|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-14-to-18-of-august-2023/624341/

|

Grain market:

Last week, the Luna-25 automatic station was launched into space, as well as the ruble. Each of the objects will have different trajectories. One will be landed on the pole of the moon, the second … it can be left in free flight, it is possible that the “wooden” one will head for the Sun, burn out there and become digital.

We are horrified by the close of Friday for the USD/RUR pair and now we believe in the afterlife, in the afterlife of the ruble. Hello!

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

The USDA has published a new harvest forecast for the 23/24 season. The numbers came out pretty good. There is a slight decrease, which can be attributed to hot weather in Europe, but overall the picture remains optimistic. Wheat: down 0.41% to 793.373 million tons. Corn: down 0.9% to 1213501. Soybeans: down 0.62% to 402.787 million tons.

Apparently, due to constant arrivals from the Ukrainian side, the work of ports in southern Russia was disrupted, which led to the collapse of the railway. Grain shipment rates slowed down. The volume is accumulating, which on paper can already be sold, but physically it remains in the territory of R. This fact will put pressure on prices in the Black Sea region and slightly raise them in Chicago if the situation is not resolved within a month. It is possible that until the cork resolves, wheat from the Russian Federation will go to Central Asia. Kazakhstan can close transit not only by road, which has already been done, but also by rail, protecting its farmers, who traditionally sell grain to the south.

Energy market:

Oil is holding up. The OPEC report pleases the bulls with forecasts of an increase in oil demand in the 4th quarter to 103 million barrels per day. In the 24th year, demand in the 4th quarter is already estimated at 105 million barrels per day.

These hopes are unlikely to come true, as China is experiencing deflation and its exports are falling. In the US and Europe, it has already fallen by more than 20% year-on-year. Due to overstocking, China reduces imports of raw materials. If the assembly shop of the planet rises, a chain reaction will begin.

According to the classics, at the moment when the rates in the US after the peak begin to decline, the world begins an economic crisis. It is unlikely that OPEC should paint such a rosy picture of the growth in demand for raw materials now. Not solid.

For Russia, the fall in demand for oil, which will inevitably be in the event of a crisis, is extremely dangerous, because in addition to falling prices, which can be avoided by further production cuts, there may come a moment when, on orders from London, India will stop buying Russian oil and will take it, as before, in the Middle East, and Russia will be artificially cut out of the economy of the entire civilization. The same thing will happen with oil, which has already happened with gas: Russian supplies will be replaced by other players.

USD/RUB:

Now for the ruble…

Well … apparently the budget will be balanced by any means. This year it will almost succeed. In the next, at such a pace as now, we will face a rate of 200, that is, we will again collapse twice. And so year after year: 400, 800, 1600… If this really happens, it will be worse than our expectations. The weakening of the ruble by 20-30% per year during the NWO would be a good option, and the people were morally ready for this. But 100% per year is too much.

We are waiting for autumn, in October, inflation in the region of 25% per annum (not yet galloping), which will be associated with rising prices for clothing and durable goods (prices for cars and electronics will rise especially strongly). Foodstuffs will remain affordable, but their prices will also continue to rise, and by December we will see a strong increase in the indices of all New Year’s salads, which by the end of the year will also be about 25% y-o-y.

We hasten to reassure that in the lower segment of luxury: medium-sized diamonds, non-collectible watches, daubs by unknown artists, antique furniture, prices will not rise so aggressively. At the same time, a multiple increase in prices in rubles will be observed in the upper segment.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 5.1 thousand contracts. Vendors enter the market. There are no new volumes from buyers. The spread between short and long positions widened. Sellers hold the edge.

Growth scenario: switched to the December futures, the expiration date is December 14th. A very seductive picture to start collecting a bullish position. We will refrain from active actions, we will buy only when we touch 635.0.

Fall scenario: sales are not possible due to the tense situation in the Black Sea.

Recommendations for the wheat market:

Purchase: on touch 635.0. Stop: 615.0. Target: 880.0.

