Price forecast from 23 to 27 January 2023

23 January 2023, 13:44

-

Grain market:

From the West, two price ceilings for oil products in February are waiting for us at once. We are waiting for the third and fourth ceilings in March, the fifth and sixth in April. In such a situation, the main thing is not to get confused where the floor is and where the ceiling is. Just look, the liberal Brussels European officials will begin to feel dizzy from the new ceilings and the approach of spring.

Take the situation soberly. Hello everybody!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Two agricultural giants: Brazil and Argentina are thinking about creating a single currency. For Argentina, with its rhythmic defaults every 10 years, this is just a salvation, since the country is so mired in socialism that there is simply nowhere else to go. Perhaps, with the introduction of a single currency, laws will also change, and some citizens of Buenos Aires and the surrounding area will again have to not only go to work, but also work. And some will even be fired. It is scary to imagine this now, since trade unions are everywhere and it is almost impossible to remove a person from his place.

Increasing the economic efficiency of the countries of South America in the future will provide higher food supplies to foreign markets. For the sake of a stable future, we allow Brazil and Argentina to introduce a single currency. Well done. The main thing is that laziness does not paralyze at the most crucial moment.

Russian wheat makes Kazakh wheat uncompetitive. Agrarians of Kazakhstan are asking to tighten control over imports, as they cannot sell at the same price as the Russians. It is already clear that there will be large carry-over stocks in Russia. The grain must be attached somewhere. If Kazakh traders lower prices, Russians will lower prices even more and continue shipments from Kazakhstan to end consumers. It cannot be ruled out that closer to spring, Kazakhstan will indeed go for the introduction of protective duties in order to sell its grain in the republics of Central Asia and save its own peasants from overstocking.

Reading our forecasts, you could make money on the WTI oil market by taking a move down from 86.80 to 81.60 dollars per barrel. You could also make money in the soybean market by taking a move up from 1425.0 to 1517.0 cents per bushel. In addition, it was possible to make money in the gold market by taking a move up from 1675 to 1904 dollars per troy ounce.

Energy market:

Saudi Arabia wanted to sell its resources not only for dollars. The Euro and Saudi Real will also be considered as a means of payment. This decision, announced by the country’s finance minister in Davos, may cause negative reactions from Washington. And here the question arises: how long can Saudi Arabia withstand US pressure. After all, the Saudis have no other wealth other than oil and gas. You can hit the price ceiling. And plus, beautiful cities for tourists can suddenly become empty. For example, because of the pandemic. That’s all of Saudi Arabia. Here it is worth hoping that the eastern sages have calculated everything.

Mr. Novak said that he hopes to reduce the discount on Russian oil against Brent in the near future. I would like to believe in it. In practice, at the moment the situation is as follows: in 2022, the average selling price of Urals oil was $77, from mid-November to mid-December, oil was sold at $57, from mid-December to mid-January 2023 already at $47. And from mid-January to mid-February, the cost of a barrel of Urals is expected to fall to $44, which is 50% less than the price of Brent oil on the stock exchange. Yes, the discount should be reduced. So this is a robbery, but let it be called «discount».

USD/RUB:

The Russian currency will no doubt be under strong pressure throughout the 23rd year. The decrease in revenue from the sale of hydrocarbons can lead to the fact that the budget deficit will reach 6 trillion. rubles. (this is a pessimistic assessment, but it has the right to exist now).

The deficit will be covered by the sovereign wealth fund, by selling foreign currency, by additional taxation of businesses capable of generating profits, and ultimately by turning on the printing press. The last resort will not have to be resorted to if the discount on Russian oil and oil products is reduced.

The strengthening of the ruble is possible up to 65 rubles per 1 US dollar, lower levels are not visible at the moment.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between the long and short positions of managers increased by 2,000 contracts. Sellers entered the market, buyers remained indifferent to what was happening. The spread between short and long positions has changed by a small amount. Sellers keep the edge.

Growth scenario: we consider the March futures, the expiration date is March 14. We continue to wait for the market to fall to the level of 650.0 cents per bushel, and we will buy there. Growth from current levels looks unnatural.

