|

Отчеты

|

https://exp.idk.ru/analytics/report/price-forecast-from-25-to-29-of-july-2022/592989/

|

Grain market:

Hello!

Turkey signed a memorandum on the supply of Ukrainian grain to the world market. This event pushed prices down. But now it will be harder and harder to go down with every cent.

The harvest promises to be rich, so there should be no unrest among buyers. Sellers would benefit now from the hype, but among traders there is a growing understanding that there will be enough grain for everyone. Hence, it is difficult to assume that by winter, after the fall, which is unfolding before our eyes, the market will be able to rise above the current values by more than 10%.

In terms of speculation, buying from 650.0 cents per bushel in wheat and 420.0 cents per bushel in corn would be ideal. Domestic exporters are preparing for the fact that while the US dollar is worth 55 rubles, the proceeds in rubles from exports will be ridiculous.

Reading our forecasts, you could make money on the euro/dollar pair by taking a downward move from 1.0600 to 1.0120 points.

Energy market:

«Countries that impose a ceiling on the price of Russian oil will not be able to receive it», say powerful figures in the Russian government one after another.

Outrageous things are happening before our eyes: it turns out that where the market is not beneficial to Washington, it must cease to exist.

But what about competition, free pricing, balance of supply and demand?

But no way. The truth is that there are many ways to make money.

The Western world needs more fossil fuels. The environmental agenda is no longer in vogue. Need cheap gas? «So … fly to the Mars,» is what one wants to say to them.

Europe has already allowed Russia to supply oil to third countries so that there is no shortage anywhere. And she herself, the Old Woman, calmly buys what Sovcomflot supplies her, which is under sanctions, only under the Liberian flag. Well, that’s it… And everyone is good from Russian oil, and not just the Indians and the Chinese.

But in June, oil from Russia was not supplied to Japan. Well, okay.

After Biden’s disgusting trip to our incredibly dear Prince Salman, may his sorrows never be overcome, the Western world cannot count on cheap hydrocarbons. Oil below $90 per barrel is not yet visible, but a fall to this level is possible.

Note that if the data on US GDP for the second quarter at the end of the week comes out worse than expected, then oil may look at the level of 80.00 dollars per barrel.

USD/RUB:

The rate cut by the Central Bank of the Russian Federation by 1.5% did not lead to the weakening of the ruble. It must be admitted that the situation in the economy is better than expected. The trade balance continues to be positive. Inflation is slowing down. Nabiullina promised to lower the rate further. Cheap money should help deal with the shock of February 24 this year.

The losses of the West due to the sanctions turned out to be very sensitive. No one will completely block Russian exports, which means that the inflow of foreign currency into the country will remain at a high level.

Four governments have already reformed in Europe: Great Britain, Italy, Bulgaria and Estonia, and we have not even started anything yet. Comrade Scholz from Germany is still ripening, but he is already on the way.

In addition, the elections to the US Congress are coming soon, and then the impeachment of Biden, and everyone is at the negotiating table. By winter, we are waiting for the return of Visa and Mastercard payment systems to the country with apologies and reduced service fees, as well as the release of funds from the Central Bank of the Russian Federation. Let’s buy something with that money. Maybe some state.

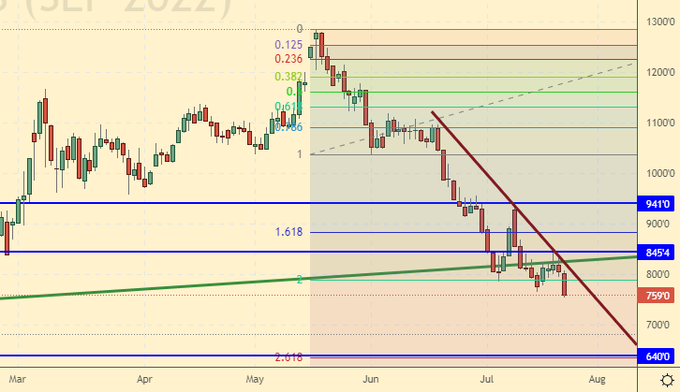

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 1.1 thousand contracts. Both buyers and sellers entered the market. At the same time, there are more bears on the market at the moment.

