|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-23-to-27-december-2024/665051/

|

Grain market:

Is World War 3 already underway or not? This is the question politicians are asking. Judging by the fact that the Central Bank of Russia is working and not even raising the rate? Not yet. But judging by what we see from Kazan, yes. But the main thing, the main miracle, is the growing shares of Gazprom. That’s faith in Hermes. That’s fortitude!

To fortitude. To profit, to money, comrades! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

It is already evident that Trump has begun to test the political structures of neighboring countries and Europe through verbal interventions. We will increase duties, we will withdraw from NATO, we will take back the Panama Canal. Canada is the 51st state of the United States, Mexicans should stay at home, we will come to you. And so on. There, too, the ambitions are no weaker than those of Grandpa Erdogan, who started the process of absorbing Syria.

Such vectors of force may lead to the fact that the West will try in the next 20 years to establish explicit control through its legislative framework and military presence wherever it can. The world awaits consolidation and strengthening of the strong and absorption of the weak.

A free global food market may cease to exist. Goods will circulate only within certain blocs and go beyond them only through the organization of giant batches with barter exchange of one pile for another. For example: corn for rice, wheat for soybeans, coffee for chicory. No joke.

I’d like to see wheat fall to 430.0 cents a bushel, and then it can go up.

Energy market:

Since there is nothing left to do in London, Washington and Brussels, the politicians who came out of the golden billion have smoked and increased their pressure on Russian tankers. There is no doubt that Russia will face further complications in shipping, as well as an attempt to impose a directive on our regular buyers (primarily India) to buy Russian oil only at $40 a barrel. Both of these actions will make it problematic for the country to receive any foreign currency in the previous volumes.

It can be assumed that against the backdrop of lower demand for oil from China, Russia will try to remove from the oil market through secondary sanctions on buyer states. Oil will also be at 70.00, but there will be no Russia on the international market. This must be understood and countered. Here we can mention Iran, which somehow found opportunities to sell crude, during the period of Western sanctions, thank you, China is around. But Iran has never had a grim reality in which it is necessary to constantly increase the output of armaments, they do not plan to go to war with the whole world. We need five Chinas. Where are we gonna get them?

USD/RUB:

The princess succumbed to persuasion…sorry, Elvira Nabiullina left the rate at 21%.

You know, all these howls of the representatives of the real sector are understandable, and even they can be sympathized with, but we can’t go the Turkish way, when Erdogan cut the rate while inflation was rising, and then they got hyperinflation for two years. Why? Because the Turks can borrow on the foreign market. They have free movement of capital. Turkish labor became cheaper. Competitiveness has increased. They can offer low prices for their goods. They can borrow in Swiss francs at 3% per annum. As long as we are throwing money into the defense industry, no one can do anything about inflation. We have to get used to living with inflation of 20% a year and a 21% annual interest rate. Replace Nabiullina? You can. But another person will not bring a new reality.

We wanted to see March pair futures at least at 98000. We didn’t even get that.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 22.9 th. contracts. Sellers continue to increase their positions for selling. At that, they do it quite aggressively. Buyers were reducing their positions. Bears keep control.

Growth scenario: we consider the March contract, expiration date March 14. We see a new local minimum. Buyers seem to have nothing to do here, but we came to the Fibo level. It is possible to buy with a small risk.

Downside scenario: it makes sense to hold sales. There’s a lot of interesting stuff at the bottom, and most importantly it’s all so deep it’s breathtaking.

Recommendations for the wheat market:

Buy: now (533.0). Stop: 522.0. Target: 650.0.

Sell: no. Those in position from 552.2, move stop to 555.6. Target: 380.0 (revised).

Support — 528.6. Resistance — 568.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers decreased by 7.9 thousand contracts. Buyers were leaving, sellers were also leaving, but in more modest volumes.

Growth scenario: we consider the March contract, expiration date is March 14. Bulls need to push the market above 453.0, then we can talk about growth. So far out of the market.

Downside scenario: Let’s sell. Very disconcerting bearish behavior in wheat. A big bullish failure in the grain market is possible.

Recommendations for the corn market:

Buy: not yet.

