Price forecast from 8 to 12 July 2024

Grain market:

During the FIFA World Cup in Germany, it was established by millions of fans that beer is not alcohol. By the way, the soccer there is so poor in quality, but that’s okay, you can gather and listen to the chants of a choir of boys with unnaturally high voices. Beer comes first, events can be anything.

This also applies to the market, any news is good for a beer. Especially in summer, especially in the heat. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

What can support the grain market amid good forecasts? Only a weak dollar. And this is still a question: whether it will be weak or not. Despite all the woes of American finances, it is better not to look at the other balances of developed countries, yes, there is Norway, but it is one. Therefore, we should not expect much help from the dollar to support prices. If it weakens against other currencies, it will weaken only by 3-5%.

Wheat paused its fall and claims to recover to 625.0, but it will be hard to grow further. If there is a rebound to 635.0, that would set the stage for a move to 650.0. But this will happen only if USDA on July 12 will give us a drop in gross harvest, something around 780 million tons, which is unlikely, as the problems in Russia are compensated by other countries.

The corn market is likely to touch 390.0 then bounce up. This will happen if USDA data does not show an increase in gross harvest. The estimates are already optimistic there, so where is the upside? If we still see figures much higher than 1200 million tons, then we are waiting for 370.0, and this is already extremely painful levels for farmers.

Energy market:

Brent has become overbought over the week. It is too early to say that we should definitely fall from current levels, as US stocks are melting, but we can count on a $5 pullback.

What are our fears? Rather, there is only one: OPEC discipline may break down. Some will want more freedom, for example Iraq, and so far only Kazakhstan is helping them. The story with quota overruns is likely to be quickly extinguished and the violators will be forced to listen to the «voice of reason».

In general, we note that as long as the West manages to demonstrate GDP growth (artificial intelligence to help), the demand for oil will remain at high levels, so Brent prices will be above 80.00.

USD/RUB:

Oh, we’re gonna hook up with Iran! Business-wise. Their payment system, our payment system. And let the whole world wait. We give them oil, they give us oil, we give them gas, they give us gas. We give them gold and they give us gold. Everything is good, but we have nothing to change from each other. No, we have: we give them wood, they give us carpets and airplane carpets. Tea bowls again.

Fears: how Nabiullina might not slow down with the rate hike, which everyone is waiting for. And then one day, it will not happen. Because then the loan will be very expensive. If the fight against inflation is our first priority, then we will see both 20% and 25% rates. And most importantly, it will not help in any way. It is possible that the choice will be made (even if not tomorrow) not in favor of fighting inflation, but in favor of preserving acceptable conditions for the functioning of the economy.

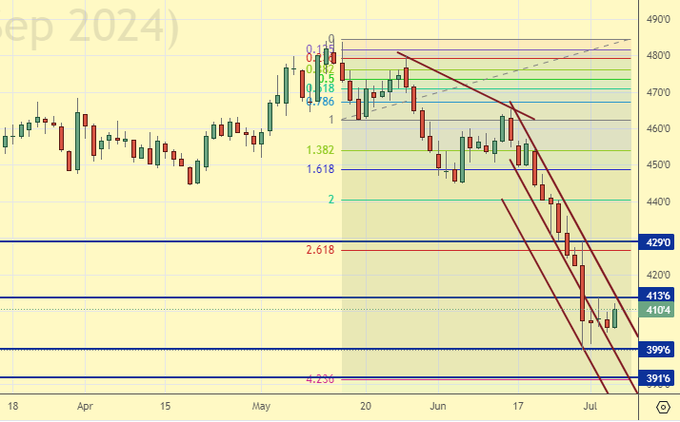

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 14.3 th. contracts. Buyers were entering the market a little bit at a time. Sellers were increasing volumes much more actively. Bears strengthened their control.

Growth scenario: we consider September futures, expiration date September 13. There is a hint of recovery. It is possible to buy, however, the deal does not look too good in terms of profit/risk ratio.

