Price forecast from 25 to 29 November 2024

25 November 2024, 11:37

-

Grain market:

Louvre workers are wringing their hands, dragging masterpieces into deep cellars that won’t really save them. There’s a pause in Western capitals. Something needs to be said, and it doesn’t work. The real prospect of becoming responsible for turning one’s own cities into ruins holds back, even the frankly insane.

Here’s to diversity in botany. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

According to the IGC report, cereal demand will increase while supply will decrease in MY25 due to unfavorable weather conditions. Stocks at the end of the 24/25 season are forecast at 576 million tons, which is the lowest in the last ten years. This factor will support prices for 3 — 6 months, but the market is likely to remain weak in the coming weeks due to the expectation of reduced foreign trade in grains in the USA. The Americans will have to cut prices to compete with Brazil and other suppliers, including Russia, and look for new markets. The story with Beijing is clearly going to change. China, a major importer of wheat and other agricultural products, is frankly frightened by the new-old American president’s speeches on duties, causing it to shy away from buying agricultural products from the United States and the British Commonwealth.

Prices in the country, given the weakening of the ruble, are falling in dollars, but remain stable in rubles. This will allow grain traders in the future to offer shipments at prices around $225 per tonne FOB, while the comfort level of transactions will increase, although farmer labor will become cheaper in the same dollars, but is this a cause for concern… The situation with prices in the grain market may improve in the 25th year. Especially if the escalation of conflicts around the world continues to grow.

Energy market:

January 20th is getting closer. One old grandfather will replace another old grandfather in faraway Washington. And a trade war with China will start, which will lead to a drop in global trade turnover, which will negatively affect oil consumption. On the other hand, no place is empty. Other countries will be able to quickly replace China. But the development of domestic industry in the U.S. is still in question. Why? Because it is very convenient to go to the store, take $999 worth of goods without paying and walk out. And then have a beer in front of the TV, where hairy giants run around and do not throw, but put the ball in the ring. It’s nirvana. Why do carcasses need to come out of it?

OPEC+ will not increase production in the near future, which certainly supports quotations. The level of 75.00 on Brent now acts as an invisible magnet, to which prices are constantly returning. Only the actions of politicians can break the balance in the near future.

USD/RUB:

We have almost arrived at the 104.00 area. On Monday and Tuesday we are likely to push into this level, then, maybe…, a pullback will follow, which will be accompanied by comments from leaders of various countries that it is necessary to negotiate with Russia. If Europe chooses the way to… to reduce the standard of living of its own citizens, then nothing good will happen to us. The ruble will continue to weaken. Targets above 104.00 are 110.00 and 118.00.

The dollar index is approaching a strong resistance level around 108.500, which in a relatively calm situation: that is, the exchange of blows between Russia and Ukraine with missiles and drones will continue, but not much, not much, can have a positive effect on the ruble. If we talk about harmony in trade, after reaching 104.00, we would need to go back to 100.00 before continuing to rise.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 6.9 th. contracts. Both buyers and sellers increased their positions. Bears strengthened their control.

Growth scenario: we consider December futures, expiration date December 13. We continue to wait for a fall to 500.0. Do nothing at the current price levels.

Downside scenario: nothing interesting for sellers for a long time. Out of the market.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sale: no.

Support — 527.6. Resistance — 558.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 7.3 th. contracts. Buyers and sellers left the market in insignificant volumes.

Growth scenario: we consider the December futures, expiration date December 13. Buyers risk losing their advantage if the market fails to consolidate above 435.0. We move a stop order on the track.

Downside scenario: sellers have chances to break bullish sentiment. It is possible to sell.

Recommendations for the corn market:

Buy: no. Who is in position from 415.6, 410.0 and 400.0, move the stop to 418.0. Target: 465.0.

Sell: now (425.4). Stop: 438.0. Target: 370.0. Count the risks!

Support — 417.0. Resistance — 434.6.

Soybeans No. 1. CME Group

Growth scenario: we consider January futures, expiration date January 14. Nothing new. Don’t think about buying while we are below 1050.0.

Downside scenario: we will continue to keep open shorts. Soybeans are plentiful.

Recommendations for the soybean market:

Buy: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: no. Those who are in position from 1049.0, move the stop to 1041.0. Target: 835.0.

Support — 971.4. Resistance — 1013.2.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 33.3 th. contracts. Buyers entered the market, sellers reduced positions. Bulls strengthened their control.

Growth scenario: switched to December futures, expiration date December 31. We are not doing anything yet. Growth above 76.00 may give food for thought in the future.

Downside scenario: nothing is clear. Off-market.

Recommendations for the Brent oil market:

Buy: no.

Sale: no.

Support — 70.28. Resistance — 75.75.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 1 unit to 479.

U.S. commercial oil inventories increased by 0.545 to 430.292 million barrels. Gasoline stocks increased by 2.054 to 208.927 million barrels. Distillate stocks fell -0.114 to 114.301 million barrels. Cushing storage stocks fell by -0.14 to 25.051 million barrels.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 28.7 th. contracts. Buyers were leaving and sellers were entering the market. Bulls loosened their control.

Growth scenario: we consider January futures, expiration date December 20. The market did not give us the level of 65.00, and it was not comfortable to buy at higher prices. We take a pause in trading.

Downside scenario: nothing interesting so far. Off-market.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 66.29. Resistance — 72.43.

