Price forecast from 27 to 31 December 2021

Grain market:

The wind has blown in Europe, so the euro will fall against the dollar in January.

Why?

This is elementary: as a result of the growth of wind generation, gas prices in the EU will fall, inflationary pressure in the European economy will decrease, therefore, the ECB will not raise the rate before the FED, trying to stifle inflation, which means that the euro will still weaken against the dollar.

Yes, this is how we crochet here.

Good day to you, dear investors!

Exporting countries such as Russia, Argentina, and now Ukraine, impose restrictions on the export of agricultural products until the end of the 21/22 season. This is a strong bullish fundamental signal. Producers do not want a deficit in the domestic market and expect to ensure a more or less tolerable existence for themselves during a period of high inflation and increased demand for grain.

India has banned trading on the stock exchange in an attempt to restrain the rise in food prices that are hitting the poor hard. The measure is extraordinary, its effectiveness is questionable, but if it is possible to contain the rise in prices at least a few months before the new harvest of 2022, then it will be justified.

If in 2022 the grain harvest is lower than the levels shown in the current season, then a new round of price increases may await us. If the agricultural sector does not fail and the situation in the world is generally calm, overstocking is possible, since many companies are already purchasing for future use. So, in the United States, only 30% of grain reserves are in farmers’ warehouses, the remaining 70% are already at the processors.

You can find our statistics, reviews and forecasts here.

Energy market:

A little more than two years have passed since the beginning of the pandemic. The world is fighting infection. Oil prices have been recovering throughout 2021, rising from $ 55 to $ 75 per barrel. The love between Russia and Saudi Arabia has become brighter, sharper and freer, it has become more independent from outside consultants. Flying western carrier pigeons cannot ruin the holiday for two lovers. What to wish for this hydrocarbon pair: as many cloudless days as possible in 2022. And, may they never see oil below $ 50 per barrel again.

One cannot but mention the prices for natural gas in Europe. 800 million people have a great love for their politicians and economists, many of whom are Nobel Prize winners. And the peak of this love has not yet arrived. If the prices of 1000 dollars per 1000 cubic meters of gas will hold out in January and February, then in March, driven by spring hormones, the residents of Londons and Parises will start making fires in the buildings of local administrations. Anticipating such a thing, the nuclear power industry was quickly and quietly recognized in Europe as «green», let’s hope that this will help, and if not, then we are waiting for the actions of GAZPROM at the level of 480 rubles.

You can find our statistics, reviews and forecasts here.

USD/RUB:

One cannot but mention Turkey.

Erdogan shows the whole world an example of how to fight inflation in the country and maintain relatively low interest rates for loans only with the help of political will. Prices go up, while the Central Bank rate goes down. The lira has depreciated more than twice in recent months, but last week it strengthened against the dollar on promises of compensation for losses on deposits from the depreciation of the lira. For a while, such a move will bring down the excitement, but what will happen next is not clear. Erdogan has chances to leave lending at a level feasible for business and at the same time not to destroy the lira, but for this it is necessary to make the trade balance not zero, as it is now, but positive. It cannot be ruled out that Turkey will introduce strict currency regulation, and this will also help for a while.

Now about the ruble. In contrast to Turkey, our trade balance is positive, which allows the Ministry of Finance to draw on the exchange through the budget rule such a ruble-to-dollar exchange rate as it wants.

Next year, without strengthening the national currency, it will not be possible to defeat the rise in prices for imported goods. Domestic prices will also rise, although at a slower pace than commodity prices in Europe and the United States. Note that this has never happened in the history of new Russia.

Growth in producer prices in Germany reached 16% per annum, which will very soon lead to an increase in prices for both wholesalers and retail. Some of these goods will arrive in Russia, naturally, with new price tags.

It will be enough for ruble next year to remain near the level of 70.00 against the US dollar in order for Russian debt and equity securities to be attractive to foreign investors.

Most likely, we saw only the first wave of a new commodity supercycle. Everything will be fine with us.

Happy New Year, everyone!

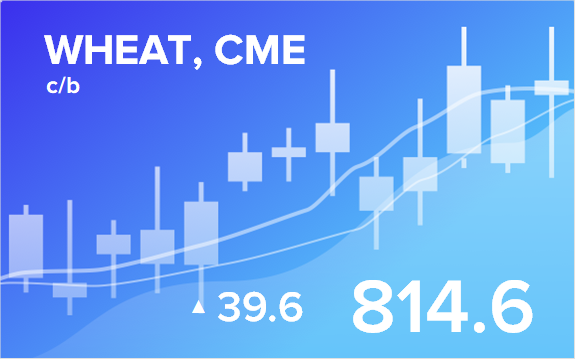

Wheat No. 2 Soft Red. CME Group

Growth scenario: considering the March futures, the expiration date is March 14. We continue to refrain from shopping. We expect a rollback to 730.0. Note that after the growth above 830.0, the mark 900.0 will open.