Downside scenario: without upward correction, medium-term sales are not safe. Outside the market.

Recommendations for the wheat market:

Buy: now (590.4). Stop: 577.0. Target: 625.0.

Sell: thinking when approaching 625.0.

Support — 571.4. Resistance — 626.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 86.9 thnd contracts. Sellers have torn up the market, buyers have fled. The bears have stepped up their control again.

Growth scenario: we consider September futures, expiration date September 13. Against the background of good expectations for the harvest, we do not buy yet.

Downside scenario: we continue to keep shorting. The 390.0 mark is already looming in front of us.

Recommendations for the corn market:

Buy: when approaching 393.0. Stop: 380.0. Target: 445.0.

Sell: no. Those who are in position from 463.0, move the stop to 430.0. Target: 393.0.

Support — 399.6. Resistance — 413.6.

Soybeans No. 1. CME Group

Growth scenario: we consider September futures, expiration date September 13. Do not buy. Expectations for gross soybean harvest are excellent.

Downside scenario: we were knocked out of our shorts by a trailing stop order. We are not opening new positions downwards yet.

Recommendations for the soybean market:

Buy: no.

Sale: no.

Support — 1094.0. Resistance — 1147.2.

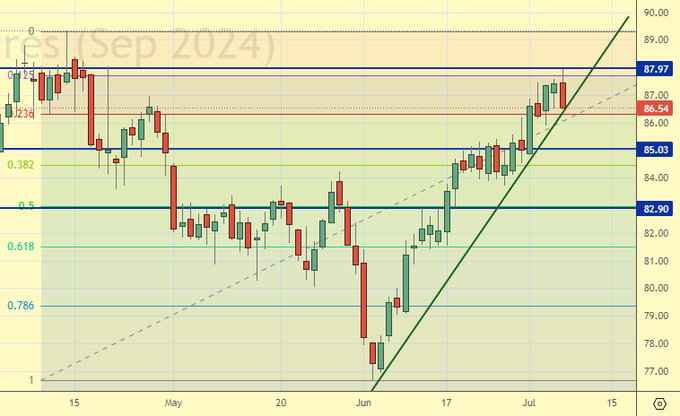

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 37.3 th. contracts. Buyers actively entered the market, sellers slightly reduced their positions. Buyers keep control over the market.

Growth scenario: we consider July futures, expiration date July 31. Strong overbought may turn into correction. We are waiting for interesting levels at the bottom, for example 80.00. And then 99.90.

Downside scenario: you can go short. Even though it seems mandatory now.

Recommendations for the Brent oil market:

Buy: when approaching 80.20. Stop: 79.20. Target: 99.90.

Sell: now (86.54). Stop: 88.07. Target: 80.20.

Support — 85.03. Resistance — 87.97.

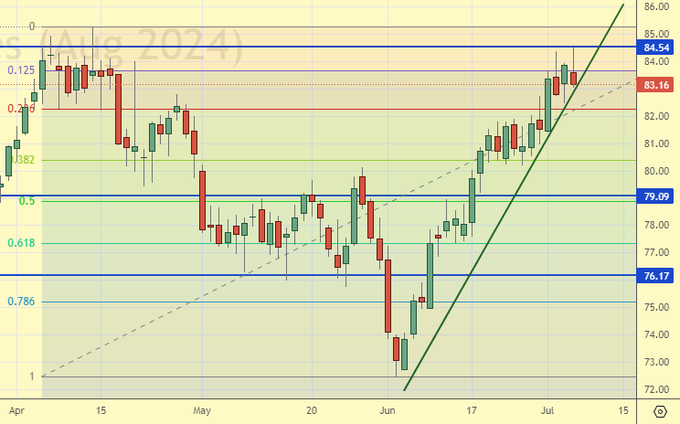

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 479.

