Price forecast from 2 to 6 of October 2023

Grain market:

If the personal income tax is multiplied by the mineral extraction tax and divided by the current real inflation, then you can get the number “pi”. This is the alchemy of finance. At the same time, it is worth considering that already in 24, all indicators will increase, but “pi” will remain as it was.

Mathematics is the queen of sciences, sometimes even for economics. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Two cargo ships with Ukrainian grain were able to pass along the coast and left with the goods to their buyer. But this is a drop in the bucket. Ukrainian grain exports fell by 30% year-on-year in September. Despite this, quotes on stock exchanges, and prices locally, including in Russia, are falling, which suggests that at the moment we are in a buyer’s market, which can dictate terms when concluding contracts.

Information is coming from the field that farmers are ready to give in on price if real deals are reached. A drop from 800 to 1200 rubles per ton is recorded for all classes of wheat. Exporters, perhaps intentionally, are holding a pause and not contracting, apparently wanting to get even lower prices.

Friday’s collapse in the Chicago wheat market reinforces the fact that we are still on the path to finding equilibrium. Despite the collapse of the “grain deal,” the product finds its buyer. There is no stress for bidders.

Energy market:

In the United States, a temporary solution was found with government funding for a month and a half. There will be no shutdown. You can continue to work. Meanwhile, the threat of paralysis of the state apparatus of the world’s largest economy last week had a negative impact on both the dollar and oil, but on Friday we saw the markets’ desire to maintain confidence in continued growth in the black gold market and confidence in the strength of the dollar.

American debt securities are in good demand. This fact puts pressure on the commodity group, as there are prospects for a slowdown in economic growth due to decreased investor appetite for risk and lower investment. A guaranteed return of 4% per annum will remove from the market a significant part of participants who will prefer to stay in bonds for about 1 year, perhaps a little longer. During this time, the stock market will have to adjust significantly.

We are forced to note that the escalation of the conflict in Ukraine can affect the markets, increasing volatility. Long-term forecasts will lose all meaning. Unfortunately, the prospect of continuing the conflict in 2024 is very high.

USD/RUB:

I’m frankly bad at robbing. We cannot go below 95.00; there is no talk about 90.00.

To save the bloated budget for the 24th year, the Russian government will be forced to borrow 4 trillion rubles, and possibly more. At the same time, there is nowhere to get money. Perhaps China will give a little boost, but that leaves only the domestic market. Bankers will twist the government’s arms, wanting a high interest rate, this is already visible in the RGBI index.

In addition, there is (remained) some corporate profit and, of course, household deposits. And if nothing works out, then the ruble will go to 250, then to 1000. There is nothing more to say regarding the current situation.

Oh, no, there is: “Don’t get sick!”

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 1.5 thousand contracts. Buyers have appeared, there are few of them yet, but after Friday’s price drop there will be more.

Growth scenario: we are considering December futures, expiration date is December 14. Friday’s red candle is scary, so we will not recommend buying from 540.0 as we did before. You need to buy from 515.0, and even more so from 430.0.

Fall Scenario: This fall was expected. The only difficulty is that a sharp upward rebound can follow at any moment. We don’t sell.

Recommendations for the wheat market:

Purchase: when approaching 515.0. Stop: 497.0. Target: 650.0 (710.0).

Sale: no.

Support – 515.1. Resistance – 569.2.

Corn No. 2 Yellow. CME Group

We look at the volume of open interest of managers in corn. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers increased by 17.2 thousand contracts. The sellers keep coming. There are no buyers. The bears have tightened their control over the market.

Growth scenario: we are considering December futures, expiration date is December 14. We continue to refuse purchases. We wait.

Fall scenario: it is better to work out the fall at “hourly” intervals.

Recommendations for the corn market:

Purchase: when approaching 425.0. Stop: 405.0. Goal: 600.0.

Sale: no.

Support – 473.6. Resistance – 490.1.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date is November 14. We see a new low. We continue to refrain from shopping.

Fall scenario: keep short. We have broken through the minimum at 1281, the mark of 1195 awaits us. We can increase the shorts a little, by 20%.

Recommendations for the soybean market:

Purchase: no.

Sale: no. If you are in a position from 1370, move your stop to 1352.0. Goal: 1000.0!

Support – 1194.5. Resistance – 1281.6.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 25.5 thousand contracts. Sellers decided to enter the market, buyers slightly reduced their positions. The spread between long and short positions has narrowed and the bulls remain in control.

Growth scenario: we are considering November futures, expiration date is November 30. It is possible that the correction will continue; from 90.00 a long entry is possible.

