Price forecast from 20 to 24 of February 2023

20 February 2023, 13:56

-

Grain market:

Soon we will have a lot of tea, coffee, flowers and exotic fruits. Kenya, a country in Africa, is increasing the export of Russian grain and sunflower oil. Kenyans have already reached the honorable 11th place among the buyers of our agricultural products. Of course, in return, we will buy everything they have: tea, coffee, flowers, as well as elephants and lions for our circuses, well, or someone will bring them home. And our stock exchange will soon launch trading in the Kenyan shilling against the ruble.

Drink purple Kenyan tea. Very helpful. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

In Mexico, the government puts up barriers to GMO corn importers. In Brazil, Bayer, a producer of GMO soybeans, is being sued to return $252 million to farmers. Like, they charged a fee for their development illegally.

These are vivid examples of new trends. It is possible that against the backdrop of good GMO harvests, seeds will lose their positions, as the market begins to approach its balance. Farmers are no longer interested in producing as much as possible. It is necessary to produce as much as humanity can digest, in the literal sense of the word. If the introduction of new lands for agricultural crops continues, then while maintaining the population, GMO technology may begin to lose the market, since without it it will become possible to provide civilization with food.

In January, grain exports from Russia by rail increased by 46.6% compared to January last year, to 1.6 million tons. We see that in the conditions of direct and indirect sanctions pressure, Russia is using all available opportunities to increase the export of agricultural products.

Energy market:

According to OPEC and IEA forecasts, oil demand will continue to grow in 2023 and reach 101.9 million barrels per day by the end of the year. Both the agency and the cartel give practically the same figures. Everyone believes in demand growth. And they do not want to admit that high rates in the US can simply kill economic growth.

Representatives of Saudi Arabia publicly complain about the underfunding of the industry, and this against the backdrop of revenue for 9 months of 2022 of $180 billion, which is more than the revenue of Chevron, Exxon and Shell combined. Members of the royal family can indulge in nothing. You can continue to spend $1 million a day per person. It’s quite normal. No, it’s just natural.

Novak said Russia would cut oil production by 500,000 bpd from March. However, while the available data for February suggests that Russia is not reducing production at the moment, and sanctions, if they affect the sector, will not immediately. The production level is close to last year and amounts to 1.5 million tons per day. The EU cannot live without Russian oil, as evidenced by the loopholes left to circumvent sanctions. That is why we do not see a rapid move to the level of $110 per barrel for Brent oil. There is no shortage in the market.

Goldman Sach’s cut its US natural gas price forecast for the second time this year. Warmer weather conditions in February than usual, plus a shift from gas to coal in some consumers, were key drivers for the downgrade. The bank lowered its price forecast by 20 cents to $3.50 per million British thermal units (MMBtu) for summer 2023, and cut its winter 2023-2024 forecast to $3.40 and its summer 2024 forecast to $3.

USD/RUB:

The ruble indicated the possibility of some strengthening. Market sentiment will depend on the President’s speech scheduled for March 21st. If the state goals and objectives require even more money and resources, then we can expect the pair to continue moving towards the level of 88 rubles per dollar.

Can the ruble strengthen in the short term to the level of 70.00? Yes, such a possibility exists, for example, due to the sale of foreign currency by companies that will be obliged to fork out as part of a one-time fee for the needs of the budget. However, on the horizon of 6-12 months, without significant changes in foreign policy, the situation for the national currency will remain negative.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. The bulls were able to leave the market above the 750.0 level. A hike to 840.0 remains highly likely. The bulls, based on the cyclical nature of the wheat market, have time until March 12. Then the fall should begin.

Fall scenario: we will talk about sales when we approach the level of 840.0, not earlier.

Recommendations for the wheat market:

Purchase: now. Stop: 734.0. Target: 840.0. Who is in position between 760.0 and 780.0, move the stop to 734.0. Target: 840.0.

Sale: when approaching 840.0. Stop: 860.0 Target: 650.0 cents per bushel.

Support — 757.0. Resistance — 798.4.

Growth scenario: we consider the March futures, the expiration date is March 14. Buyers do not want to retreat yet. We are holding above the level of 670.0, which leaves chances for further growth. We hold longs. Can be bought at current levels.

Fall scenario: for sellers, the situation has not changed in any way. We do not open new positions, we keep the old ones. As long as we have not risen above 690.0, the chances of falling to the level of 550.0 cents per bushel remain.

Recommendations for the corn market:

Purchase: now. Stop: 667.0. Target: 800.0. Who is in position from 679.0, keep the stop at 667.0. Target: 800.0.

Sale: no. Who is in position from 688.0, keep the stop at 698.0. Target: 590.0 (550.0) cents per bushel.

Support — 669.2. Resistance is 689.0.

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, the expiration date is March 14. The bulls failed to succeed. We close all longs. We take a break for a week.

Fall scenario: the bulls failed to convince us of their strength. The market failed to consolidate above 1550.0. Let’s sell here.

