|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-13-to-17-december-2021/574167/

|

Grain market:

USDA’s December crop report was upbeat. The forecast for the gross harvest of both wheat and corn increased by 0.34%. After the release of the data, corn remained in place, while wheat fell slightly. If the dollar index continues to strengthen after the US Federal Reserve meeting on the 15th, the grain market may undergo a short-term sale, but there will be no downward trend reversal, as importers continue to build up grain stocks. Egypt can already feed itself for 5 months, China 1.5 years. This information so far influences the minds and supports the bull market, but if the next year is not bad, then importers can count on falling prices, including due to the deeper reserves being created now.

The pandemic showed the authorities of a number of states how vulnerable they are in the event of a supply interruption. It is possible that in the future the grain market will become not as thin and volatile as it is now, precisely because of the growing volumes of strategic storage facilities.

Energy market:

Therefore we will not fear the sale by the Americans of 18 million tons of oil on December 17th. May the OPEC be with you.

Next week we have a Fed meeting, which may affect the dollar directly and indirectly on the commodity markets. If Powell says on Wednesday that the pace of reduction of the quantitative easing program will accelerate, this will lead to further strengthening of the dollar. However, the strengthening of the position of the American currency will be restrained, since everyone is well aware that inflation will not only gut the wallets and savings of citizens, but also in relative terms reduces the US debt, which is incredibly convenient. This means that the Fed will not rush to raise the rate, no matter how much those who pray every night in front of the monitor on the American labor market would like it.

Gas in Europe again costs $ 1,200 per 1,000 cubic meters. It is possible that already in January the Europeans will have to choose between the operation of factories and heating their houses, since there will not be enough gas for everyone before the arrival of heat. In such a situation, oil prices cannot fall much, no matter how much Washington sells its black goods from its reserves.

All who can, will drown with oil and its derivatives. In the current situation, we can assume a short-term decline in prices to the level of $ 60.00 per barrel of Brent oil. A stronger fall is unlikely to be possible.

USD/RUB:

On Friday we have a meeting of the Central Bank of the Russian Federation. In November, inflation in the country amounted to 8.4% in November. We expect the rate from Nabiullina to rise by 1% to 8.5%. So far, the dollar still has a slight advantage against the ruble, but one cannot deny the possibility of strengthening the national currency until the end of December and then throughout January, since the likelihood of Powell’s weak speech on Wednesday is quite high. If the Fed wanted to raise the dollar rate as part of the fight against inflation, it would have done so a few months ago.

Our references to terms such as «transitory inflation» and «weak labor market» look just like a bad disguise for an unwillingness to raise rates. If the value of money rises, a number of American companies will not be able to survive the debt burden. A wave of bankruptcies and an increase in unemployment may begin.

It is scary to launch the market mechanisms at full capacity, as the result will be an aggravation of social problems, and Mr. Biden’s rating will fall below the current already terrible level of 36%. That is why the ruble has chances for a stable future in the range of 70.00 -75.00 at least until the end of January.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 6 thousand contracts. There are more buyers in the market only due to the outflow of sellers.

Growth scenario: March futures, the expiration date is March 14. The market could not hold above the level of 780.0, which led to a move down to 770.0. We are not buying yet.

Falling scenario: we saw a fall below 780.0. You can enter the market with a target at 735.0. Not the best spot for a short, but with risk control, the deal is acceptable.

Recommendation:

Purchase: no.

Sale: now. Stop: 817.0. Target: 735.0.

Support — 768.4. Resistance — 823.0.

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 17.4 thousand contracts. Buyers are in control of the situation. For now, the crowd wants to see further growth in the market.

Growth scenario: March futures, the expiration date is March 14. It is unlikely that we will rise above 610.0. There is no good place to shop. Out of the market.

Falling scenario: we continue to believe that when approaching 605.0, one can sell in anticipation of a rollback to 550.0. The current levels are also of interest for short entry.

Recommendation:

Purchase: no.

Sale: when approaching 605.0. Stop: 617.0. Target: 550.0. Or now. Stop: 597.0. Target: 550.0.

Support — 563.0. Resistance — 597.2.

Soybeans No. 1. CME Group

Growth scenario: January futures, the expiration date is January 14. We continue to recommend buying at current levels. The move to 1354 (1462) is highly probable.

Falling scenario: we continue to refuse to sell. We are waiting for the rise in prices.

Recommendation:

Purchase: now. Stop: 1236.0. Target: 1462.0. Those who are in the position from 1267.0, move the stop to 1236.0. Target: 1462.0.

Sale: no.

