Price forecast from 3 to 7 of April 2023

03 April 2023, 12:05

-

Grain market:

Tragedy in Germany. Egg prices go up at Easter. They have already grown by 10%, and by the holiday prices will rise even more. Deficit. What to wish neighbors in the West? As many holidays as possible. Eggs in the West should not be cheap!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

According to the US Department of Agriculture, the area under wheat this year will grow by 9%, for corn by 4%. The data turned out to be better than expected and in the coming days may have a deterrent effect on the rise in prices on the stock exchange in Chicago.

Russian wheat rose $2.50 to $275 FOB. Most likely, we will not return to the minimum levels for the next three months, as the uncertainty about the volume of the new crop will support prices. The equilibrium level looks like $300 per ton at the moment.

“Rusagrotrans” sees the volume of wheat harvest in Russia in 2023 at the level of 82.5 million tons. Grain harvest at the level of 128 million tons. Forecasts can be considered optimistic. It should be noted that if problems continue in the sale of products this fall, farmers can significantly reduce wheat sowings for the next season.

By reading our forecasts, you could make money in the Brent oil market by taking a move up from $70.10 to $79.00 per barrel.

Energy market:

Data on US GDP for the fourth quarter of 2022 has arrived. Growth was 2.6%, expected 2.7%. At the same time, oil prices fell by 6% over the week, which can be considered a sufficient reaction to the fact that the US economy is not going to bend yet.

The current rise in oil prices is also caused by expectations of maintaining the status quo in production on the part of the OPEC countries. This fact directly tells us that there is no shortage in the market. The meeting will take place on Monday.

Forecasts by major fund managers suggest that growth in the US economy will decline to 1 percent a year in the long run. The current high rates in the US should cause a slowdown in the economy and a drop in oil demand over a 3-6 month horizon. It is possible that the market will begin to include this probability in prices next week.

We do not currently see Brent crude above $82 per barrel.

USD/RUB:

The ruble reacted negatively to information on the expansion of the budget deficit to 4 trillion rubles in the first three months of this year. There are not so many options where to take money from the government. The potential of internal loans from banks is limited, as well as the potential of the population.

In general, while oil prices are at acceptable levels (above $70.00 per barrel), one can count on a tolerable passage of this year, however, if the budget deficit growth trend continues, next year the national currency will be extremely unhappy. The market is already putting this negative into the ruble exchange rate. We go to 88.00.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 3.6 thousand contracts. Both buyers and sellers left the market. Buyers did it somewhat more actively. The spread between short and long positions widened. Sellers keep the edge.

Growth scenario: consider the May futures, the expiration date is May 12. Let’s move the target to 765.0. The upward movement remains the main one for us. The bulls have all April to raise prices. But then it will be impossible to do this, the season will begin.

Fall scenario: we need a rise to 765.0. If the market reaches this mark, then we will sell. The current levels are of no interest from the point of view of speculation.

Recommendations for the wheat market:

Purchase: now. Stop: 664.0. Target: 765.0. Who is in position from 692.0, move the stop to 664.0. Target: 765.0.

Sale: when approaching 765.0. Stop: 784.0. Target: 600.0.

Support — 679.6. Resistance is 727.0.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. The sellers seized the initiative from the buyers. Last week the difference between long and short positions of managers decreased by 32.5 thousand contracts. The change is significant. Vendors left the market in large numbers. Their current advantage has become extremely small.

Growth scenario: consider the May futures, the expiration date is May 12. We refuse to buy, and the market goes up. It happens. In this situation, there are no interesting levels for purchases. Out of the market.

Fall scenario: We continue to recommend shorts. The rise in prices does not seem justified. There is speculation that hedge funds are fighting each other. Someone wants to ruin someone. For example, on narrowing the spread between wheat and corn.

Recommendations for the corn market:

Purchase: no.

Sale: now. Stop: 674.0. Target: 550.0 cents per bushel. Who is in position from 688.0, move the stop to 674.0. Target: 550.0 cents per bushel. Count the risks.

