Price forecast from 9 to 13 December 2024

Grain market:

Syria decided to format the hard drive, the driver escaped, killed a million people, but it was “fun”. And it’s happening all over the world. And it will continue to happen. When they say that speculation is a dirty business, they are scoundrels, these speculators. First of all, look around you, then try to speculate.

Here’s to a sober assessment of the situation. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Russia is likely to sharply reduce wheat exports from January to June 2025, as exports in the second half of FY24 were significant at 5 — 5.5 million tons per month. Russia is expected to sell 13 million tons of wheat for export in the first half of FY25, half the amount sold in the same period last year. Exhaustion of the overhang from the season before last could stimulate domestic grain prices closer to the spring of FY25.

The idea of a “grain exchange” or a “BRICS grain exchange”, whatever you like, continues to be nurtured. There are no problems here, they are artificially created. The exchange does not even require a computer, who did not know. As one farmer said at a forum in Rostov: “I have an exchange in my office during the harvesting season. It is necessary to gather a dozen of such farmers and their potential buyers in a barn with a samovar. Then you need one student who will write numbers on the blackboard with chalk. That’s it. But no, that’s not all. Turns out something has to be coordinated with someone. Waiting. We watch the agony with curiosity. Go to IDK.ru everything has long been done for bidding.

Energy market:

So, OPEC and its “+”, like the expression, will hold its production, but the US, as expected, does not intend to do so. We see the U.S. production rising to 13.513 million barrels per day. Comrades are growing at a Stakhanovite pace, breaking records.

The situation on the market is such that if at least one “half-naked hysterical girl” (this is a metaphor), who is greedy for immediate profits through an immediate increase in production and withdrawal from the agreement, runs onto the stage, and even more so if she gets to the microphone, it will lead to a collapse in prices. Quotes are already looking down at the end of the week. If Brent goes below 70.00, it will lead to a move to 65.00. And Trump hasn’t even sat on the throne yet.

So far, looking at copper and silver quotes, we cannot say that the market is waiting for the death of China’s industry. But the downside for the entire commodity group, especially in the first months of the apparent confrontation between Beijing and Washington, could be strong. We need someone to explain to Donald the perniciousness of his possible policy of barrier duties, otherwise, with the reduction of world trade, we will see Brent at 40.00.

USD/RUB:

And they told him to rise. And he rose from the ashes with a flaming sword in his hand. And the tribunes and heralds heralded his approach, watered by the straining bass of the signal horns.

Something like that.

But all this show of ruble appreciation is unlikely to last long. Taking into account that oil does not want to grow, and defense spending will not be reduced in the near future under any conditions, and sanctions will not be lifted, we will see nothing but inflation growth, rate increase up to 25%, and a fall in the ruble-dollar (yuan) exchange rate. After visiting 96.00 we expect the pair to grow to 118.00. Yes, this mark will be reached not tomorrow, but rather in the second half of next year, but the way we have on the chart so far only to the north.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 10.2 thousand contracts. Both buyers and sellers were increasing their positions. Sellers did it more actively. Bears strengthened their control.

Growth scenario: we consider the March contract, expiration date March 14. At the bottom we have 527.0, and further only 435.0 and 375.0. We should not hurry to buy.

Downside scenario: we continue to threaten to break 540.0 with the target at 527.0. But it is better to work out this idea on hourly intervals.

Recommendations for the wheat market:

Buy: no.

Sale: no.

Support — 540.2. Resistance — 560.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 10.7 th. contracts. Buyers were leaving the market, sellers were entering it in small volumes.

Growth scenario: we consider the March contract, expiration date March 14. Buyers are trying to convince us of their strength. But we don’t believe them yet. Out of the market.

Downside scenario: our short is in danger, but holding a position with too much risk is not our style. If the position is closed by stop order, we will take a pause.

Recommendations for the corn market:

Buy: no.

Sell: no. Those who are in position from 435.2, move the stop to 442.0. Target: 351.0.

Support — 434.4. Resistance — 442.2.

Soybeans No. 1. CME Group

Growth scenario: we consider January futures, expiration date January 14. Nothing new. Don’t think about buying while we are below 1025.0.

Downside scenario: we will continue to keep open shorts. Soybeans are plentiful. The market is on the verge of a strong fall.

Recommendations for the soybean market:

Buy: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: no. Who is in position from 1049.0, keep stop at 1041.0. Target: 835.0.

Support — 974.6. Resistance — 1013.2.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 29.7 th. contracts. Buyers entered the market, sellers reduced positions. Bulls strengthened their control.

Growth scenario: we consider December futures, expiration date December 31. We are not looking upwards yet.

Downside scenario: continue to make attempts to capitalize on the sale.

