|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-16-to-20-december-2024/664520/

|

Grain market:

In Paris, they rebuilt the cathedral after the fire. Everyone gathered. They started praying. No one can remember the last time this happened. How long will the zeal of the congregation last? It’s beautiful, it’s bright, it’s good. The most money was given by the man who earns from luxury (200 million euros). So it is greed on the greedy. This is Europe! The main thing is not to forget what you were like in church when you step outside.

Here’s to the right internal attitudes. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The WASDE report did not impress the market. The market saturation of grain is 100% and no one has even a wild idea on the basis of which it would be possible to raise prices. On the contrary, given the strong position of the U.S. dollar against other currencies, producers from poor countries or countries prone to persistent inflation will offer grain at low prices in an effort to get dollars, sometimes from similarly inflationary but hungry countries. Russia’s reduction of wheat supplies in December by 1 million tons, due to weather in the Black Sea, will certainly support prices by inflating them in the news, but it is unlikely to give impetus to growth in the global wheat market.

Domestic wheat prices are not falling, and in the last couple of weeks we see signs of growth. If exporters really do not close the volumes for January, we can expect a rise in prices for wheat of all classes inside the country in rubles. Against the background of external stable demand, farmers can impose their position on traders. There are episodes when the 5th class in the south goes above 11000 rubles per ton, which is a confirmation of a generally strong market. Class 3 in terms of dollars at EXW costs 140, current duty 40, and at FOB flour milling goes at 228. With three transshipments at $5, it turns out that traders don’t have much room to maneuver, but there is still some. Sorry we counted your money.

Energy market:

Deflation in China, which has been going on for 6 quarters now, is becoming a problem. Consumers are waiting for low prices and are ready to wait, but companies are not ready for it at all, as the means of production are bought on credit and falling sales lead to delays in debt repayment. If the flywheel of bankruptcies is started, no one will save anyone. We will go into a state of crisis and falling commodity asset prices pretty quickly. Remember, China imports 11% of all the oil produced in the world. That’s a lot. It’s worth keeping an eye on the situation.

U.S. oil producers have started to ramp up. Production has risen again. The United States is already at 13.631 million barrels per day. It’s clearly possible to go up to 15 there, but beyond that it’s going to be tough. Much more interesting things may happen in the near future, when London’s interests will be pushed to the sidelines and Canada (a province of the British Crown) will be divided into parts and become part of the country, as Trump wants. The number of stars on the U.S. flag will increase dramatically, and Washington will have direct access to all the resources of the north. And the logistics will be much more convenient, if compared to Alaska.

USD/RUB:

The ruble is somehow trying to survive around 105.00. It is unlikely to be directly affected by the Fed’s rate decision on the 18th. The pair has almost lost its primary importance, giving way to the yuan/ruble pair. Now we will focus on the Moscow Exchange Index in yuan from December 17.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 2.5 thousand contracts. Both buyers and sellers slightly reduced their positions. Sellers did it more actively. Bears keep control.

Growth scenario: we consider the March contract, expiration date is March 14. There is nothing good for buyers in this situation. At the bottom we have 527.0, and further only 440.0 and 380.0. We should not hurry to buy.

Downside scenario: we have exhibited very attractively over the last three days. We can sell.

Recommendations for the wheat market:

Purchase: no.

Sell: now (552.2). Stop: 577.6. Target: 440.0.

Support — 527.0. Resistance — 577.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers increased by 92.3 thousand contracts. The change is gigantic! Buyers entered the market, sellers fled. If the bet on growth turned out to be wrong, we will get a market collapse in the near future. It is not excluded that the big players pumped the market up on purpose to send it in the opposite direction.

Growth scenario: we consider the March contract, expiration date is March 14. Bulls need to push the market above 453.0, then we can talk about growth. For now we will refrain from buying.

Downside scenario: we take a break for a week. Let’s see if the sellers manage to go below 430.0.

Recommendations for the corn market:

Purchase: no.

Sale: no.

Support — 436.2. Resistance — 452.6.

Soybeans No. 1. CME Group

Growth scenario: we consider January futures, expiration date January 14. Nothing new. Don’t think about buying while we are below 1025.0.