Support — 648.4. Resistance — 666.6.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We did not reach 1360, which is very disappointing. We will not buy from current levels. We take a break.

Fall scenario: We will have to be persistent in this situation. We will sell at current levels. We admit, the flight up is extremely unpleasant.

Recommendations for the soybean market:

Purchase: when approaching 1360.0. Stop: 1340.0. Target: 1420.0.

Sale: now. Stop: 1527.0. Target: 1360.0 (1000.0) cents per bushel. Count the risks.

Support — 1468.4. Resistance — 1514.0.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers decreased by 0.5 thousand contracts. The change is practically zero. Both buyers and sellers entered the market in extremely small volumes. The spread between long and short positions narrowed slightly.

Growth scenario: we are considering the April futures, the expiration date is April 28. The target at 79.00 has been reached. Those who wish can leave buys from 70.10 in order to achieve our long-term target at 110.00, while it is worth aggressively tightening stops.

Fall scenario: the current area is interesting for sales. It is possible that after the OPEC meeting on Monday prices will go down.

Recommendations for the Brent oil market:

Purchase: no. Who remained in the position from 70.10, move the stop to 76.80. Target: 110.00.

Sale: now. Stop: 82.30. Target: $66.64 per barrel.

Support — 72.28. Resistance is 80.71.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 1 unit to 592 units.

Commercial oil reserves in the US fell by -7.489 to 473.691 million barrels, while the forecast was +0.092 million barrels. Inventories of gasoline fell -2.904 to 226.694 million barrels. Distillate inventories rose by 0.281 to 116.683 million barrels. Inventories at Cushing fell -1.632 to 35.217 million barrels.

Oil production fell by -0.1 to 12.2 million barrels per day. Oil imports fell by -0.847 to 5.325 million bpd. Oil exports fell by -0.348 to 4.584 million barrels per day. Thus, net oil imports fell by -0.499 to 0.741 million barrels per day. Oil refining increased by 1.7 to 90.3 percent.

Gasoline demand rose by 0.185 to 9.145 million barrels per day. Gasoline production increased by 0.535 to 10.038 million barrels per day. Gasoline imports rose by 0.402 to 0.873 million barrels per day. Gasoline exports fell -0.066 to 0.826 million barrels per day.

Demand for distillates fell by -0.261 to 3.713 million barrels. Distillate production increased by 0.13 to 4.633 million barrels. Distillate imports fell -0.076 to 0.146 million barrels. Distillate exports fell -0.199 to 1.026 million barrels per day.

Demand for petroleum products increased by 0.45 to 20.476 million barrels. Production of petroleum products increased by 1.179 to 22.208 million barrels. Imports of petroleum products increased by 0.198 to 2.275 million barrels. Exports of petroleum products fell by -0.974 to 6.038 million barrels per day.

Propane demand rose 0.057 to 1.091 million barrels. Propane production fell by -0.03 to 2.37 million barrels. Propane imports rose by 0.057 to 0.172 million barrels. Propane exports fell by -0.002 to 1.802 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 45.8 thousand contracts. The change is significant. Sellers actively left the market, buyers did it in much more modest volumes. There is an outflow of funds in the market, which makes it thinner. The spread between long and short positions widened. The bulls have regained their previously lost positions and continue to control the situation.

Growth scenario: we are considering the May futures, the expiration date is April 20. Departed at 75.00, rest begs. The market is locally overbought. In case of a rollback to 70.00, you can buy.

Fall scenario: current area is suitable for sales. We wrote about him last week. It is not a fact that prices will continue to rise, as the world economy is in no hurry to please us with high numbers.

Recommendations for WTI oil:

Purchase: think when approaching 70.00.

Sale: now and when approaching 78.00. Stop: 79.70. Target: $60.10 per barrel. Count the risks.

Support — 71.71. Resistance — 81.13.

Gas-Oil. ICE

Growth scenario: we are considering the April futures, the expiration date is April 12. Unlike oil, fuel does not grow, which is strange. You can buy, but with close stop orders.

