Price forecast from 7 to 11 February 2022

07 February 2022, 12:03

-

Grain market:

In Texas, during a winter storm and temperatures drop below zero Celsius, the blades of wind farms were covered with ice and cut themselves off from electricity generation, as a result of which aquarium fish literally freeze into the ice in the homes of local residents.

Hello everybody! We really hope you’re not in the US South right now.

The grain price index increased by 0.1% in January compared to December. Export prices for corn rose 3.8% during the month, driven by fears of a prolonged drought in South America, while world wheat prices fell 3.1% amid large harvests in Australia and Argentina. It should be noted that lower harvests and stable purchases by Asian buyers led to a monthly increase in world rice prices by 3.1 percent.

Global wheat plantings are expected to increase in 2022, driven mainly by favorable weather conditions in the Northern Hemisphere. Maize has good prospects, with high prices foreshadowing record plantings in Argentina and Brazil.

Global cereal consumption is projected to rise by 1.6% year-on-year in 2021/22, indicating a likely decline in the ratio of global cereal stocks to consumption to 28.7%.

A number of experts consider this level of stocks to be comfortable, but recent events such as the pandemic, natural disasters, the US-China crisis, and political tensions in Europe do not create a sense of security when there are only four months of stocks in storage.

We do not expect a significant drop in grain prices this year. Only seasonal adjustments of 15-20% from current price levels are possible.

Reading our forecasts, you could make money on the dollar/ruble pair by taking a move up from 74.30 to 77.20.

Energy market:

The oil market reacted nervously to the negative change in weather conditions in Texas, which will clearly affect production and transportation. The state produces 4 million barrels of oil per day, which is a little more than a third of all US production.

Due to bad weather in the US, oil prices will continue to rise on Monday, but then cooling should come, as the current overbought market is a big temptation to enter shorts.

With oil prices so high, the United Arab Emirates and Saudi Arabia can easily continue to sort things out with Yemen by force of arms. If the conflict escalates, it will keep oil prices high. If tensions escalate in the Arabian Peninsula, it could lead to the inability of the main members of OPEC to supply more and more oil to the market, and this could push prices well above current levels.

USD/RUB:

Producer price inflation in the EU has reached 26.2%, which looks frankly indecent. In the future, the ECB may be forced to raise rates faster than the US Federal Reserve, and this will put pressure on the dollar index in the long run.

The ruble has been strengthening for almost two weeks. Contacts with China at the highest level have created a positive atmosphere at the moment. It cannot be ruled out that the dollar will undergo a small sell-off on Monday, and then begin to strengthen against the ruble.

It should be noted that only the rise in the price of Brent oil to the level of $110.0 per barrel will prevent the weakening of the national currency. Such a movement is unlikely, but we cannot deny it.

On Friday, the meeting of the Bank of Russia. As expected, the rate will be raised again on it. It is very likely that immediately by 1%. The fight against inflation continues. Citizens have already gone to open deposits in banks, which should hold back price increases, but we will not have a real slowdown in the growth in the cost of goods and services until inflationary processes subside in Europe and the United States.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 13.9 thousand contracts. At the same time, the number of sellers in the market is greater than the number of buyers and continues to grow, and this does not exclude a further fall in prices.

Growth scenario: March futures, the expiration date is March 14. Let’s be a little stubborn and keep buying. Corn and soybeans continue to trade high, which could help wheat rise.

Falling scenario: from the area of 770.0 you can enter short. At the same time, it is highly desirable for corn and soybeans to go down at the same time.

Recommendation:

Purchase: now. Stop: 730.0. Target: 1180.0.

Sale: when approaching 770.0. Stop: 790.0 Target: 700.0. At the same time, corn and soybeans should fall.

Support — 735.2. Resistance — 776.4.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 8.7 thousand contracts. There are many more bulls in the market than bears. Nobody believes in cheap corn this year.

Growth scenario: March futures, the expiration date is March 14. From the level of 600.0, you can go long. The current levels are acceptable for purchases, but to a lesser extent.

Falling scenario: when approaching 685.0, it is mandatory to sell. Sales from current levels are perceived as premature.

Recommendation:

Purchase: now and when approaching 600.0. Stop: 580.0 Target: 685.0.

Sale: when approaching 685.0. Stop: 716.0. Target: 600.0.

Support — 610.2. Resistance — 642.6.

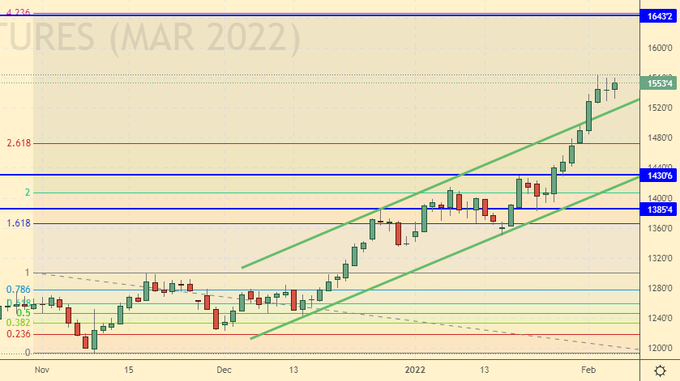

Soybeans No. 1. CME Group

Growth scenario: March futures, the expiration date is March 14. The market continues to go up. There are no good levels to buy here. We are out of the market.

