Price forecast from 16 to 20 of October 2023

16 October 2023, 13:33

-

Grain market:

Latvia exported more wine to Russia than Italy in 2022. This year the trend continues. Lithuania is in second place and also imports “its” wine to us. Georgia is in third. “Friends” will not let you fall into ruin. Yes. As we see, it is impossible to isolate Russia.

Jews can use weapons close to MDW. Everyone is scared, traders too. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

A very good USDA report on gross harvest for the 23/24 season has been released. We see that the gross harvest of wheat fell by 0.5% to 783.430 million tons, corn increased by 0.02% to 1214.473 million tons, soybeans fell by 0.45% to 399.5001 million tons. These figures are unlikely to be revised in the future.

We can conclude that the threat of rising prices now lies not in shortages, but in the rupture of supply chains that may arise due to conflicts of a larger or smaller scale.

The fall in wheat prices, which occurred in September due to the abundance of grain in Russia and Argentina, appears to be over. Against the background of the conflict in the Middle East, the demand for grain from importers will only increase. Egypt, Turkey, Saudi Arabia, Lebanon, Pakistan, perhaps India — everyone will increase purchases as millions of refugees have already appeared on the horizon and they need to be fed with something.

Reading our forecasts, you could take a downward move on the RTS index from 105800 to 102600.

Energy market:

On Sunday evening we are in a very unpleasant place. Israel may significantly increase its use of force against the Gaza Strip. If there are carpet bombings, and this is what is happening, the consequences will become unpredictable.

Oil and gold, seeing no signs of the confrontation easing, rose sharply on Friday, which clearly tells us that investors are simply scared to watch all this…

If new hordes become involved in the conflict, this will lead to a rapid movement of oil to the 100.00 area. In the current conditions, we are unlikely to fall.

An OPEC report has been released, in which it is clearly indicated in Arabic numerals that in 2024 we will experience an increase in oil demand: as much as 105 million barrels of oil per day in the 4th quarter. It must be taken into account that these forecasts were made for a calm situation in the Middle East.

A little more and we will enter a “who will blink first” situation, when the slightest movement of countries such as Iran, Iraq, Turkey, Saudi Arabia can lead to a response from the United States and Europe. Then it will be possible to talk about oil at around $150 per barrel.

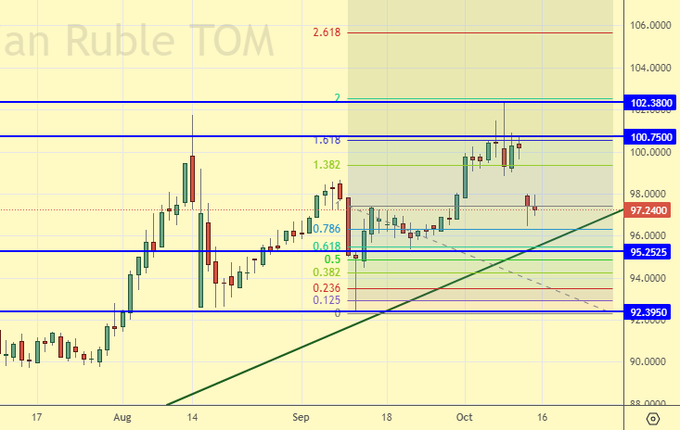

USD/RUB:

So, exporters will have to import 80% of foreign currency earnings into Russia over the course of 6 months and sell 90% of this volume on the stock exchange. The ruble was frightened by such a presidential decree and strengthened somewhat.

It is not yet clear whether there will be enough “power” to overpower importers who constantly need foreign currency. What if after the decree the exchange rate goes higher? Erdogan’s lyre doesn’t hurt and listens. It is possible that the price for the oligarchs will be too high and they will refuse to keep the exchange rate at 100.00 and will not bring currency into the country. I would also like to understand how this will be done if dollar transactions do not work. Who will be lucky where, in what volume, in what paper, in what carriage…

The situation is far from simple. Taking into account the fact that no one will lift sanctions from Russia, it is not clear how the situation will improve and the ruble will strengthen not against the backdrop of the decree, but for natural reasons.

For now we see the level of 90.00. We will call into question a stronger strengthening of the national currency.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 4.6 thousand contracts. The bulls were running and few new sellers appeared. In general, the advantage remains with the sellers.

Growth scenario: we are considering December futures, expiration date is December 14. Let’s continue to insist on purchases. The situation around Israel is nervous and there may be consequences.

Fall scenario: we refuse to sell. There will now be no new grain until next year.

Recommendations for the wheat market:

Purchase: Now. Stop: 546.0. Target: 650.0 (710.0). When approaching 515.0. Stop: 497.0. Target: 650.0 (710.0).

Sale: no.

Support – 546.3. Resistance – 607.4.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers decreased by 45.2 thousand contracts. The sellers left. The growth in buyers was small. Bears continue to control the market.

