Price forecast from 14 to 18 October 2024

Grain market:

In faraway Nigeria, they have come to the conclusion that oil should be sold for naira, not for capelin, but for naira, which is their currency. Not everyone can give up dollars and euros. Maybe we will also sell oil for naira. Why not? For anything.

They say that 20% of Russians keep their money at home. That’s right. 20% of pensioners have collected their last paycheck. Hello longer! And don’t be in a hurry.

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The concerns of market participants about the volume of the Russian harvest in the 25th year are justified. There is a risk of an unsuccessful sowing campaign in the fall, which could lead to a situation next summer, when we will be contracting wheat and there will be nowhere to get it. There may be a risk of grain being washed out of the domestic market and even a certain deficit.

So far, the “shortage” sounds a bit of a stretch, given that even against the backdrop of inflation, there is no increase in local wheat prices. If we make assumptions in what case it will not be good: if less than 60 million tons of wheat will be harvested. If we proceed from historical data that once in 7 years there is a drought, especially in the Volga region, then it is time for us to get the full program from the weather. It’s just the climate. Yes, it happens. Of course, no one needs it, but if in fact “suddenly” only 60 million tons are collected, then maybe the land reclamation program will be more developed.

There is evidence, and commentary, that in Canada farmers are not happy with current price levels and are holding on to grain. This may well be the case, as the previous years of ’22 and ’23 were much more hearty. And you get used to good things quickly. 600 cents a bushel now is not the same as 800 cents a bushel then.

Yes, you can bet that next spring in Russia will be dry. But what if it isn’t? Producers don’t have to come up with anything. Sell it gradually as part of your own needs.

Energy market:

After Iran’s attack on Israel, Israel’s attack on the Arabs, Hezbollah’s attack on Israel, it’s endless, the oil market in the form of Brent shook off 70.00 and is now hovering around 80.00. Will they continue to pound each other? Absolutely. But it’s expensive. Iran has already recouped its costs for the attack due to the growth of oil, because of its own actions, but Israel has to get money for its Middle East adventures somewhere. You saw the Merkava tank, not only is it expensive to build, it’s expensive to fuel. And who’s going to pay for all this? The tankers! They’ll pay for the shells, too. If that’s the way it’s going to be. It’ll all be over very quickly.

The U.S. set a new record for oil production per day: 13.4 million barrels. And that’s despite the hurricanes that hit the country one after another. We should drill. Suddenly, the oil craze will be over. Everyone will live in wooden houses, ride horses. There’ll be flavors!

In general, it is worth recognizing that if there is no oil tomorrow, nothing terrible will happen. There is gas, there are biofuels, electric batteries, there are finally cycle rickshaws and sailing fleets. Therefore, the current bacchanalia with the growth of energy consumption, and the demand in the 25th year will continue to grow and will reach almost 105 million barrels per day, it is economically important, but for the normal functioning of humanity is no longer.

The oil market will remain in tension for some time, maybe a couple of weeks. But if Israel does not bomb Iranian oil rigs, the price will slowly slide back to 70.00. And then the New Year.

USD/RUB:

“Give the rate 50%,” we wrote already the week before last. Unfortunately, the background remains such that you realize: nothing is impossible. For the time being, we will talk about the 20% threshold. This is the level from which extremely negative events in the economy may start, if the Central Bank decides to raise the rate on October 25. The development of new large projects by independent business (if there is such a thing) is impossible. Only if a corporation makes a profit, it will go somewhere with its own money at its own risk, but nobody does that, as a rule they borrow from banks, and at these rates it is an extremely difficult story.

Ruble on the futures has moved down from 96000. If it will be 93000 we can think about buying. As long as we are above 90000 we cannot say that the upward trend is over.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 6.6 th. contracts. Buyers and sellers were leaving the market. Buyers did it more actively. Bears keep control.

Growth scenario: we consider December futures, expiration date December 13. On downward pullbacks it is possible to buy. Those who wish can do it right now. Note that the risk of price drop to 500.0 remains.

Downside scenario: we need levels above the current levels to sell. We want 656.0.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0. Those who are in position from 589.6, keep the stop at 577.0. Target: 656.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 582.0. Resistance — 617.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 37.2 thousand contracts. The change is significant. Sellers were leaving the market. Buyers were also closing positions, but in a small volume. Bears risk losing control over the market.

Growth scenario: we consider December futures, expiration date December 13. We see the pullback “predicted” in the previous forecast. We can buy here, or wait for a fall to 410.0.

Downside scenario: need higher levels to sell. For example: 465.0.

Recommendations for the corn market:

Buy: now (415.6), on approach to 410.0 and 400.0. Stop: 398.0. Target: 465.0.

Selling: thinking when approaching 465.0.

Support — 400.6. Resistance — 422.2.

