Price forecast from 12 to 16 February 2024

Grain market:

As soon as there is nothing left to do in the country, they will legalize bitcoin ETF. In the US it has already happened, in China it will happen today — tomorrow.

And who doesn’t know what ETF are, that’s okay, it means you have more to do in life. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

As expected, the February USDA report came out quite positive. There is a slight increase in gross harvest of +0.11% for wheat, a slight drop in gross harvest of corn and soybeans in the amount of 0.26% and 0.19%, respectively.

FOB prices in Russia are going down, as well as all over the world. The current price for a ton of milling wheat 12.5% protein is $238 per ton in Novorossiysk and continues to fall. The 11.5% protein is already 222 dollars. This means only one thing: no one will give a farmer a good price inside the country. So we will stand at the current levels: around 12000 rubles for the 3rd class. Moreover, export shipments are going at a much worse rate than last year, which means that there will be a lot of leftovers in the country.

Corn continues to fall and our target of 420.0 cents per bushel is getting closer. We do not rule out a deeper dive to 390.0, but prices are unlikely to fall any lower, otherwise farmers will not make ends meet, not just one farm, but the entire agricultural sector on a global scale.

Energy market:

Oil prices have been rising over the past week as talks between Israel and Hamas have broken down. Although the probability of peace was not highly estimated by anyone, there is still some disappointment. In addition, there are fears that the conflict will affect oil fields. However, modern warfare is such an expensive endeavor that poor guerrilla groups will not last long. Yes, there will be security problems in the Red Sea, but the world has already adapted to them and put a price tag on them.

Foreign investors are fleeing China. There is a feeling that the world is holding its breath. Everyone is just waiting for the CCP to admit that it is not worth expecting GDP growth of 5% per year in the future, and in previous years GDP was simply inflating. If China starts, no, not stalling, but at least stopping, it will lead to a strong drop in prices for all commodity assets, including oil.

USD/RUB:

On Friday we are waiting for the meeting of the Central Bank of Russia. It is unlikely that the rate will be lowered. It is not excluded, it is suspected that the state continues large injections into the defense sector, and their size may go beyond the budget. Failure to give the front the equipment in the required volume is being criticized by the country’s leadership. So, the problem must be solved, with money, of course.

Note that without increased spending on SWO at a 16% rate, inflation would have been suppressed long ago.

We see that even on the eve of the elections the ruble is not strengthened below 90.00, which indicates the weakness of the currency. With a more expensive ruble, the budget will be extremely difficult to bring down.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 1.6 thousand contracts. Buyers entered the market with insignificant, but still larger volumes than sellers. Bears keep control.

Growth scenario: we consider March futures, expiration date March 14. We hold long. There are doubts in the market strength, so we do not open new purchases. We keep the old longs. We press the stop order hard.

Downside scenario: corn could drag the market down. It continues to stare into the abyss. Nevertheless, we are not selling wheat.

Recommendations for the wheat market:

Purchase: no. Those who are in position from 580.0, move the stop to 577.0. Target: 700.0.

Sale: no.

Support — 583.6. Resistance — 606.3.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 14.1 th. contracts. Both buyers and sellers entered the market. Sellers did it in big volumes. Bears strengthened their advantage.

Growth scenario: we consider the March futures, expiration date March 14. The idea with a visit to the 420.0 level continues to not only live, but has begun to shine.

Downside scenario: the probability of a move to 420.0 remains. Keep shorting.

Recommendations for the corn market:

Purchase: when approaching 420.0. Stop: 407.0. Target: 600.0.

Sell: no. Those who are in position from 470.0, move the stop to 447.0. Target: 422.0.

Support — 419.3. Resistance — 436.2.

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, expiration date March 14. Soybeans can fall to 1130. When approaching this level, buying is possible.

Downside scenario: we will continue to keep shorting. Lower levels are also possible. Here we can build up the previously opened short.

Recommendations for the soybean market:

Purchase: when approaching 1130.0. Stop: 1110.0. Target: 1300.0.

Sell: no. Those who are in position from 1295.0, move the stop to 1206.0. Target: 1130.0 (revised).

Support — 1129.7. Resistance — 1204.4.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 24.1 th. contracts. Buyers were actively leaving the market. Sellers were practically inert to what was happening. Bulls keep the advantage.

Growth scenario: switched to February futures, expiration date February 29. Growth above 85.00 will be a surprise. Until it has not happened, we do not look up.

Downside scenario: the market is frozen in an extremely interesting position for shorting. Sell.

Recommendations for the Brent oil market:

Purchase: no.

