Price forecast from 7 to 11 April 2025

Burn in hell! No! Burn in hell! That’s what half of America was yelling in the streets on Saturday at Trump and his-so-son Musk. Someone even drew posters where, instead of the face of the incumbent president, how to write… right here is the very center of his bottom part. Someone was yelling songs, amidst the destruction of 3 trillion of American money after the stock revaluation.

Here’s to developing new skills in times of crisis. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Grain market:

The complete absence of ideas in this market is a blessing for all of us, because while gasoline can still be joked about, wheat and corn should not be joked about. They have to be. There are 8 billion of us here and we should not rock the boat.

The gloom about the global trade war visited all markets, but hardly touched grains, but negatively affected soybeans, which started to go down again. It may drag wheat and corn into a bearish trend. Be prudent: buy corn from 380.0 and wheat from 450.0 if you get a chance.

In general, globally, we should get a harvest at the level of last year, which is reflected in the current prices. If merchants understand the new realities of who is bringing how much to whom, and they will in a couple of weeks, we should not expect too low prices (corn 300, wheat 400 cents per bushel).

Energy market:

You write forecasts and think that nothing worse can happen except negative oil prices. It can! Negative development of the neocortex (erasure of crinkles). OPEC+ against the backdrop of American springtime schizophrenia decided to increase production. It’s springtime there too! I don’t even know if it’s worth giving the rest of us what they were smoking there at the meeting. Apparently it would be not that illegal, but extremely inhumane. But! Today the stupefaction is out of our heads. And now by April 15 we have to submit plans… for downsizing! Hooray! But it won’t help. The West has already started to fight within itself. And it’s the main consumer.

China did not look calmly at the wiggles of the American grandfather and began to wiggle back itself. You give us 34%, and we will give you 34% of trade duties. And that’s when the world realized that the contagion came out of the dining room and began to spread through the wards. Oil collapsed merrily and without alternative.

Gentlemen and ladies, with all responsibility I must state that we are in for a severe financial and economic crisis!

Beating each other with duties will lead to the fact that the WTO system will be completely destroyed, production will be localized, if not by countries, then by blocks, and the population will be scattered in search of any work. Under such conditions, a move in Brent to 38.00 (thirty-eight) looks very likely.

USD/RUB:

Budget deficit of 3.8 trillion rubles for January-February ’25 according to the Treasury. Ah-ah, how come? And what will happen now? Now we need to find out how much we lack. I want to believe that it’s only 1 trillion rubles a month. Then… modestly and consistently the ruble-dollar exchange rate falls by 1.25% for the same month. And if 2 trillion, then by 2.5%. And that’s it. That’s it. Yes. That’s it.

Without cutting spending on the military-industrial complex, our budget won’t come together. There’s nothing terrible about that. They’ll just raise the VAT to 25% and gasoline prices. That’s all. That’s all.

The pair can be bought from the current levels. If there will be an indicative nod towards 82.00 by May 9, then take 82.00 by all means.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 10.4 th. contracts. There were few buyers. Sellers entered the market with average volumes. Bears are controlling the situation.

Growth scenario: we consider the May contract, expiration date May 14. We have set a medium-term low. We are waiting for an approach to 500.0.

Downside scenario: it is worth keeping short. When reaching 500.0 it makes sense to close only 50% of the position. The mark of 450.0 is not excluded.

Recommendations for the wheat market:

Buy: obligatory when approaching 500.0. Stop: 400.0. Target: 700.0. Add when approaching 450.0. Consider the risks.

Sell: No. Those who are in position from 558.2, move the stop to 546.0. Target: 500.0 (450.0).

Support — 517.4. Resistance — 544.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 54.5 thousand contracts. Buyers suddenly swooped in a large volume. There were no sellers. Bulls kept control.

Growth scenario: we consider the May contract, expiration date May 14. Corn has not proved anything to us yet. Fall is more likely scenario we do not buy.

Downside scenario: really want 380.0. Deeper levels? Maybe 350.0. We hold shorts.

Recommendations for the corn market:

Buy: no.

Sell: no. Who is in the position from 470.0, keep the stop at 468.0. Target: 380.0 (350.0).

Support — 447.2. Resistance — 465.0.