Fall scenario: the picture continues to be bearish after another week. We hold shorts, expect a fall to the level of 650.0 cents per bushel.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 630.0. Target: 800.0. Or in case of growth above 780.0. Stop: 730.0. Target: 1200.0?!!!

Sale: no. Who is in position from 750.0, keep the stop at 772.0. Target: 650.0.

Support — 720.2. Resistance — 759.2.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 49.2 thousand contracts. The change is significant. An unexpectedly large number of bulls entered the market, while the sellers did not run away. The spread between long and short positions widened. The advantage of the bulls has increased markedly.

Growth scenario: we consider the March futures, the expiration date is March 14. We continue to believe that from a technical point of view, purchases look like a risky business in this situation. If we buy, then only after the upward breakdown of the level of 710.0. While out of the market.

Fall scenario: we will continue to insist on shorts. Wednesday, Thursday and Friday were not for the bulls. The market may turn down.

Recommendations for the corn market:

Purchase: not yet.

Sale: now. Stop: 690.0. Target: 590.0 (550.0) cents per bushel.

Support — 648.2. Resistance — 688.6.

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. We will not buy. We collected a lot of soybeans. Prices should pull back from current highs.

Fall scenario: we will continue to insist on sales. There is a fine target below: 1000.0 cents per bushel. We will probably go to it, winning back a significant surplus in the market.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1553.0. Target: 1000.0. Count the risks.

Support — 1430.6. Resistance — 1548.2.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 56.9 thousand contracts. The change is gigantic. Buyers entered the market aggressively, sellers fled. The spread between long and short positions widened significantly. Bulls are in control.

Growth scenario: consider the January futures, the expiration date is January 31. We keep growing. It is worth keeping longs open two weeks ago. If the market rises above the level of 90.00, you can increase the position.

Fall scenario: we refuse new sales. We keep the old short.

Recommendations for the Brent oil market:

Purchase: no. Who is in position from 79.00, move the stop to 81.20. Target: 120.00?!

Sale: no. Who is in position from 85.00, move the stop to 88.30. Target: 55.00 (45.00?!!!) dollars per barrel.

Support — 83.77. Resistance is 91.52.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 10 units and now stands at 613 units.

Commercial oil reserves in the US increased by 8.408 to 448.015 million barrels, while the forecast was -0.593 million barrels. Inventories of gasoline rose by 3.483 to 230.259 million barrels. Distillate inventories fell -1.939 to 115.777 million barrels. Inventories at Cushing rose by 3.646 to 31.427 million barrels.

Oil production has not changed and is 12.2 million barrels per day. Oil imports rose by 0.511 to 6.861 million barrels per day. Oil exports rose by 1.735 to 3.872 million barrels per day. Thus, net oil imports fell by -1.224 to 2.989 million barrels per day. Oil refining increased by 1.2 to 85.3 percent.

Gasoline demand rose by 0.496 to 8.054 million barrels per day. Gasoline production increased by 0.332 to 8.865 million barrels per day. Gasoline imports rose by 0.04 to 0.556 million barrels per day. Gasoline exports rose by 0.067 to 0.934 million barrels per day.

Demand for distillates rose by 0.203 to 4.024 million barrels. Distillate production increased by 0.057 to 4.601 million barrels. Distillate imports fell -0.061 to 0.148 million barrels. Distillate exports fell -0.083 to 1.002 million barrels per day.

Demand for petroleum products rose by 2.687 to 20.314 million barrels. Production of petroleum products increased by 2.14 to 21.11 million barrels. Imports of petroleum products increased by 0.767 to 2.405 million barrels. Exports of petroleum products fell by -0.286 to 6.317 million barrels per day.

Demand for propane rose by 0.297 to 1.518 million barrels. Propane production increased by 0.013 to 2.396 million barrels. Propane imports rose by 0.005 to 0.18 million barrels. Propane exports fell by -0.298 to 1.339 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 29.5 thousand contracts. The change is significant. Buyers actively entered the market, while sellers ran away from it even more actively. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: switched to March futures, expiration date February 21. We are growing. We continue to keep longs open two weeks ago. In case of growth above 84.00, positions can be increased.

Fall scenario: unlike Brent, the falling trend in WTI has not yet been broken, the current area is interesting for sales. Let’s sell now. In case of a fall below the level of 75.00, shorts can be increased.

