|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-9-to-13-of-october-2023/629317/

|

Grain market:

It’s good that our athletes will not go to the Olympics in Paris. There were bugs there. Macron assured that there was nothing wrong, I mean, they don’t bite much. So some sprinter will naturally run to the finish line, as if bitten. He will also bring friends home.

Ah-ah, we are not in Paris. And we don’t need to go to Tel Aviv now either. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The first suspicions appeared that the wheat market had reached its bottom. Given the rising tensions in the world, grains may respond by rising prices. Current events in the Middle East, who do not know that Israel was attacked, could lead to the involvement of almost all states of the Old World, the Middle East and North America in the conflict. Russia and China, however, like India, have nothing special to do there. Maybe just a little bit.

Rising tensions around the world will only increase the tendency of states and individuals to stockpile food. It’s no longer strange to see videos on YouTube from some Czech Republic about which food products have a long shelf life. In the Russian-language segment, stories about how to preserve buckwheat for a long period already have the character of epics and legends.

Considering the rise in inflation in a number of countries, we can safely say that those who can afford to store grain for as long as possible may not receive a win, but save part of the funds, and better than in any bank. There will be continued growth in demand for elevators and other storage systems.

Reading our forecasts, you could take a downward move in the gold market from 1920 to 1832 dollars per troy ounce.

Energy market:

Saudi Arabia finds itself in a difficult situation due to an attack by militants from the Gaza Strip on Israel. Events will develop there, and most likely Israel will expand in a couple of years. It will be very difficult for the Saudi prince to restrain himself and not interfere. And it is necessary, because in exchange for an increase in oil production next year, the States, according to rumors, promised all sorts of carrots, including assistance with the development of peaceful nuclear energy.

Iran is also excited about attacking Israel, but it is also sitting on an oil needle. And how good everything was in Tehran a month ago. If the Persians get directly involved in the conflict, then Washington will dive headfirst into it. But this is political judo. Leaders of countries are now paying any price to satisfy their ambitions, and therefore we are facing very volatile days and weeks in the oil market. By the way, Russia is not so bad from what is happening now in the Middle East. You just need to gain your wits and remain silent. And Maduro is also good. His American comrades began to enrich him.

USD/RUB:

We are waiting for Elvira to raise the rate to 14% on October 27 (as if there were no extraordinary meeting of the Central Bank). This is understandable, there is nothing to be done, we must somehow remove the excess money supply into deposits, the same one that is now migrating in a continuous stream into the dollar. Dear Russians need to be offered an alternative for savings. You need to stop believing in Mr. Franklin, that is, in the 100 dollar bill.

It’s a pity, but we’ll most likely get 105.00, then 115.00. It is too early to talk about higher levels.

Regarding the ruble/dollar exchange rate, there are questions about foreign exchange earnings. A number of experts believe that it simply disappears somewhere abroad and does not return to the country or go through the stock exchange. Perhaps there are reasons for this, for example, sanctions, it’s more convenient, and the like, but ordinary citizens will not be able to cope with Turkish resorts at this rate next year.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are currently more open asset manager short positions than long positions. Sellers control the market. Over the past week, the difference between long and short positions of managers has increased by 3.2 thousand contracts. A small number of sellers appeared, there were no buyers. In general, the advantage remains with the sellers.

Growth scenario: we are considering December futures, expiration date is December 14. We grew from 540.0. The upward movement does not yet look clear. But we will have to buy based on technical factors.

Fall Scenario: This fall was expected. The only difficulty is that a sharp upward rebound can follow at any moment. We don’t sell.

Recommendations for the wheat market:

Purchase: Now. Stop: 548.0. Target: 650.0 (710.0). When approaching 515.0. Stop: 497.0. Target: 650.0 (710.0).

Sale: no.

Support – 552.2. Resistance – 580.4.

Corn No. 2 Yellow. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

There are more open short positions than long ones. Over the past week, the difference between long and short positions of managers decreased by 11.0 thousand contracts. Sellers left in small numbers. The growth of buyers was meager. Bears continue to control the market.

Growth scenario: we are considering December futures, expiration date is December 14. The place to shop is a mixed bag. You can enter with a close stop order.

Fall scenario: we don’t sell. It is better to work out a possible short from the current position on hourly intervals.

Recommendations for the corn market:

Purchase: Now. Stop: 484.0. Goal: 600.0. Or when approaching 425.0. Stop: 405.0. Goal: 600.0.

Sale: no.

Support – 490.1. Resistance – 499.6.

Soybeans No. 1. CME Group

Growth scenario: we are considering November futures, expiration date is November 14. Nothing new. Another new low. We continue to refrain from shopping.

Fall scenario: keep short. We have consolidated under 1281, the mark of 1190 awaits us ahead. Those who wish can increase their shorts a little, by 20%.

Recommendations for the soybean market:

Purchase: no.

Sale: no. If you are in a position from 1370, move your stop to 1312.0. Goal: 1190.0 (1000.0)!