Sell: Now (446.2). Stop: 452.0. Target: 370.0?!

Support — 436.0. Resistance — 451.0.

Soybeans No. 1. CME Group

Growth scenario: we consider January futures, expiration date January 14. Nothing new. Don’t think about buying while we are below 1020.0.

Downside scenario: we will continue to keep open shorts. Soybeans are plentiful. We can add to shorts at current levels.

Recommendations for the soybean market:

Buy: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: no. Who is in position from 1049.0 and 990.0, move the stop to 1002.0. Target: 835.0.

Support — 944.4. Resistance — 990.0.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 17.8 th. contracts. Buyers entered the market, sellers left. Bulls strengthened their control.

Growth scenario: we consider December futures, expiration date December 31. In case of growth above 75.00 it makes sense to consider buying opportunities. Out of the market for now.

Downside scenario: attempts to make money on shorts failed. Outside the market.

Recommendations for the Brent oil market:

Buy: now (72.94.) Stop: 71.87. Target: 90.00?!

Sale: no.

Support — 71.96. Resistance — 75.01.

WTI. CME Group

US fundamentals: the number of active drilling rigs increased by 1 unit to 483.

U.S. commercial oil inventories fell -0.934 to 421.016 million barrels, with a forecast of -1.6 million barrels. Gasoline inventories rose by 2.348 to 222.037 million barrels. Distillate stocks fell by -3.18 to 118.155 million barrels. Cushing storage stocks rose by 0.108 to 23.002 million barrels.

Oil production fell by -0.027 to 13.604 million barrels per day. Oil imports rose by 0.665 to 6.649 million barrels per day. Oil exports rose by 1.796 to 4.895 million barrels per day. Thus, net oil imports fell by -1.131 to 1.754 million barrels per day. Oil refining fell by -0.6 to 91.8 percent.

Gasoline demand rose by 0.117 to 8.927 million barrels per day. Gasoline production fell -0.173 to 9.872 million barrels per day. Gasoline imports rose 0.291 to 0.755 million barrels per day. Gasoline exports fell -0.027 to 1.012 million barrels per day.

Distillate demand rose by 1.048 to 4.498 million barrels. Distillate production fell -0.135 to 5.094 million barrels. Distillate imports rose 0.01 to 0.164 million barrels. Distillate exports fell -0.257 to 1.214 million barrels per day.

Demand for petroleum products increased by 0.662 to 20.82 million barrels. Petroleum products production fell by -0.557 to 21.702 million barrels. Petroleum product imports rose 0.455 to 2.001 million barrels. Exports of refined products rose by 0.159 to 7.065 million barrels per day.

Propane demand fell -0.402 to 1.281 million barrels. Propane production fell -0.075 to 2.667 million barrels. Propane imports rose 0.053 to 0.179 million barrels. Propane exports rose 0.376 to 1.987 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 59.4 th. contracts. Buyers were actively entering the market. Sellers ran in substantial volumes. Bulls keep control.

Growth scenario: we switched to February futures, expiration date is January 21. In case of growth above 73.00 we will think about purchases.

Downside scenario: sellers’ efforts have not been successful yet. The previously opened short is holding on from the last efforts. Most likely it will be closed by stop order, but there is always a chance.

Recommendations for WTI crude oil:

Buy: now (69.46). Stop: 68.00. Target: 80.00.

Sell: no. Those in position from 67.65, keep stop at 71.23. Target: 60.00?

Support — 66.77. Resistance — 71.04.

Gas-Oil. ICE

Growth scenario: we consider the January futures, expiration date is January 10. Looking at the retest of the broken falling channel, we would like to buy, which we will do.

Downside scenario: since we broke the falling channel upwards, we will be out of the market.

Gasoil Recommendations:

Buy: now (675.25). Stop: 664.50. Target: 900.00?!

Sale: no.

Support — 641.25. Resistance — 696.25.

Natural Gas. CME Group

Growth scenario: we consider February futures, expiration date January 29. High volatility. If there is a pullback, we can buy.

Downside scenario: out of the market.

Natural Gas Recommendations:

Buy: when approaching 3.200. Stop: 3.100. Target: 5,000?!