Recommendations for WTI oil:

Purchase: no. Who is in position from 74.00, move the stop to 75.30. Target: 110.00.

Sale: now. Stop: 83.60. Target: 66.00 (40.00).

Support — 77.79. Resistance — 82.76.

Gas-Oil. ICE

Growth scenario: we consider the February futures, the expiration date is February 10. We continue to refuse purchases. Only in case of growth above 1000.0 we will buy.

Fall scenario: while we insist on sales. We enter short from the current levels. It can be aggressive.

Gasoil recommendations:

Purchase: think after rising above 1000.0.

Sale: now. Stop: 1070.0. Target: 750.0.

Support — 960.25. Resistance is 1018.25.

Natural Gas. CME Group

Growth scenario: we consider the March futures, the expiration date is February 24th. We continue to refuse to make transactions on this market. It is necessary to take a break to clarify the situation.

Downfall scenario: it makes no sense to sell. Prices are low. Against the background of warm weather in Europe, there will be nothing surprising in the fall of prices to the level of 2.825.

Recommendations for natural gas:

Purchase: no.

Sale: no.

Support — 2.825. Resistance is 3.549.

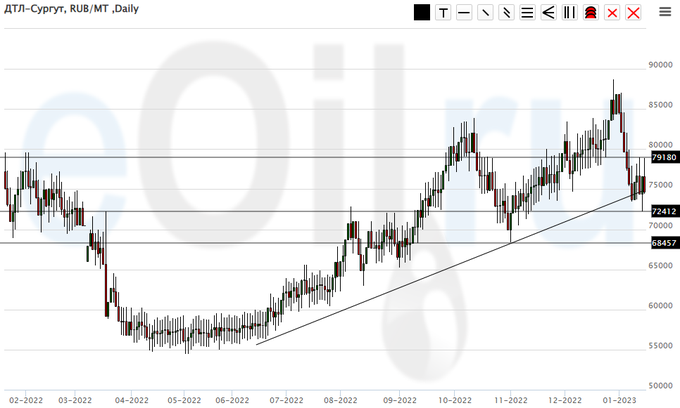

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: the market stopped falling at the growing trend line in the 75000 area. Most likely we will go even lower. Against the background of the upcoming overproduction of fuel within the country due to the embargo, we refuse to buy,

Fall scenario: we continue to discharge. Shorts from 80000 are welcome. In the current crisis situation, the level of 60000 looks like a reasonable long-term support.

Diesel market recommendations:

Purchase: no.

Sale: when approaching 80,000. Stop: 83,000. Target: 65,000 (60,000) rubles per ton. Those who are in positions from 84,000, move the stop to 83,000. Target: 65,000 (60,000) rubles per ton.

Support — 72412. Resistance — 79180.

Propane butane (Surgut), ETP eOil

Growth scenario: the market sees the prospect of supply growth. Prices continue to fall. It cannot be ruled out that quotes will be under the level of 5000 for a long time. In case of growth above 4300, those who wish can buy.

Fall scenario: we will not sell. The market is at low levels.

Recommendations for the PBT market:

Purchase: after day close above 4300. Stop: 3100. Target: 8000.

Sale: no.

Support — 1992. Resistance — 5918.

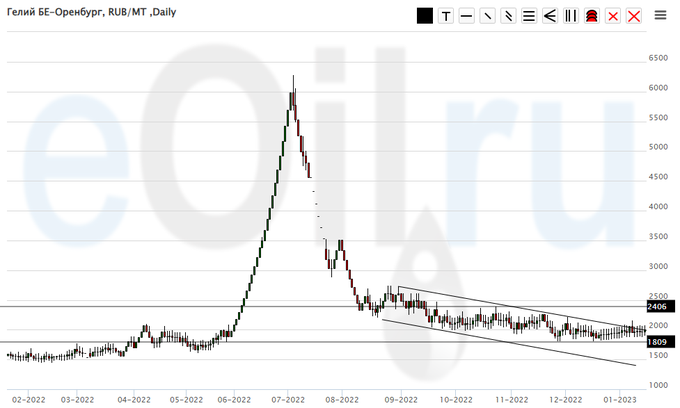

Helium (Orenburg), ETP eOil

Growth scenario: stabilized. We will continue to recommend purchases from current levels. We consider it possible to restore to the level of 3000.

