Price forecast from 10 to 14 February 2025

Grain market:

Rumor has it that they found an unbroken cable somewhere, and the leaders talked. Or maybe it was Ensign Petrov, having killed all the SEALs and other animals, clamped the telephone wire with his teeth at a depth of 555 meters and ensured contact, recording the conversation itself for posterity on a chip embedded in the brain.

To unbroken contacts! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Trump shook a stick a little in the anthill. Insects began to run and fuss, and some started buying grain. On the whole, the excitement quickly subsided and, as a result, we see a smooth recovery of the grain market, including against the backdrop of reduced shipments of Russian wheat and poor forecasts for the Russian harvest. Yes, there will be grain, but it is expected to be 10% less than last year. Weather…seeds…The situation is better in the rest of the world. Nobody is saying that the global gross will fall by 10%, if that were actually the case, wheat would already be going for $400 a ton.

Domestic prices continue to shake in a range. No one is talking about growth. FOB is good though, almost $240 per ton in Novorossiysk, but it is not enough for traders to give farmers something to earn over and above. Note that the number of active independent players in the market continues to shrink. Grain traders will soon simply act as one agglomerate with the same protocols and prices. Competition is likely to be recognized as undesirable. Under current conditions, centralization is needed to forecast budget revenues. All that will be allowed: to gather small piles into large batches. That is preparation for ship, but not implementation.

Energy market:

At the moment, the oil market remains in equilibrium, as politics now dominates the economy, and there are no breakthroughs on the political field yet. There are still a lot of uncertainties, what with the NWO, what with Iran, what with Venezuela. The only thing that can be emphasized is the inability of states to move away from oil dependence. Yes, it’s coming, it’s about to happen, but it’s not happening. The truth is that by providing citizens with spacious sidewalks, we can reduce CO2 emissions by many millions of tons, because walking is good for us. And a couple of kilometers one way will give out even a grandmother, yes under the arm with grandfather. But it is not profitable, so there will be no wide sidewalks. There will be subways and streetcars — electric transportation for money. And the path is free, so there will be no sidewalks.

There are clear prerequisites that Europe will quickly return to buying Russian resources this year, especially with the completion of the SWO, and the middle class will once again have Mercedes at their disposal instead of this… And we still need jamon, it is not related to oil, but we need it.

The OPEC+ Technical Committee has spelled out that we will not now discuss renegotiating, much less ending, the production cut deal. Why would they do that? The money is flowing.

Therefore, based on the situation, we continue to believe that we have nothing to do below 75.00 (70.00) now. It should be noted that prices for Russian Urals have gone below 60 dollars. It is not pleasant. The discount has become significant.

USD/RUB:

In the new week we have a meeting of the Central Bank of Russia. It is likely that the CBR will leave the rate at 21% amid slowing inflation. At the same time, the market will wait, with impatience, whether there will be negotiations on Ukraine between the presidents of Russia and the USA. What these talks will yield. Peace, truce, nothing will be given. Until there are specifics, no one will be ready to predict anything for at least one quarter ahead. Phone calls between Washington and Moscow, that’s already good, but it’s just news of contact, not any agreement. We’ll have to wait and see. Against the backdrop of positive expectations, we may, but not necessarily, gravitate towards 95.00 on Monday and Tuesday.

Note that the ruble will be able to hold around 100.00 at current oil prices, provided that there is no increase in spending on the army and military-industrial complex.

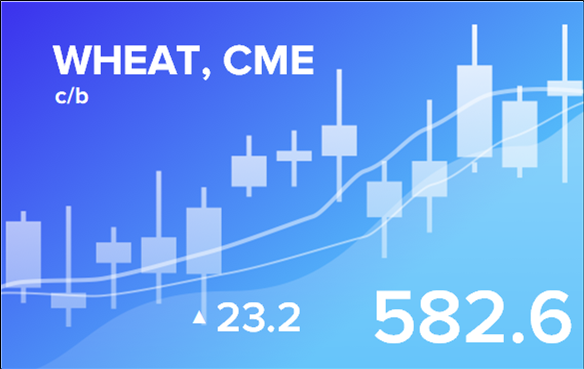

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 24.4 th. contracts. Sellers fled. Buyers have retreated in insignificant volumes. The bears remain in control.

Growth scenario: we consider the March contract, expiration date is March 14. We will keep longing. There is a little overbought, i.e. there will be a correction, but in general we are ready to move to 630.0.

Downside scenario: don’t sell yet.

Recommendations for the wheat market:

Buy: no. Who is in position from 533.0, move the stop to 549.0. Target: 631.0 (revised).

Sale: no.

Support — 567.0. Resistance — 592.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 17.7 th. contracts. Buyers arrived, sellers left the market in small volumes. Bulls strengthened their control again.

Growth scenario: we consider the March contract, expiration date is March 14. There is nowhere to buy. Out of the market. If we go to 440.0, then we will think about it.

Downside scenario: shorting from 509.0 remains the main idea.

Recommendations for the corn market:

Buy: no.

Sell: on approach to 509.0. Stop: 511.0. Target: 440.0.

Support — 472.4. Resistance — 498.4.

