|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-13-to-17-january-2025/665661/

|

Grain market:

Got a smoke? — asked a lonely Hollywood cowboy, sitting behind the wheel of his smoky, exclusive Porsche, recently bought for $230,000, to Jessica, who was wandering along the scorched road.

She reluctantly began rummaging through her purse, where a Zippo lighter would be mixed in with the gun, pads, ammunition, and bearer shares of insurance companies.

It hasn’t burned this well in America since Hawaii.

Here’s to a working fire suppression system, including in the head. All the problems are inside of us. From inflamed, constantly overheated neurons. Hence the errors in both design and trade. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Another WASDE report showed us a 0.29% drop in corn gross harvest expectations for the 24/25 season, and a 0.04% increase in wheat harvest expectations. Market conditions look wild at the end of the week as the spread between the two crops has narrowed to 60 cents a bushel. If someone used a strategy based on the fact that wheat will never be cheaper than corn, he or she may suffer a lot in the near future. It is possible that the current game is aimed at taking a major participant out of the market, perhaps more than one. The growth of corn above 460.0, despite the released data, cannot be considered as obligatory. But the stops were broken, it’s true.

The corn market now besides the drop in harvest forecast will support ethanol demand. Oil is not falling. Recall that since the end of October we have been listening to the chants on the net that oil has no chance and it must fall because some Trump wanted it to fall during the election campaign, coddling rednecks in the squares. You can’t promise voters anything, including cheap Benin, in order to get into office.

Energy market:

US sanctions against Russia’s oil and gas sector may lead to the fact that Moscow will find it very difficult to keep budget revenues at the same level in the 25th year. On the horizon we have Indonesia, which is able and willing to take oil, taking advantage of the situation not only from the Arabs. Unfortunately, there are no large consumers left on the planet who are ready to buy without looking at the US. Only China, which wants a discount. India can be written off for the future, as they will not resist American pressure, especially since they will be explained everything in their native English. It is worth recognizing that the 25th year will not be easy.

In favor of oil consumption growth, it is worth noting the growing trend of militarization, which implies, first of all, the creation of substantial strategic reserves, as well as the reduction of markets for Russia due to sanctions, as a result of which the countries that have under-received Russian volumes will look primarily to the Arabs.

At the moment, because of the strong labor market in the U.S., because of rising energy prices, there is a risk of inflation, which will force the Fed to raise rates again, which will slow development, fall corporate profits and, on a one-year horizon, should reduce energy demand, provided that the infrastructure for extraction and transportation is not destroyed by military conflicts.

USD/RUB:

On the evening of Friday, January 10, Washington distinguished itself by introducing another package of sanctions against Russian companies, which may lead us to a new round of sadness for the Russian currency on Monday.

Since the level of spending on the military-industrial complex remains high (it is some dark tens of trillions already), it is necessary to find somewhere a profit for the production of something that will disappear in a day. If you can’t find it, then you have to print it. It will be interesting to learn that the life time of a tank in a modern battle, when two commensurate armies collide, is estimated from 3 to 12 minutes. After that, think whether there are enough digits on the calculator.

There is no doubt that the West will continue to tighten the screws in order to sell its position in the so-called “negotiations”, sometime in the indefinite future.

For the ruble, this means another round of losses with no possibility of recovery in the foreseeable future. The nearest targets for the pair are 115.00 and 120.00. Thoughts about a pullback to 95.00, which could have been expected recently, are put aside.

Wheat No. 2 Soft Red. CME Group

Growth scenario: we consider the March contract, expiration date March 14. Nothing new. The market continues to fall. We will meet it at 440.0 (380.0).

Downside scenario: it makes sense to hold sales. The fact that corn is rising, it could be some itch of a group of traders based on prior collusion.

Recommendations for the wheat market:

Buy: no. Who is in position from 533.0, keep stop at 524.0. Target: 650.0.

Sell: no. Who is in position from 552.2, move the stop to 552.0. Target: 440.0 (380.0).

Support — 437.2. Resistance — 544.6.

Corn No. 2 Yellow. CME Group

Growth scenario: we consider the March contract, expiration date March 14. The level of 460.0 did not resist after the release of WASDE data. We went higher. We were not ready for the market growth, taking into account the fundamental data in general. Now there is no place to buy.

Downside scenario: we will refrain from selling for now. There’s plenty of corn on paper. Maybe there’s no corn on the ground. This is weird.

Recommendations for the corn market:

Buy: no.

Sale: no.

Support — 460.2. Resistance — 509.0.

Soybeans No. 1. CME Group

Growth scenario: we are looking at the March futures, expiration date March 14. We went above 1020.0, which makes us look up.

Downside scenario: we did not fall on the back of a 0.67% drop in crop forecasts. Still, the gross harvest is 10% higher than last year, so this spurt may be a local movement. We’re not selling yet.

Recommendations for the soybean market:

Buy: Now (1025.0). Stop: 990.0. Target: 1200.0?!!!

Sale: no.

Support — 1016.2. Resistance — 1055.2.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 43.3 th. contracts. Buyers continued to enter the market, sellers kept the volumes of their open positions. Bulls strengthened their control.

Growth scenario: we consider January futures, expiration date January 31. The market did not give a good pullback to 74.30 for optimal buying. Current levels for buying are overvalued. We are waiting for a pullback to 76.00. The movement target is 84.22.

Downside scenario: we stay out of the market. We’ve consolidated above 75.00. Sellers have no ideas yet.

