Price forecast from 17 to 21 of July 2023

17 July 2023, 14:07

-

Grain market:

In Europe and Britain save fresh water. Cars cannot be washed. Save electricity — do not use air conditioners. You can’t crush lice — these are also animals and they have rights.

It’s good that we are not in Europe. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Whether the grain deal is extended or not, it doesn’t matter. Grains, according to a new forecast from the USDA, the world will be the sea. Another thing is that demand is constantly catching up with supply. We noted earlier that this sector is far from being saturated and as the new citizens of the world start to get used to eating delicious white bread, the demand for wheat will rise and not roll back, which is important.

Why does Russia need a grain deal? With our own high ending stocks: 15-20 million tons of wheat and excellent prospects for a crop of around 85 million tons, we would have to think about how to sell it. The more Russia controls the grain market, the better. Tomorrow — the day after tomorrow everything will become clear with the deal. At a minimum, it will be suspended until all conditions are met, including opening a SWIFT account with Rosselkhozbank. It’s better to forget about it altogether.

For this day and hour, it can be stated that El Niño, if it affects the harvest, does so in an extremely limited form. The lack of moisture in the soil in a number of areas is immediately transferred to the category of “drought” by lovers of fried foods, so that people are horrified and read their Internet creativity. Do not worry, citizens, the forecasts for the gross harvest remain optimistic!

By reading our predictions, you could take a down move in the gold market from 2020 to $1957 per troy ounce.

Energy market:

We are stating a fact: so far OPEC+ has managed to keep oil prices at an acceptable level. By removing excess supply from the market, the cartel not only regulates the physical balance of supply and demand, but also terrifies importers who have nothing to oppose.

The data for the second quarter on the world’s leading economies will be interesting. It is expected that almost everyone will show a decline in GDP, except for China, of course, which will draw something there. Any dashing 3%.

The crowd of analysts is eager to believe that China will revive and by the end of the year there will be an increase in demand for oil, and company stocks will continue to grow. However, remembering the high rate in the US and the fact that it has a negative effect on the economy with a lag of 6-9 months, we understand that a miracle will not happen. We will fluctuate around zero at the end of the 23rd year. That is, there will be no growth, no 102 million barrels per day of oil consumption in the 4th quarter. OPEC, if necessary, will cut production again.

As long as the oil market is perceived as balanced, quotes above the level of 80.00 are not visible.

USD/RUB:

As expected next week on Friday, July 21, the Bank of Russia will raise the rate by 0.5%, preventing inflation from accelerating.

This measure could not be carried out if the Central Bank was engaged in stabilizing the exchange rate, and did not look past its fall. If there had been no exchange rate failure, there would have been no need to raise the rate. It is clear that all imports, from things to individual components, will rise in price.

Well, why should we grieve. One cent will equal one ruble. Is it bad? And it’s convenient to count. And then two rubles, then five, then ten. Everything is easy to count. The Central Bank should work harder with the exchange rate, without regard to the budget, otherwise the acceleration of inflation and panic on the stock exchange cannot be avoided, and then no budget will converge.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 2,000 contracts. Both buyers and sellers left the market in insignificant volumes. The spread between short and long positions narrowed. Sellers hold the edge.

Growth scenario: consider the September futures, the expiration date is September 14th. We fight for long. We hold previously opened positions. Most likely upside target: 700.0.

Fall scenario: we expect prices to recover. It makes no sense to sell at current levels.

Recommendations for the wheat market:

Purchase: no. Who is in position from 632.0 and 640.0, keep the stop at 622.0. Target: 700.0 (880.0.?!!!)

Sale: no.

Support — 632.0. Resistance — 729.4.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more asset managers open short positions than long positions. Last week the difference between long and short positions of managers increased by 48.8 thousand contracts. Sellers actively entered the market. Buyers reduced their positions a little. Sellers keep control of the market.

Growth scenario: consider the September futures, the expiration date is September 14th. You have to keep long. Our stop at 470.0 didn’t get hit. This is good.

Fall scenario: we continue to refrain from selling. We are very low.

Recommendations for the corn market:

Purchase: no. Who is in position from 490.0, move the stop to 480.0. Target: 600.0.

Sale: no.