Soybeans No. 1. CME Group

Growth scenario: we consider March futures, expiration date March 14. We may reach 1100. Those who wish can buy at current levels with a stop order at 1039.0.

Downside scenario: refuse to sell for now.

Recommendations for the soybean market:

Buy: no. Who is in position from 1025.0, keep stop at 1030.0. Target: 1100.0.

Sell: on approach to 1100. Stop: 1117. Target: 830.0.

Support — 1016.2. Resistance — 1080.2.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 16.6 th. contracts. Buyers and sellers were leaving the market. Sellers were doing it more actively. Bulls are controlling the situation.

Growth scenario: we consider February futures, expiration date is February 28. It makes sense to hold on and buy for the time being.

Downside scenario: we stay out of the market. It is possible to sell from 84.00.

Recommendations for the Brent oil market:

Buy: now (74.66). Stop: 73.70. Target: 84.00 (94.00).

Sell: on approach to 84.00. Stop: 84.80. Target: 75.00.

Support — 73.86. Resistance — 75.11.

WTI. CME Group

US fundamental data: the number of active drilling rigs rose by 1 unit to 480.

U.S. commercial oil inventories rose 8.664 to 423.79 million barrels, with a forecast of +2.4 million barrels. Gasoline stocks rose 2.233 to 251.088 million barrels. Distillate stocks fell by -5.471 to 118.48 million barrels. Cushing storage stocks fell by -0.034 to 20.947 million barrels.

Oil production increased by 0.238 to 13.478 million barrels per day. Oil imports increased by 0.467 to 6.915 million barrels per day. Oil exports rose by 0.645 to 4.331 million barrels per day. Thus, net oil imports fell by -0.178 to 2.584 million barrels per day. Oil refining rose by 1 to 84.5 percent.

Gasoline demand rose by 0.026 to 8.328 million barrels per day. Gasoline production fell -0.027 to 9.166 million barrels per day. Gasoline imports fell -0.041 to 0.593 million barrels per day. Gasoline exports rose -0.098 to 0.86 million barrels per day.

Distillate demand rose by 0.093 to 4.599 million barrels. Distillate production fell -0.186 to 4.552 million barrels. Distillate imports fell -0.023 to 0.159 million barrels. Distillate exports fell -0.234 to 0.893 million barrels per day.

Demand for petroleum products fell by -0.012 to 21.075 million barrels. Petroleum products production increased by 0.292 to 21.113 million barrels. Imports of refined petroleum products rose 0.058 to 1.706 million barrels. Exports of petroleum products fell -0.067 to 6.301 million barrels per day.

Propane demand fell -0.682 to 1.296 million barrels. Propane production rose 0.087 to 2.592 million barrels. Propane imports fell -0.022 to 0.153 million barrels. Propane exports rose 0.309 to 2.137 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 47.4 thnd contracts. The buyers fled. The sellers came again, in the same modest volumes as a week ago. The bulls remain in control.

Growth scenario: we consider the March futures, expiration date February 21. Here you can buy.

Downside scenario: there is no sense to sell yet.

Recommendations for WTI crude oil:

Buy: no. Who is in position from 70.70 and 72.53, keep stop at 69.20. Target: 83.00. Count the risks!

Sale: no.

Support — 66.54. Resistance — 71.93.

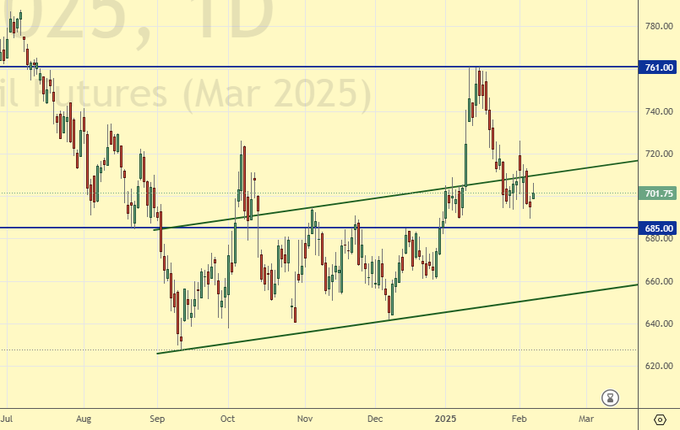

Gas-Oil. ICE

Growth scenario: we consider the March futures, expiration date March 12. It is possible to buy here, but we should take into account the possibility of the market to go below 680.0.

Downside scenario: don’t sell yet.

Gasoil Recommendations:

Buy: now (701.75) and when approaching 680.0. Stop: 670.0. Target: 900.0.

Sale: no.

Support — 685.00. Resistance — 761.00

Natural Gas. CME Group

Growth scenario: we consider March futures, expiration date February 26. We can hold positions. The U.S. did not take over Europe to sell them cheap gas. It’s going to be very expensive. Very expensive.

Downside scenario: we don’t think about sales yet.

Natural Gas Recommendations:

Buy: no. Those in position from 3.044, move your stop to 3.080. Target: 5,000.

Sale: no.

Support — 2.992. Resistance — 3.435.