Sale: no.

Support – 640.5 Resistance – 688.6.

Corn No. 2 Yellow. CME Group

We look at the volume of open interest of managers in corn. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

There are more open short positions than long ones. Last week the difference between long and short positions of managers increased by 45.7 thousand contracts. Vendors entered the market. Buyers lost interest in what was happening. The sellers have taken the lead. There are more of them.

Growth scenario: switched to the December futures, the expiration date is December 14th. Let’s take a break, let’s see if we can set a new low on the December contract (we managed to do it on the September contract).

Fall scenario: it makes no sense to sell. Out of the market.

Recommendations for the corn market:

Purchase: not yet.

Sale: no.

Support — 480.0. Resistance — 506.7.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We will continue to stop shopping. Out of the market.

Fall scenario: we hold the previously opened short from 1333. Stop order close.

Recommendations for the soybean market:

Purchase: no.

Sale: no. Who is in position from 1333, move the stop to 1338. Target: 1000.0?!

Support — 1256.5. Resistance — 1337.6.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 0.4 thousand contracts. Buyers and sellers entered the market in small volumes. The spread between long and short positions has widened, and the bulls continue to control the situation.

Growth scenario: consider the August futures, the expiration date is August 31. We continue to stay out of the market. There are no good levels for shopping.

Fall scenario: the market is clearly overbought. If the day closes below 86.00, you can sell. However, reduce your capital exposure to half of your standard level.

Recommendations for the Brent oil market:

Purchase: no.

Sale: if the day closes below 86.00. Stop: 87.70. Target: 78.30.

Support — 83.40. Resistance — 88.04.

WTI. CME Group

US fundamental data: the number of active drilling rigs has not changed and is 525 units.

Commercial oil reserves in the US increased by 5.851 to 445.622 million barrels, while the forecast was +0.567 million barrels. Inventories of gasoline fell -2.661 to 216.42 million barrels. Distillate inventories fell -1.706 to 115.447 million barrels. Inventories at Cushing rose 0.159 to 34.639 million barrels.

Oil production increased by 0.4 to 12.6 million barrels per day. Oil imports rose by 0.014 to 6.682 million barrels per day. Oil exports fell -2.923 to 2.36 million barrels per day. Thus, net oil imports increased by 2.937 to 4.322 million barrels per day. Oil refining increased by 1.1 to 93.8 percent.

Gasoline demand rose by 0.464 to 9.302 million barrels per day. Gasoline production increased by 0.092 to 9.921 million barrels per day. Gasoline imports fell -0.261 to 0.684 million barrels per day. Gasoline exports rose by 0.123 to 0.941 million barrels per day.

Demand for distillates fell by -0.064 to 3.762 million barrels. Distillate production increased by 0.05 to 4.911 million barrels. Distillate imports fell -0.048 to 0.065 million barrels. Distillate exports rose by 0.042 to 0.196 million barrels per day.

Demand for oil products rose by 0.704 to 20.727 million barrels. Production of petroleum products increased by 0.747 to 22.778 million barrels. Imports of petroleum products fell by -0.168 to 1.801 million barrels. Exports of petroleum products fell by -0.085 to 6.411 million barrels per day.

Propane demand fell -0.082 to 0.803 million barrels. Propane production increased by 0.187 to 2.687 million barrels. Propane imports rose by 0.025 to 0.104 million barrels. Propane exports fell by -0.119 to 0.07 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers increased by 6.4 thousand contracts. Buyers and sellers left the market, but sellers did it more actively. The advantage in the market remains with the bulls.

Growth scenario: consider the September futures, the expiration date is August 22. There is no point in buying at current levels. Out of the market.

Fall scenario: keep looking for sell levels as long as we are below 86.20. We sell if the day closes below 82.00.

Recommendations for WTI oil:

Purchase: no.

Sale: if the day closes below 82.00. Stop: 83.70. Target: 75.20. Count the risks!

Support — 81.83. Resistance — 86.06.