Support — 486.0. Resistance — 591.6.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. If the market moves above 1400 it will come as a surprise. In the meantime, this has not happened, we will not think about shopping.

Fall scenario: keep short. We see that the bulls are climbing, but it is hard for them. One more price branch suggests itself down.

Recommendations for the soybean market:

Purchase: no.

Sale: no. Who is in position from 1390.0, keep a stop at 1385.0. Target: 1000.0.

Support — 1235.6. Resistance is 1385.0.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 46.7 thousand contracts. Buyers entered the market, sellers left it. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: we are considering the July futures, the expiration date is July 31. If we go to the 85.00 region without a pullback, it will be an unpleasant surprise. We need to buy now move down to 77.00.

Fall scenario: entering shorts from 83.40 is mandatory. We cannot recommend the current sales levels.

Recommendations for the Brent oil market:

Purchase: when approaching 77.00. Stop: 76.00. Target: 91.90?!

Sale: when approaching 83.40. Stop: 85.30. Target: 66.00.

Support — 77.13. Resistance is 83.42.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 3 units to 537 units.

Commercial oil reserves in the US increased by 5.946 to 458.128 million barrels, while the forecast was +0.483 million barrels. Inventories of gasoline fell -0.004 to 219.452 million barrels. Distillate inventories rose by 4.815 to 118.181 million barrels. Inventories at Cushing fell -1.605 to 41.239 million barrels.

Oil production fell by -0.1 to 12.3 million barrels per day. Oil imports fell by -1.158 to 5.88 million bpd. Oil exports fell by -1.757 to 2.144 million barrels per day. Thus, net oil imports rose by 0.599 to 3.736 million barrels per day. Oil refining increased by 2.6 to 93.7 percent.

Gasoline demand fell by -0.843 to 8.756 million barrels per day. Gasoline production fell by -0.158 to 10.107 million barrels per day. Gasoline imports fell -0.072 to 0.779 million barrels per day. Gasoline exports rose by 0.253 to 1.116 million barrels per day.

Demand for distillates fell -0.842 to 2.969 million barrels. Distillate production increased by 0.236 to 5.086 million barrels. Distillate imports fell -0.042 to 0.071 million barrels. Exports of distillates rose by 0.017 to 0.204 million barrels per day.

Demand for petroleum products fell by -2.534 to 18.701 million barrels. Oil products production fell by -0.024 to 22.584 million barrels. Imports of petroleum products fell by -0.331 to 1.877 million barrels. The export of petroleum products increased by 1.091 to 7.033 million barrels per day.

Propane demand fell by -0.528 to 0.626 million barrels. Propane production fell by -0.038 to 2.53 million barrels. Propane imports rose by 0.03 to 0.091 million barrels. Propane exports fell -0.049 to 0.114 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Last week the difference between long and short positions of managers increased by 44.3 thousand contracts. Buyers entered the market in significant volumes, sellers left it. The advantage in the market remains with the bulls.

Growth scenario: switched to September futures, expiration date 22 August. You can consider buying from the 70.00 area. We do not buy at these levels.

Fall scenario: WTI looks weaker than Brent. From these levels you can sell.

Recommendations for WTI oil:

Purchase: think when pulling back to 70.00.

Sale: now. Stop: 77.30. Target: 60.00.

Support — 75.04. Resistance is 81.83.

Gas-Oil. ICE

Growth scenario: consider the August futures, the expiration date is August 10. I would like to see growth to 800.0. We hold long positions, fix part of the profit, tighten stop orders.

Fall scenario: can be sold. At the same time, capital risks should be taken two times less than the standard ones.

Gasoil recommendations:

Purchase: no. Who is in position between 700.0 and 744.0, move the stop to 744.0. Target: 800.0. Close 30% of the position.

Sale: now. Stop: 773.0. Target: 550.0?!

Support — 713.50. Resistance is 767.25.

Natural Gas. CME Group

Growth scenario: we are considering the August futures, the expiration date is July 27. Shopping only. We look up. It is hot now. It will be cold in winter. Need energy.

Fall scenario: we will not sell. Only when approaching 4,000, you can think about entering the short.

