|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-10-to-14-of-april-2023/613889/

|

Grain market:

The Turkish president advised European official Barrell not to give him advice on how to deal with Russia, and reminded that 44% of all grain that Europe buys goes through the Turkish straits. Why would such accurate statistics. It is 44%, not 45%. I wonder who will be the first from Europe to call Ankara and ask that Recep said this in the heat of emotion. He’s not serious. We, they say, are all in NATO.

Those who wish can cheer for Recep in the elections on May 14. Interesting insights sometimes come to him.

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms. Here an assessment of the situation in the world and Russian markets is given.

Egypt bought 600,000 tons of Russian wheat at $275 per ton plus $18-19 freight. What is happening is a little like a tender. Rather, these are preliminary negotiations, consideration of applications, and then subsequent negotiations. However, the volume is very good, so apparently our grain traders agreed to this price, especially since the fall of the ruble in recent weeks made this deal attractive.

Stocks of wheat inside the country are 17.6 million tons. This is a lot and the producers will not have time to fully unload. Nevertheless, the state is in a hurry to help with subsidies for sowing. In the current situation, we cannot afford a bad harvest.

The active import of Ukrainian grain caused strikes by farmers in Europe who are trying to protect their own right to profit, or rather to work. The consumer wins. Prices for bakery products in a number of countries (Poland, Germany) decreased significantly. For some items on the shelf in the store, the price drop was 30 — 40%.

Reading our forecasts, you could make money on the euro / dollar pair, taking a move up from 1.0600 to 1.0790. Target: 1.2000.

Energy market:

The cartel sent a signal to American speculators through production cuts after significant sales were recorded in the market. Like, do not be impudent, comrades, or rather gentlemen — pirates. In fact, the spot market will easily beat the futures market, no matter what the amounts are spinning there. In Chicago, they thought, but the market is still being held and it is not allowed to go above Monday’s levels. Apparently, an order was received from the Democratic Party — to crush prices. And they don’t push.

However, Americans who dream of low prices can be helped here by their own economy, which has begun to lose growth since last year. For the fourth quarter, the US grew by 2.6% per annum, which is 0.6% per annum less than a quarter ago. Such figures may spoil the mood of investors and they will begin to put everything in a row on the fall in oil prices.

The cartel is unlikely to retreat yet. More production cuts cannot be ruled out in the event of a new attempt to lower prices.

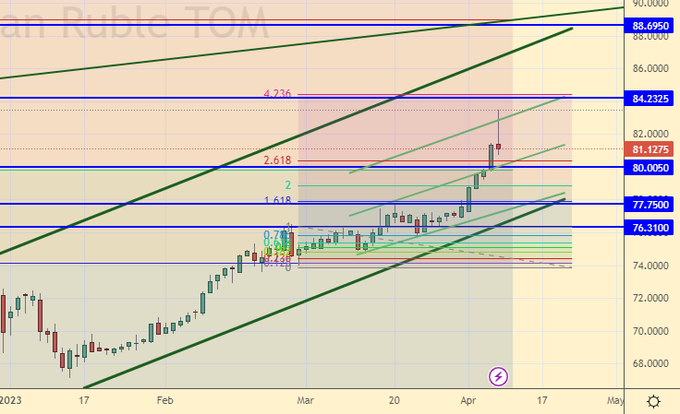

USD/RUB:

The ruble gave us an extremely gloomy week, which ended with Mr. Siluanov’s soothing speeches that the budget deficit for three months was only 2.5 trillion. rubles, because taxes managed to collect 2.5 trillion. Income tax and severance tax gave a significant increase. March will be uneventful.

Having received these statistics, which appeared more than ever on time, the ruble moved away from the 84.00 area. Nevertheless, the ruble’s downward trend remains. Analysts are very skeptical about the prospect of continued strengthening of the ruble after Friday’s sharp pullback from the highs.

We can cool down to 78.00, but we should not expect a deep correction until we reach 88.00. We are forced to look up the pair, as oil and gas revenues are falling, and defense spending has risen sharply at the beginning of the year.