Soybeans No. 1. CME Group

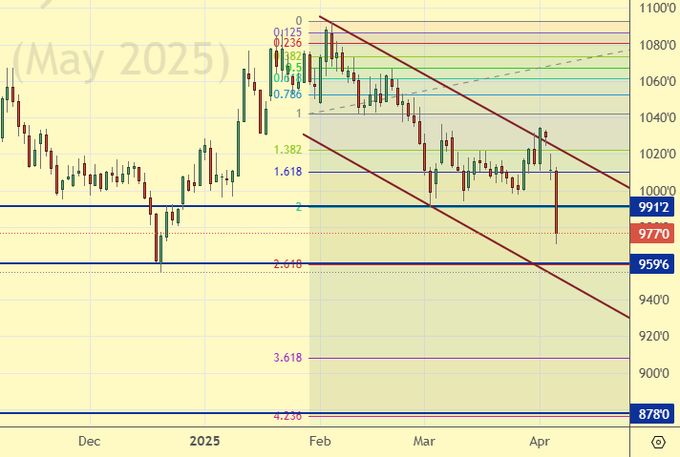

Growth scenario: we consider the May contract, expiration date May 14. Soybean unexpectedly turned around. Only a pullback to 1005.0 will allow us to hold on to the long.

Downside scenario: the market could be taken on the reversal from 1035.0. We entered from 1030.0. We hold the short.

Recommendations for the soybean market:

Buy: no.

Sell: those in position from 1030.0, move stop to 1035.0. Target: 880.0.

Support — 959.6. Resistance — 991.2.

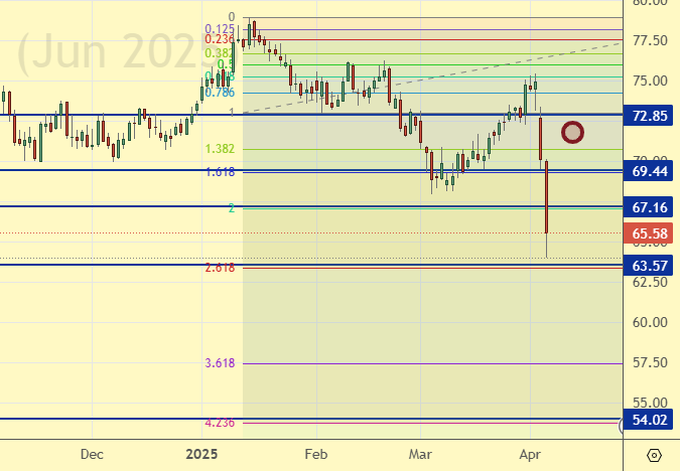

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 62.5 th. contracts. Bulls actively entered the market for 3 weeks in a row. There were no bears. The bulls strengthened their control. So they were all taken out on Friday.

Growth scenario: we consider April futures, expiration date April 30. Bulls have nothing to do here. Out of the market.

Downside scenario: who would have thought… Holding shorts.

Recommendations for the Brent oil market:

Buy: no.

Sell: no. Those who are in position from 73.00 and 71.61, move the stop to 73.70. Target: 54.00 (revised).

Support — 63.57. Resistance — 67.16.

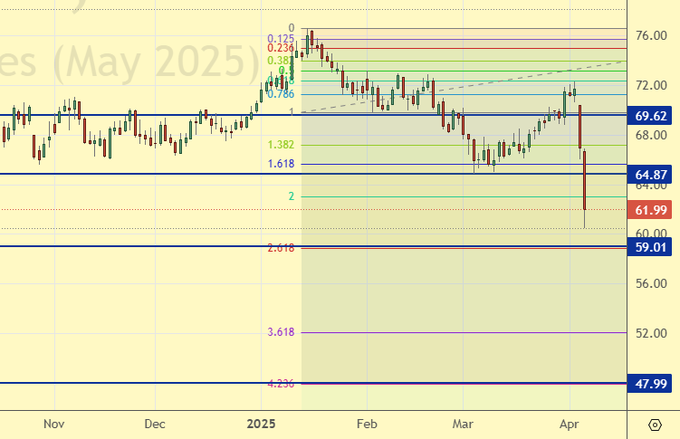

WTI. CME Group

US fundamentals: the number of active rigs rose by 5 to 489.

U.S. commercial oil inventories rose by 6.165 to 439.792 million barrels, against a forecast of -0.4 million barrels. Gasoline inventories fell -1.551 to 237.577 million barrels. Distillate stocks rose 0.264 to 114.626 million barrels. Cushing storage stocks rose by 2.373 to 25.078 million barrels.

Oil production increased by 0.006 to 13.58 million barrels per day. Oil imports increased by 0.271 to 6.466 million barrels per day. Oil exports fell by -0.728 to 3.881 million barrels per day. Thus, net oil imports rose by 0.999 to 2.585 million barrels per day. Oil refining fell -1 to 86 percent.

