Price forecast from 15 to 19 of May 2023

15 May 2023, 11:53

-

Grain market:

Do you know what will be the most popular spare part in Europe this summer? Bearing. And why? And because rollers, unicycles, scooters, bicycles, boards, strollers, carts from supermarkets, everything on which you can reduce the time to get yourself from home to work, will be in high demand. And of course it will break. You give us the 11th package of sanctions from hell, and we give you a reduction in oil production.

The most enduring will walk. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

The May, which is also the main, USDA report with forecasts for the gross harvest for the 23/24 season has been released. We see positive in all major cultures. Compared to the previous season, wheat will be harvested by 0.19% more — 789.764 million tons. If this happens we get a new record. Maize is up 6.04% at 1219.625 million tons, driven by strong production in Brazil and a recovery in the US and Argentina. Soybeans are 10.84% more — 410.585 million tons. Due to the growth of production in South America, mainly in Argentina. Thus, there should be no problems with providing the people with food. Any speculation about the shortage will be groundless.

Global demand, as in previous years, will continue to follow supply. Almost everything that will be collected will find its buyer. With several billion people still living below the poverty line and moving out of poverty very slowly, there will be strong demand in the grain market for the foreseeable future, even if it rises by another 30 percent.

The forecast from USDA for the gross harvest of wheat in Russia is 81.5 million tons, which is 11.41% less than the super-shock last year. Our export potential is estimated at 45.5 million tons. If there are buyers, the surplus of the current season will be completely sold out by June 24, at the current level of development of logistics capacities.

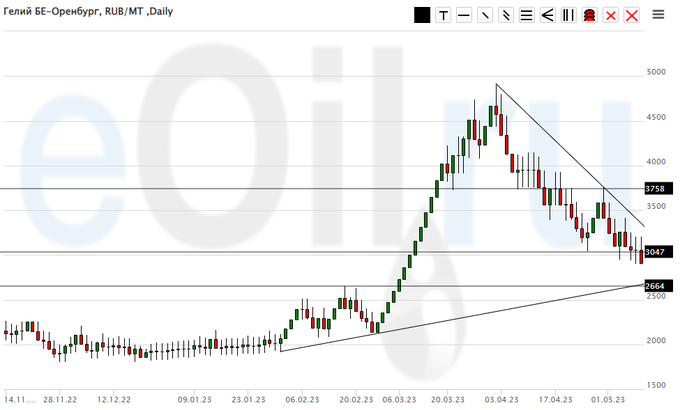

Reading our forecasts, you could make money on the helium market on the eOil.ru site by taking a downward move from 4,500 to 2,900 rubles per ton.

Energy market:

OPEC expects annual average world oil demand to reach 101.9 mb/d. Despite the problems in the US economy, the bank-fall alone is worth something, not to mention the falsified data on unemployment, the Arabs continue to stubbornly repeat that everything will be fine. This is understandable, because you have to somehow sell. And the best thing is when the consumer is sure that tomorrow there will be no such prices.

But in its own report, OPEC writes that growth in the US will be 1.2%, in the EU 0.8%, in China 5.1% But you can write a lot about China, both about the quality of construction, and about the fact that new houses are being demolished place put the same, apparently again under demolition. That’s 5% of GDP for you. Russia put minus 2.1%.

In the US, stagnation in both production and drilling rates. Less than 600 installations continue to operate actively, which does not coincide with the plans of politicians to increase production, as Biden recently spoke about. On-the-mountain issue, as well as several years ago, 12.3 million barrels per day.

USD/RUB:

For several days, the couple walked down and then up by 3 rubles. Jumping 4% per day is frankly a lot. Surely all economic entities lay at least 10% risk when making short-term international trade transactions. It’s hard to talk about long-term projects now.

Given the increase in tension in Ukraine and the increase in the cost of conducting the NWO, the growth of the budget deficit to 3.4 trillion. rubles for the first 4 months, evidence of this, we can not count on the strengthening of the ruble in the medium term.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 8.2 thousand contracts. Vendors left the market. Buyers remained in their positions. The spread between short and long positions narrowed. Sellers hold the edge.

Growth scenario: we are considering the July futures, the expiration date is July 15. You have to stay long. In general, the positive report from the USDA did not make a big impression on the people. Everyone who wanted to sell did it before. Ripe growth.

Fall scenario: short from 710.0. Here is the only idea for the near future. Given that in a month and a half new grain will begin to put pressure on the market, this is a normal topic.

Recommendations for the wheat market:

Purchase: no. Who is in position from 606.0, keep the stop at 610.0. Target: 710.0.

Sale: when approaching 710.0. Stop: 730.0. Target: 550.0?!!!