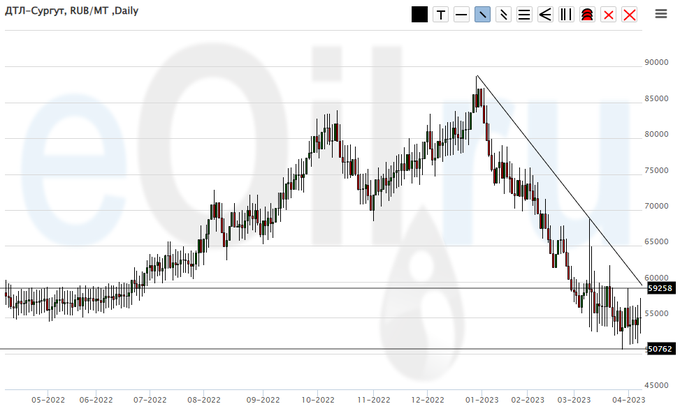

Arctic diesel fuel (Surgut), ETP eOil.ru

Growth scenario: continue to recommend buys. We see that buyers are ready to take at current prices. We are forming support around 50,000. We are able to return to 65,000. Some kind of «tax maneuver» may affect the rise in prices. We have a hole in our budget.

Fall scenario: sales are not interesting. It is unlikely that a ton of fuel will cost less than 50,000 in the near future.

Diesel market recommendations:

Purchase: now. Stop: 49000. Target: 65000 (70000). Count the risks. Whoever is in position from 55000, keep the stop at 49000. Target: 65000 (70000).

Sale: no.

Support — 50762. Resistance — 59258.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: it is worth holding buys from 5000. While there are no big chances of taking 11300 and continuing to grow, it is better than closing with a negligible profit.

Fall scenario: we continue to refuse sales. There are no interesting levels to enter shorts.

Recommendations for the PBT market:

Purchase: now. Stop: 3700. Target: 15000 (20000). Who is in position from 5000, move the stop to 3700. Target: 15000 (20000). Count the risks.

Sale: no.

Support — 4053. Resistance — 11304.

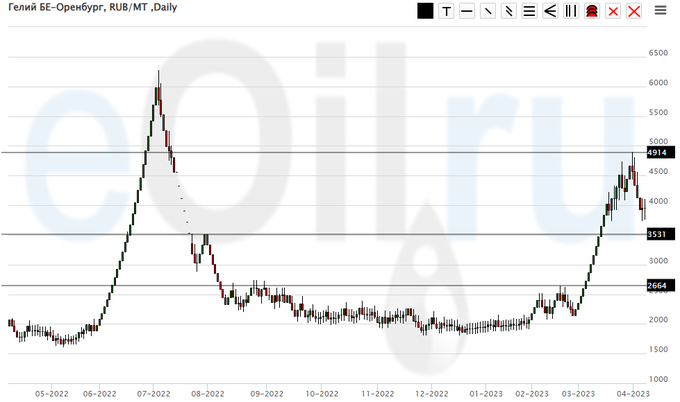

Helium (Orenburg), ETP eOil.ru

Growth scenario: if prices go to the 2700 area, then it will be possible to buy. Buying from current levels looks overpriced.

Fall scenario: you can keep an open short from 4500. It makes sense to move the stop a little lower and take profit on 20% of the position volume.

Recommendations for the helium market:

Purchase: when approaching 2700. Stop: 2400. Target: 5000.

Sale: not. Who is in position from 4500, move the stop to 4600. Target: 2800.

Support — 3531. Resistance — 4914.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 2.9 thousand contracts. Vendors were reluctant to leave the market. Buyers have not changed their position size in a week. The spread between short and long positions narrowed slightly. Sellers keep the edge.

Growth scenario: consider the May futures, the expiration date is May 12. Extremely attractive picture for shopping. It makes sense to enter with slightly larger volumes than usual. Target 765.0 cents per bushel.

Fall scenario: we continue to talk about the need for growth to 765.0. The current drop is completely optional. We will not sell from current levels.