Growth scenario: we are considering December futures, expiration date is December 14. Can buy. Reduce your capital risks by half.

Fall scenario: we don’t sell. It is better to work out a possible short from the current position on hourly intervals.

Recommendations for the corn market:

Purchase: Now. Stop: 482.0. Goal: 600.0. Or when approaching 425.0. Stop: 405.0. Goal: 600.0.

Sale: no.

Support – 490.1. Resistance – 499.6.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date is November 14. Another new low. We continue to refrain from shopping.

Fall scenario: keep short. We indicated resistance at 1300. While we are under it, sellers have nothing to fear.

Recommendations for the soybean market:

Purchase: no.

Sale: no. For those in position from 1370, keep your stop at 1312.0. Goal: 1190.0 (1000.0)!

Support – 1188.4. Resistance – 1300.0.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 78.5 thousand contracts. Buyers left the market in large volumes. And sellers came to the market. At the end of the week we see that this was a mistake. The buyers’ advantage has become noticeably smaller.

Growth scenario: we are considering November futures, expiration date is November 30. We didn’t reach 80.00, which means we didn’t buy it. We will not buy at current prices. We are still waiting for a correction at 80.00.

Fall scenario: we will face very strong and unpredictable movements in the oil market. Off the market.

Recommendations for the Brent oil market:

Purchase: when approaching 80.00. Stop: 78.80. Goal: 104.00.

Sale: no.

Support – 83.40. Resistance – 95.26.

WTI. CME Group

US fundamentals: the number of active drilling rigs increased by 4 to 501.

Commercial oil reserves in the United States increased by 10.176 to 424.239 million barrels, with a forecast of +0.492 million barrels. Gasoline inventories fell by -1.313 to 225.671 million barrels. Distillate inventories fell by -1.837 to 116.958 million barrels. Inventories at the Cushing storage facility fell by -0.319 to 21.771 million barrels.

Oil production increased by 0.3 to 13.2 million barrels per day. Oil imports increased by 0.114 to 6.329 million barrels per day. Oil exports fell by -1.889 to 3.067 million barrels per day. Thus, net oil imports increased by 2.003 to 3.262 million barrels per day. Oil refining fell by -1.6 to 85.7 percent.

Demand for gasoline increased by 0.567 to 8.581 million barrels per day. Gasoline production increased by 0.858 to 9.684 million barrels per day. Gasoline imports fell by -0.33 to 0.589 million barrels per day. Gasoline exports increased by 0.341 to 1.178 million barrels per day.

Demand for distillates fell by -0.145 to 3.67 million barrels. Distillate production increased by 0.038 to 4.727 million barrels. Imports of distillates increased by 0.035 to 0.12 million barrels. Exports of distillates increased by 0.022 to 0.16 million barrels per day.

Demand for petroleum products increased by 0.509 to 19.666 million barrels. Production of petroleum products increased by 1.45 to 22.368 million barrels. Imports of petroleum products fell by -0.013 to 2 million barrels. Exports of petroleum products increased by 0.475 to 7.019 million barrels per day.

Propane demand fell by -0.137 to 0.587 million barrels. Propane production increased by 0.005 to 2.631 million barrels. Propane imports increased by 0.03 to 0.101 million barrels. Propane exports fell -0.06 to 0.067 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 38.7 thousand contracts. Buyers and sellers were leaving the market, but buyers were doing it more actively. The bulls’ advantage has narrowed significantly.

Growth scenario: we are considering December futures, expiration date November 20. We will continue to wait for the descent to 76.00. We will not take at current levels.

Fall scenario: out of market. Until it becomes clear what will happen to the Gaza Strip, it is better not to short.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.70. Target: 83.00. Anyone in position from 83.50, keep a stop at 81.00. Goal: 91.00.

Sale: no.

Support – 80.21. Resistance – 92.49.

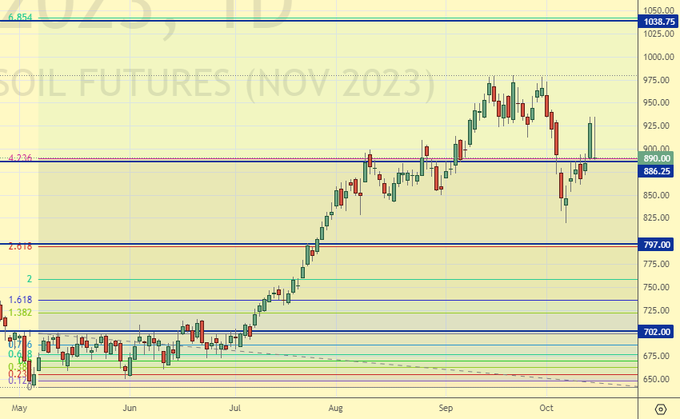

Gas-Oil. ICE

Growth scenario: we are considering November futures, expiration date is November 10. We do not buy at current prices. We are waiting for a rollback.