Gas-Oil. ICE

Growth scenario: we consider the December futures, expiration date December 12. We came out of a short-term falling channel upward. We’re holding the long.

Downside scenario: it makes sense to work out the probability of a fall when approaching 710.0.

Gasoil Recommendations:

Buy: no. Who is in position from 645.00, move the stop to 664.00. Target: 910.00 (revised).

Sell: when approaching 710.0. Stop: 720.0. Target: 600.0.

Support — 652.50. Resistance — 727.25.

Natural Gas. CME Group

Growth scenario: switched to January futures, expiration date December 27. Strong reset to the downside. Mono buy, but with a close stop order.

Downside scenario: out of the market.

Natural Gas Recommendations:

Buy: now (3.287). Stop: 3.080. Target: 5.000.

Sale: no.

Support — 3.238. Resistance — 3.642.

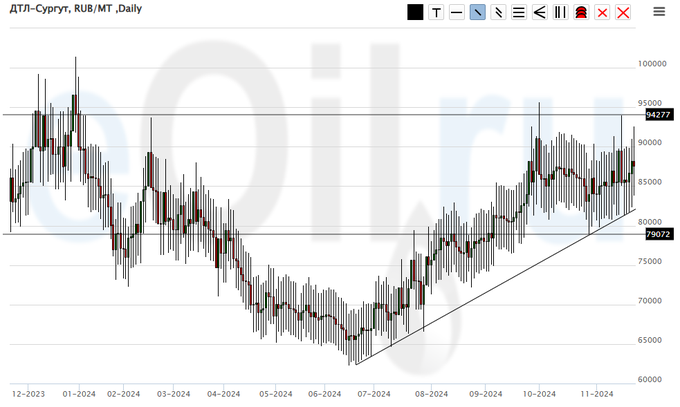

Diesel arctic fuel, ETP eOil.ru

Growth scenario: nothing new. We will keep longing. Chances for growth remain.

Downside scenario: we won’t sell, as we can’t believe we don’t need diesel right now.

Diesel Market Recommendations:

Buy: No. Who is in position from 65000, keep your stop at 78000. Target: 100000!

Sale: no.

Support — 79072. Resistance — 94277.

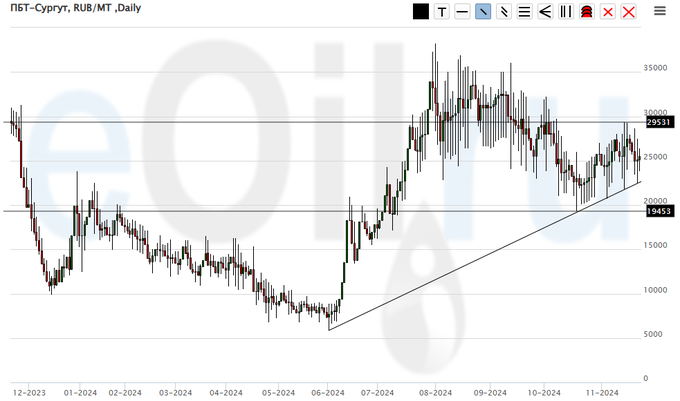

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we see consistently rising lows. We will keep longs from 23800 and from 20000.

Downside scenario: we will not sell, while we should note the market’s ability to go below 20000.

PBT Market Recommendations:

Buy: No. Who is in position from 20000 and 23800, move the stop to 18000. Target: 40000.

Sale: no.

Support — 19453. Resistance — 29531.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation around 1000. We are unlikely to fall below 900, but to confirm the growth it is better to wait for a move above 1100.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 930. Resistance — 1076.

Growth scenario: we consider the December futures, expiration date December 27. It makes sense to continue to hold longs as politicians and the military are not calming down.

Downside scenario: Gone up high. Gone fast. Out of the market.

Gold Market Recommendations:

Buy: no. Those who are in position from 2550, move the stop to 2590. Target: 2838 (3100).

Sale: no.

Support — 2650. Resistance — 2835.

EUR/USD

Growth scenario: we continue falling. We will remember about purchases in case of a move to 1.0000.

Downside scenario: the market approached 1.0300 and rebounded. We will wait for growth to 1.0660 and sell again.

Recommendations on euro/dollar pair:

Buy: when approaching 1.0040. Stop: 0.9930. Target: 1.1000.

Sell: when approaching 1.0660. Stop: 1.0730. Target: 1.0000.

Support — 1.0314. Resistance — 1.0495.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. We see aggressive growth. We press the stop order on the trend. If there is no pullback from 104000 and we go higher, it will cause panic and get rid of the ruble.

Downside scenario: we are not discussing shorts yet. There is too much politics in the current situation, which makes the economy suffer.

Recommendations on dollar/ruble pair:

Buy: No. Those in position from 96234, move your stop to 102800. Target: 150000, 200000?! (reference points so far)

Sale: no.

Support — 98028. Resistance — 104396.

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. The market has not grown. We are not going to look for the bottom here. It can be at 60000 or 40000. Outside the market.

Downside scenario: the market is able to continue falling. There are hysterical notes. Not a single green candle for the last week. We will sell only on a pullback to 87000.

Recommendations on the RTS index:

Buy: no.

Sell: on a pullback up to 87000. Stop: 89000. Target: 60000.

Support — 78360. Resistance — 84090.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|