Price forecast from 1 to 5 of August 2022

01 August 2022, 13:04

-

Grain market:

After leaving Afghanistan, the US military in the Pentagon is going crazy with idleness. So, they took and sent an aircraft carrier to the Chinese coast. It remains only to write with paint on the take-off deck: “There are too many of you. Stop eating our grain!» Well, or something like that. There is only one cure: «Cut the salaries of the military and reduce the staff.» And there will be peace.

Hello!

The market as a whole looks calm. The new crop continues to arrive at the elevators. Volumes are close to record highs, so price growth in this situation is unlikely to be possible. The heat in Europe added a headache to the farmers, but the fall in the crop will not be total. The EU will take its 130 million tons of soft wheat, and this will be enough to send 15-20 million tons for export.

Russia was recently allowed to sell grain and fertilizer, which again softens the situation in the food market. It can be predicted that a number of states will increase their own food supplies due to instability in the world. This step will prevent prices from falling by more than 15% from current levels by September. After the fall in August, the grain market will begin a smooth increase, which will last until winter.

Energy market:

Pelosi, a US citizen, named Nancy, decided to visit Taiwan. Well, why not. But the ruling circles of the Chinese Communist Party gave the order to irrigate the strait between the mainland and the island with rockets and everything else that is available, from long and short barrels. It was, admittedly, a lot of firing in the air. On the other hand, we no longer see such a destination as Taiwan on the agenda of the Speaker of the House of Representatives of the US Congress. Indeed, there are other islands in the region where you can relax.

Those who seriously hope that the US and China will come together in a deadly battle can be advised to calm down. What will the war be for? Three million powerful American businessmen hired about three hundred million poor Asians and got a solid profit for 20 years, and now they are shooting everyone, right? And then who will work?

Rather, the Americans are simply playing on the Chinese nerves so that they do not think of imagining themselves as an independent state.

The US has already entered recession, and China will show only 3.6% GDP growth this year, against the forecast for the beginning of the year of 5.5%. These two points are really capable of affecting the oil market, and negatively.

We hope that OPEC+ will make an informed decision next week on August 3rd. A further increase in production, which the United States is counting on, may harm exporters, since in this case there will be no need to talk about any shortage in the oil market.

USD/RUB:

The market is waiting for investors from «friendly» countries on August 8th. Most likely, everyone who enters the auction will be pumped by Western curators and will clearly understand what to do. This is a threat to the stability of both the stock market and the foreign exchange market. We hope that the Central Bank and the Ministry of Finance know what they are doing by opening the door to foreigners. Assumptions about the cancellation of trading in the dollar / ruble pair received a new impetus. The Central Bank began to prepare for such a development of events. No big deal, it’s just practice. However, they were reported to the masses. What can be done here?

Go all in yuan, comrades!

It’s good that there is still somewhere to go. And then, after all, it may be so that you won’t even enter the yuan. We do not expect sharp movements in the market next week. The currency continues to flow into the country. It is unlikely that the pair will rise above the level of 65 rubles per dollar. It should be noted that in general the situation in the Russian economy is better than expected three months ago.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 3,000 contracts. Vendors continued to arrive at the market. Most expect prices to continue falling.

Growth scenario: consider the September futures, the expiration date is September 14th. We continue to refuse purchases. We are waiting for the market at 650.0 cents per bushel. We will go long there.

Fall scenario: you can try to catch short from current levels. Friday ended in favor of sellers, which could lead to further price drops. Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 630.0. Target: 860.0 cents per bushel.

Sale: now. Stop: 857.0. Target: 650.0 cents per bushel.

Support — 755.6. Resistance — 845.4.

Let’s look at the volumes of open interest of corn managers. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 8.5 thousand contracts. A small part of the sellers chose to leave the market. The number of purchase contracts did not change.

Growth scenario: consider the September futures, the expiration date is September 14th. We will continue to keep the long, but we will strongly push the stop order. We expect the market to turn down.

Fall scenario: we have come to a good sales area. It is possible that the market will rise to the level of 640.0 cents per bushel, but it will be extremely difficult to go even higher. Here you need to look for opportunities to enter the shorts.

Recommendations for the corn market:

Purchase: no. Who is in position from 580.0, move the stop to 590.0. Target: 640.0 cents per bushel.

Sale: now and when approaching 640.0. Stop: 660.0. Target: 450.0 cents per bushel. Count the risks.

Support — 604.2. Resistance — 642.4.