Fall scenario: nothing has changed. Let’s keep short with the target at 670.0. Consider selling from 850.0 if the market allows.

Gasoil recommendations:

Purchase: now. Stop: 743.0. Target: 850.0.

Sale: no. Who is in position from 900.0, keep the stop at 810.0. Target: 670.0.

Support — 744.50. Resistance is 798.50.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 26. We continue to fight for long. We will buy again.

Fall scenario: there is no point in selling. Prices are low.

Recommendations for natural gas:

Purchase: now. Stop: 1.900. Target: 4,000 (8,000?!). It can be aggressive.

Sale: no.

Support — 2.056. Resistance — 3.160.

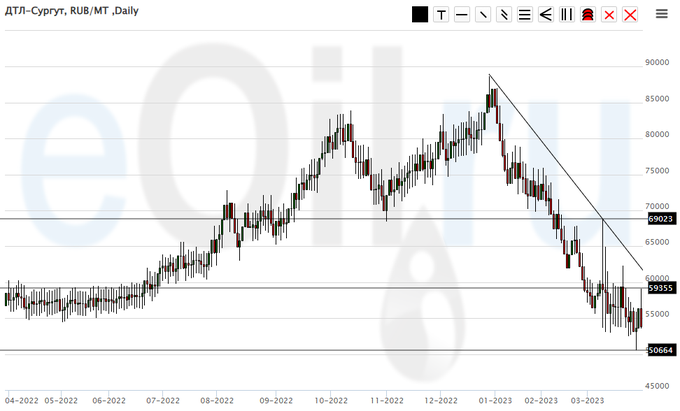

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: continue to recommend buys. We are able to return to 65,000. Moreover, as a result of “tax maneuvers”, something may happen to fuel prices, they will go up, since we have a very serious budget deficit.

Fall scenario: sales are not interesting. A breach towards 50,000 did not result in prices continuing to fall further. At least a short-term rise in prices is brewing.

Diesel market recommendations:

Purchase: now. Stop: 49000. Target: 65000. Count the risks.

Sale: no.

Support — 50654. Resistance — 59355.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: those who wish could buy from 50,000, we wrote about this possibility in the previous forecast. Now it is worth holding open longs. There are fundamental prerequisites for rising prices.

Fall scenario: we continue to refuse sales. There are no interesting levels to enter shorts.

Recommendations for the PBT market:

Purchase: now. Stop: 3000. Target: 15000 (20000). Who is in position from 5000, keep the stop at 3000. Target: 15000 (20000). Count the risks.

Sale: no.

Support — 20850. Resistance — 31914.

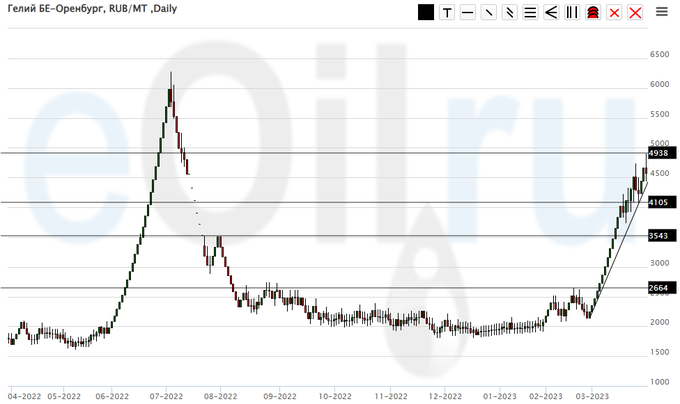

Helium (Orenburg), ETP eOil.ru

Growth scenario: prices are high. We need a correction to the 3000 area for new purchases.

Fall scenario: here you can sell with targets at 3500 (3000). At a minimum, we will see some price reduction, which makes the current sale relatively safe.

Recommendations for the helium market:

Purchase: no.

Sale: now. Stop: 5200. Target: 3500 (3000).

Support — 4105. Resistance — 4938.

