|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-23-to-27-september-2024/658132/

|

Grain market:

Do gods need brains? Why? They’re gods. The gods of the oil market have a hard time with this organ, but sometimes they have it too. OPEC+ is likely to extend the moratorium on production growth until the end of the year.

Here’s to hope! Oh, and check to see if there are any hidden video cameras in the office. You never know.

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Ten days after the release of the September WASDE report, we can say that the market has realized its own balance. It will not be surprising that the outlined correction in wheat and corn will continue all next week. The risk of wheat falling to 500.0 is higher than the risk of corn falling to 360.0. These levels are not necessarily reached at all, but we may get this surprise before the already two-month fall rally begins. Fall prices could be due to grain from the Black Sea region leaving at “any price”, due to tensions related to the SWO. In addition, traditional major grain suppliers such as Brazil and Argentina are as keen as ever on the currency. Especially Argentina with its triple digit inflation. So, they will sell at throwaway prices.

It is interesting that everyone sees signs of slowdown in China, and now this very China will say to everyone and everyone: we are not doing well here, so give us a 25% discount. And they will give it, because everyone is used to selling raw materials to China. It will be interesting times. It is already happening with energy resources under long-term contracts, and the same will happen with food. China will look us in the eye and say that it will buy for 75 what yesterday cost 100. You don’t want it? Fine, we will buy at 100 only 10% of what you wanted to sell, and then we will see where the wind blows. Do many agricultural suppliers have a margin of safety when it comes to trading? Obviously not. Then, quicker you sell, quicker you buy US paper at 5% and you can smoke Cohiba until next year.

Energy market:

The U.S. Federal Reserve reduced the rate by 0.5% at once. This created a long-term fundamental threat of the dollar’s value falling against other currencies, which supports the entire commodities market at this stage.

The China card will undoubtedly continue to be played by all analysts. How much oil the country imports, how the dynamics is changing. China imports 11.56 million barrels per day (data for August), with 2.21 million barrels per day coming from Russia. The volume of imports is more than 10% of all oil produced in the world, or 25% of all imports. At the same time, people started to rub the topic of electric cars, saying that they may take a significant part of demand. No such thing. Only 0.5 million barrels per day, which is frankly not enough. Practice shows that the demand for energy is growing faster than its partial replacement by alternative sources. As long as there is room in the market for all energy sources.

And you know that 70 dollars is the level below which it is not profitable to develop areas in the U.S. by hydraulic fracturing. And if this is so, then the Americans themselves do not need oil below 70.00. By the way, this cost of production is growing from year to year. 10 years ago it was “killed” in some parts of the Permian basin up to 40 dollars, but now there is no talk about it. Those who are lucky enough to have a new well will be knocked back from 62 dollars, the rest of us should pray for 70. Yes, the current holes in the ground only need half the amount for maintenance, but the problem is that they are quickly depleted, losing economic appeal. Gotta keep drilling all the time!

USD/RUB:

We see a gradual weakening of the ruble. The rise of the pair to 94.00 is practically beyond doubt. Further growth will also be possible, but it will be of a smooth measured nature, provided that the second wave of mobilization is not announced and the expenditure part of the budget for the 25th year is not sharply increased. There is a reasonable suspicion that both of the first and second conditions will occur. In this case we will be waiting for a rise to the 104.00 area by the end of the year and this rate will hold until the end of March of the year 25.

The Central Bank of Russia in conditions of constant growth of unsecured money supply will be forced to keep the rate close to 20% for a long time, probably for the whole 25th year, in order to limit inflation growth.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 4.4 th. contracts. Sellers and buyers were reducing their positions. Bears did it more actively. Bears maintain control.

Growth scenario: we consider December futures, expiration date December 13. On downward pullbacks, it is possible to buy.

Downside scenario: the current upside pullback did not break the bears. However, we need levels above the current levels to sell. The risk of prices falling to 500.0 remains.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 553.4. Resistance — 597.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 2.6 th. contracts. Buyers entered the market in small volumes. Sellers were not active. Bears are still controlling the situation.