Sell: now (82.13). Stop: 83.13. Target: 68.00.

Support — 80.11. Resistance — 82.49.

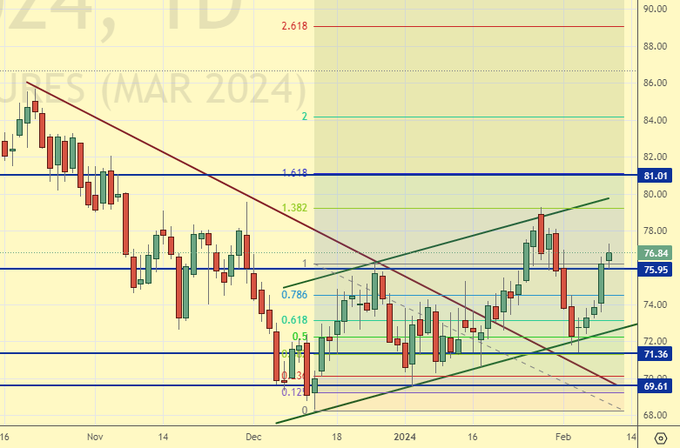

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 499.

U.S. commercial oil inventories rose 5.52 to 427.432 million barrels, with +1.7 million barrels forecast. Gasoline inventories fell by -3.146 to 250.988 million barrels. Distillate stocks fell by -3.221 to 127.574 million barrels. Cushing storage stocks fell by -0.033 to 28.061 million barrels.

Oil production increased by 0.3 to 13.3 mln barrels per day. Oil imports increased by 1.302 to 6.907 mln barrels per day. Oil exports fell by -0.298 to 3.596 million barrels per day. Thus, net oil imports rose by 1.6 to 3.311 million barrels per day. Oil refining fell by -0.5 to 82.4 percent.

Gasoline demand rose 0.663 to 8.807 million barrels per day. Gasoline production fell -0.27 to 9.011 million barrels per day. Gasoline imports rose 0.136 to 0.536 million barrels per day. Gasoline exports fell -0.286 to 0.747 million barrels per day.

Distillate demand rose by 0.06 to 3.817 million barrels. Distillate production fell -0.028 to 4.357 million barrels. Distillate imports fell -0.012 to 0.126 million barrels. Distillate exports fell -0.003 to 1.126 million barrels per day.

Demand for petroleum products increased by 0.108 to 20.227 million barrels. Petroleum products production fell -0.072 to 20.755 million barrels. Imports of refined petroleum products rose 0.408 to 2.079 million barrels. Exports of petroleum products rose by 0.447 to 6.372 million barrels per day.

Propane demand fell -0.691 to 1.24 million barrels. Propane production rose 0.067 to 2.495 million barrels. Propane imports rose 0.006 to 0.147 million barrels. Propane exports increased 0.024 to 0.12 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 60.4 thnd contracts. Buyers were fleeing. Sellers retreated in much smaller volumes. The bulls may be losing control.

Growth scenario: we consider the March futures, expiration date is February 20. There is growth, but it is still unconvincing in this situation. Out of the market.

Downside scenario: it is interesting to sell here. We were going up very quickly, we need at least a pullback, which may turn into a fall in the future.

Recommendations for WTI crude oil:

Purchase: no.

Sell: now (76.84). Stop: 78.20. Target: 65.00. Count the risks!

Support — 75.95. Resistance — 81.01.

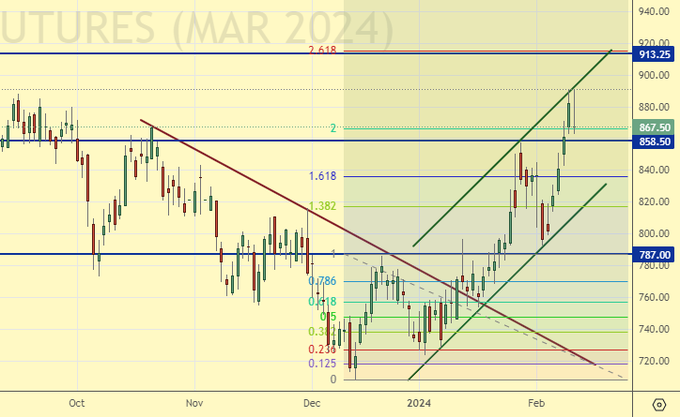

Gas-Oil. ICE

Growth scenario: we consider the March futures, expiration date March 12. It is not excluded that the growth will continue. But there are few chances, so we sharply tighten stop orders.