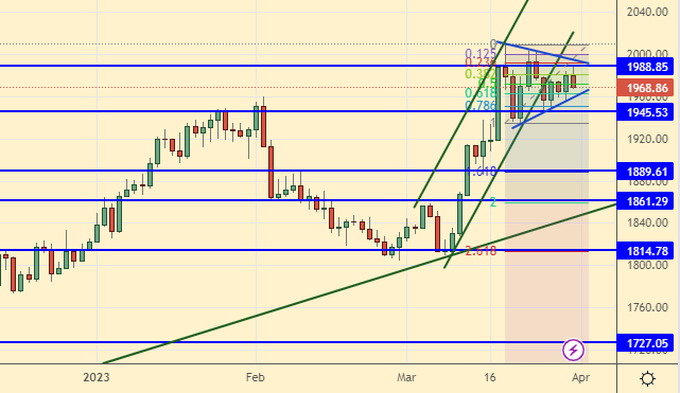

Gold. CME Group

Growth scenario: there is a risk of upward exit from the current consolidation. If there is an increase above 2000.0, you will have to buy.

Fall scenario: we continue to expect a fall to 1890 — 1860. We will sell from current levels.

Recommendations for the gold market:

Purchase: no. Who is in position from 1960, keep the stop at 1940. Target: 2500 (3000) dollars per troy ounce.

Sale: now. Stop: 2007. Target: 1890. Count the risks. Anyone in position from 1970, keep stop at 2010. Target: 1890 (1860).

Support — 1945. Resistance — 1988.

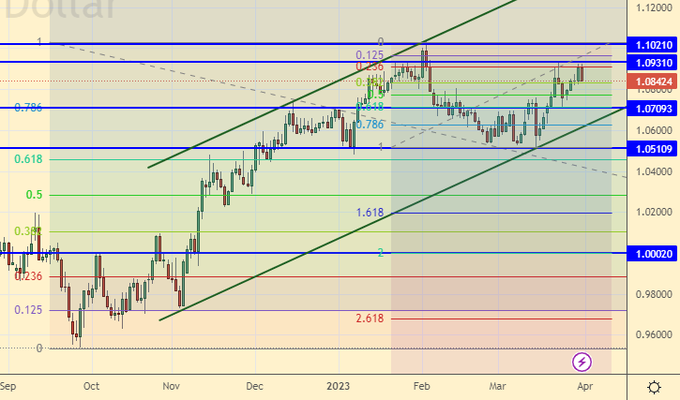

EUR/USD

Growth scenario: we will continue to pull up stop orders on open longs. The euro was not allowed to go above 1.0930, which could lead us to a pullback to the 1.0200 area.

Fall scenario: here it is necessary to sell. The bulls do not have so much strength, judging by the Friday candle. There are chances that the dollar will get stronger.

Recommendations for the EUR/USD pair:

Purchase: no. Who is in position from 1.0600, move the stop to 1.0790. Target: 1.2000.

Sale: now. Stop: 1.0947. Target: 1.0200.

Support — 1.0709. Resistance is 1.0931.

USD/RUB

Growth scenario: set a new high. It is worth continuing to hold long positions with the target at 88.00.

Fall scenario: we will refrain from sales for now. It is possible to work out a short on the hourly charts in case the day closes below 76.50.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 76.70, move the stop to 76.40. Target: 88.00.

Sale: no.

Support — 76.50. Resistance — 80.00.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. We are trying to settle in a growing channel. There are some chances for growth, but they are fundamentally not supported by anything. Raiffeisen Bank is going to sell its subsidiary in Russia, but for now it has tightened the conditions for currency transfers for individuals.

Fall scenario: as long as we are below 102000, any downward reversal signals should be worked out. Here you can enter the short.

Recommendations for the RTS index:

Purchase: no. Who is in position from 98000, move the stop to 96600. Target: 112000.

Sale: now. Stop: 101200. Target: 80000 (50000, then 20000) points. Who is in position from 106000, 103000, 101000 and 98000, move the stop to 101200. Target: 80000 (50000, then 20000) points.

Support — 96820. Resistance — 100870.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|