Support — 625.4. Resistance — 669.2.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more asset managers open short positions than long positions. Last week, the difference between short and long positions of managers decreased by 7.3 thousand contracts. The change is minor. Buyers increased their positions, sellers remained at the previously reached values. Sellers keep the edge.

Growth scenario: we are considering the July futures, the expiration date is July 15. Can buy. There will be a lot of corn, but traders will begin to win back this fact a little later. Until then, you can grow.

Fall scenario: it makes no sense to sell. Prices are low.

Recommendations for the corn market:

Purchase: now. Stop: 570.0. Target: 650.0.

Sale: think about approaching 650.0.

Support — 572.4. Resistance — 600.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the July futures, the expiration date is July 15. Given the excellent forecasts for the gross harvest, we will buy soybeans only from 1000.0. Not earlier.

Fall scenario: all is well. We continue to believe in the success of our shorts. You could build a short from 1445.0 We clearly wrote about this possibility.

Recommendations for the soybean market:

Purchase: no.

Sale: no. Who is in positions from 1520.0, 1510.0 and 1445.0, move the stop to 1460.0. Target: 1000.0!

Support — 1383.2. Resistance — 1445.4.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers has decreased by 28.5 thousand contracts. Vendors continue to enter the market. Buyers are not in a hurry to take flight. The spread between long and short positions is shrinking, and the bulls are at risk of losing their lead.

Growth scenario: we are considering the May futures, the expiration date is May 31. The last three red candles look very menacing. We don’t buy.

Fall scenario: sellers can grab buyers. The idea to push the market below 70.00 remains relevant. Keep shorts.

Recommendations for the Brent oil market:

Purchase: no.

Sale: no. Who is in position from 86.50, keep the stop at 77.60. Target: $66.67 per barrel.

Support — 73.68. Resistance — 77.62.

WTI. CME Group

US fundamental data: the number of active drilling rigs decreased by 2 units and now stands at 586 units.

Commercial oil reserves in the US increased by 2.951 to 462.584 million barrels, while the forecast was -0.917 million barrels. Inventories of gasoline fell by -3.167 to 219.711 million barrels. Distillate inventories fell -4.17 to 106.153 million barrels. Inventories at Cushing rose by 0.397 to 34.007 million barrels.

Oil production has not changed and stands at 12.3 million barrels per day. Oil imports fell by -0.843 to 5.553 million bpd. Oil exports fell by -1.861 to 2.876 million barrels per day. Thus, net oil imports rose by 1.018 to 2.677 million barrels per day. Oil refining increased by 0.3 to 91 percent.

Gasoline demand rose by 0.685 to 9.303 million barrels per day. Gasoline production increased by 0.445 to 9.823 million barrels per day. Gasoline imports rose by 0.055 to 0.853 million barrels per day. Gasoline exports fell by -0.081 to 0.76 million bpd.

Demand for distillates rose by 0.163 to 4.035 million barrels. Distillate production increased by 0.03 to 4.606 million barrels. Distillate imports fell -0.033 to 0.111 million barrels. Exports of distillates rose by 0.26 to 1.278 million barrels per day.

Demand for oil products rose by 0.359 to 20.164 million barrels. Production of petroleum products increased by 0.222 to 21.404 million barrels. Imports of petroleum products increased by 0.105 to 2.056 million barrels. Exports of petroleum products rose by 0.441 to 6.361 million barrels per day.

Propane demand fell -0.651 to 0.454 million barrels. Propane production fell by -0.021 to 2.459 million barrels. Propane imports rose by 0.003 to 0.081 million barrels. Propane exports rose by 0.104 to 1.642 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 15.4 thousand contracts. Buyers entered the market. The sellers remained neutral. The spread between long and short positions widened somewhat. The advantage of the bulls has grown.

Growth scenario: we are considering the June futures, the expiration date is May 22. Despite the fact that we have risen sharply from the 65.00 region, we still do not recommend buying.

Fall scenario: if there is an increase to 77.00, it makes sense to sell. We will not explicitly recommend entering short from current levels.

Recommendations for WTI oil:

Purchase: no.

Sale: when approaching 77.00. Stop: 79.00 Target: 62.00?!

Support — 63.55. Resistance — 73.81.

Gas-Oil. ICE

Growth scenario: consider the May futures, the expiration date is June 12. Until we dropped to 600.0. When this happens, it will be available for purchase. There is high volatility in the market, which increases the risks in points when placing positions.

Fall scenario: there is nowhere to sell. Cheap fuel from Asia, made from Russian oil, is holding back prices.

Gasoil recommendations:

Purchase: when approaching 600.0. Stop: 570.0. Target: 800.0.

Sale: no.

Support — 629.75. Resistance is 703.50.