Fall scenario: at current levels, a short is possible with little capital risk.

Recommendation:

Purchase: not yet.

Sell: now, add after falling below 780.0. Stop: 830.0. Target: 735.0. Also sell when approaching 900.0. Stop 930.0. Target: 735.0.

Support — 781.0. Resistance — 823.4.

Growth scenario: considering the March futures, the expiration date is March 14. We see a threat to move to 670.0. If the market goes above 617.0, you will have to purchase.

Fall scenario: excellent sell levels. If Monday opens with a fall, enter the short.

Recommendation:

Purchase: after rising above 617.0. Stop: 580.0. Target: 665.0.

Sell: if Monday opens lower. Stop: 617.0. Target: 550.0.

Support — 581.4. Resistance — 606.4 (667.6).

Soybeans No. 1. CME Group

Growth scenario: considering the January futures, the expiration date is January 14. We go to 1354.0 (1462.0) and it pleases. We continue to hold longs. At 1354, you can close 25% of the position.

Fall scenario: while out of the market. Around 1500, let’s think about shorts.

Recommendation:

Purchase: no. Those who are in positions between 1267.0 and 1280.0, move the stop to 1262.0. Target: 1462.0.

Sale: no.

Support — 1288.0. Resistance — 1354.2.

Sugar 11 white, ICE

Growth scenario: considering the March futures, the expiration date is February 28. A week later, analyzing the market has not become easier. The price is in the range. We do not purchase.

Fall scenario: we keep our short from 19.80. We do not open new positions.

Recommendation:

Purchase: when approaching 18.15. Stop: 17.70. Target: 23.20.

Sale: no. Whoever is in the position from 19.80, keep the stop at 20.00. Target: 18.21.

Support — 18.47. Resistance — 19.91.

Сoffee С, ICE

Growth scenario: considering the March futures, the expiration date is March 21. We remain with our previous opinion: for a new round of purchases, we need to drop to the area of 200.0. Out of the market so far.

Fall scenario: we hold short positions, the formation of the “head and shoulders” pattern is confirmed. We can retreat to area 200.0, which is what we need.

Recommendation:

Purchase: think when approaching 200.0.

Sale: no. Those who are in the position from 245.0, move the stop to 246.0. Target: 200.0.

Support — 218.05. Resistance — 241.45.

Brent. ICE

Growth scenario: considering the January futures, the expiration date is January 31. The prospect of a move at 95.00 exists, but for a good purchase it would be preferable to see a pullback to 60.00.

Fall scenario: continue to recommend shorts. The spread of the omicron strain in Europe and lockdowns are ahead.

Recommendation:

Purchase: when approaching 60.00.

Sale: now. Stop: 78.90. Target: 60.00 (50.00). Whoever is in positions from 82.00, 77.00 and 76.00, move the stop to 78.90. Target: 60.00 (50.00).

Support — 65.73. Resistance — 77.81.

WTI. CME Group

Fundamental data from the USA: the number of active drilling rigs increased by 5 units and is now 480 units.

Commercial oil reserves in the US fell by -4.715 to 423.571 million barrels, while the forecast was -2.750 million barrels. Gasoline inventories rose by 5.533 to 224.118 million barrels. Distillate stocks rose 0.396 to 124.154 million barrels. Inventories at the Cushing storage facility increased by 1.463 to 33.674 million barrels.

Oil production fell by -0.1 to 11.6 million barrels per day. Oil imports fell by -0.277 to 6.194 million barrels per day. Oil exports fell by -0.766 to 2.879 million barrels per day. Thus, net oil imports rose by 0.489 to 3.315 million barrels per day. Oil refining fell by -0.2 to 89.6 percent.

Gasoline demand fell by -0.486 to 8.986 million barrels per day. Gasoline production fell by -0.1 to 9.942 million barrels per day. Gasoline imports rose 0.189 to 0.688 million barrels per day. Gasoline exports rose 0.2 to 0.821 million barrels per day.

Distillate demand fell -1.074 to 3.822 million barrels. Distillate production rose 0.04 to 4.852 million barrels. Distillate imports fell by -0.247 to 0.203 million barrels. Distillate exports rose 0.403 to 1.176 million barrels per day.

The demand for petroleum products fell by -2.737 to 20.454 million barrels. Production of petroleum products fell by -0.46 to 21.928 million barrels. Imports of petroleum products fell by -0.041 to 2.259 million barrels. Exports of petroleum products rose by 1.531 to 5.887 million barrels per day.

Propane demand fell by -0.867 to 1.193 million barrels. Propane production rose 0.002 to 2.427 million barrels. Propane imports rose 0.056 to 0.195 million barrels. Propane exports rose 0.703 to 1.55 million barrels per day.

Growth scenario: considering the February futures, the expiration date is January 20. As in the previous week, we remain outside the market and wait for lower levels for purchases. Current growth can be cheating.