Growth scenario: we consider the December futures, expiration date December 13. As long as we are below 445.0, the risk of falling to 360.0 remains. It is interesting to buy from 393.0.

Downside scenario: when approaching 445.0 it is possible to sell. It cannot be ruled out that the price recovery will be short-term.

Recommendations for the corn market:

Buy: when approaching 393.0. Stop: 390.0. Target: 445.0.

Sell: on approach to 445.0. Stop: 465.0. Target: 360.0?!

Support — 392.6. Resistance — 415.0.

Soybeans No. 1. CME Group

Growth scenario: we are looking at the November futures, expiration date November 14. Given the record gross soybean harvest, it will be very hard for us to grow. Don’t buy.

Downside scenario: sell again despite two previous failures. Oilseeds are plentiful. We should continue to fall.

Recommendations for the soybean market:

Buy: when approaching 850.0. Stop: 830.0. Target: 1100.0.

Sell: no. Who is in position from 1006.0, keep stop at 1035.0. Target: 850.0.

Support — 986.4. Resistance — 1023.0.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), it is also the most recent data published by the ICE exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 7.1 th. contracts. Buyers and sellers were leaving the market. Sellers were doing it more actively. Sellers are still controlling the market.

Growth scenario: moved to December futures, expiration date October 31. Buying in this situation is not interesting.

Downside scenario: current levels can be used for short entry.

Recommendations for the Brent oil market:

Buy: no.

Sell: now (73.69), on approach to 76.00 and 77.00. Stop: 77.70. Target: 56.50. Count the risks!

Support — 67.43. Resistance — 74.70.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 488.

U.S. commercial oil inventories fell -1.63 to 417.513 million barrels, with -0.2 million barrels forecast. Gasoline inventories rose 0.069 to 221.621 million barrels. Distillate stocks rose 0.125 to 125.148 million barrels. Cushing storage stocks fell by -1.979 to 22.711 million barrels.

Oil production fell by -0.1 to 13.2 million barrels per day. Oil imports fell by -0.545 to 6.322 million barrels per day. Oil exports rose by 1.284 to 4.589 million barrels per day. Thus, net oil imports fell by -1.829 to 1.733 million barrels per day. Oil refining fell by -0.7 to 92.1 percent.

Gasoline demand increased by 0.298 to 8.776 million barrels per day. Gasoline production rose 0.284 to 9.661 million barrels per day. Gasoline imports fell -0.176 to 0.467 million barrels per day. Gasoline exports fell -0.199 to 0.737 million barrels per day.

Distillate demand rose 0.24 to 3.798 million barrels. Distillate production fell -0.153 to 5.056 million barrels. Distillate imports fell -0.063 to 0.138 million barrels. Distillate exports fell -0.145 to 1.378 million barrels per day.

Demand for refined products increased by 0.409 million barrels to 19.792 million barrels. Petroleum products production increased by 0.086 to 22.169 million barrels. Petroleum product imports fell -0.333 to 1.643 million barrels. Exports of refined products fell by -0.577 to 6.661 million barrels per day.

Propane demand fell by -0.216 to 0.607 million barrels. Propane production rose 0.003 to 2.705 million barrels. Propane imports fell -0.037 to 0.078 million barrels. Propane exports rose 0.016 to 1.849 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 34.9 th. contracts. There were no buyers. Sellers have sharply reduced their positions. Bulls are maintaining control.

Growth scenario: we switched to November futures, expiration date October 22. For now we forget about buying.

Downside scenario: current levels can be used for selling.

Recommendations for WTI crude oil:

Buy: no.

Sell: Now (71.00). Stop: 72.00. Target: 54.00.

Support — 64.52. Resistance — 72.88.

Gas-Oil. ICE

Growth scenario: we consider October futures, expiration date is October 10. Buying in this situation is not interesting.

Downside scenario: it will be interesting to sell when rising to 710.0. The current levels are undervalued, but from them you can look for opportunities to enter short on “hourly” intervals.

Gasoil Recommendations:

Buy: no.

Sell: when approaching 710.00. Stop: 730.00. Target: 505.00.

Support — 626.50. Resistance — 689.00.