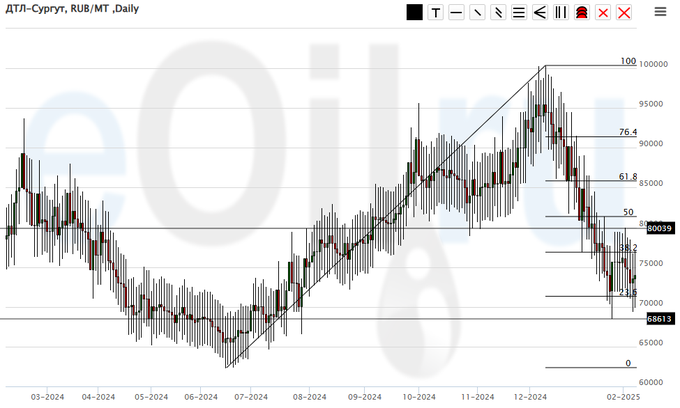

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we should buy here. Technically, the situation is favorable.

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: No. Who is in position from 72000, keep stop at 68000. Target: 110000.

Sale: no.

Support — 68613. Resistance — 80039.

Helium (Orenburg), ETP eOil.ru

Growth scenario: it makes sense to buy here. It is unlikely that the company will release helium cheaper. This is most likely the bottom.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: possible. Those who are in position from 900, keep stop at 770. Target: 2000.

Sale: no.

Support — 813. Resistance is 949.

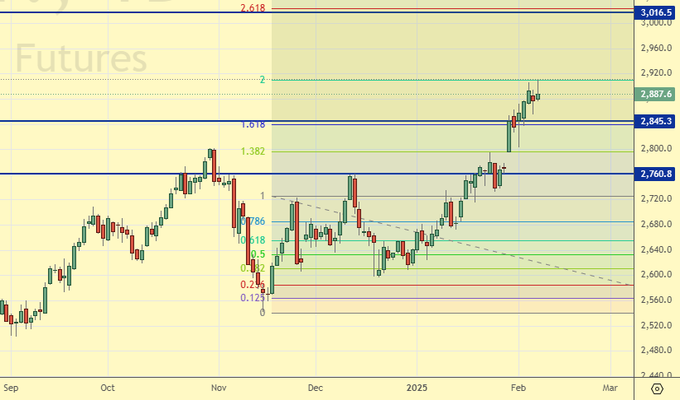

Growth scenario: we consider February futures, expiration date February 26. A pullback to 2760 is needed to continue buying.

Downside scenario: you can sell given the failure to go above the “2” Fibo level.

Gold Market Recommendations:

Buy: when approaching 2760. Stop: 2740. Target: 3000.

Sale: now. Stop: 2917. Target: 2120.

Support — 2845. Resistance — 3016.

EUR/USD

Growth scenario: the dollar will be under pressure due to the exuberant behavior of the new — old US president. You can buy.

Downside scenario: refrain from selling.

Recommendations on euro/dollar pair:

Buy: now (1.0325). Stop: 1.0230. Target: 1.1000 (1.2000?!). From 0.9900 is mandatory. Who is in the position from 1.0356, move the stop to 1.0230. Target: 1.1000 (1.2000).

Sale: no.

Support — 1.0269. Resistance — 1.0351.

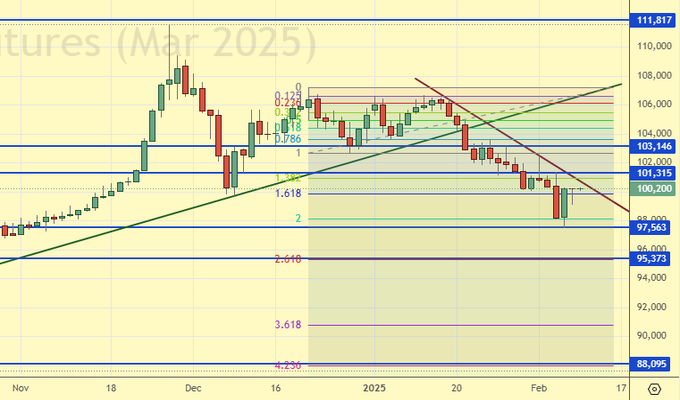

USD/RUB

Growth scenario: we consider the March futures, expiration date March 20. Buying from the 95000 area remains attractive. Any hint of the completion of the SWO will strengthen the ruble by 5 rubles within one hour.

Downside scenario: a possible hike to 95300 is better worked out on hourly intervals.

Recommendations on dollar/ruble pair:

Buy: when approaching 95400. Stop: 94700. Target: 115000? !!!!!!

Sell: now (if the market gives at the opening on Monday to sell not lower than 99000. Stop: 100300. Target: 88100.

Support — 97563. Resistance — 101315.

RTSI. MOEX

Growth scenario: we consider March futures, expiration date March 20. We want 80000 for a nice buy. Buying from current levels is very hard psychologically.

Downside scenario: it is scary to sell, since if Mir, it’s all upside. Out of the market.

Recommendations on the RTS index:

Buy: on a pullback to 80000. Stop: 78800. Target: 103000.

Sale: no.

Support — 92870. Resistance — 97940.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.