Price forecast from 11 to 15 of April 2022

Grain market:

In France, a battle unfolded in the presidential election. Most likely, the current President Macron and his far-right opponent Marine Le Pen will make it to the second round, the gap between them is only one percent. If the lady wins, then France can expect to leave NATO, revise the conditions for emigration to the country and turn to face the deep French people. Then there will still be a chance that ten years later, just like thirty years ago, a white-nosed garcon will bring a fresh baguette with goose pate and a glass of white wine to a miniature table for a poor Russian tourist. Grain markets are in no hurry to fall.

Hello!

The USDA report, released on the 8th, did not show any significant changes in the gross harvest of wheat and corn for the 21/22 season, which is coming to an end.

There is a feeling that Europe is very much carried away by anti-Russian sanctions. Maybe it’s for the best. Everyone will suddenly see that over the course of several decades we have strongly grown together with each other. In everything that happens, the hand of the Masonic lodge is felt, but after counting the losses and shedding tears, the West will calm down after a couple of blocks. Otherwise, right-wingers will begin to come to power all over Europe and, in their corrosive manner, with red-hot rods in their hands, will begin to ask unpleasant questions to fans of an unbridled lifestyle.

Energy market:

Magicians from the energy giant Shell have learned how to turn banned Urals oil into legal Brent oil. By interfering with two grades at a plant in the Baltics so that Russian oil becomes slightly less than 50% in it, they receive a legally pure product for further deliveries to Europe.

It is clear that Europe will not be able to get through 2022 and the winter of 2023 without Russian resources. But the prospects for abandoning Russian minerals are real and our Government will have to look for alternative markets. Deliveries will be complicated by logistics and legal formalities. But if you can interfere with Shell, then why can’t the rest do it. We take Arabic oil, mix it with Russian oil in almost equal proportions, and voila, we just have twice as much Arabic oil. And she is absolutely clean. And a little later it will be possible to interfere with oil simply on paper. Nobody will check.

There are more and more fans of the procedure for buying gas for rubles from Gazprom in Europe. For some countries it will be very convenient: Bulgaria, Moldova, Hungary. Collect rubles from the sale of your goods in Russia and buy energy resources with them. It’s a genius idea.

USD/RUB:

The ruble continues to strengthen. The Central Bank of the Russian Federation has already lowered the rate to 17% per annum. The 12% tax on the purchase of foreign currency through brokers has already been canceled, and the ruble does not want to stop its strengthening. However, Friday gave us a hint of a change in the situation and the growth of the dollar next week. But, this is just a hint.

Imports to the country clearly collapsed. There are no customers in stores. Consumers have taken a wait-and-see attitude and will not spend money on tinsel, and even more so on credit at almost 40% per annum. There is no demand for imports, and there is no need for foreign currency.

It is possible that the government will have to repeal the law on the sale of 80% of the proceeds in foreign currency. And on the other hand, which of the companies will now decide to leave large amounts of currency on their accounts. Rubles are better than nothing.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 0.3 thousand contracts. Money came to the market in a small amount, while the balance between the parties was preserved.

Growth scenario: we are considering the April futures, the expiration date is April 29. We see that the sellers are trying to organize an attack, but the market has not yet consolidated below 100.00. Can buy.

Falling scenario: to confirm their own strength, sellers must push the market to 90.00, if this does not work, then we are waiting for a move up.

Recommendation: Purchase: now. Stop: 97.30. Target: 150.00.

Sale: no. Who is in position from 104.00, move the stop to 108.00. Target: 92.00.

Support — 96.90. Resistance is 104.43.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 13 units and now stands at 546 units.

Commercial oil reserves in the US increased by 2.421 to 412.371 million barrels, with the forecast of -2.056 million barrels. Inventories of gasoline fell -2.041 to 236.787 million barrels. Distillate inventories rose by 0.771 to 114.301 million barrels. Inventories at Cushing rose by 1.654 to 25.887 million barrels.

Oil production increased by 0.1 to 11.8 million barrels per day. Oil imports rose by 0.041 to 6.3 million barrels per day. Oil exports rose by 0.705 to 3.693 million barrels per day. Thus, net oil imports fell by -0.664 to 2.607 million barrels per day. Oil refining increased by 0.4 to 92.5 percent.