Support – 1188.4. Resistance – 1281.6.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 20.6 thousand contracts. Buyers left the market in approximately the same volumes in which sellers came. The buyers’ advantage has become noticeably smaller.

Growth scenario: we are considering November futures, expiration date is November 30. Surprise. They fell hard. We will buy from 80.50. We are likely to have a volatile week in the oil market due to the attack on Israel.

Fall Scenario: Falling demand for gasoline in the US crashes the market. However, it is unlikely that we will be able to go below 80.00.

Recommendations for the Brent oil market:

Purchase: when approaching 80.00. Stop: 78.80. Goal: 104.00.

Sale: no.

Support – 80.34. Resistance – 89.29.

WTI. CME Group

US fundamentals: the number of active drilling rigs decreased by 5 to 497.

US commercial oil inventories fell by -2.224 to 414.063 million barrels. Gasoline inventories increased by 6.481 to 226.984 million barrels. Distillate inventories fell by -1.269 to 118.795 million barrels. Inventories at the Cushing storage facility increased by 0.132 to 22.09 million barrels.

Oil production remained unchanged at 12.9 million barrels per day. Oil imports fell by -1.014 to 6.215 million barrels per day. Oil exports increased by 0.944 to 4.956 million barrels per day. Thus, net oil imports fell by -1.958 to 1.259 million barrels per day. Oil refining fell by -2.2 to 87.3 percent.

Gasoline demand fell by -0.605 to 8.014 million barrels per day. Gasoline production fell by -0.313 to 8.826 million barrels per day. Gasoline imports increased by 0.209 to 0.919 million barrels per day. Gasoline exports increased by 0.023 to 0.837 million barrels per day.

Demand for distillates fell by -0.157 to 3.815 million barrels. Distillate production fell by -0.243 to 4.689 million barrels. Imports of distillates fell by -0.029 to 0.085 million barrels. Exports of distillates increased by 0.002 to 0.138 million barrels per day.

Demand for petroleum products fell by -0.984 to 19.157 million barrels. Production of petroleum products fell by -1.22 to 20.917641 million barrels. Imports of petroleum products increased by 0.613 to 2.013 million barrels. Exports of petroleum products increased by 0.221 to 6.544 million barrels per day.

Propane demand increased by 0.18 to 0.724 million barrels. Propane production increased by 0.023 to 2.626 million barrels. Propane imports fell -0.015 to 0.071 million barrels. Propane exports fell -0.007 to 0.127 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are currently more open long asset manager positions than short positions. Over the past week, the difference between long and short positions of managers decreased by 8.4 thousand contracts. There are slightly fewer buyers on the market, and there are no sellers. The bulls’ advantage narrowed slightly.

Growth scenario: we are considering November futures, expiration date October 20. Due to the conflict in the Middle East, it is extremely difficult to predict anything. But an increase in volatility is most likely guaranteed.

Fall scenario: went below 90.00, and then just fell. There are no interesting levels for sales. Off the market.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.70. Target: 83.00. Anyone in position from 83.50, keep a stop at 81.00. Goal: 91.00.

Sale: no.

Support – 76.06. Resistance – 83.35.

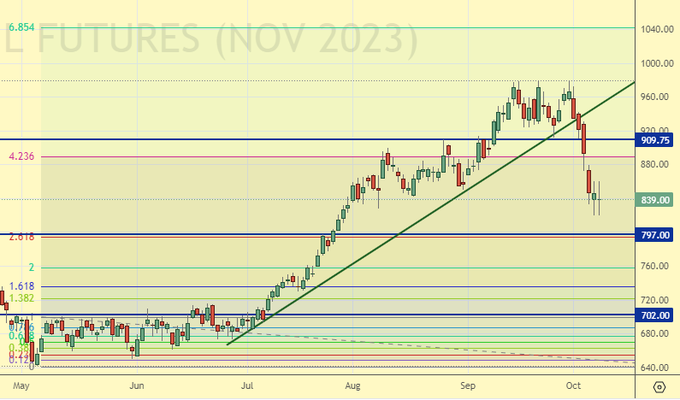

Gas-Oil. ICE

Growth scenario: we are considering November futures, expiration date is November 10. At this rate we can fall to 700.0. Let us note that the ban on the export of diesel from the Russian Federation does not concern the market.

Fall scenario: no interesting levels for sales. Off the market.

Recommendations for Gasoil:

Purchase: when approaching 700.00. Stop: 670.00. Goal: 830.00.

Sale: no.

Support – 797.00. Resistance – 909.75.

Natural Gas. CME Group

Growth scenario: switched to November futures, expiration date October 27. We waited a long time. But, apparently, not in vain. We continue to hold long.

Fall scenario: let’s see where the market goes. It is possible that we will rise above 4,000.

Natural gas recommendations:

Purchase: no. Who is in position from 2.137, 2.223 and 2.430, keep stop at 2.640. Goal: 6,000 (revised).

Sale: no.

Support – 3.087. Resistance – 3.483.