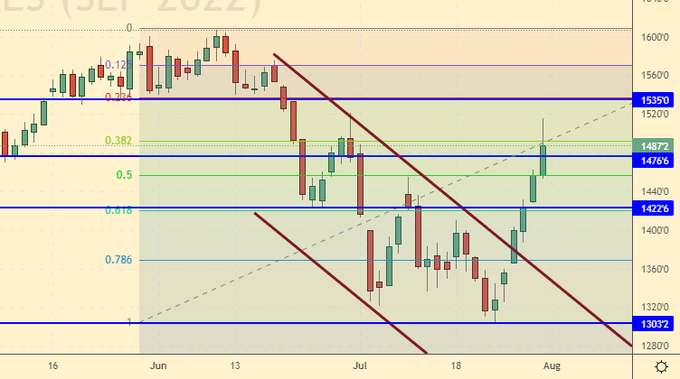

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, the expiration date is September 14th. Unexpected sharp growth on the back of good forecasts for gross output. Most likely we are seeing tough American speculation. We don’t buy.

Fall scenario: from current levels and approaching 1535, it makes sense to sell. We shouldn’t be so high at the moment. Recommendations for the soybean market: Purchase: no.

Sale: now and on the rise to 1535.0. Stop: 1575.0. Target: 1360.0 cents per bushel.

Support — 1422.6. Resistance is 1535.0.

Sugar 11 white, ICE

Growth scenario: consider the October futures, the expiration date is September 30th. We continue to stay out of the market. We are preparing money for purchases from 16.40 and 15.20 cents per pound.

Fall scenario: continue to hold shorts. The market may leave at 15.20.

Recommendations for the sugar market:

Purchase: not yet.

Sale: no. Those who are in positions from 19.40 and 19.00, move the stop to 18.70. Target: 15.20 cents a pound.

Support — 17.19. Resistance — 17.98.

Сoffee С, ICE

Growth scenario: we are considering the September futures, the expiration date is September 20. Shopping here is extremely inconvenient. We need confirmation from the market that it is going to rise further.

Fall scenario: despite the fact that the stop was hit at 220.0, we will enter the market again. Possible continuation of the fall. Recommendations for the coffee market:

Purchase: when approaching 140.00. Stop: 120.00. Target: 180.00 cents per pound.

Sale: now. Stop: 223.0. Target: 140.00 cents per pound.

Support — 209.40. Resistance is 221.60.

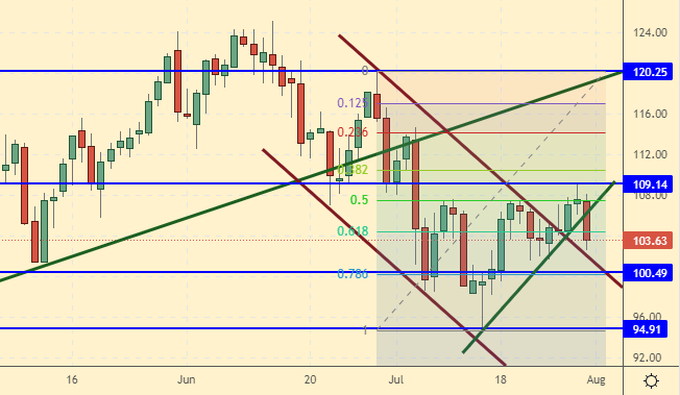

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 8.9 thousand contracts. The bulls entered the market while the sellers took a wait-and-see attitude.

Growth scenario: consider the August futures, the expiration date is August 31. The bulls failed to gain a foothold above the level of 108.00 dollars per barrel. We don’t buy.

Fall scenario: at current levels, shorts can be increased in anticipation of market cooling. To begin with, we are waiting for the fall to 90.00. Further, a move to the level of 80.00 dollars per barrel is possible.

Recommendations for the Brent oil market:

Purchase: no. Who is in position from 100.00, move the stop to 98.00. Target: $140.00 per barrel.

Sale: now. Stop: 109.60. Target: 80.00. Those in positions between 117.00 and 120.00 move the stop to 109.60. Brent target: $80.00 per barrel.

Support — 100.49. Resistance — 109.14.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 6 units and amounts to 605 units.

US commercial oil inventories fell by -4.523 to 422.086 million barrels, while the forecast was -1.037 million barrels. Inventories of gasoline fell -3.304 to 225.131 million barrels. Distillate inventories fell -0.784 to 111.724 million barrels. Inventories at Cushing rose 0.751 to 23.54 million barrels.

Oil production increased by 0.2 to 12.1 million barrels per day. Oil imports fell by -0.355 to 6.164 million barrels per day. Oil exports rose by 0.789 to 4.548 million barrels per day. Thus, net oil imports fell by -1.144 to 1.616 million barrels per day. Oil refining fell by -1.5 to 92.2 percent.

Gasoline demand rose by 0.724 to 9.245 million barrels per day. Gasoline production increased by 0.29 to 9.658 million barrels per day. Gasoline imports fell -0.266 to 0.599 million barrels per day. Gasoline exports fell by -0.038 to 0.768 million bpd.