Soybeans No. 1. CME Group

Growth scenario: we consider November futures, expiration date November 14. We are not thinking about buying yet. There are a lot of soybeans.

Downside scenario: we will keep open short. There is a risk of falling to 895.0.

Recommendations for the soybean market:

Buy: when approaching 850.0. Stop: 830.0. Target: 1100.0.

Sell: no. Those who are in position from 1037.6, move the stop to 1052.0. Target: 895.0 (revised).

Support — 986.4. Resistance — 1040.4.

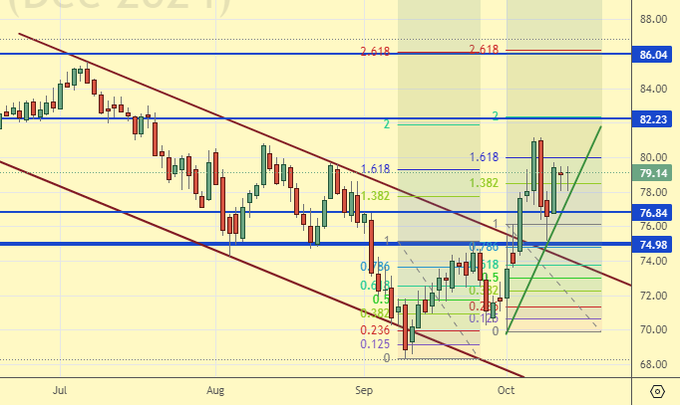

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers grew by 126.5 thousand contracts. The change is gigantic! Buyers entered the market, sellers left it in approximately equal volumes. Bulls strengthened their control over the market.

Growth scenario: we switched to December futures, expiration date October 31. We wrote about the downward pullback, but we did not mark the levels. Volatility is high. Those wishing to enter long are waiting for a pullback to 76.20.

Downside scenario: there is no sense to sell yet.

Recommendations for the Brent oil market:

Buy: on a pullback to 76.20. Stop: 75.00. Target: 86.00.

Sale: no.

Support — 76.84. Resistance — 82.23.

WTI. CME Group

US fundamental data: the number of active rigs increased by 2 to 581.

U.S. commercial oil inventories rose 5.81 to 422.741 million barrels, with +2 million barrels forecast. Gasoline inventories fell by -6.304 to 214.898 million barrels. Distillate stocks fell by -3.124 to 118.513 million barrels. Cushing storage stocks rose by 1.247 to 24.914 million barrels.

Oil production increased by 0.1 to 13.4 million barrels per day. Oil imports fell by -0.389 to 6.239 million barrels per day. Oil exports fell by -0.084 to 3.794 million barrels per day. Thus, net oil imports fell by -0.305 to 2.445 million barrels per day. Oil refining fell -0.9 to 86.7 percent.

Gasoline demand increased by 1.133 to 9.654 million barrels per day. Gasoline production rose 0.627 to 10.229 million barrels per day. Gasoline imports fell -0.112 to 0.428 million barrels per day. Gasoline exports fell -0.02 to 0.942 million barrels per day.

Distillate demand increased by 0.393 to 4.031 million barrels. Distillate production rose by 0.194 to 4.988 million barrels. Distillate imports fell -0.09 to 0.104 million barrels. Distillate exports fell -0.027 to 1.507 million barrels per day.

Demand for refined products increased by 1.338 million barrels to 21.185 million barrels. Petroleum products production increased by 0.997 to 22.589 million barrels. Petroleum product imports fell -0.252 to 1.337 million barrels. Exports of refined products fell by -0.371 to 6.797 million barrels per day.

Propane demand increased by 0.117 to 0.996 million barrels. Propane production increased by 0.014 to 2.701 million barrels. Propane imports rose 0.029 to 0.115 million barrels. Propane exports fell -0.315 to 1.542 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 5.9 th. contracts. Buyers and sellers were leaving the market. Buyers were doing it more actively. Bulls keep control.

Growth scenario: we consider November futures, expiration date October 22. We need a pullback to buy. So far out of the market.

Downside scenario: came out of the falling channel upwards. Out of the market.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 71.46. Resistance — 78.41.

Gas-Oil. ICE

Growth scenario: we switched to November futures, expiration date November 12. If the market allows, it will be possible to buy from 690.0.

Downside scenario: it will be interesting to sell from 765.0. If the market really grows so significantly, it is possible to enter the short.

Gasoil Recommendations:

Buy: when approaching 690.0. Stop: 676.0. Target: 765.0.

Sell: on approach to 765.0. Stop: 785.00. Target: 505.00.

Support — 674.75. Resistance — 765.50.

Natural Gas. CME Group

Growth scenario: we consider November futures, expiration date October 29. Despite the strong correction we will continue to buy.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: now (2.632). Stop: 2.480. Target: 4.000?!

Sale: no.

Support — 2.580. Resistance — 2.725.