Gasoline demand fell by -0.148 to 8.495 million barrels per day. Gasoline production rose 0.062 to 9.284 million barrels per day. Gasoline imports rose 0.159 to 0.748 million barrels per day. Gasoline exports increased by 0.188 to 0.853 million barrels per day.

Distillate demand increased by 0.043 to 3.679 million barrels. Distillate production increased by 0.164 to 4.677 million barrels. Distillate imports rose 0.029 to 0.149 million barrels. Distillate exports increased by 0.052 to 1.109 million barrels per day.

Demand for refined products increased by 0.884 million barrels to 20.121 million barrels. Production of petroleum products increased by 0.866 to 21.446 million barrels. Petroleum product imports rose 0.189 to 1.775 million barrels. Exports of refined products increased by 0.329 to 6.451 million barrels per day.

Propane demand increased by 0.102 to 1.193 million barrels. Propane production rose 0.039 to 2.794 million barrels. Propane imports fell -0.012 to 0.125 million barrels. Propane exports fell -0.242 to 1.586 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 8.2 th. contracts. Buyers entered the market in insignificant volumes. There were no sellers. Bulls keep control.

Growth scenario: we consider May futures, expiration date April 22. Out of the market. We do not think about purchases in principle.

Downside scenario: it makes sense to keep shorting. The situation is such that oil from Venezuela, Iran and Russia can be replaced on the external market, albeit not quickly. And there is also LNG, which has nowhere to go.

Recommendations for WTI crude oil:

Buy: no.

Sell: no. Those who are in positions from 70.00 and 68.28, move the stop to 71.30. Target: 48.55 (revised).

Support — 59.01. Resistance — 64.87.

Gas-Oil. ICE

Growth scenario: we switched to the May futures, expiration date May 9. We continue to believe that to buy we should wait for the momentum downward to fully work out, which will happen at 557.0.

Downside scenario: it was possible to get a hold on the short. Now it should be held. A drop in consumption is possible against the backdrop of a slowdown in the global economy.

Gasoil Recommendations:

Buy: when approaching 560.0. Stop: 540.0. Target: 645.0.

Sell: no. Who is in the position from 688.0 and 677.0 (taking into account the transition to a new contract), move the stop to 677.0. Target: 560.00.

Support — 557.75. Resistance — 633.50

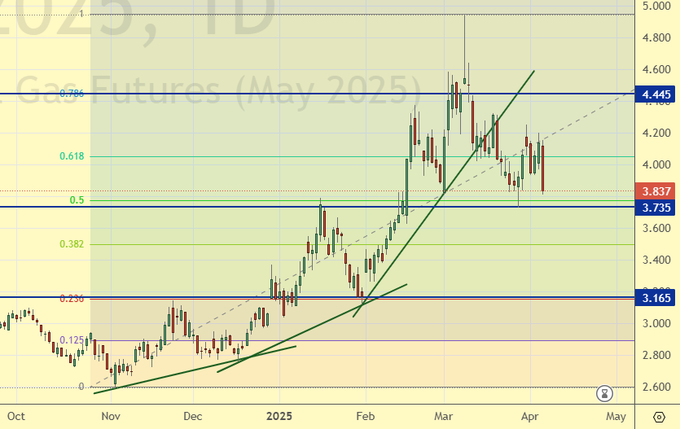

Natural Gas. CME Group

Growth scenario: we consider May futures, expiration date April 28. We are waiting for lower levels for buying. For example, 2,800. Summer’s ahead. And the crisis.

Downside scenario: we will not see 4.500. Sell from current levels.

Natural Gas Recommendations:

Buy: when approaching 2.800. Stop: 2.600. Target: 3.600.

Sell: Now (3,837). Stop: 4.300. Target: 3.200.

Support — 3.735. Resistance — 4.445.

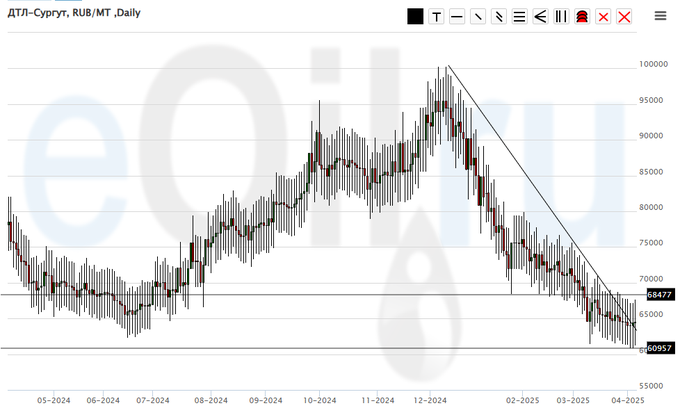

Diesel arctic fuel, ETP eOil.ru

Growth scenario: you can buy. Bad things are happening to the budget. Fuel will be taxed (hypothesis).