Sale: no.

Support — 3.145. Resistance — 3.475.

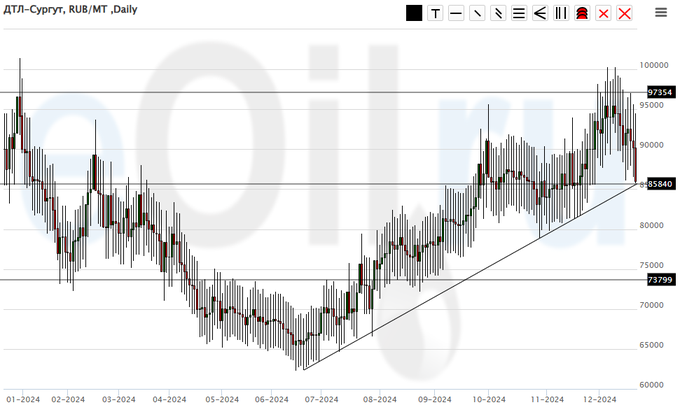

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we hardly took everything we could from the rising trend. We will be satisfied with closing with a profit at 87000. In any case, we do not expect low prices in this market. But they can be in case of blockade of supplies from the Russian Federation to the external market. Remember gasoline at 7 kopecks per liter?

Downside scenario: sales are asking for it, but we’ll look for other opportunities.

Diesel Market Recommendations:

Buy: no.

Sale: no.

Support — 85840. Resistance — 97354.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: seasonal decline continues. Out of the market for now. When approaching 6000, it is mandatory to buy.

Downside scenario: there are no good levels for selling. Out of the market.

PBT Market Recommendations:

Buy: on approach to 6000. Stop: 3600. Target: 19000.

Sale: no.

Support — 5938. Resistance — 19531.

Helium (Orenburg), ETP eOil.ru

Growth scenario: continue to refrain from buying. The market is experiencing a formidable disaster. Whether there will be a reversal is not clear.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 813 Resistance — 1077.

Growth scenario: we consider February futures, expiration date February 26. The outlook for the dollar has improved. It is very likely that it will continue to be a strong currency for the foreseeable future.

Downside scenario: sellers made a mess of things. The market is sawing 2630, which may open the way to 2120.

Gold Market Recommendations:

Buy: no.

Sell: now (2645). Stop: 2680. Target: 2120.

Support — 2597. Resistance — 2664.

EUR/USD

Growth Scenario: The Fed cut rates by 0.25%, but told investors not to dream of even 2% for the next two years. The dollar is strong.

Downside scenario: there is nothing interesting for shorting. Out of the market. The euro is unlikely to become worth 90 US cents.

Recommendations on euro/dollar pair:

Buy: when approaching 1.0030. Stop: 0.9930. Target: 1.1000.

Sell: now (1.0429). Stop loss: 1.0470. Target: 1.0030.

Support — 1.0343. Resistance — 1.0453.

USD/RUB

Growth scenario: we consider March futures, expiration date March 20. High volatility. So far out of the market. Suspension of the Central Bank rate hike is unlikely to strengthen the ruble, but such a step will clearly sober up part of the trading community.

Downside scenario: those willing to sell now. We are already in shorts from 106300.

Recommendations on dollar/ruble pair:

Buy: think after rising above 109000.

Sell: No. Who is in position from 106300, move your stop to 107770. Target: 98000?!!!

Support — 103251. Resistance — 106389.

RTSI. MOEX

Growth scenario: we consider the March futures, expiration date March 20. Who would have thought… And here it is. I’m happy to see the 21% rate remaining at the level. Honestly. Guys, that’s 21%, not 2.1%. Things just keep getting weirder and weirder. Buy? Only on a pullback to 78200.

Downside scenario: if we go above 85000, the 95000 mark opens up. There will be a struggle at current price levels.

Recommendations on the RTS index:

Buy: when approaching 78200. Stop: 77000. Target: 100000????!!!!!

Sell: no. Who is in position from 84000, keep stop at 83500. Target: 55000.

Support — 78180. Resistance — 86850.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.