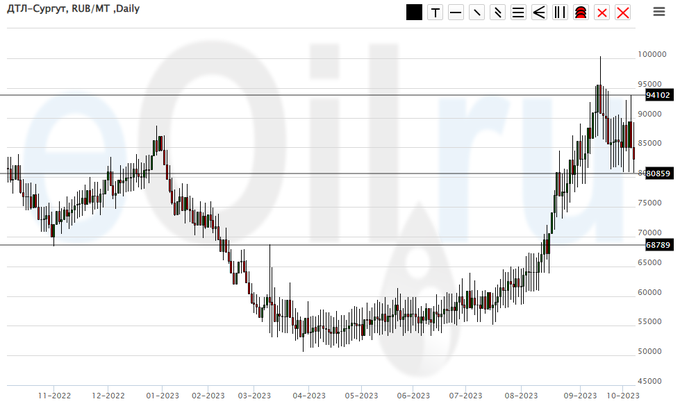

Diesel arctic fuel, ETP eOil.ru

Growth scenario: no changes. We are waiting for the price to drop to 70,000. It will be possible to buy there.

Fall scenario: knocked out of short. We will sell again.

Recommendations for the diesel market:

Purchase: think when approaching 70,000.

Sale: now. Stop: 93000. Target: 71000.

Support – 80859. Resistance – 94102.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: not yet on the market. We continue to count on falling prices.

Fall scenario: knocked out of short. We will sell again. I would like to see the market below 15,000.

Recommendations for the PBT market:

Purchase: no.

Sale: now. Stop: 23200. Target: 12000 (8000).

Support – 16328. Resistance – 23027.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we will refrain from commenting on this market. Liquidity should appear. We see that there are no offers at current prices.

Fall scenario: we continue to remain out of the market.

Helium Market Recommendations:

Purchase: no.

Sale: no.

Support – 3102. Resistance – 4000.

Gold. CME Group

Growth scenario: will have to buy, given the increasing chaos in the world.

Fall scenario: close positions at current levels and take a break.

Recommendations for the gold market:

Purchase: Now. Stop: 1809. Target: 2400.

Sale: no.

Support – 1811. Resistance – 1884.

EUR/USD

Growth scenario: for now we still remain in the falling channel. We are waiting for the approach to 1.0200. You can buy it there. However, if there is a rise above 1.0650, we will buy.

Fall scenario: we will keep shorts from 1.0600. We have chances to reach 1.0200, only now they are significantly less than a week ago.

Recommendations for the euro/dollar pair:

Purchase: in case of growth above 1.0650. Stop: 1.0530. Target: 1.2000. Or when touching 1.0220. Stop: 1.0120. Goal: 1.2000?!

Sale: no. If you are in a position from 1.0600, move your stop to 1.0650. Target: 1.0200.

Support – 1.0449. Resistance – 1.0755.

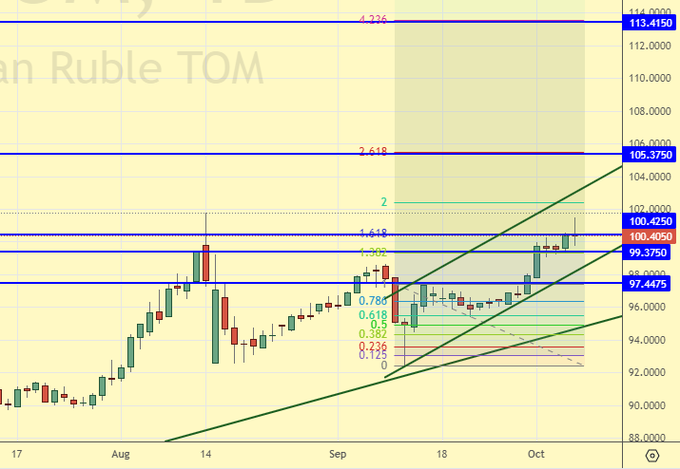

USD/RUB

Growth scenario: bulls have taken control of the market. Raising the Central Bank rate to 14% will not help. Eh, we wouldn’t turn into the Argentine peso.

Fall scenario: very difficult… Only if, in theory, we can retreat somewhere to 95.00. And then, this is perceived as an unlikely thing. We don’t sell.

Recommendations for the dollar/ruble pair:

Purchase: no. Anyone in position from 99.30, move the stop to 98.80. Target: 114.50!

Sale: no.

Support – 99.37. Resistance – 105.37.

RTSI

Growth scenario: we are considering December futures, expiration date is December 21. We froze at the upper border of the channel. There are prerequisites that shares in rubles will rise in price next week, but the weakening ruble will not allow the RTS index to rise much.

Fall scenario: we will continue to hold shorts from 105800 and 105000. We went below 100000, which may strengthen the position of sellers.

Recommendations for the RTS Index:

Purchase: no.

Sale: no. For those in positions between 105800 and 105000, move your stop to 102600. Target: 92000 (50000, 20000).

Support – 98260. Resistance – 101880.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.