Growth scenario: consider the September futures, the expiration date is September 14th. While we do nothing. We are waiting for the arrival of prices at the level of 650.0 cents per bushel. We will buy there.

Fall scenario: yes, we are falling, but there are no interesting options for entering shorts. Out of the market.

Recommendations for the wheat market:

Purchase: when approaching 650.0. Stop: 630.0. Target: 860.0 cents per bushel.

Sale: no.

Support — 640.0. Resistance — 845.4.

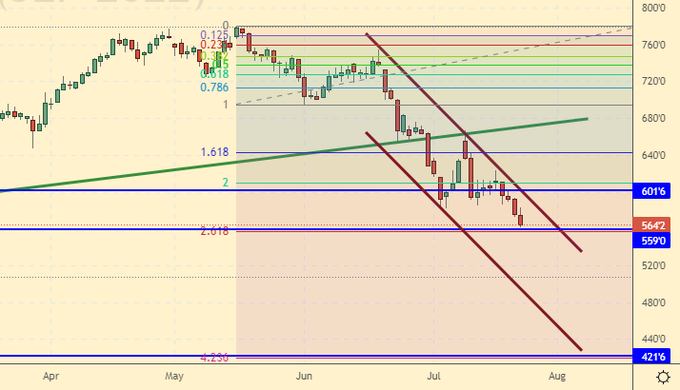

Let’s look at the volumes of open interest of corn managers. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

Last week the difference between long and short positions of managers decreased by 25.2 thousand contracts. The bulls are fleeing the market.

Growth scenario: consider the September futures, the expiration date is September 14th. We came to an interesting area for shopping. If there is a green daily candle, you can buy. We do not have high hopes for the long. The market may continue to fall. Fall scenario: we will not sell from current levels. Yes, the market may fall to the level of 420.0 cents per bushel, but this assumption is better to work out on a small time scale. Our recommendation for daily candle trading is out of the market for the time being.

Recommendations for the corn market:

Purchase: when a green daily candle occurs. Stop: 540.0. Target: 685.0 cents per bushel.

Sale: no.

Support — 559.0. Resistance — 601.6.

Soybeans No. 1. CME Group

Growth scenario: consider the September futures, the expiration date is September 14th. Basically, nothing has changed. We remain out of the market. Judging by the behavior of palm oil, a further fall is possible.

Fall scenario: we continue to believe that there is a threat of a market collapse. You can look for sales opportunities.

Recommendations for the soybean market: Purchase: no.

Sale: now and on the rise to 1370.0. Stop: 1396.0. Target: 1150.0 cents per bushel.

Support — 1146.2. Resistance — 1457.2.

Sugar 11 white, ICE

Growth scenario: consider the October futures, the expiration date is September 30th. Let’s commend ourselves for our endurance. We did everything right: we did not go long. We remain out of the market.

Fall scenario: holding shorts. The market may leave at 15.20.

Recommendations for the sugar market:

Purchase: not yet.

Sale: no. Who are in positions from 19.40 and 19.00, move the stop to 19.10. Target: 15.20 cents a pound.

Support — 17.69. Resistance — 18.74.

Сoffee С, ICE

Growth scenario: we are considering the September futures, the expiration date is September 20. Let’s remove the recommendation to buy from the level of 180.00. Rather, it will have to be done from the level of 140.00.

Fall scenario: we will keep the previously open shorts. Stop at 220.0 survived. Let’s set a more aggressive target below: 140.00 cents per pound. Those interested can sell here.

Recommendations for the coffee market:

Purchase: when approaching 140.00. Stop: 120.00. Target: 180.00 cents per pound.

Sale: now. Stop: 220.0. Target: 140.00. Who is in position from 225.0, keep the stop at 220.00. Target: 140.00 cents per pound.

Support — 191.40. Resistance is 218.85.