Recommendations for the wheat market:

Purchase: now. Stop: 664.0. Target: 765.0. It can be aggressive. Who is in position from 692.0, keep the stop at 664.0. Target: 765.0.

Sale: when approaching 765.0. Stop: 774.0. Target: 600.0.

Support — 670.6. Resistance — 692.6.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers have regained the advantage. Last week, the difference between long and short positions of managers increased by 38,000 contracts. The change is significant. The sellers fled. Buyers entered the market.

Growth scenario: consider the May futures, the expiration date is May 12. When approaching 638.0 it is worth buying. Perhaps the appearance of a price branch up to 680.0.

Fall scenario: the market rolled back. To confirm the seriousness of intentions, we should fall below 630.0. Keep shorts.

Recommendations for the corn market:

Purchase: when approaching 638.0. Stop: 632.0. Target: 680.0.

Sale: no. Who is in position from 688.0 and 660.0, move the stop to 667.0. Target: 550.0 cents per bushel.

Support — 638.6. Resistance — 660.0.

Soybeans No. 1. CME Group

Growth scenario: consider the May futures, the expiration date is May 12. We will continue to refuse purchases, as we see the market is much lower.

Fall scenario: we continue to short soybeans as this is the most correct behavior with a 30% crop growth last year. The demand for it cannot be colossal now.

Recommendations for the soybean market:

Purchase: when approaching 1360.0. Stop: 1340.0. Target: 1420.0.

Sale: no. Who is in position from 1510.0, keep the stop at 1528.0. Target: 1360.0 (1000.0) cents per bushel.

Support — 1468.4. Resistance — 1514.0.

Brent. ICE

Growth scenario: we are considering the April futures, the expiration date is April 28. We see a big gap at 85.50 on Monday. Most likely it will be closed. The only question is when. Now or after the move to 89.20.

Fall scenario: the current area is interesting for sales. If we go even higher, we will definitely sell from 89.20.

Recommendations for the Brent oil market:

Purchase: no. Who remained in the position from 70.10, keep the stop at 76.80. Target: 110.00. It is possible to reduce the position by 25%.

Sale: now. Stop: 85.70. Target: $66.64 per barrel.

Support — 83.40. Resistance is 85.51.

WTI. CME Group

Fundamental US data: the number of active drilling rigs fell by 2 units to 590 units.

US commercial oil inventories fell by -3.739 to 469.952 million barrels, while the forecast was -2.329 million barrels. Inventories of gasoline fell -4.119 to 222.575 million barrels. Distillate inventories fell -3.632 to 113.051 million barrels. Inventories at Cushing fell -0.97 to 34.247 million barrels.

Oil production has not changed and is 12.2 million barrels per day. Oil imports rose by 1.819 to 7.144 million barrels per day. Oil exports rose by 0.655 to 5.239 million barrels per day. Thus, net oil imports rose by 1.164 to 1.905 million barrels per day. Oil refining fell by -0.7 to 89.6 percent.

Gasoline demand rose by 0.15 to 9.295 million barrels per day. Gasoline production fell -0.187 to 9.851 million barrels per day. Gasoline imports fell by -0.16 to 0.713 million barrels per day. Gasoline exports rose by 0.033 to 0.859 million barrels per day.

Demand for distillates rose by 0.527 to 4.24 million barrels. Distillate production increased by 0.107 to 4.74 million barrels. Distillate imports fell -0.031 to 0.115 million barrels. Distillate exports rose by 0.108 to 1.134 million barrels per day.

Demand for petroleum products increased by 0.123 to 20.599 million barrels. Production of refined products fell by -1.217 to 20.991 million barrels. Imports of petroleum products fell by -0.361 to 1.914 million barrels. Exports of petroleum products fell by -0.108 to 5.93 million barrels per day.

Demand for propane rose by 0.21 to 1.301 million barrels. Propane production increased by 0.046 to 2.416 million barrels. Propane imports fell by -0.05 to 0.122 million barrels. Propane exports fell -0.488 to 1.314 million barrels per day.

We look at the volumes of open interest on WTI. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 68.3 thousand contracts. The change is significant. Sellers actively left the market, buyers went on the attack. The spread between long and short positions widened. Bulls continue to control the situation.