Natural Gas. CME Group

Growth scenario: we switched to November futures, expiration date is October 29. We continue to hold longs. The target at 3.190 on the threshold of winter seems interesting.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: no. Who is in the position from 2.480 (taking into account the transition to a new contract) move the stop to 2.600. Target: 3.190 (3.600).

Sale: no.

Support — 2.617. Resistance — 2.901.

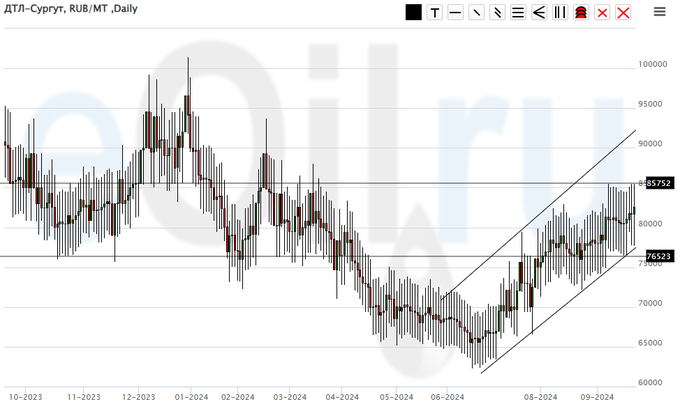

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 72000. Target: 100000!

Sale: no.

Support — 76523. Resistance — 85752.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 21172. Resistance — 33047.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1010. Resistance — 1537.

Growth scenario: we consider December futures, expiration date December 27. After coming out of consolidation upwards, buy on pullbacks.

Downside scenario: after analyzing the history, there are suspicions that we approached a strong resistance level. Let’s go short.

Gold Market Recommendations:

Buy: not yet.

Sale: now (2646). Stop: 2667. Target: 2200?!

Support — 2571. Resistance — 2646.

EUR/USD

Growth scenario: we see prerequisites for a move to 1.1400. Hold long. Fed rate cut by 0.5% will support the euro.

Downside scenario: the bet on dollar growth did not play out. Let’s take a break.

Recommendations on euro/dollar pair:

Buy: now (1.1160). Stop loss: 1.1090. Target: 1.1400 (1.2000).

Sale: no.

Support — 1.1068. Resistance — 1.1207.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. Nothing new. The market is able to go higher. We hold the long.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Those who are in position from 85976, move your stop to 88900. Target: 100000 (200000. Yes, yes, it is possible).

Sale: no.

Support — 90516. Resistance — 94411.

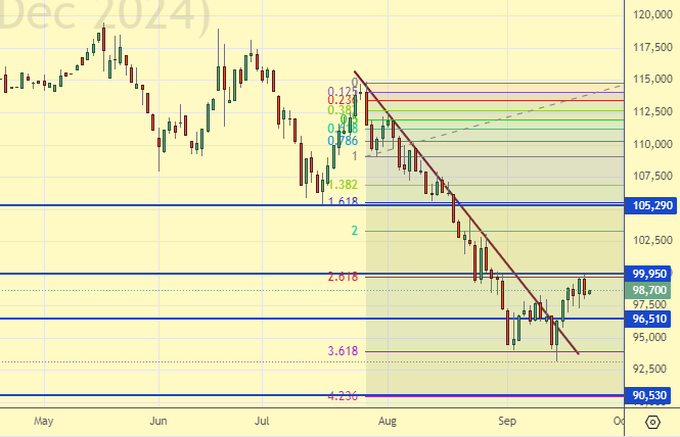

RTSI. MOEX

Growth scenario: we switched to December futures, expiration date December 19. We will buy when approaching 90600. Failure under 90600 will lead to panic dumping of shares.

Downside scenario: if the market gives, the entry to short from 105000 will be ideal. Taking into account the negative external background we have to work out the level of 100000.

Recommendations on the RTS index:

Buy: when approaching 90600. Stop: 90300. Target: 105000.

Sale: now (98700). Stop: 101700. Target: 90600 (76000?!). Or when approaching 105000. Stop: 107000. Target: 90600.

Support — 96510. Resistance — 99950.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.