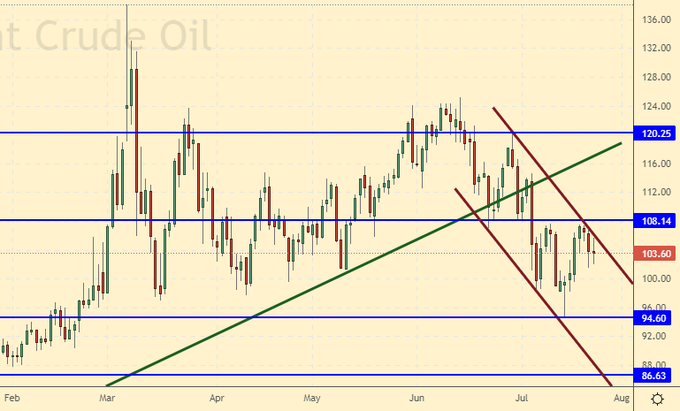

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers has increased by 10 thousand contracts. Bulls are trying to regain the initiative.

Growth scenario: consider the August futures, the expiration date is August 31. As long as the level of $108 per barrel holds, we will not see a large number of bulls on the market. We do not open new longs, we keep the old ones.

Fall scenario: it makes sense to continue to hold the short opened earlier from the level of 120.0. A fall to the area of 90.00 dollars per barrel is visible. It is possible to argue about the fall to the area of 80.00. Recommendations for the Brent oil market: Purchase: no. Who is in position from 100.00, keep the stop at 97.00. Target: $140.00 per barrel.

Sale: no. Those in positions between 117.00 and 120.00 keep the stop at 113.00. Brent target: $80.00 per barrel.

Support — 94.60. Resistance is 108.14.

WTI. CME Group

Fundamental US data: the number of active drilling rigs has not changed and is 599 units.

US commercial oil inventories fell by -0.445 to 426.609 million barrels, while the forecast was +1.357 million barrels. Inventories of gasoline rose by 3.498 to 228.435 million barrels. Distillate inventories fell -1.295 to 112.508 million barrels. Inventories at Cushing rose by 1.143 to 22.789 million barrels.

Oil production fell by -0.1 to 11.9 million barrels per day. Oil imports fell by -0.156 to 6.519 million barrels per day. Oil exports rose by 0.735 to 3.759 million barrels per day. Thus, net oil imports fell by -0.891 to 2.76 million barrels per day. Oil refining fell by -1.2 to 93.7 percent.

Gasoline demand rose by 0.459 to 8.521 million barrels per day. Gasoline production increased by 0.447 to 9.368 million barrels per day. Gasoline imports rose by 0.15 to 0.865 million barrels per day. Gasoline exports fell -0.034 to 0.806 million bpd.

Demand for distillates rose by 0.329 to 3.697 million barrels. Distillate production fell -0.102 to 5.031 million barrels. Distillate imports fell -0.015 to 0.122 million barrels. Exports of distillates rose by 0.121 to 1.642 million barrels per day.

Demand for petroleum products rose by 2.305 to 21.025 million barrels. Production of petroleum products increased by 1.099 to 22.736624 million barrels. Imports of petroleum products fell by -0.025 to 2.174 million barrels. Exports of petroleum products fell by -0.226 to 5.601 million barrels per day.

Demand for propane rose by 0.576 to 1.133 million barrels. Propane production fell -0.074 to 2.347 million barrels. Propane imports fell by -0.02 to 0.081 million barrels. Propane exports fell by -0.457 to 1.095 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week the difference between long and short positions of managers increased by 10.9 thousand contracts. We see a little pressure from the bulls, nothing more.

Growth scenario: consider the September futures, the expiration date is August 22. Despite the bad Thursday and Friday for the bulls, attempts to break above the 100.00 level cannot be ruled out. We keep the open long.

Falling scenario: prices are in a falling channel, we keep open shorts in anticipation of a fall in the market to the levels of 80.00 and 70.00 dollars per barrel.

Recommendations for WTI oil:

Purchase: no. Who is in position from 95.00, move the stop to 89.00. Target: $130.00 per barrel.

Sale: no. Those in positions from 114.00, 108.00 and 106.00, move the stop to 106.30. Target: $70.00 per barrel.

Support — 88.22. Resistance — 100.98.

Gas-Oil. ICE

Growth scenario: we are considering the August futures, the expiration date is August 11. While out of the market. The situation for the bulls is bad.

Fall scenario: we will continue to hold the previously open shorts. Moreover, those who wish can increase their positions here.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position between 1320.0 and 1180.0, move the stop to 1130.0. Target: $850.0 per ton!