Recommendations for the Brent oil market:

Buy: on a pullback to 76.00. Stop: 74.80. Target: 84.22 (94.30).

Sale: no.

Support — 77.87. Resistance — 84.22.

WTI. CME Group

Growth scenario: we consider February futures, expiration date is January 21. The market did not give a pullback to 71.00, which did not allow those wishing to enter. Those who are in position, keep longs. Targets at the top are very interesting.

Downside scenario: no sense in selling here. After listening to Trump’s pre-election populism, the market went up.

Recommendations for WTI crude oil:

Buy: no. Who is in position from 69.46, move the stop to 72.80. Target: 81.50 (92.60).

Sale: no.

Support — 72.90. Resistance — 80.05.

Gas-Oil. ICE

Growth scenario: we consider February futures, expiration date February 10. Nothing new. You can buy on pullbacks. Don’t forget to move stop orders along the trend.

Downside scenario: do not sell yet. Technically, a reversal is possible (it is always possible), but it does not make sense to look down yet. Friday was too aggressive.

Gasoil Recommendations:

Buy: No. Anyone in position at 670.00, move your stop to 690.00. Target: 900.00?!

Sale: no.

Support — 713.00. Resistance — 756.75

Natural Gas. CME Group

Growth scenario: we consider February futures, expiration date January 29. Russia is warm, Europe is cold. It’s all wrong. But interesting.

Downside scenario: we don’t think about sales yet. Gas periodically explodes upwards.

Natural Gas Recommendations:

Buy: no. Those in position from 3.354, move your stop to 3.400. Target: 5,000.

Sale: no.

Support — 3.552. Resistance — 4.208.

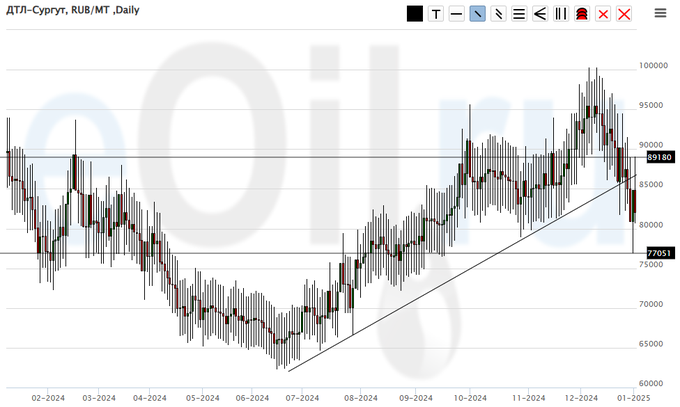

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we remain out of the market for now.

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 77051. Resistance — 89180.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: it is possible that the bottom is in front of us. We can’t rule out another strike at 5000, but we should buy here. Allows shaking, the brave ones, looking at the monitor, just twitch their leg.

Downside scenario: no good levels for selling. Out of the market. Note that an approach to 22000 will force us to consider shorts.

PBT Market Recommendations:

Buy: on approach to 6000. Stop: 3600. Target: 19000. Who is in position from 7500, keep stop at 8000. Target: 30000.

Sale: no.

Support — 7891. Resistance — 19375.

Helium (Orenburg), ETP eOil.ru

Growth scenario: no one wants to sell below 800. This is interesting. Let’s buy.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: Now (900). Stop: 770. Target: 2000.

Sale: no.

Support is 813. Resistance is 1005.

Growth scenario: we consider the February futures, expiration date February 26. Friday closed in such a way that we cannot guarantee the continuation of growth. Out of the market.

Downside scenario: sellers don’t see how the market can rise when the odds of a US rate cut are falling. We get both a strong dollar and strong gold. It’s weird.

Gold Market Recommendations:

Buy: no.

Sale: no.

Support — 2681. Resistance — 2738.

EUR/USD

Growth scenario: nothing new: it will be extremely difficult to go below 0.9900. If the pair will be in that area, we will buy.

Downside scenario: there is no sense in opening new shorts. We keep the old positions down.

Recommendations on euro/dollar pair:

Buy: when approaching 0.9900. Stop: 0.9800. Target: 1.1000.

Sell: no. Those who are in position from 1.0429, move the stop to 1.0380. Target: 0.9900.

Support — 1.0117. Resistance — 1.0438.

USD/RUB

Growth scenario: we consider March futures, expiration date March 20. It is likely that due to new sanctions the market will jerk upward on Monday, but this activity will be extinguished for a while. There will be some stagnation. Only after growth above 109000 we will buy.

Downside scenario: it is not necessary to sell now. If you don’t have shorts open earlier, it’s better to wait for the fall below 103000. The only thing is that it is not clear on the basis of what kind of news we can strengthen.

Recommendations on dollar/ruble pair:

Buy: think after rising above 109000.

Sell: No. Who is in position from 106300, move your stop to 106600. Target: 95000?!!!

Support — 102672. Resistance — 106515.

RTSI. MOEX

Growth scenario: we consider the March futures, expiration date March 20. If we take away from the news background, we should buy here. Everything is very beautiful, but there is not a single long green candle after the breakdown of the falling channel. There will be no direct recommendations to buy. But from 60000 — please go long.

Downside scenario: we will continue to hold shorts. Why should our shares cost more and more against the background of sanctions. Why would they?

Recommendations on the RTS index:

Buy: only when you approach 60,000

Sell: no. Who is in position from 87680, move the stop to 91000. Target: 60000.

Support — 85230. Resistance — 90670.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.