Fall scenario: we do not go short due to the extremely uncertain situation.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sale: no.

Support – 797.00. Resistance – 1038.75.

Natural Gas. CME Group

Growth scenario: switched to November futures, expiration date October 27. We continue to hold long. If Qatar interrupts gas supplies to Europe, prices will go through the roof.

Fall scenario: we don’t sell. Let’s see. It is possible that we will rise above 4,000.

Natural gas recommendations:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, move the stop to 2.840. Goal: 6,000 (revised).

Sale: no.

Support – 3.087. Resistance – 3.483.

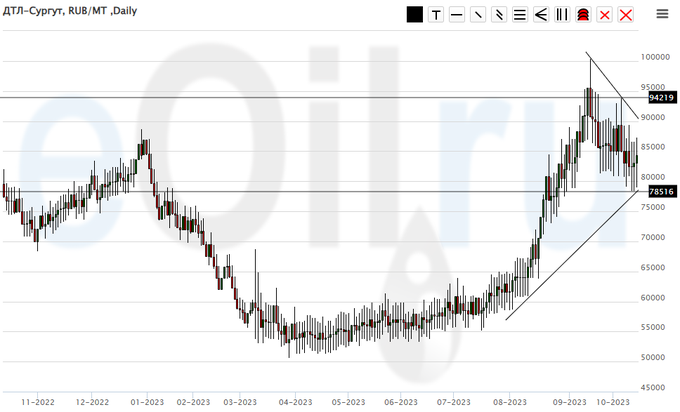

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 70,000. It will be possible to buy there.

Fall scenario: we will sit on sale, but we will move our stop.

Recommendations for the diesel market:

Purchase: think when approaching 70,000.

Sale: no. If you are in a position from 85000, move your stop to 91000. Target: 71000.

Support – 78516. Resistance – 94219.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: not yet on the market. We continue to count on falling prices.

Fall scenario: we will refrain from new attempts to enter the short. Off the market.

Recommendations for the PBT market:

Purchase: no.

Sale: no.

Support – 16396. Resistance – 24736.

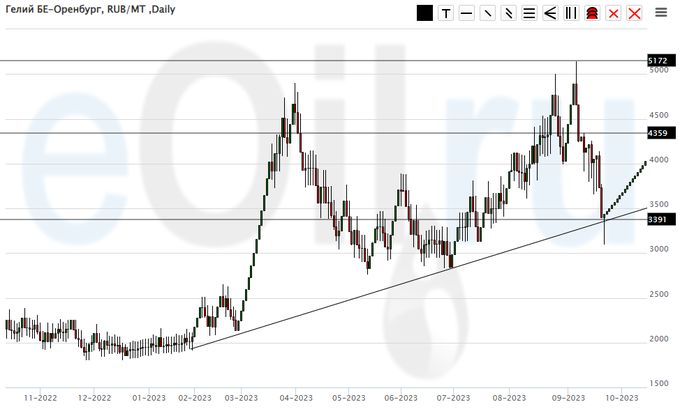

Helium (Orenburg), ETP eOil.ru

Growth scenario: nothing new. We refrain from commenting on this market. Liquidity should appear. We see that there are no offers at current prices.

Fall scenario: we continue to remain out of the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 3391. Resistance – 4359.

Gold. CME Group

Growth scenario: sharp. We will remain long. The closing of the candle is clearly bullish.

Fall scenario: it was not for nothing that we ran away a week ago. We don’t sell. The world is going crazy very quickly.

Recommendations for the gold market:

Purchase: no. For those in position from 1840, move the stop to 1830. Target: 2400.

Sale: no.

Support – 1883. Resistance – 1932.

EUR/USD

Growth scenario: we did not go above 1.0650, so our long did not open. We don’t buy.

Fall scenario: we will keep shorts from 1.0600. The dollar is strengthening amid the conflict in the Middle East. Note that everything can quickly turn in the opposite direction.

Recommendations for the euro/dollar pair:

Purchase: in case of growth above 1.0650. Stop: 1.0530. Target: 1.2000. Or when touching 1.0220. Stop: 1.0120. Goal: 1.2000?!

Sale: no. If you are in a position from 1.0600, move your stop to 1.0610. Target: 1.0220.

Support – 1.0449. Resistance – 1.0636.

USD/RUB

Growth scenario: the presidential decree on the sale of foreign currency earnings turned everything upside down. Off the market.

Fall scenario: the ideal sale will be during a rise to 98.00. Let’s wait for this rollback. It is better to work out sales from current levels on hourly intervals.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: when rising to 98.50. Stop: 101.20. Goal: 90.00. Consider the risks.

Support – 95.25. Resistance – 100.75.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. The strengthening ruble helped the RTS index. There are no good levels to enter long. Off the market.

Fall scenario: we didn’t go down. We’re taking a break for a week.

Recommendations for the RTS Index:

Purchase: no.

Sale: no.

Support – 101240. Resistance – 104970.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|