Falling scenario: when approaching 1640.0, it is mandatory to sell. It is extremely likely that we will get the fifth extended wave and a sharp rollback down.

Recommendation:

Purchase: no.

Sale: when approaching 1640.0. Stop: 1680.0. Target: 1480.0.

Support — 1430.6. Resistance — 1643.2.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 28. Let’s be persistent. We buy at current levels. It can be aggressive.

Falling scenario: our opinion remains unchanged. Only around 20.00 will we think about shorts. The current levels for entering shorts are not interesting.

Recommendation:

Purchase: now. Stop: 17.70. Target: 23.20.

Sale: think when approaching 20.00.

Support — 17.43. Resistance — 18.46.

Сoffee С, ICE

Growth scenario: March futures, the expiration date is March 21. Found resistance at 245.0. Most likely we will see a rollback down. If there is an increase above 247.0, a small long is possible.

Falling scenario: we continue to hold shorts, counting on a downward breakdown of the 230.0 level and a move to 200.0, possibly to 190.0.

Recommendation:

Purchase: in case of growth above 247.0. Stop: 233.0. Target: 300.0?!

Sale: no. Who is in positions from 245.0, 240.0 and 235.0, move the stop to 247.0. Target: 200.0 (190.0).

Support — 220.25. Resistance is 244.85.

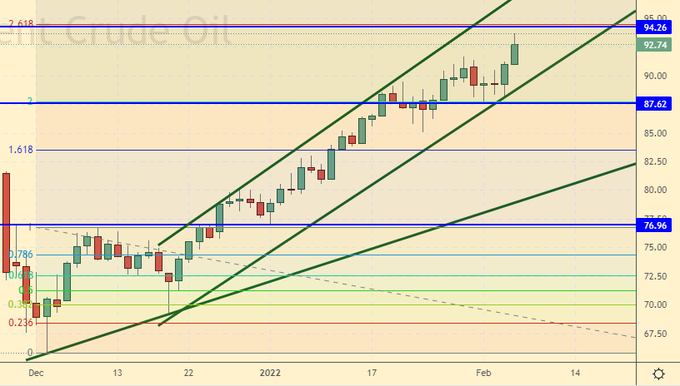

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 21.2 thousand contracts. Bulls leave the market for the second week in a row, which tells us about the imminent completion of the current upward movement.

Growth scenario: February futures, the expiration date is February 28. The market was approaching the level of 94.20 last week. A rollback to the 80.00 area should begin from the current levels. We don’t buy.

Falling scenario: from 94.20 it is mandatory to sell. The current levels are also of interest for short entry.

Recommendation:

Purchase: when approaching 80.00. Stop: 75.00. Target: 93.90.

Sale: now and when approaching 94.00. Stop: 96.90. Target: 80.00. Who is in position from 93.80, keep the stop at 96.90. Target: 80.00. Support — 87.62. Resistance — 94.26.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 2 units and now stands at 497 units.

Commercial oil reserves in the US fell by -1.047 to 415.143 million barrels, while the forecast was +1.525 million barrels. Inventories of gasoline rose by 2.119 to 250.037 million barrels. Distillate inventories fell -2.41 to 122.744 million barrels. Inventories at Cushing fell -1.173 to 30.528 million barrels.

Oil production fell by -0.1 to 11.5 million barrels per day. Oil imports rose by 0.849 to 7.085 million barrels per day. Oil exports fell by -0.42 to 2.376 million barrels per day. Thus, net oil imports rose by 1.269 to 4.709 million barrels per day. Oil refining fell by -1 to 86.7 percent.

Gasoline demand fell by -0.279 to 8.226 million bpd. Gasoline production fell by -0.267 to 8.65 million barrels per day. Gasoline imports rose by 0.119 to 0.433 million barrels per day. Gasoline exports rose by 0.228 to 0.64 million barrels per day.

Demand for distillates fell by -0.085 to 4.669 million barrels. Distillate production fell -0.154 to 4.602 million barrels. Distillate imports rose by 0.024 to 0.25 million barrels. Distillate exports fell -0.1 to 0.527 million barrels per day.

Demand for petroleum products fell by -1.007 to 21.41 million barrels. Production of petroleum products fell by -1.115 to 20.494 million barrels. Imports of petroleum products fell by -0.091 to 1.729 million barrels. The export of oil products increased by 0.411 to 4.344 million barrels per day.