Downside scenario: we will continue to keep open shorts. Soybeans are plentiful. The market is on the verge of a strong fall.

Recommendations for the soybean market:

Purchase: when approaching 835.0. Stop: 815.0. Target: 1000.0.

Sell: No. Those who are in position from 1049.0, move the stop to 1007.0. Target: 835.0. You can add to the previously opened shorts.

Support — 974.6. Resistance — 1003.4.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 5.5 thousand contracts. Buyers entered the market, the position of sellers did not change. Bulls strengthened their control.

Growth scenario: we consider December futures, expiration date December 31. In case of growth above 75.00 it makes sense to consider buying opportunities. Out of the market for now.

Downside scenario: attempts to make money on shorts failed. Outside the market.

Recommendations for the Brent oil market:

Purchase: no.

Sale: no.

Support — 72.69. Resistance — 74.89.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 482.

U.S. commercial oil inventories fell -1.425 to 421.95 million barrels, with -1 million barrels forecast. Gasoline inventories rose 5.086 to 219.689 million barrels. Distillate stocks rose 3.235 to 121.335 million barrels. Cushing storage stocks fell by -1.298 to 22.894 million barrels.

Oil production increased by 0.118 to 13.631 million barrels per day. Oil imports fell by -1.306 to 5.984 million barrels per day. Oil exports fell by -1.136 to 3.099 million barrels per day. Thus, net oil imports fell by -0.17 to 2.885 million barrels per day. Oil refining fell by -0.9 to 92.4 percent.

Gasoline demand increased by 0.072 to 8.81 million barrels per day. Gasoline production rose 0.549 to 10.045 million barrels per day. Gasoline imports fell -0.047 to 0.464 million barrels per day. Gasoline exports rose 0.045 to 1.039 million barrels per day.

Distillate demand rose by 0.052 to 3.45 million barrels. Distillate production fell -0.086 to 5.229 million barrels. Distillate imports rose 0.038 to 0.154 million barrels. Distillate exports fell -0.079 to 1.471 million barrels per day.

Demand for petroleum products increased by 0.19 to 20.158 million barrels. Petroleum products production fell -0.359 to 22.259 million barrels. Imports of refined petroleum products rose 0.067 to 1.546 million barrels. Exports of refined products fell by -0.636 to 6.906 million barrels per day.

Propane demand rose 0.858 to 1.683 million barrels. Propane production fell -0.066 to 2.742 million barrels. Propane imports rose 0.013 to 0.126 million barrels. Propane exports fell -0.579 to 1.611 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 9.9 th. contracts. Buyers were leaving the market, sellers were entering it in minimal volumes. Bulls keep control.

Growth scenario: we switched to February futures, expiration date is January 21. In case of growth above 73.00 we will think about purchases.

Downside scenario: sellers’ efforts have not been successful yet. The previously opened short is holding on from the last efforts. Most likely it will be closed by stop order, but there is always a chance.

Recommendations for WTI crude oil:

Purchase: no.

Sell: no. Who is in the position from 67.65 (taking into account the transition to a new contract), move the stop to 71.23. Target: 60.00?

Support — 68.56. Resistance — 71.04.

Gas-Oil. ICE

Growth scenario: we consider the January futures, expiration date January 10. A move above 700.00 will make us talk about buying. Out of the market for now.

Downside scenario: sales did not give us anything positive. Off-market.

Gasoil Recommendations:

Purchase: no.

Sale: no.

Support — 677.75. Resistance — 696.25.

Natural Gas. CME Group

Growth scenario: we consider January futures, expiration date December 27. High volatility within a wide range. Out of the market.

Downside scenario: out of the market.

Natural Gas Recommendations:

Purchase: no.

Sale: no.

Support — 2.972. Resistance — 3.563.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will continue to press the stop order. We realize that prices may pull back down a bit.

Downside scenario: you can sell, but given the strong volatility within the day, you should do it based on your own situation on the ground. We will not explicitly recommend shorting.

Diesel Market Recommendations:

Purchase: No. Who is in position from 65000, move stop to 87000. Target: 120000 (revised).

Sale: no.

Support — 85049. Resistance — 100430.