Fall scenario: we will continue to look downward at the market. Note that growth above 78.00 is undesirable for a bearish scenario.

Recommendation:

Purchase: no.

Sale: when rising to 76.00. Stop: 78.30. Target: 50.00.

Support — 69.20. Resistance — 76.16.

Gas-Oil. ICE

Growth scenario: considering the January futures, the expiration date is January 12. Growth above 690.0 is hard to believe. We will refrain from purchasing.

Fall scenario: sell here. You can also sell when prices rise, up to 690.0.

Recommendation:

Purchase: no.

Sale: now. Stop: 670.00. Target: 500.00. Those who are in positions between 650.0 and 630.0, keep the stop at 670.00. Target: 500.00.

Support — 600.75. Resistance — 683.50.

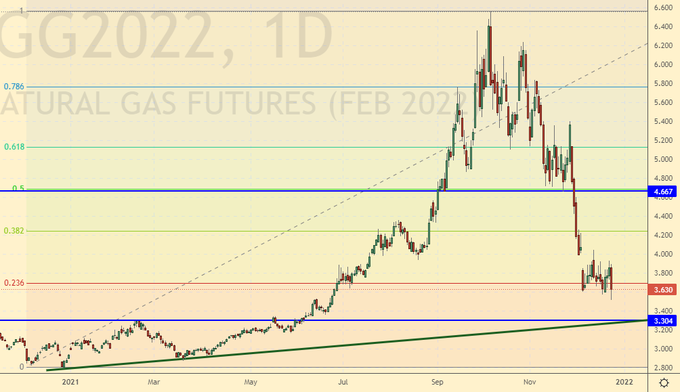

Natural Gas. CME Group

Growth scenario: consider the February futures, expiration date January 27. Nothing has changed in a week. We will purchase. The levels remain attractive for long entry.

Fall scenario: we will not sell. Europe cannot go through the winter without problems.

Recommendation:

Purchase: now. Stop: 3.100. Target: 8.777. Those who are in the position from 3.600, move the stop to 3.100. Target: 8.777.

Sale: no.

Support — 3.304. Resistance — 4.667.

Gold. CME Group

Growth scenario: sellers were met at 1750.0. The bull’s advantage is minimal, but it is there. We keep longs.

Fall scenario: do not open short for gold yet. We are monitoring the situation.

Recommendations:

Purchase: no. Anyone in the position from 1780, keep the stop at 1770. Target: 2300.

Sale: no.

Support — 1751. Resistance — 1814.

EUR/USD

Growth scenario: wait for the market at 1.1070 and purchase. The US administration has no plans to stop printing money.

Fall scenario: here you can enter short with a short stop order and a target at 1.1070.

Recommendations:

Purchase: when approaching 1.1070. Stop: 1.1020. Target: 1.2100. Whoever is in the position from 1.1300, keep the stop at 1.1220. Target: 1.1680 (1.2100).

Sale: now. Stop: 1.1380. Target: 1.1070.

Support — 1.1185. Resistance — 1.1361.

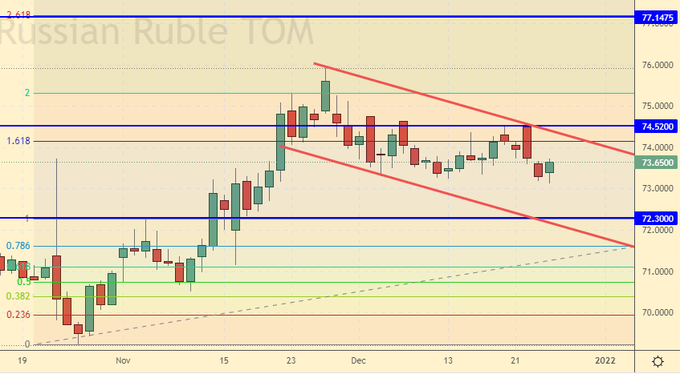

USD/RUB

Growth scenario: the fall towards 72.30 cannot be denied. Let’s call a deeper dive into question. In the future, you would not like to miss a possible move up to 77.10. Maintaining concentration.

Fall scenario: the market below 72.30 is not visible. We do not sell.

Recommendations:

Purchase: when approaching 72.30. Stop: 72.10. Target: 77.10. Anyone in the position from 74.10, keep the stop at 72.90. Target: 77.00 (82.00).

Sale: no.

Support — 72.30. Resistance — 74.52.

RTSI

Growth scenario: the market is in balance. The growth of quotations is possible. You can enter a purchase if the index futures rise above 166000.

Fall scenario: if Monday is red, then you can sell with a target of 145,000.

Recommendations:

Purchase: think after growth above 166000. We do not give direct recommendations to purchase.

Sell: If the index falls on Monday. Stop: 161000. Target: 145200.

Support — 153450. Resistance — 161630.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.