Recommendations for the Brent oil market:

Buy: no.

Sell: now (71.12). Stop: 73.30. Target: 66.44!

Support — 69.67. Resistance — 71.52.

WTI. CME Group

US fundamentals: the number of active rigs rose by 5 to 482.

U.S. commercial oil inventories fell by -5.073 to 423.375 million barrels, with a forecast of -1.6 million barrels. Gasoline inventories rose 2.362 to 214.603 million barrels. Distillate stocks rose 3.383 to 118.1 million barrels. Cushing storage stocks increased by 0.05 to 24.192 million barrels.

Oil production increased by 0.02 to 13.513 million barrels per day. Oil imports increased by 1.207 to 7.29 million barrels per day. Oil exports fell by -0.428 to 4.235 million barrels per day. Thus, net oil imports rose by 1.635 to 3.055 million barrels per day. Oil refining rose by 2.8 to 93.3 percent.

Gasoline demand rose by 0.232 to 8.738 million barrels per day. Gasoline production fell -0.248 to 9.496 million barrels per day. Gasoline imports fell -0.125 to 0.511 million barrels per day. Gasoline exports fell -0.069 to 0.994 million barrels per day.

Distillate demand fell by -0.32 to 3.398 million barrels. Distillate production rose by 0.219 to 5.315 million barrels. Distillate imports fell -0.028 to 0.116 million barrels. Distillate exports rose 0.087 to 1.55 million barrels per day.

Demand for petroleum products fell by -0.503 to 19.968 million barrels. Petroleum products production increased by 0.812 to 22.618 million barrels. Petroleum product imports fell -0.261 to 1.479 million barrels. Exports of refined products rose by 0.885 to 7.542 million barrels per day.

Propane demand fell -0.86 to 0.825 million barrels. Propane production rose 0.051 to 2.808 million barrels. Propane imports fell -0.04 to 0.113 million barrels. Propane exports rose 0.821 to 2.19 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 8.4 th. contracts. Buyers entered the market, the volume of sellers’ positions left overnight did not change. Bulls strengthened their control.

Growth scenario: we consider January futures, expiration date December 20. We will postpone purchases for the time being. The market did not react in any way to the extension of the OPEC+ deal.

Downside scenario: it makes sense to keep shorting for now. The level of 66.29 is under the threat of breakdown.

Recommendations for WTI crude oil:

Buy: no.

Sell: no. Those in position from 68.00, keep your stop at 71.00. Target: 60.00?

Support — 66.29. Resistance — 72.43.

Growth scenario: we consider January futures, expiration date is January 10. We do not consider buying yet.

Downside scenario: at least a small pullback to the upside is needed for an optimal short entry. If it does not happen, we stay out of the market.

Gasoil Recommendations:

Buy: no.

Sell: when approaching 655.0. Stop: 672.0. Target: 600.0.

Support — 636.50. Resistance — 658.00.

Natural Gas. CME Group

Growth scenario: we consider January futures, expiration date December 27. Bulls disappointed. Out of the market.

Downside scenario: out of the market.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 2.972. Resistance — 3.642.

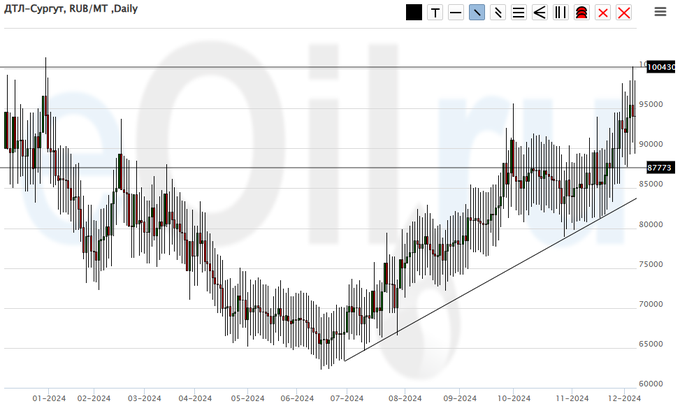

Diesel arctic fuel, ETP eOil.ru

Growth scenario: keep longing. In case of growth above 100000 we will pull up stop orders.

Downside scenario: we won’t sell, as we can’t believe we don’t need diesel right now.

Diesel Market Recommendations:

Buy: No. Who is in position from 65000, move stop to 84000. Target: 120000 (revised).

Sale: no.