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: Now (64000). Stop: 59000. Target: 120000.

Sale: no.

Support — 60957. Resistance — 68477.

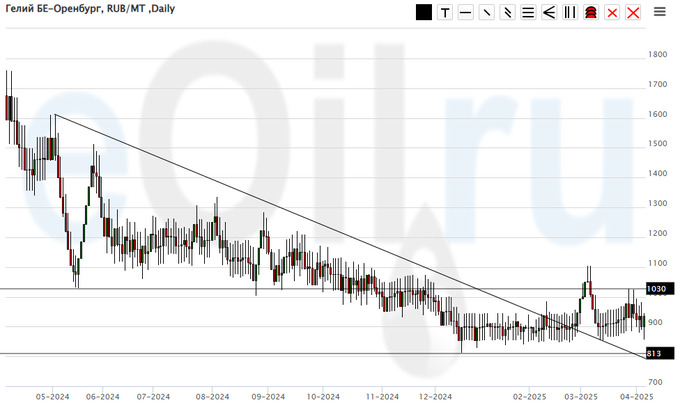

Helium (Orenburg), ETP eOil.ru

Growth scenario: it makes sense to keep longing. At a certain point, prices will start to rise for everything. And helium, too.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: No. Who is in position from 900, keep stop at 850. Target: 2000.

Sale: no.

Support — 813. Resistance — 1030.

Growth scenario: we consider April futures, expiration date April 28. With such red candles, the bulls should order a funeral service. Out of the market.

Downside scenario: very evil. Selling only at rise to 3130.

Gold Market Recommendations:

Buy: no.

Sell: at rise to 3130. Stop: 3160. Target: 2665.

Support — 2997. Resistance — 3198.

EUR/USD

Growth scenario: we will wait for a pullback to 1.0550. It is uncomfortable to buy from current levels.

Downside scenario: sell only when approaching 1.1100.

Recommendations on euro/dollar pair:

Buy: on a pullback to 1.0550. Stop: 1.0450. Target: 1.1090 (1.2000).

Sell: when approaching 1.1100. Stop: 1.1150. Target: 1.0550.

Support — 1.0777. Resistance — 1.1143.

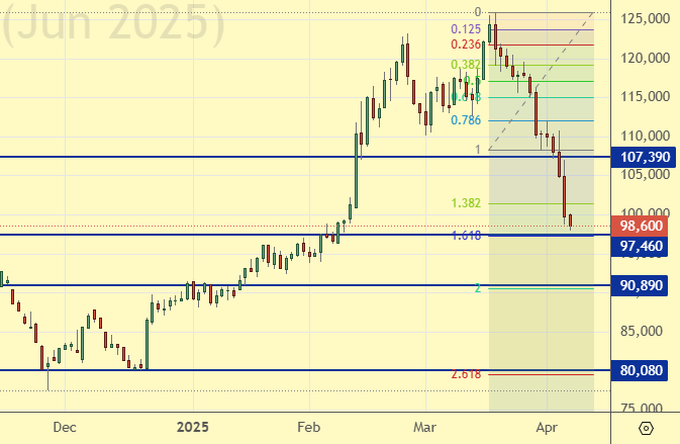

USD/RUB

Growth scenario: we consider the June futures, expiration date June 19. Nothing new. From 82600 to buy unambiguously. A rise above 91000 will also make us think about buying.

Downside scenario: a move to 82600 remains possible. Taking into account the approaching Victory Day, it is possible to sell.

Recommendations on dollar/ruble pair:

Buy: when approaching 82600. Stop: 81400. Target: 115000?!!! In case of further growth and touching 91000. Stop: 88500. Target: 115000. Consider the risks.

Sale: now (90460). Stop: 91600. Target: 82600.

Support — 89788. Resistance — 93410.

RTSI. MOEX

Growth scenario: we consider June futures, expiration date June 19. Buying only from the 80000 area. That’s terrible.

Downside scenario: beautiful. You could paint a picture. We’re going for 80000.

Recommendations on the RTS index:

Buy: when approaching 89500. Stop: 88300. Target: 110000.

Sell: on approach to 107000. Stop: 110000. Target: 80000 (60000). Who is in the position from 117500, move the stop to 101000. Target: 80200 (revised).

Support — 97460. Resistance — 107390.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.