Support — 1238.2. Resistance — 1277.0.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 28. We see an aggressive flight up, which did not simplify the situation in any way. Whoever did not buy, like us, is out of the market. Falling scenario: a sharp splash beckons to short. Sell carefully.

Recommendation:

Purchase: when approaching 18.15. Stop: 17.70. Target: 23.20.

Sale: now. Stop: 20.10. Target: 18.21.

Support — 19.31. Resistance — 20.71.

Сoffee С, ICE

Growth scenario: March futures, the expiration date is March 21. For a new round of purchases, we need to drop to the area of 200.0. Out of the market so far.

Falling scenario: it’s good that we set our stop high. As you can see, the puppeteers tried to knock us, and not only us, out of the shorts. We keep short positions.

Recommendation:

Purchase: no.

Sale: no. Those who are in the position from 245.0, move the stop to 248.0. Target: 200.0.

Support — 218.05. Resistance — 252.10.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, 12/01/21 — 12/07/21, the difference between long and short positions of managers decreased by 5.3 thousand contracts. At the same time, speculators left the market. Bulls, stronger than bears, have reduced their positions. Growth scenario: December futures, expiration date December 31. There are slight hints of growth, but we will continue to refrain from shopping. I would like to see the 60.00 level.

Falling scenario: the current area is not bad for a short entry. However, one cannot deny the price movement towards 80.00.

Recommendation:

Purchase: think when approaching 60.00.

Sale: now. Stop: 77.90. Target: 60.00 (50.00). Whoever remained in the position from 82.00, move the stop to 77.90. Target: 60.00 (50.00).

Support — 70.55. Resistance — 77.59.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 4 units and is 471 units.

Commercial oil reserves in the United States fell by -0.24 to 432.871 million barrels, while the forecast was -1.705 million barrels. Gasoline inventories rose by 3.882 to 219.304 million barrels. Distillate stocks rose by 2.734 to 126.611 million barrels. Inventories at the Cushing storage facility increased by 2.373 to 30.917 million barrels.

Oil production increased by 0.1 to 11.7 million barrels per day. Oil imports fell by -0.105 to 6.499 million barrels per day. Oil exports fell by -0.434 to 2.27 million barrels per day. Thus, net oil imports rose by 0.329 to 4.229 million barrels per day. Oil refining rose 1 percent to 89.8 percent.

Gasoline demand rose by 0.167 to 8.963 million barrels per day. Gasoline production fell by -0.086 to 9.563 million barrels per day. Gasoline imports fell by -0.085 to 0.558 million barrels per day. Gasoline exports fell by -0.095 to 0.792 million barrels per day.

Distillate demand fell by -0.631 to 3.578 million barrels. Distillate production rose 0.045 to 4.917 million barrels. Distillate imports rose 0.035 to 0.269 million barrels. Distillate exports rose 0.63 to 1.218 million barrels per day.

The demand for petroleum products fell by -0.385 to 19.837 million barrels. Production of petroleum products increased by 0.461 to 21.107 million barrels. Imports of petroleum products fell by -0.2 to 1.973 million barrels. Exports of petroleum products rose by 0.456 to 5.263 million barrels per day.

Propane demand fell by -0.058 to 1.615 million barrels. Propane production rose 0.001 to 2.456 million barrels. Propane imports rose 0.022 to 0.138 million barrels. Propane exports fell by -0.143 to 0.891 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Over the past week, the difference between long and short positions of managers decreased by 7.2 thousand contracts. Bulls left the market, bears, on the contrary, increased their positions. Changes in the balance of power can be considered insignificant.

Growth scenario: January futures, the expiration date is December 20. Looking at the rebound from 62.50, I would like to buy, but we consider the current levels to be overestimated. Out of the market.

Falling scenario: current prices, as well as a rise to 76.70, are acceptable for sales. Note that in anticipation of the market falling by 50.00, the rise of quotations above 78.00 is undesirable. Recommendation:

Purchase: no.

Sale: now. Stop: 73.70. Target: 50.00. And also when climbing to 76.70. Stop: 78.70. Target: 50.00. Those who are in the position from 69.40, move the stop to 73.70. Target: 50.00.

Support — 62.50. Resistance — 73.29 (77.21).