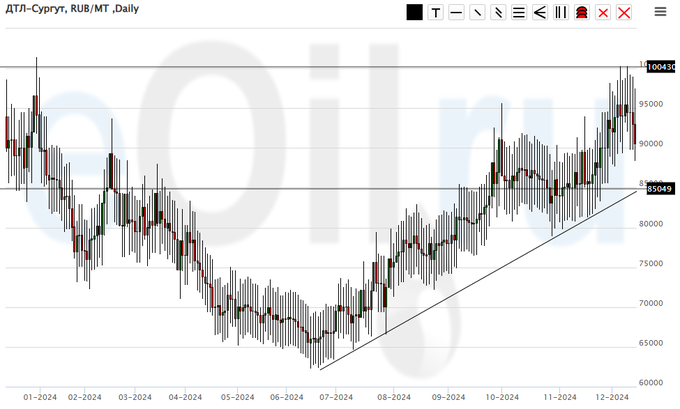

Propane butane (Surgut), ETP eOil.ru

Growth scenario: seasonal decline continues. Out of the market for now. When approaching 5000, buying is mandatory.

Downside scenario: everything happened very quickly. There are no good levels for selling. Out of the market.

PBT Market Recommendations:

Purchase: on approach to 5000. Stop: 3600. Target: 19000.

Sale: no.

Support — 8984. Resistance — 16875.

Helium (Orenburg), ETP eOil.ru

Growth scenario: continue to refrain from buying. The market is experiencing a formidable disaster. Whether there will be a reversal is not clear.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: no.

Sale: no.

Support — ???? Resistance is 931.

Growth scenario: we consider the February futures, expiration date February 26. The US inflation data showed us that the rate cut may be a longer process than previously thought. We hold the long. It is worth recognizing that it may not give us the desired profit.

Downside scenario: despite the drop on Thursday and Friday so far out of the market.

Gold Market Recommendations:

Purchase: no. Who is in position from 2575, move the stop to 2620. Target: 2863 (3170).

Sale: no.

Support — 2630. Resistance — 2690.

EUR/USD

Upside scenario: ECB cut the rate by 0.25% to 3.15%. Now we wait for the 18th (Fed meeting). A 0.25% cut is also possible there. The market is balanced. Outside the market.

Downside scenario: out of the market for now.

Recommendations on euro/dollar pair:

Purchase: no.

Sale: no.

Support — 1.0455. Resistance — 1.0629.

USD/RUB

Growth scenario: switched to March futures, expiration date March 20. High volatility. There are no favorable levels to buy. Out of the market.

Downside scenario: if we go to 106300 once again, we can sell.

Recommendations on dollar/ruble pair:

Purchase: no.

Sell: on approach to 106300. Stop: 107300. Target: 97000?!!!

Support — 103251. Resistance — 106389.

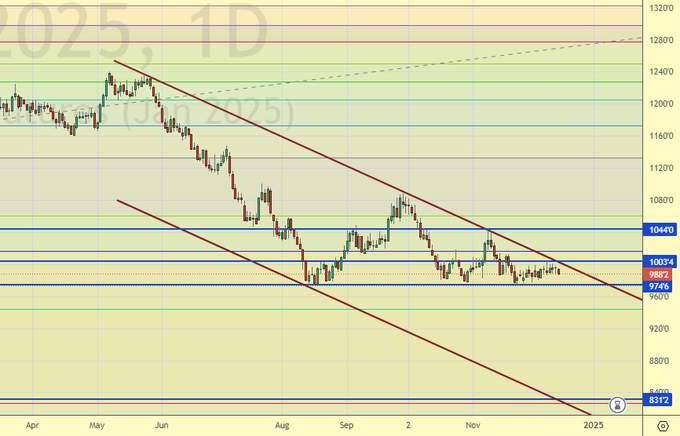

RTSI. MOEX

Growth scenario: switched to March futures, expiration date March 20. Nothing new. The market is falling, and we continue to refuse to buy. A long from 55000 would be a beautiful story.

Downside scenario: it makes sense to keep the previously opened shorts. The market tends to continue falling. No bulls were seen last week.

Recommendations on the RTS index:

Purchase: no.

Sell: no. Who is in the position from 84000 (taking into account the transition to a new contract), move the stop to 83500. Target: 55000.

Support — 69680. Resistance — 85170.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.