Fall scenario: Fall does not seem obvious. Let’s refrain from thinking about shorts for now.

Recommendations for the Brent oil market:

Purchase: when approaching 90.00. Stop: 88.80. Goal: 104.00.

Sale: no.

Support – 94.62. Resistance – 97.73.

WTI. CME Group

US fundamentals: the number of active drilling rigs decreased by 5 to 502.

Commercial oil reserves in the US fell by -2.169 to 416.287 million barrels, with the forecast of -1.32 million barrels. Gasoline inventories increased by 1.027 to 220.503 million barrels. Distillate inventories increased by 0.398 to 120.064 million barrels. Inventories at the Cushing storage facility fell by -0.943 to 21.958 million barrels.

Oil production remained unchanged at 12.9 million barrels per day. Oil imports increased by 0.712 to 7.229 million barrels per day. Oil exports fell by -1.055 to 4.012 million barrels per day. Thus, net oil imports increased by 1.767 to 3.217 million barrels per day. Oil refining fell by -2.4 to 89.5 percent.

Demand for gasoline increased by 0.209 to 8.619 million barrels per day. Gasoline production fell by -0.572 to 9.139 million barrels per day. Gasoline imports increased by 0.199 to 0.71 million barrels per day. Gasoline exports fell by -0.33 to 0.814 million barrels per day.

Demand for distillates fell by -0.194 to 3.972 million barrels. Distillate production increased by 0.15 to 4.932 million barrels. Imports of distillates increased by 0.031 to 0.114 million barrels. Exports of distillates fell by -0.041 to 0.136 million barrels per day.

Demand for petroleum products fell by -0.773 to 20.141 million barrels. Production of petroleum products fell by -0.587 to 22.138 million barrels. Imports of petroleum products fell by -0.486 to 1.4 million barrels. Exports of petroleum products increased by 0.696 to 6.323 million barrels per day.

Propane demand fell by -0.701 to 0.544 million barrels. Propane production increased by 0.023 to 2.603 million barrels. Propane imports fell -0.034 to 0.086 million barrels. Propane exports increased by 0.003 to 0.134 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers has increased by 20.0 thousand contracts. The bulls are increasing their advantage, but there are simply no sellers.

Growth scenario: we are considering November futures, expiration date October 20. Let’s refrain from shopping for now. Prices are high. Need a rollback.

Fall scenario: we will not insist on sales. Off the market.

Recommendations for WTI oil:

Purchase: only upon a rollback to 83.50. Stop: 81.00 Target: 103.80.

Sale: no.

Support – 88.33. Resistance – 95.09.

Gas-Oil. ICE

Growth scenario: we are considering November futures, expiration date is November 10. It is unlikely that we will be able to rise above 1040.0 without a correction. We don’t buy.

Fall scenario: short from 1040.0 possible. Most likely we will reach this mark.

Recommendations for Gasoil:

Purchase: no.

Sale: when approaching 1040.0. Stop: 1054.0. Target: 920.0.

Support – 899.25. Resistance – 980.50.

Natural Gas. CME Group

Growth scenario: switched to November futures, expiration date October 27. We have been holding a long position for a very long time. We are waiting for winter.

Fall scenario: do not sell, levels are too low.

Natural gas recommendations:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep stop at 2.640. Goal: 3.900.

Sale: no.

Support – 2.795. Resistance – 3.087.

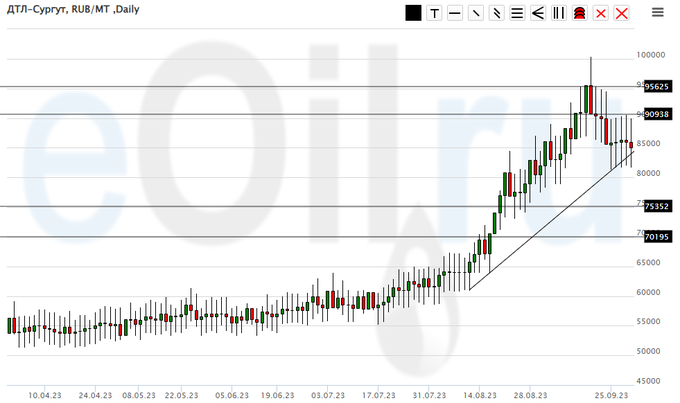

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we wait for prices to fall to 70,000. It will be possible to buy there.

Fall scenario: keep short. The position is quite comfortable.

Recommendations for the diesel market:

Purchase: think when approaching 70,000.