Gas-Oil. ICE

Growth scenario: we are considering the September futures, the expiration date is September 12. There is no point in shopping. Out of the market.

Fall scenario: Bulls are very convincing so far. Refrain from selling.

Gasoil recommendations:

Purchase: no.

Sale: no.

Support — 904.75. Resistance — ???

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. Nothing has changed in a week. Let’s continue to stand in the longs.

Fall scenario: do not sell. Only when approaching 4,000, you can think about entering the short.

Recommendations for natural gas:

Purchase: no. Who is in positions from 2.137, 2.223 and 2.430, move the stop to 2.320. Target: 3.900.

Sale: no.

Support — 2.476. Resistance is 2.759.

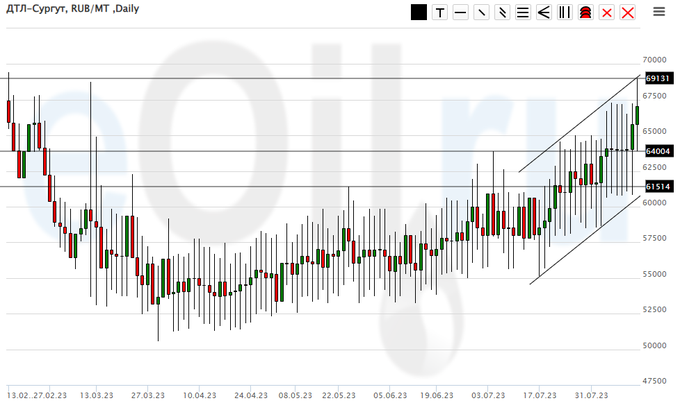

Diesel arctic fuel, ETP eOil.ru

Growth scenario: the situation has only become brighter over the week. New highs again. We keep long.

Fall scenario: do not sell. At the moment, there are no prerequisites for lowering fuel prices.

Diesel market recommendations:

Purchase: no. Who is in position from 55000, move the stop to 57000. Target: 80000.

Sale: no.

Support — 64004. Resistance — 69131.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: if the day closes above 15,000 you can buy.

Fall scenario: we do not make sales. Russia is on the threshold of strong inflation.

Recommendations for the PBT market:

Purchase: after day close above 15000. Stop: 13000. Target: 30000!

Sale: no.

Support — 12773. Resistance — 26582.

Helium (Orenburg), ETP eOil.ru

Growth scenario: the market has formed a growing channel, while prices are in it, we will keep long.

Fall scenario: do not sell. It is difficult to talk now about any fall in prices.

Recommendations for the helium market:

Purchase: no. Who is in position between 2900 and 3200, keep a stop at 3200. Target: 6000.

Sale: no.

Support — 3625. Resistance — 4914.

Gold. CME Group

Growth scenario: the market is falling. We do not make purchases.

Fall scenario: plunged deep. In case of a pass below 1910, a move to 1860 will become possible. However, there are no interesting levels for sales.

Recommendations for the gold market:

Purchase: no.

Sale: no.

Support — 1902. Resistance — 1945.

EUR/USD

Growth scenario: sellers did not allow the market to grow. For now, hold off on shopping.

Fall scenario: there are no interesting levels for sales. We do not sell.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: no.

Support — 1.0912. Resistance is 1.1064.

USD/RUB

Growth Scenario: The ruble is starting to look like the Turkish lira. Perhaps, but not a fact, when going to 115.00 we will close the long. In the meantime, aggressively tighten the stop.

Fall scenario: we will not sell. Out of the market.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 86.00, move the stop to 98.90. Target: 114.00.

Sale: no.

Support — 93.98. Resistance is 114.03.

RTSI

Growth scenario: we are considering the September futures, the expiration date is September 15th. Growth is not visible. We don’t buy.

Fall scenario: opened down at 102000, but further events cannot suit us. We sharply press the stop order.

Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 102000, move the stop to 102700. Target: 90000 (50000; 20000?!!!).

Support — 97600. Resistance — 104130.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.