Fall scenario: we refuse to sell. Prices are extremely low.

Recommendations for the helium market:

Purchase: now. Stop: 1820. Target: 3000. Whoever is in position from 1900, keep the stop at 1820. Target: 3000 rubles per cubic meter.

Sale: no.

Support — 1809. Resistance — 2405.

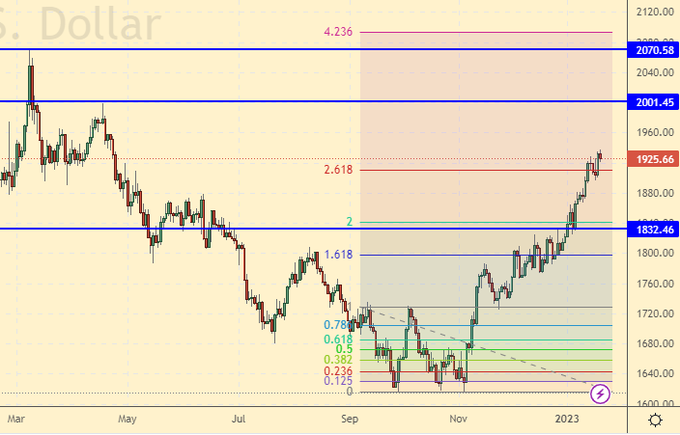

Growth scenario: we do not want to roll back down. Under the circumstances, we cannot miss the move to the 2100 area. We will buy at current prices.

Fall scenario: we will sell again at this point. The market is overbought, a rollback is ripe.

Recommendations for the gold market:

Purchase: now. Stop: 1894. Target: 2100 (2400).

Sale: now. Stop: 1939. Target: $1,800 per troy ounce.

Support — 1832. Resistance — 2001.

EUR/USD

Growth scenario: most likely we went to 1.1500 from current levels. This is unexpected, but it is worth accepting as a new working hypothesis.

Fall scenario: we are not thinking about entering shorts yet. Most likely the dollar will continue to lose its positions against the euro.

Recommendations for the EUR/USD pair:

Purchase: now and when approaching 1.0600. Stop: 1.0570. Target: 1.1500. Who is in position from 1.0800, keep the stop at 1.0570. Target: 1.1500. Count the risks.

Sale: no.

Support — 1.0774. Resistance is 1.0928.

USD/RUB

Growth scenario: we continue to believe that it is necessary to buy from the level of 65.00. The tax period has been extended until the 28th. This means that the market still has time to drop and visit the level of 65.00 at the expense of those who will sell the currency to pay taxes. If there is no such decrease, then this will indicate negative expectations among market participants regarding the ruble exchange rate for this year.

Fall scenario: we will continue to hold short from 72.50 to the level of 65.60. Below 65.00 the market is not visible due to the growth of the budget deficit.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 65.00. Stop: 63.00. Target: 83.00. In case of growth above 73.00. Stop: 71.00. Target: 83.00.

Sale: no. Who is in position from 72.50, move the stop to 71.60. Target: 65.60 rubles per dollar.

Support — 64.84. Resistance — 69.82.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. Market participants have finally realized that there will be no profits from oil and gas companies this year. Even if something can be earned, the government will take away all the surplus. Growth in a situation of total collection from enterprises, not even taxes, but simply all profits, is possible only if oil prices rise to the region of $150 per barrel. Note that the area 98000 — 99000 is attractive for purchases from a technical point of view. We will have to go long with a close stop order.

Fall scenario: if the market goes below 98,000, then this can lead to a fast move to 90,000. After that, disappointed novice investors of whom millions will cover all their positions and buy ice cream with the remaining crumbs in the children’s accounts, which will bring down quotes even more.

Recommendations for the RTS index:

Purchase: now. Stop: 97000. Target: 112000.

Sale: no. Who is in position from 106000, 103000 and 101000, move the stop to 103000. Target: 80000 (50000, then 20000) points.

Support — 98120. Resistance — 103290.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|