Support — 998.75. Resistance is 1131.25.

Natural Gas. CME Group

Growth scenario: we are considering the September futures, the expiration date is August 29. We will hold our positions. We expect that the market demand will continue to grow, as the weather is hot. Moreover, winter is coming.

Fall scenario: we continue to refuse to enter the short. The global gas situation remains tense. Recommendations for natural gas:

Purchase: no. Who is in position between 6.000 and 5.500, move the stop to 6.200. Target: $15,000 for 1 million BTUs.

Sale: no.

Support — 6.670. Resistance is 8.747.

Gold. CME Group

Growth scenario: our stop at 1670 survived. We keep long. We are waiting for growth to 1800 dollars per troy ounce.

Fall scenario: for the time being, we will refrain from shorts. We are waiting for the rise to 1800. Recommendations for the gold market:

Purchase: no. Those in positions between 1695 and 1700 move the stop to 1690. Target: 1800 (2300!). Sale: up to 1800. Stop: 1830. Target: $1,612 a troy ounce.

Support — 1680. Resistance — 1804.

EUR/USD

Growth scenario: The ECB raised the rate by 0.5%, but this euro decision did not help. On Wednesday, the US Federal Reserve meeting, most likely after it, the pair will continue to fall. We don’t buy.

Fall scenario: we continue to assume that the pair is able to go to 0.9700. New positions can be opened from 1.0350.

Recommendations for the EUR/USD pair: Purchase: no.

Sale: when approaching 1.0350. Stop: 1.0430. Target: 0.9700.

Support — 1.0122. Resistance is 1.0363.

USD/RUB

Growth scenario: lowering the rate of the Central Bank of the Russian Federation to 8% did not help the dollar. Pressure from exporters on the pair, which sell foreign exchange earnings, remains. At the same time, from a technical point of view, the level of 55.00 is a good area for buying the US currency. Those who wish can enter long. Who bought the dollar against the ruble from 54.00 hold positions.

Fall scenario: the Russian government will resist further strengthening of the ruble. We do not sell.

Recommendations for the dollar/ruble pair:

Purchase: now and when approaching 53.70. Stop: 52.70. Target: 73.00 rubles per dollar. Who is in position from 54.00, keep the stop at 52.70. Target: 73.00 rubles per dollar.

Sale: no.

Support — 53.71. Resistance — 59.00.

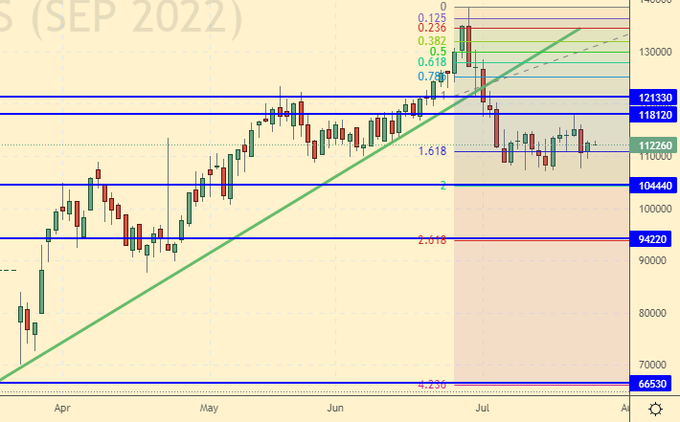

RTSI

Growth scenario: the stock market did not react in any way to the rate cut by the Central Bank. According to the classics, he should have grown, but nothing happened. Sales problems for Russian metallurgists and oilmen remain. If hydrocarbon exporters can count on an improvement in the situation, then metallurgists are currently in an extremely bad position due to Western sanctions. They don’t have a market right now. For the given day and hour we refrain from going long on the RTS index. If Sberbank starts showing signs of life, then we will revise our recommendations.

Fall scenario: we continue to hold short positions. The RTS index may touch the level of 120,000 points, but it is unlikely to succeed in rising higher. Recommendations for the RTS index:

Purchase: no.

Sale: no. Who is in position from 129000, keep stop at 123000. Target: 9400 0 points.

Support — 104440. Resistance — 118120.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.