Downside scenario: we are not selling yet. Out of the market.

Gasoil Recommendations:

Purchase: no. Who is in position from 800.0 and 830.00, move the stop to 848.00. Target: 1200.00.

Sale: no.

Support — 858.50. Resistance — 913.25.

Natural Gas. CME Group

Growth scenario: we consider the March futures, expiration date February 27. We have come to the theoretical support level. It is possible to buy, but with a close stop order.

Downside scenario: like a week earlier, we will continue to hold short in the expectation of a deeper plunge. Probably to 1.500.

Natural Gas Recommendations:

Purchase: now (1.847). Stop: 1.784. Target: 3.000.

Sell: no. Those in position from 2.570, move your stop to 2.120. Target: 1.500.

Support — 1.796. Resistance — 2.028.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: continue to stay out of the market. Prices are too high for interesting purchases.

Downside scenario: we will continue to keep shorting. We have a target at 65000. We have earlier reduced the position by 50%, taking some profit, and keep the rest.

Diesel Market Recommendations:

Purchase: no.

Sell: no. Who is in position from 90300, keep stop at 87000. Target: 65000.

Support — 71992. Resistance — 84570.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: buying from current levels is possible, but it is better to wait until the market either falls to 10000 or rises above 20000.

Downside scenario: we took a profit of 15000. So far there are no more interesting short ideas on this market.

PBT Market Recommendations:

Purchase: no.

Sale: no.

Поддержка – 9941. Сопротивление – 20225.

Helium (Orenburg), ETP eOil.ru

Growth scenario: like a week ago, we believe that when approaching 2100, we must buy. In other cases, out of the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: when approaching 2100. Stop: 1900. Target: 5000.

Sale: no.

Support — 2500. Resistance — 2836.

Growth scenario: the market is at equilibrium. Refrain from any deals.

Downside scenario: it is difficult to say something about this situation. Off-market.

Gold Market Recommendations:

Purchase: no.

Sale: no.

Support — 2014. Resistance — 2044.

EUR/USD

Growth scenario: we continue to count on touching the level of 1.0720. The US Fed, as well as the ECB earlier, left the rate unchanged, for America it is 5.5%.

Downside scenario: we continue to keep shorting. There is a prospect of a move to 1.0720.

Recommendations on euro/dollar pair:

Purchase: no. Who is in position from 1.0722, move the stop to 1.0690. Target: 1.2000.

Sell: no. Those in position from 1.1050, move stop to 1.0885. Target: 1.0460 (revised).

Support — 1.0722. Resistance — 1.0800.

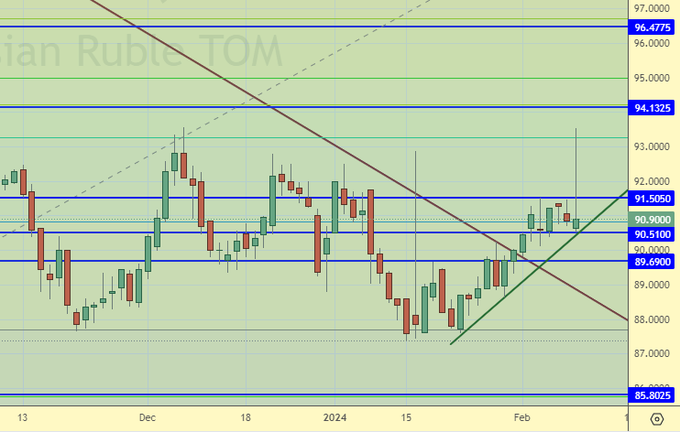

USD/RUB

Growth scenario: the prospects for buying do not look very bright, but they are still there. Those in position from 91.60 hold long.

Downside scenario: forget about shorts for a while. As if not forever…

Recommendations on dollar/ruble pair:

Purchase: no. Those in position from 91.60, move stop to 90.10. Target: 97.00 (120.00?!).

Sale: no.

Support — 90.51. Resistance — 91.50.

RTSI

Growth scenario: we consider the March futures, expiration date March 21. Nothing happened during the week, so we leave our reasoning unchanged. Growth to 125000? Yes, there is a small chance, but it would be better if we grow above 115000. Then a large number of bulls will believe in the growth.

Downside scenario: for now we will continue to insist on selling, it is good that the levels are convenient for short entry.

Recommendations on the RTS index:

Purchase: think after rising above 115000.

Sale: now (113010). Stop: 113900. Target: 103000. Add after falling below 110000.

Support — 111320. Resistance — 113710.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.