Growth scenario: we are considering the May futures, the expiration date is April 20. The market went up to 81.80. Current levels for purchases are not interesting. If we fall to 75.00, we can go long.

Fall scenario: from 84.00 it makes sense to sell. The current levels are extremely inconvenient for short entry.

Recommendations for WTI oil:

Purchase: when approaching 76.00. Stop: 73.00. Target: 96.00. Count the risks.

Sale: now and when approaching 78.00. Stop: 79.70. Target: $60.10 per barrel. Count the risks.

Support — 75.75. Resistance is 81.84.

Gas-Oil. ICE

Growth scenario: we are considering the May futures, the expiration date is May 11. Fuel resists growth. Does everyone have everything? We keep the long, but tighten the stop orders. We will likely continue to grow.

Fall scenario: holding shorts has become mentally unpleasant. Since we have shorts from 900.0, we can afford to be patient for some more time. Moreover, we are at breakeven.

Gasoil recommendations:

Purchase: no. Who is in position from 790.0, move the stop to 740.0. Target: 1000.0. Count the risks.

Sale: no. Who is in position from 900.0, keep the stop at 810.0. Target: 670.0.

Support — 753.50. Resistance is 808.00.

Natural Gas. CME Group

Growth scenario: we are considering the May futures, the expiration date is April 26. Our attempts to enter the long do not bring results. The market continues to fall. We take a break in trading for a week.

Fall scenario: we will not sell. Prices were low and now even lower. Out of the market.

Recommendations for natural gas:

Purchase: no.

Sale: no.

Support — 1.000. Resistance — 2.243.

Gold. CME Group

Growth scenario: we can continue the upward movement without pauses and rollbacks. Much will depend on the prospects for the suspension of the growth rate in the US. If the Fed changes its tone from hawkish to dovish, then we will see a continuation of the rise in the price of gold.

Fall scenario: sales from 2060 can be tried. The prospects for correction are not great, but the profit / risk ratio allows you to enter into such transactions.

Recommendations for the gold market:

Purchase: no. If you are in position from 1960, move your stop to 1970. Target: $2500 (3000) per troy ounce.

Sale: approaching 2060. Stop: 2080. Target: 1600.

Support — 1961. Resistance — 2057.

EUR/USD

Growth scenario: the market has an unpleasant equilibrium near the previous local maximum. We are able to go higher as the problems with the dollar intensify. The weakening US labor market may push the pair higher. We will buy after growth above 1.1035.

Fall scenario: here you need to go short. Rollback to 1.0470 is possible. A visit to the level of 1.0100 is also possible.

Recommendations for the EUR/USD pair:

Purchase: after rising above 1.1035. Stop: 1.0940. Target: 1.1930.

Sale: now. Stop: 1.1035. Target: 1.0100.

Support — 1.0786. Resistance is 1.1025.

USD/RUB

Growth scenario: The story progresses upward faster than we thought. Even the rise in oil prices does not help. We can roll back to 77.80 after which the upward movement will resume to 88.70.

Fall scenario: we will not sell. The market pulled back sharply and gave no chance to sell at good levels. Out of the market.

Recommendations for the dollar/ruble pair:

Purchase: no. Who is in position from 76.70, move the stop to 77.40. Target: 88.70.

Sale: no.

Support – 80.00. Resistance — 84.23.

RTSI

Growth scenario: we are considering the June futures, the expiration date is June 15. The weakening ruble does not allow the RTS index to raise its head. If in rubles Russian papers are steadily drawing an uptrend, then in dollars nothing works. I want to buy, but we will not do it.

Fall scenario: we will continue to recommend sales. Entering shorts from 100,000 looks natural. Keep open shorts.

Recommendations for the RTS index:

Purchase: no.

Sale: when approaching 100,000. Stop: 101,200. Target: 80,000 (50,000, then 20,000) points. Who is in position from 106000, 103000, 101000 and 98000, keep the stop at 101200. Target: 80000 (50000, then 20000) points.

Support — 96490. Resistance — 100870.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.