Recommendations for the soybean market:

Purchase: no. Close all positions.

Sale: now. Stop: 1557.0. Target: 1000.0. Who is in position from 1540.0, keep the stop at 1557.0. Target: 1000.0 cents per bushel.

Support — 1505.2. Resistance is 1555.0.

Brent. ICE

Growth scenario: consider the January futures, the expiration date is February 28. Current levels can be used for purchases. If the market falls below the level of 80.00, long positions will have to be left.

Fall scenario: the market is generally in equilibrium. However, if we can break below the 80.00 level, then we can increase the available shorts.

Recommendations for the Brent oil market:

Purchase: now. Stop: 79.70. Target: 110.00.

Sale: no. Who is in position from 87.30, keep the stop at 87.50. Target: $70.00 per barrel.

Support — 81.58. Resistance — 86.84.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and now stands at 607 units.

US fundamental data: the number of active drilling rigs decreased by 2 units and now stands at 607 units.

Commercial oil reserves in the US increased by 16.283 to 471.394 million barrels, with the forecast of +1.166 million barrels. Inventories of gasoline rose by 2.316 to 241.922 million barrels. Distillate inventories fell -1.285 to 119.237 million barrels. Inventories at Cushing rose 0.659 to 39.711 million barrels.

Oil production has not changed and stands at 12.3 million barrels per day. Oil imports fell by -0.826 to 6.232 million barrels per day. Oil exports rose by 0.246 to 3.146 million barrels per day. Thus, net oil imports fell by -1.072 to 3.086 million barrels per day. Oil refining fell by -1.4 to 86.5 percent.

Gasoline demand fell by -0.154 to 8.274 million barrels per day. Gasoline production fell by -0.004 to 9.089 million barrels per day. Gasoline imports fell by -0.4 to 0.589 million barrels per day. Gasoline exports fell -0.157 to 0.786 million bpd.

Demand for distillates rose by 0.132 to 3.894 million barrels. Distillate production fell -0.155 to 4.509 million barrels. Distillate imports fell -0.471 to 0.221 million barrels. Distillate exports fell -0.156 to 1.02 million barrels per day.

Demand for petroleum products fell by -1.234 to 19.302 million barrels. Oil products production fell by -1.016 to 20.218 million barrels. Imports of petroleum products fell by -0.729 to 2.253 million barrels. Exports of petroleum products fell by -0.202 to 6.06 million barrels per day.

Propane demand fell -0.821 to 1.032 million barrels. Propane production fell by -0.038 to 2.356 million barrels. Propane imports fell -0.035 to 0.153 million barrels. Propane exports rose by 0.501 to 1.845 million barrels per day.

Growth scenario: we are considering the April futures, the expiration date is March 21. While we are below the level of 82.00, we should not buy. Out of the market.

Fall scenario: we will continue to hold the shorts. Prices are inside a wide falling channel, sellers have nothing to worry about.

Recommendations for WTI oil:

Purchase: after rising above 82.00. Stop: 80.40. Target: 110.00.

Sale: no. Those in positions between 82.00 and 80.50 keep the stop at 80.80. Target: 66.00 (55.00) dollars per barrel.

Support — 70.23. Resistance — 80.78.

Gas-Oil. ICE

Growth scenario: we consider the March futures, the expiration date is March 10. The market cannot convince us to go long. As long as we are below 950.0, we remain out of the market.

Fall scenario: we will keep the shorts. Since no shortage is foreseen, prices may move lower.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 900.0, move the stop to 880.0. Target: 700.0.

Support — 761.75. Resistance — 863.25.

Natural Gas. CME Group

Growth scenario: we are considering the April futures, the expiration date is March 29. When approaching 2.200 we will buy. The warm weather of February in the US is already in the price.

Fall scenario: we will not sell anything. The levels are extremely low for sales. Out of the market.

Recommendations for natural gas:

Purchase: when approaching 2.200. Stop: 2.100. Target: 3.200.

Sale: no.

Support — 2.178. Resistance is 2.741.

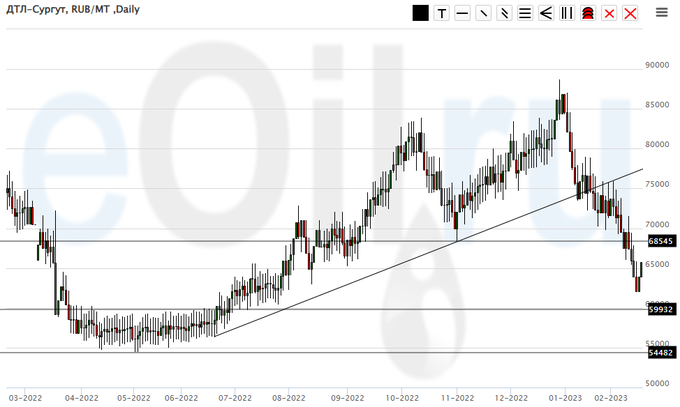

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: we have worked out most of the fall, which took place due to the embargo on petroleum products by the EU. Is a deeper price cut possible? Under unfavorable circumstances, we can see the market around 55,000, but it’s too early to talk about such a development. The current levels are already perceived as adequate.