Support — 87773. Resistance — 100430

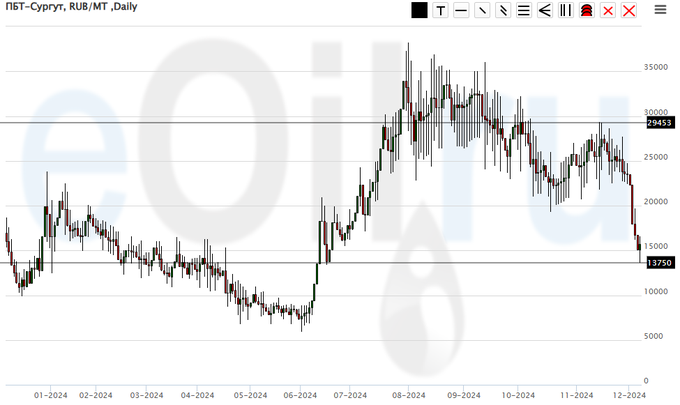

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we have not seen any growth in this instrument. There is a seasonal decline. It is still out of the market.

Downside scenario: went down sharply. There are no good levels for selling. Out of the market.

PBT Market Recommendations:

Buy: no.

Sale: no.

Support — 13750. Resistance — 29453.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation around 1000. We are unlikely to fall below 900, but to confirm the growth it is better to wait for a move above 1100.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 906. Resistance is 1075.

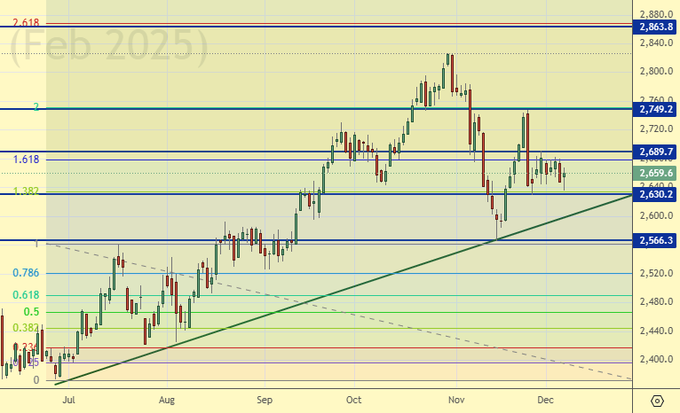

Growth scenario: switched to February futures, expiration date February 26. Nothing new. It makes sense to continue holding longs. Then there is a crisis in South Korea, now Syria will be under other people.

Downside scenario: out of the market for now. Too many hot spots on the map. And everything is inflamed in the brain, too.

Gold Market Recommendations:

Buy: no. Who is in the position from 2575 (taking into account the transition to a new contract), move the stop to 2610. Target: 2863 (3170).

Sale: no.

Support — 2630. Resistance — 2689.

EUR/USD

Growth scenario: out of the market for now. There will be nothing interesting on the pair until the 12th (ECB meeting), and rather we will start to move somehow only after the Fed meeting on December 18. Out of the market.

Downside scenario: There are a number of questions about what is happening before our eyes. We need clarity on the situation. Outside the market.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.0474. Resistance — 1.0753.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. We see a strong fall. It makes sense to buy from 97000.

Downside scenario: we give up on shorts.

Recommendations on dollar/ruble pair:

Buy: when approaching 97000. Stop: 95700. Target: 118000.

Sale: no.

Support — 97071. Resistance — 102342.

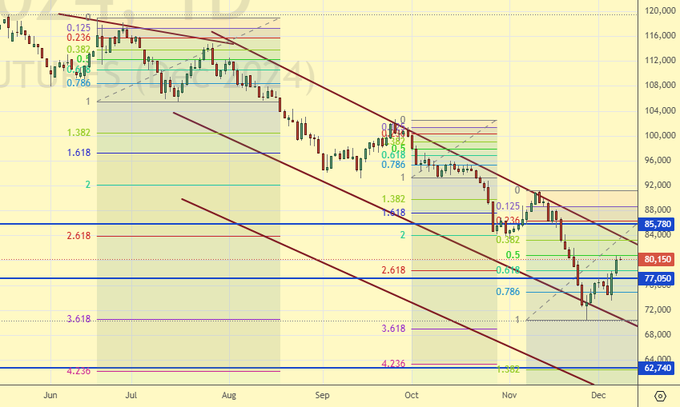

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. We continue to refuse to buy. We may be late to start believing in the “Christmas rally”, but the foreign policy background is very contradictory. In general, we do not deny that this place is interesting for buying, but the level of 60000 is much more interesting.

Downside scenario: it makes sense to sell from the current area and on a rise to 85000.

Recommendations on the RTS index:

Buy: no.

Sell: on a pullback to 85000. Stop: 87000. Target: 60000. Those who are in position from 80000, keep stop at 82000. Target: 60000.

Support — 77050. Resistance — 85780.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Gas-Oil. ICE

Gas-Oil. ICE