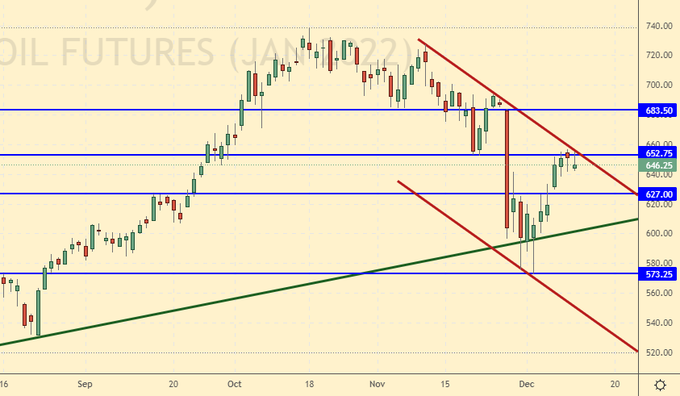

Gas-Oil. ICE

Growth scenario: January futures, the expiration date is January 12. A rise above 660.00 may lead to a move towards the 700.00 area. We keep longs.

Falling scenario: sell here. Gasoline stocks in the US are growing, this fact may put pressure on prices.

Recommendation:

Purchase: no. Whoever is in the position from 620.00, move the stop to 610.00. Target: 800.0 ?!

Sale: now. Stop: 690.00. Target: 500.00.

Support — 627.00. Resistance — 683.50.

Natural Gas. CME Group

Growth scenario: January futures, expiration date December 29. A strange fall against the backdrop of problems in Europe. Those interested can buy. We keep open purchases from 3.750.

Falling scenario: we will not sell. The market situation is abnormal.

Recommendation:

Purchase: now. Stop: 3.600. Target: 8.777. Anyone in the position from 3.750, move the stop to 3.600. Target: 8.777.

Sale: no.

Support — 3.383. Resistance — 4.738.

Gold. CME Group

Growth scenario: frankly looking forward to the Fed meeting. The Friday candle does not instill confidence that we must necessarily grow. We keep the longs opened earlier. We do not increase the position.

Falling scenario: shorting gold is only possible after Powell’s comment on Wednesday. We recommend staying out of the market due to uncertainty. Recommendations:

Purchase: no. who is in the position from 1780, move the stop to 1766. Target: 2300 !!!

Sale: no.

Support — 1756. Resistance — 1834.

EUR/USD

Growth scenario: the euro has a chance to start growing against the dollar, provided that inflation in Europe picks up speed due to the rise in energy prices. You can buy here.

Falling scenario: do not sell. We have very big doubts about the strength of the dollar. Those interested can work out a possible move to 1.1070 at hourly intervals.

Recommendations:

Purchase: now. Stop: 1.1220. Target: 1.1680 (1.2100).

Sale: no.

Support — 1.1185. Resistance — 1.1524.

USD/RUB

Growth scenario: falling of the pair to 72.30 is very likely. When approaching this level, you can buy, provided that the dollar does not show weakness against the currencies of developed countries after the Fed meeting.

Falling scenario: if the pair goes below the level of 72.00, we will think about shorts. There are too many unknowns in the equation right now. It is possible that everything will become more or less clear only on Friday, after the meeting of the CBR.

Recommendations:

Purchase: think when approaching 72.30. Anyone in the position from 74.10, keep the stop at 72.90. Target: 77.00 (82.00).

Sale: not yet.

Support — 72.27. Resistance — 74.24.

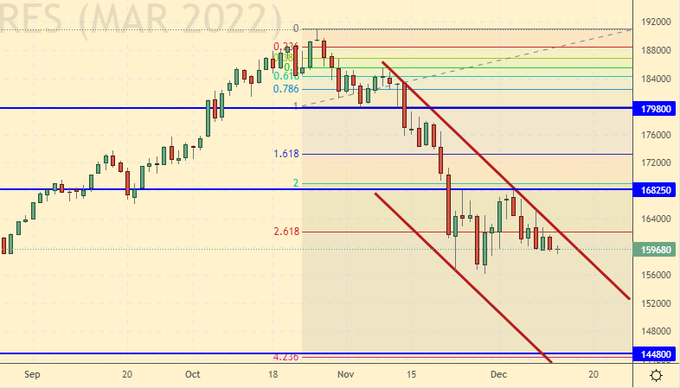

RTSI

Growth scenario: the stock market falls, because at high rates, it is much safer to keep money on a deposit in a bank, and not to own equity securities. In light of the expected rate hike by the Bank of Russia on Friday, we do not recommend index longs.

Falling scenario: as well as five weeks earlier, we do not open new sell positions, we keep the old ones. We are waiting for the 150,000 mark.

Recommendations:

Purchase: not yet.

Sale: no. Who entered from 190,000, move the stop to 169700. Target: 150,000.

Support — 144800. Resistance — 168250.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.