Demand for distillates rose by 0.053 to 3.75 million barrels. Distillate production fell -0.022 to 5.009 million barrels. Distillate imports rose by 0.002 to 0.124 million barrels. Distillate exports fell -0.147 to 1.495 mb/d.

Demand for petroleum products fell by -1.049 to 19.976 million barrels. Oil products production fell by -1.125 to 21.612 million barrels. Imports of petroleum products fell by -0.05 to 2.124 million barrels. The export of oil products increased by 0.719 to 6.32 million barrels per day.

Propane demand fell -0.506 to 0.627 million barrels. Propane production increased by 0.022 to 2.369 million barrels. Propane imports fell by -0.011 to 0.07 million barrels. Propane exports rose by 0.346 to 1.441 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers decreased by 11.2 thousand contracts. Buyers retreated cautiously, sellers entered the market no less cautiously.

Growth scenario: consider the September futures, the expiration date is August 22. The bulls failed to gain a foothold above $100.00 per barrel. This failure can cause the market to turn lower. We are not opening new positions.

Fall scenario: buyers managed to push the market out of the falling channel, but did it so uncertainly that we have a good chance of seeing prices continue to fall as early as Monday.

Recommendations for WTI oil:

Purchase: no. Who is in position from 95.00, move the stop to 93.00. Target: $130.00 per barrel.

Sale: no. Those in positions from 114.00, 108.00 and 106.00, move the stop to 102.30. Target: $70.00 per barrel.

Support — 94.35. Resistance is 101.93.

Gas-Oil. ICE

Growth scenario: we are considering the August futures, the expiration date is August 11. We will continue to refrain from buying, as the success of the bulls is still extremely modest.

Fall scenario: the situation for sellers remains good. We sell from current levels.

Gasoil recommendations:

Purchase: no.

Sale: now. Stop: 1132.0. Target: $850.0 per ton.

Support — 998.75. Resistance is 1131.25.

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. We will keep longs. The situation with gas supplies to Europe is becoming more acute day by day, which keeps the global market in suspense.

Fall scenario: we continue to refuse to enter the short. It is unlikely that the market will turn down in the current situation.

Recommendations for natural gas:

Purchase: no. Who is in position between 6.000 and 5.500, move the stop to 6.400. Target: $15,000 for 1 million BTUs.

Sale: no.

Support — 7.976. Resistance is 9.613.

Gold. CME Group

Growth scenario: good pace of recovery. Those who wish may not take profits when approaching 1780, in the expectation that aggravation will continue along the US-China line.

Fall scenario: when approaching 1780, you can sell. Target: $1,612 per troy ounce. The Fed did not disappoint and raised rates.

Recommendations for the gold market: Purchase: no. Those in positions between 1695 and 1700 move the stop to 1720. Target: 1780 (2300!).

Sale: up to 1780. Stop: 1830. Target: $1612 a troy ounce.

Support — 1740. Resistance — 1783.

EUR/USD

Growth scenario: most likely we will reach the level of 1.0350, but we cannot go higher. The euro remains under pressure due to Europe’s dependence on resources. We don’t buy.

Fall scenario: we continue to assume that the pair is able to go to 0.9700. New positions can be opened from 1.0350.

Recommendations for the EUR/USD pair: Purchase: no.

Sale: when approaching 1.0350. Stop: 1.0430. Target: 0.9700.

Support — 1.0096. Resistance is 1.0363.

USD/RUB

Growth scenario: the area of 62.00 rubles per dollar will be key for next week. If the bulls manage to pass it, then we are waiting for a test of the level of 65.00. It makes sense to keep longs. We open new positions very carefully.

Fall scenario: if the market does not rise above 62.00, then this could be a strong precondition for another round of ruble strengthening. Here you can sell. We place a stop order close.

Recommendations for the dollar/ruble pair: Purchase: no. Those who are in positions from 54.00 and 57.80, move the stop to 57.70. Target: 74.00 rubles per dollar.

Sale: now. Stop: 62.70. Target: 46.00 rubles per dollar.

Support — 59.00. Resistance — 64.79.

RTSI

Growth scenario: oil companies bounce back quickly. Sberbank is in the region of 130.00 rubles per dollar and does not want to fall any more. The mood in the stock market has clearly improved, however, no one knows what the real result of opening the market for foreign investors from «friendly», but mostly poor countries. Will they buy Russian securities, or will they get rid of them? That is the question. Until we buy.

Fall scenario: we will continue to hold short positions. The move to 96000 and 88000 points is visible. The medium-term outlook for the Russian economy remains extremely modest.

Recommendations for the RTS index:

Purchase: think when approaching 96,000 points.

Sale: no. Who is in position from 129000, move the stop to 114000. Target: 89000 points.

Support — 95610. Resistance — 113230.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|