the market. A move to 5000 is possible, but selling is risky now. It is better to be in commodities than in cash.

PBT Market Recommendations:

Buy: in case of growth above 11500. Stop: 8800. Target: 25000. You can be aggressive.

Sale: no.

Support — 6914. Resistance — 11016.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see growth from 1000. Nevertheless, still out of the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1027. Resistance — the area of 1525.

Growth scenario: we switched to the August futures, expiration date August 28. For purchases we continue to want correction. Buying from 2150 will be interesting.

Downside scenario: we will sell when approaching 2430.

Gold Market Recommendations:

Buy: from 2100 would be interesting, from 2000 would be perfect.

Sell: on approach to 2430. Stop: 2454. Target: 2150.

Support — 2315. Resistance — 2475.

EUR/USD

Growth scenario: bulls may reverse the situation, but until that happens we remain out of the market.

Downside scenario: we keep short, but we realize that there is a possibility of the market moving to 1.1000.

Recommendations on euro/dollar pair:

Buy: no.

Sell: no. Those in position from 1.0867, move your stop to 1.0910. Target: 1.0000.

Support — 1.0804. Resistance — 1.0863.

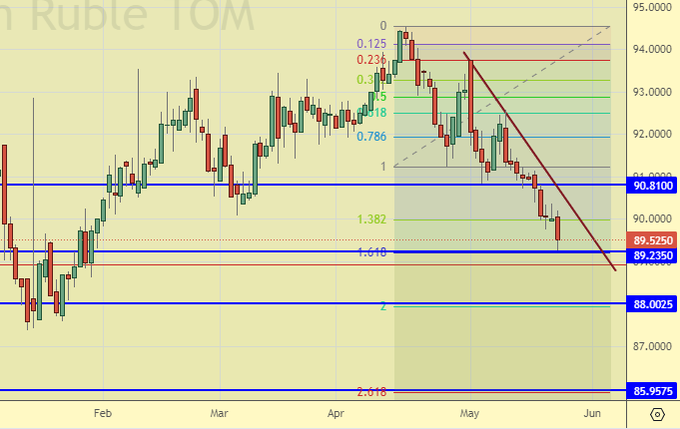

USD/RUB

Growth scenario: most likely, we will enter long from 86.00. Out of the market for now.

Downside scenario: it is possible to hold shorts. We remain of the opinion that as long as the Central Bank does not raise the rate above 20%, the ruble will be viewed as a quite healthy creature.

Recommendations on dollar/ruble pair:

Buy: when approaching 86.00. Stop: 85.00. Target: 95.00?!

Sell: no. Those in position from 92.10, move your stop to 89.70. Target: 86.00?!

Support — 89.23. Resistance — 90.81.

RTSI. MOEX

Growth scenario: we consider the June futures, expiration date June 20. We were already getting upset last week, saying that we missed the trend. And it turned out to be sluggish. Out of the market.

Downside scenario: we continue to believe that shorting from 126000 will be interesting in the future, but for now out of the market.

Recommendations on the RTS index:

Buy: no.

Sale: no.

Support — 116480. Resistance — 119540.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|