Fall scenario: those who wish could ride with us from 84,000 to 65,000. We still have a round level of 60,000 at the bottom. When we reach it, the market will begin to roll back up. If you want to try to wait for prices to fall to the 55000 level, then consider the risks and determine the stop levels in advance.

Diesel market recommendations:

Purchase: when approaching 60000. Stop: 57000. Target: 70000.

Sale: no. Those who are in positions between 84,000 and 74,000, move the stop to 71,000. Target: 60,000 (55,000) rubles per ton. At current levels, you can close another 20% of the position.

Support — 59932. Resistance — 68545.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we recommend to buy. Market recovery can lead to a good financial result.

Fall scenario: we will continue to refuse sales. Prices are extremely low.

Recommendations for the PBT market:

Purchase: now. Stop: 0 (zero). Target: 5000 rubles per ton.

Sale: no.

Support — 78. Resistance — 2549.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we have consolidated above 2000, and this gives good chances for a move to the area of 2800 — 3000. We will keep open long positions.

Fall scenario: when approaching the level of 3000, you can sell.

Recommendations for the helium market:

Purchase: no. Those who are in positions from 1800, 1900 and 2000, move the stop to 1900. Target: 2750 (3000) rubles per cubic meter.

Sale: when approaching 3000. Stop: 3200. Target: 2100.

Support — 2090. Resistance — 2887.

Gold. CME Group

Growth scenario: we are falling in a disciplined manner. We continue to consider a rollback to 1790 as the most likely scenario. We do not buy at current levels.

Fall scenario: continue to hold shorts from 1920 with a target at 1790. Demand for gold will remain, however, a correction will not hurt it now. If the US stock market starts to fall, then we will revise our downside targets from 1790 to 1720.

Recommendations for the gold market:

Purchase: no.

Sale: no. For those in position from 1920, keep your stop at 1912. Target: $1,790 a troy ounce.

Support — 1785. Resistance — 1860.

EUR/USD

Growth scenario: slowed down the fall. However, we need to get to 1.0480. An upward reversal from current levels looks inharmonious from the point of view of wave theory.

Fall scenario: keep shorts expecting to fall to 1.0480. We will continue to consider the move to 1.0120 as very probable.

Recommendations for the EUR/USD pair:

Purchase: think when approaching 1.0480.

Sale: no. Who is in position from 1.0690, keep the stop at 1.0830. Target: 1.0480 (1.0120).

Support — 1.0480. Resistance is 1.0804.

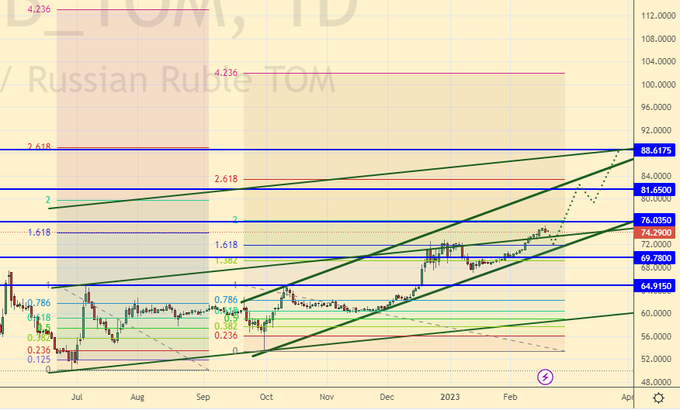

USD/RUB

Growth scenario: quickly came to the 75.00 area. There is a slight chance of a pullback to 65.00. The correction to 72.00 looks more realistic. From the level of 72.00, you can look for buying opportunities.

Fall scenario: in the current conditions, a sale from 76.00 is possible. At the same time, it is worth analyzing the news background to make this decision.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 72.00. Stop: 71.00 Target: 88.00. Who is in position from 71.50 and 74.00, keep the stop at 69.80. Target: 88.00.

Sale: when approaching 76.00. Stop: 76.70. Target: 72.00 (65.00).

Support — 69.78. Resistance — 76.03.

RTSI

Growth scenario: we consider the March futures, the expiration date is March 16. So far, there are no reasons for optimism. Tax collections are falling. The hole in the budget is growing. Even if the oil sector remains afloat, it alone will not be able to improve the mood of medium and small businesses. We are waiting for a drop in domestic demand and a drop in company income. We don’t buy.

Fall scenario: if the market goes below 90000, then we will have a quick fall to the level of 80000, possibly 75000. We keep the old shorts, do not open new ones.

Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 106000, 103000, 101000 and 98000, move the stop to 101000. Target: 80000 (50000, then 20000) points.

Support — 90930. Resistance — 94730.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|