Gasoline demand rose by 0.063 to 8.562 million barrels per day. Gasoline production increased by 0.07 to 9.124 million barrels per day. Gasoline imports fell by -0.172 to 0.484 million bpd. Gasoline exports rose by 0.372 to 0.98 million barrels per day.

Demand for distillates fell by -0.157 to 3.647 million barrels. Distillate production fell -0.057 to 5.042 million barrels. Distillate imports fell -0.067 to 0.088 million barrels. Distillate exports rose by 0.122 to 1.373 million barrels per day.

Demand for petroleum products fell by -0.059 to 19.815 million barrels. Production of refined products fell by -0.041 to 21.392 million barrels. Imports of petroleum products fell by -0.095 to 2.024 million barrels. The export of oil products increased by 0.328 to 5.938 million barrels per day.

Propane demand fell by -0.13 to 1.271 million barrels. Propane production increased by 0.081 to 2.447 million barrels. Propane imports rose by 0.004 to 0.13 million barrels. Propane exports rose by 0.14 to 1.211 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that this data is three days old (for Tuesday of the last week), it is also the most recent one published by the ICE exchange.

Last week, the difference between long and short positions of managers decreased by 6.4 thousand contracts. A small group of buyers fled the market, but in general the situation remains completely under the control of the bulls.

Growth scenario: we are considering the May futures, the expiration date is April 20. You can buy at current levels. If the market rises above 107.00, you can increase the long.

Falling scenario: we will keep the shorts open two weeks ago. We do not open new positions. If the sellers fail to push the market below 90.00, they may be in trouble. Recommendation:

Purchase: now. Stop: 94.00. Target: 150.00.

Sale: no. Who is in position from 114.00, move the stop to 108.00. Target: 80.00.

Support — 92.09. Resistance is 108.56.

Gas-Oil. ICE

Growth scenario: consider the May futures, the expiration date is May 12. There are no prospects for cheap fuel in Europe. Let’s open long.

Falling scenario: it is worth holding the previously open shorts in the hope of a move to the 700.00 area. The probability of falling is extremely small, since events in Ukraine have not yet returned to normal, so let’s wait for stop orders.

Recommendation:

Purchase: now. Stop: 930.0. Target: 1500.0! Sale: no. Who is in position from 1200.00, move the stop to 1087.00. Target: 700.00?! Support — 842.25. Resistance is 1078.00.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 27. Demand for gas will be high in the Western world. It is possible that the Europeans will have to fight the Asians for American gas this fall.

Falling scenario: there is no point in talking about a fall. The market can stop growth for a while, but it will not turn down. Recommendation:

Purchase: no. Who is in position from 3.875, move the stop to 5.000. Target: 8.777.

Sale: no.

Support — 5.103. Resistance — 6.134.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers has decreased by 5.7 thousand contracts. There are slightly more bulls than bears on the market, which creates prerequisites for growth.

Growth scenario: we are considering the May futures, the expiration date is May 13. The market stopped falling. It makes sense to buy at current prices. There is a possibility that speculators before the May harvest forecasts will spin the market up.

Fall scenario: We will keep the shorts open two weeks ago. Level 900.0 continues to attract us, but we need to be ready for a new upward turn of the market.

Recommendation:

Purchase: now. Stop: 994.0. Target: 1500.0. Sale: no. Who is in position from 1100.0, keep the stop at 1090.0. Target: 900.0 (800.0).

Support — 971.4. Resistance — 1074.2.

Let’s look at the volumes of open interest of corn managers. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions managers increased by 7.5 thousand contracts. The bulls are coming back to the market. Nobody sees a chance to fall.

Growth scenario: we are considering the May futures, the expiration date is May 13. It is uncomfortable to buy at the current levels, but there is a threat of the 840.0 move, and we do not want to miss this breakthrough, therefore, we will buy here.

Falling scenario: The hype for corn is not subsiding. Until we sell.

Recommendation:

Purchase: now. Stop: 743.0. Target: 839.0.

Sale: no.

Support — 713.2. Resistance — 782.2.

Soybeans No. 1. CME Group

Growth scenario: we are considering the May futures, the expiration date is May 13. We see the rapid growth of soybeans. We are taking a break in this market for the time being.

Falling scenario: there are chances for a continuation of the downfall. Let’s go short here.