Sale: no. For those in positions between 94,000 and 88,000, move the stop to 93,000. Target: 71,000.

Support – 75352. Resistance – 90938.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: despite last week’s rebound, we will continue to expect prices to fall.

Fall scenario: keep short. I would like to see the market below 15,000.

Recommendations for the PBT market:

Purchase: no.

Sale: no. Whoever is in a position from 24000, move the stop to 23000. Target: 8000.

Support – 16250. Resistance – 25542.

Helium (Orenburg), ETP eOil.ru

Growth scenario: most likely sellers are not ready to offer helium below 4000. But growth here, for example to 5000, is hardly possible.

Fall scenario: we continue to remain out of the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 3098. Resistance – 3994.

Growth scenario: the market is falling. We refuse to make purchases. We wait.

Fall scenario: we will keep shorts. The fall is aggressive. The 1782 mark looks achievable.

Recommendations for the gold market:

Purchase: no.

Sale: no. Who is in position from 1920, move the stop to 1928. Target: 1782 (1600?!).

Support – 1781. Resistance – 1892.

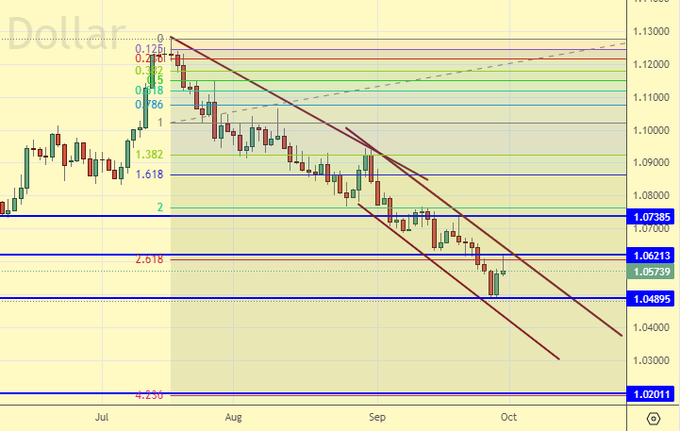

EUR/USD

Growth scenario: we remain in the falling channel. We are waiting for the approach to 1.0200. You can buy it there.

Fall scenario: we will keep shorts from 1.0600. We have every chance to reach 1.0200.

Recommendations for the euro/dollar pair:

Purchase: when touching 1.0220. Stop: 1.0120. Goal: 1.2000?!

Sale: no. If you are in a position from 1.0600, move your stop to 1.0630. Target: 1.0200.

Support – 1.0489. Resistance – 1.0621.

USD/RUB

Growth scenario: everything is going very well for the bulls. In case of growth above 99.30, we will be forced to enter long.

Fall scenario: the chances of falling have become less. But for now they are there. A rise above 99.30 will send the ruble into space. Into emptiness. Somewhere in the orbit of the Moon, by 115.00.

Recommendations for the dollar/ruble pair:

Purchase: in case of growth above 99.30. Stop: 97.00. Target: 114.50!

Sale: no. For those in positions between 97.50 and 96.80, keep your stop at 99.30. Target: 87.00.

Support – 95.29. Resistance – 98.67.

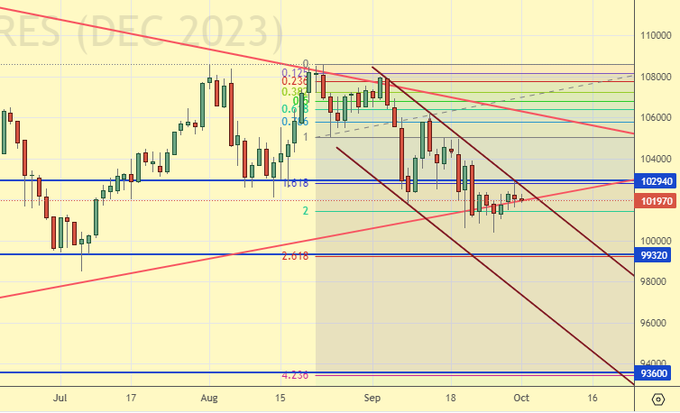

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. We are sitting in a falling channel. Everything is ready to continue the fall. We are not talking about growth yet.

Fall scenario: we will continue to hold shorts from 105800 and 105000. The bears need to crack the area of 99000 – 100000 in order to take over the market for many months (years?!).

Recommendations for the RTS Index:

Purchase: no.

Sale: no. Those in positions between 105800 and 105000, move the stop to 105600. Target: 90000 (50000, 20000).

Support – 99320. Resistance – 102940.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.