Propane demand fell by -0.265 to 1.925 million barrels. Propane production fell -0.049 to 2.373 million barrels. Propane imports rose by 0.051 to 0.183 million barrels. Propane exports rose by 0.226 to 1.249 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 5.3 thousand contracts. Due to bad weather in the US, a small number of buyers entered the market. As soon as the weather normalizes, we will see prices drop.

Growth scenario: March futures, the expiration date is February 22. There is a threat of a passage to 107.00, but buying at current levels is extremely uncomfortable. We recommend buying on a rollback to 90.00.

Falling scenario: if Monday is red, you can sell.

Recommendation:

Purchase: on a rollback to 90.00. Stop: 88.40. Target: 107.40.

Sale: if Monday is red. Stop: 92.80. Target: 74.10. From 107.40 shorts are required. Stop: 109.70. Target: 85.60.

Support — 89.82. Resistance is 107.48.

Gas-Oil. ICE

Growth scenario: March futures, the expiration date is March 10. The market is growing due to bad weather in the US. A move to 930.0 cannot be ruled out. You can buy only on a rollback to 800.0.

Falling scenario: if Monday is red, we will sell. Recommendation:

Purchase: on rollback to 800.0. Stop: 782.0. Target: 930.0.

Sale: if prices fall on Monday. Stop: 833.00. Target: 660.00.

Support — 795.50. Resistance is 930.00.

Natural Gas. CME Group

Growth scenario: March futures, the expiration date is February 24th. The current pullback can be used to increase longs.

Falling scenario: we will not sell yet. Looking forward to higher prices.

Recommendation:

Purchase: no. Who is in position from 3.875, move the stop to 3.730. Target: 8.777.

Sale: no.

Support — 4.365. Resistance — 6.123.

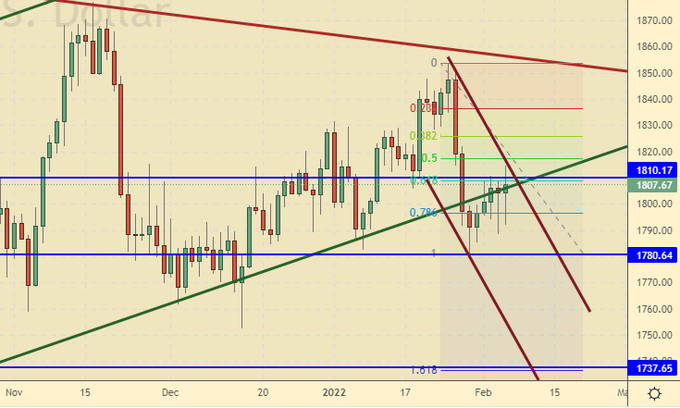

Gold. CME Group

Growth scenario: buyers hold the market around the 1800.0 level. As long as it makes sense to keep longs. The demand for investment coins is growing.

Falling scenario: shorting gold will be possible after falling below 1770 while out of the market.

Recommendations:

Purchase: no. Who is in position between 1780 and 1790, keep the stop at 1770. Target: 2300. Sale: think after falling below 1770.

Support — 1780. Resistance — 1810.

EUR/USD

Growth scenario: beautifully flew up. It makes sense to hold longs, as inflation in Europe is rising, which will lead to an increase in ECB rates.

Falling scenario: we do not believe in such a scenario yet.

Recommendations:

Purchase: no. Who is in position from 1.1130, move the stop to 1.1230. Target: 1.2100.

Sale: no.

Support — 1.1387. Resistance is 1.1525.

USD/RUB

Growth scenario: we see support at 75.60. If it is broken, then the market risks leaving by 72.00. Until this happens, it makes sense to buy.

Falling scenario: the ruble strengthened against the backdrop of rising oil prices and against the background of the visit of Russian top officials to China. New contracts with Beijing for oil and gas will support the national currency on Monday morning. However, as long as we are above the level of 75.00, we will refrain from selling dollars.

Recommendations:

Purchase: now. Stop: 75.30. Target: 86.70.

Sale: think after falling below 75.00.

Support — 75.66. Resistance — 77.37.

RTSI

Growth scenario: against the backdrop of a correction in the Russian market, in January, private investors decided to increase their longs, and diligently carried their gold soldos to the market, buying up shares of Russian companies. However, since the hysteria around Ukraine has not subsided yet from the West, it is difficult for us to count on the prevalence of optimistic moods in the market. We suggest thinking about buying only after the growth of the futures above the level of 160,000, while carefully analyzing the news background.

Falling scenario: most likely, Russia took a break for the duration of the Olympics in bickering with the West. So far, the Kremlin is letting us know that it is not ready to put up with ignoring its demands and promises to give an answer. What that answer will be, we can only guess. In conditions of uncertainty, falling is much more comfortable than rising.

Recommendations:

Purchase: no.

Sale: now. Stop: 152000. Target: 103000 (80000).

Support — 136080. Resistance — 148720.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|