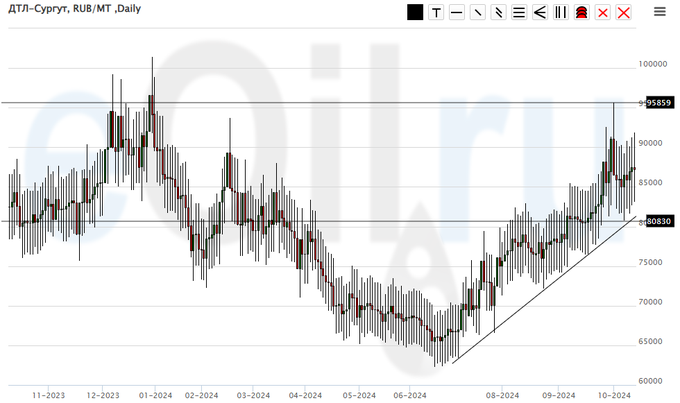

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 76000. Target: 100000!

Sale: no.

Support — 80830. Resistance — 95859.

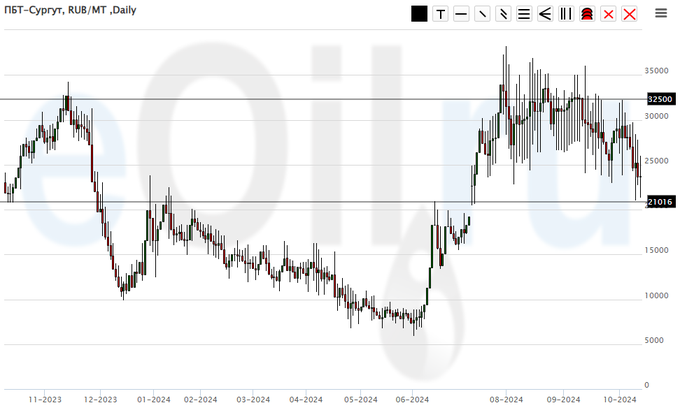

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we have come to an interesting area for buying. It is possible to enter. It should be noted that falling to 20000 is the most optimal for long entry.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: now (23800) and at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 21016. Resistance — 32500.

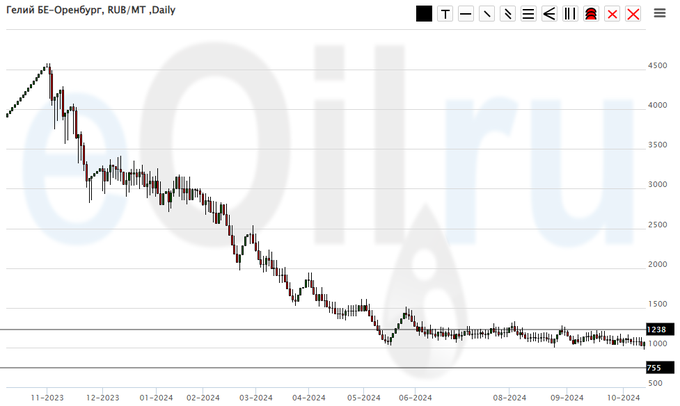

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 755. Resistance — 1238.

Growth scenario: we consider December futures, expiration date December 27. Nothing new. We need now a correction to 2570, better to 2550. It will be possible to buy there, if before this correction there will be no touch of 2719 at the beginning.

Downside scenario: shorting from 2720 will be interesting.

Gold Market Recommendations:

Buy: until touching 2719 on a pullback to 2570 (2550). Stop: 2530. Target: 2720.

Sell: on approach to 2720. Stop: 2740. Target: 2200?!

Support — 2618. Resistance — 2695.

EUR/USD

Growth scenario: went under 1.0950. Forget about buying for now.

Downside scenario: we need a pullback to sell. And it is not there… We can sell now, but with a close stop order.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.0935.). Stop: 1.0970. Target: 1.0000. Or on a rise to 1.1111. Stop: 1.1141. Target: 1.0000.

Support — 1.0792. Resistance — 1.0950.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. Nothing new. The market is able to go higher. We hold the long. We do not deny a fall to 93000 and even 90000, but we are unlikely to see many sellers in the end. For now, the rising trend is the main idea.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Those who are in position from 85976, keep your stop at 93900. Target: 100000 (200000. Yes, yes, it is possible).

Sale: no.

Support — 94049. Resistance — 96427.

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. It’s dreary. But no move up for a potential buy from 90600 is good. Waiting. Failure under 90600 will lead to panic dumping of the stock.

Downside scenario: no upside pullback. We need at least 100000 to enter short. 105000 is better.

Recommendations on the RTS index:

Buy: when approaching 90600. Stop: 90300. Target: 105000.

Sell: on approach to 100000. Stop: 101300. Target: 90600.

Support — 93130. Resistance — 97250.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.