Natural Gas. CME Group

Growth scenario: we are considering the June futures, the expiration date is May 26. We see sluggish attempts to grow up. With the tenacity of a maniac, we continue to recommend purchases. But don’t forget about stop orders.

Fall scenario: there is no point in selling. Out of the market.

Recommendations for natural gas:

Purchase: now. Stop: 1.990. Target: 3.340. Who is in position from 2.137, keep the stop at 1.990. Target: 3.340.

Sale: no.

Support — 2.137 (2.005). Resistance is 2.546.

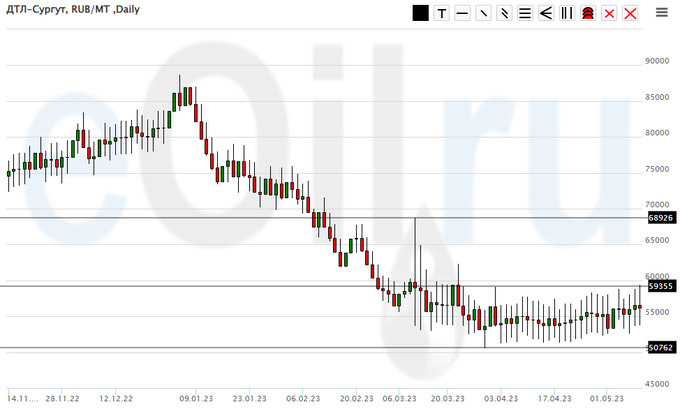

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: Nothing new. We are above 50,000. We continue to recommend purchases. The processing industry will be burdened with taxes that it will pass on to consumers.

Fall scenario: for sales, we need growth to at least 70,000. In the meantime, we will be out of the market.

Diesel market recommendations:

Purchase: now. Stop: 49000. Target: 65000 (70000). Count the risks. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 50762. Resistance — 59355.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: do not buy. Let’s wait until the market cools down after the rapid growth.

Fall scenario: here you have to continue to fight for the shorts. But we will take a break for this week, as it is an extremely inconvenient situation for entering shorts. We recognize that the area of 25000 is attractive for sales.

Recommendations for the PBT market:

Purchase: no.

Sale: think when approaching 25000.

Support — 17319. Resistance — 24570.

Helium (Orenburg), ETP eOil.ru

Growth scenario: well… we came to the area of 2700, which we wrote about for almost a month. Now you can buy. The market is able to move up to 4000 (5000).

Fall scenario: our goal at 2800 is completed. We took a good move from 4500. Close all positions. Now out of the market.

Recommendations for the helium market:

Purchase: now. Stop: 2400. Target: 5000.

Sale: no.

Support — 2664. Resistance — 3758.

Growth scenario: we continue to refuse purchases. In the US, rates are high (5.25%). Gold must fall. Unless America defaults…

Fall scenario: you need to sell if you are knocked out, like us, in 2047. You can add in aggression.

Recommendations for the gold market:

Purchase: not yet.

Sale: now. Stop: 2051. Target: 1875 (1750). Count the risks.

Support — 1952. Resistance — 2021.

EUR/USD

Growth scenario: Yes… it’s a surprise. We did not go up and apparently decided to formalize the ascent to 1.1900 through the move to 1.0400, or even to 1.0100. We don’t buy.

Fall scenario: we have a much more interesting situation with a short. We took and fell. Who would have thought. Gotta keep. We fall aggressively. We can fly up to 1.0100.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: no. Who is in position from 1.1000, move the stop to 1.1020. Target: 1.0100?!

Support — 1.0758. Resistance is 1.0941.

USD/RUB

Growth scenario: we continue to believe that a long position from 73.00 would be ideal. So far we have not reached this mark. Yes, there is a risk of developing a new branch up. We need certainty. While we will not buy below 81.60.

Fall scenario: after sales from 81.70, you need to keep short. The target at 73.00 remains on the radar.

Recommendations for the dollar/ruble pair:

Purchase: when approaching 73.00. Stop: 71.70. Target: 88.70. Think after rising above 81.60.

Sale: no. Who is in position from 81.70, move the stop to 80.90. Target: 73.00?!

Support — 75.19. Resistance — 79.03.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. Too jerky. However, we continue to grow. We will keep long since last week at 112000.

Fall scenario: nothing has changed. We will sell only after falling below 97500. We need confirmation of the break in sentiment. We have formed optimism on the MICEX. Apparently there are a lot of rubles that need to be put somewhere. Not to a Swiss bank these days. Right? But in Gazprom you can.

Recommendations for the RTS index:

Purchase: no. Who is in position from 100000, move the stop to 99000. Target: 112000.

Sale: if below 97500. Stop: 99200. Target: 90000.

Support — 99040. Resistance — 103280.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|