Recommendation:

Purchase: no.

Sale: now. Stop: 1698.0. Target: 1300.0. Support — 1577.6. Resistance — 1734.4.

Sugar 11 white, ICE

Growth scenario: we are considering the May futures, the expiration date is April 29. Our persistence in shopping has paid off. We see that the market is growing, and we have a long position.

Falling scenario: sales failed. It’s OK. We take a break.

Recommendation:

Purchase: no. Who is in position from 19.30, move the stop to 19.40. Target: 21.00 (23.00). Sale: no.

Support — 19.64. Resistance — 21.02.

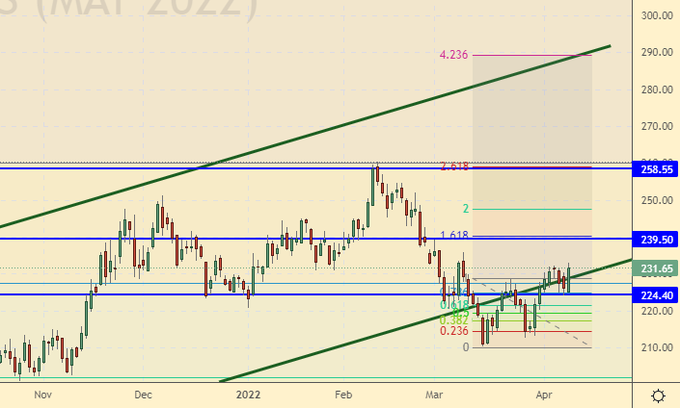

Сoffee С, ICE

Growth scenario: we are considering the May futures, the expiration date is May 18. The market does not want to fall. In case of growth above 235.0, you can increase the previously opened longs.

Falling scenario: we don’t want to fall. We keep open shorts earlier, but we do not have high hopes for success.

Recommendation:

Purchase: no. Who is in position from 227.00, move the stop to 223.00. Target: 280.00.

Sale: no. Who is in position from 250.00, keep the stop at 237.00. Target: 186.00.

Support — 224.40. Resistance is 239.50.

Gold. CME Group

Growth scenario: despite the growth of the dollar index, gold does not fall. It is possible that good demand is provided by China. If the market rises above 1970, we will buy.

Falling scenario: we believe that we can sell here. As before, the picture is attractive for short entry.

Recommendations:

Purchase: if the market rises above 1970. Stop: 1940. Target: 2300.

Sale: now. Stop: 1970. Target: 1850 (1770). Anyone in position from 1960, keep stop at 1970. Target: 1850 (1780).

Support — 1915. Resistance — 1966.

EUR/USD

Growth scenario: we were right not to buy around 1.1200. We are waiting for 1.0600. Note that things in Europe are bad.

Falling scenario: we will keep the shorts. The dollar is much more attractive than the euro. We can even reach parity.

Recommendations:

Purchase: when approaching 1.0600. Stop: 1.0400. Target: 1.2100 (1.5000?!)

Sale: no. Who is in position from 1.1020, move the stop to 1.1030. Target: 1.0600.

Support — 1.0678. Resistance is 1.0939.

USD/RUB

Growth scenario: the government is clearly concerned about the strengthening of the ruble. We are waiting for the bans and restrictions to be lifted. The budget would be more comfortable at a rate of 80-85 rubles per dollar.

Falling scenario: I would like to see the pair rise to the 100.0 area. From him, sales would be interesting.

Recommendations:

Purchase: now. Stop: 69.00. Target: 120.00 (150.00?!).

Sale: think when approaching 100.0.

Support — 69.71. Resistance is 80.49.

RTSI

Growth scenario: the RTS index grows only due to the strengthening of the ruble. Russian blue chips, being under sanctions, cannot be the locomotives of the market. The market needs an easing of pressure from the West.

Falling scenario: we do not believe in what we have drawn. In case of growth to 130,000, it is mandatory to sell. Short from current levels is also possible. The prospects for the Russian economy are extremely vague. Recommendations:

Purchase: think when approaching 50,000. Count the risks. Meditate. Read news.

Sale: now. Stop: 111,000. Target: 50,000. Or if it rises to 130,000. Stop: 143,000. Target: 50,000.

Support — 93320. Resistance — 122740.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.