Recommendations for natural gas:

Purchase: now. Stop: 2.400. Target: 4.000. Who is in position between 2.137 and 2.223, keep the stop at 2.400. Target: 4.000.

Sale: no.

Support — 2.480. Resistance is 2.940.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: nothing has changed. We are in the purchase. We are waiting for the price increase. Expecting the opposite is naive.

Fall scenario: do not sell. It is possible that in case of difficulties in the export of petroleum products, the price will fall, but hardly by a significant amount.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, keep the stop at 49000. Target: 70000 (80000).

Sale: no.

Support — 53281. Resistance — 63984.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we see consolidation. In case of growth above 20,000, you can add to the longs.

Fall scenario: Selling could be considered after falling below 15000. Out of the market for now.

Recommendations for the PBT market:

Purchase: above 20000. Stop: 17000. Target: 25000. Those in position from 15500, keep stop at 14700. Target: 25000.

Sale: no.

Support — 14072. Resistance — 20088.

Helium (Orenburg), ETP eOil.ru

Growth scenario: continue to recommend buys. We are in range. Note that going down from it could lead to a fall towards 2000.

Fall scenario: short is not very interesting at the moment. In case of growth to 4000, sales can be considered.

Recommendations for the helium market:

Purchase: now. Stop: 2700. Target: 5000. Anyone in position between 2900 and 3200, keep a stop at 2700. Target: 5000.

Sale: think when approaching 4000.

Support — 2766. Resistance — 3898.

Gold. CME Group

Growth scenario: if there is a rollback to 1935, you can buy. The dollar index was losing ground last week, which is why gold has grown.

Fall scenario: you need to sell again. The move to 2000 is undeniable, but with such a high US rate of 5.25%, it would be too much.

Recommendations for the gold market:

Purchase: Only when approaching 1875. Stop: 1867. Target: 3000?!!!

Sale: now. Stop: 1967. Target: 1875. Also approaching 2000. Stop: 2030. Target: 1875.

Support — 1934. Resistance — 1975.

EUR/USD

Growth scenario: Achieved an intermediate target. Here you can reduce the position in order to increase it again after a rollback.

Fall scenario: can be sold. It is possible that the market will roll back to 1.1000.

Recommendations for the EUR/USD pair:

Purchase: no. Those in positions between 1.0720 and 1.0830 move the stop to 1.1210. Target: 1.1900. You can close 30% of the position.

Sale: now. Stop: 1.1340. Target: 1.1010.

Support — 1.1008. Resistance is 1.1245.

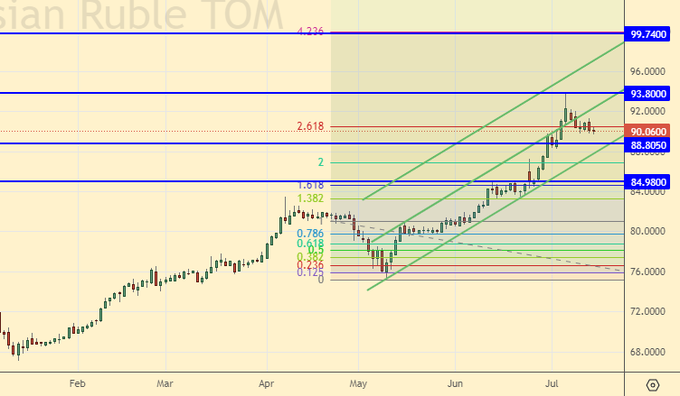

USD/RUB

Growth scenario: keep going long. A pullback to 85.00 cannot be ruled out, but it doesn’t look mandatory in the current situation.

Falling scenario: you can bet on a correction to 85.00. But! Count the risks.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 86.00, keep the stop at 88.80. Target: 100.00.

Sale: now. Stop: 91.20. Target: 85.00.

Support — 88.80. Resistance is 93.80.

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. Until we rise above 105,000, we will not think about buying.

Fall scenario: keep short. Those who wish can add, or enter from scratch.

Recommendations for the RTS index:

Purchase: no.

Sale: now. Stop: 106000. Target: 90000 (50000; 20000?!!!). Who is in position between 105000 and 103000, keep stop at 106000. Target: 90000 (50000; 20000?!!!).

Support — 101200. Resistance — 103540.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|