U.S. commercial oil inventories fell by -12.157 to 448.539 million barrels, with a forecast of -0.4 million barrels. Gasoline inventories fell -2.214 to 231.672 million barrels. Distillate stocks fell -1.535 to 119.728 million barrels. Cushing storage stocks rose by 0.345 to 34.241 million barrels.

Oil production is unchanged at 13.2 million barrels per day. Oil imports fell by -0.064 to 6.547 million barrels per day. Oil exports rose by 0.491 to 4.401 million barrels per day. Thus, net oil imports fell -0.555 to 2.146 million barrels per day. Oil refining rose by 1.3 to 93.5 percent.

Gasoline demand increased by 0.455 to 9.424 million barrels per day. Gasoline production rose 0.18 to 10.061 million barrels per day. Gasoline imports rose 0.089 to 0.851 million barrels per day. Gasoline exports increased by 0.095 to 0.971 million barrels per day.

Distillate demand increased by 0.179 to 3.715 million barrels. Distillate production rose by 0.204 to 5.106 million barrels. Distillate imports fell -0.039 to 0.094 million barrels. Distillate exports rose 0.152 to 1.705 million barrels per day.

Demand for petroleum products increased by 0.394 million barrels to 21.083 million barrels. Production of petroleum products increased by 0.423 to 23.112 million barrels. Petroleum product imports rose 0.104 to 2.063 million barrels. Exports of refined products increased by 0.837 to 7.116 million barrels per day.

Propane demand fell by -0.367 to 0.66 million barrels. Propane production rose 0.032 to 2.737 million barrels. Propane imports rose 0.004 to 0.079 million barrels. Propane exports rose 0.373 to 1.827 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 44 th. contracts. Buyers were boldly entering the market. Sellers were actively fleeing. Bulls strengthened their control.

Growth scenario: we consider the August futures, expiration date July 22. We need a pullback to buy. Out of the market for now.

Downside scenario: it is possible to sell. The odds are not great, but the profit/loss ratio is good.

Recommendations for WTI crude oil:

Buy: when approaching 76.30. Stop: 75.30. Target: 95.00.

Sell: now (83.16). Stop: 84.80. Target: 76.30.

Support — 79.09. Resistance — 84.54.

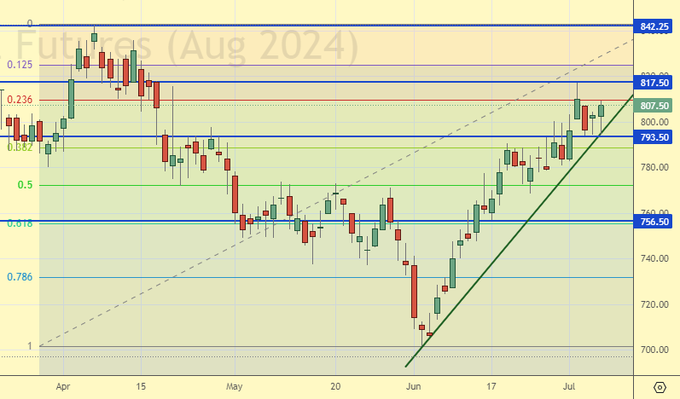

Gas-Oil. ICE

Growth scenario: we consider the August futures, expiration date August 12. We need correction. In case of a pullback to 735.00 it is possible to buy.

Downside scenario: Let’s be persistent and sell for the third time in a row. Technical analysis so far allows for a fall. Yeah, it’s scary. Ah, what can we do?

Gasoil Recommendations:

Buy: on a pullback to 730.00. Stop: 720.00. Target: 950.00.

Sell: now (807.50) and on approach to 823.00. Stop: 837.00. Target: 650.00!

Support — 793.50. Resistance — 817.50.

Natural Gas. CME Group

Growth scenario: we consider the August futures, expiration date July 29. Yes… This is one of the wildest situations in recent memory (several years). Out of the market.

Downside scenario: the market is killed. Nothing to do here. Thank you for your attention.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 2.202. Resistance — 2.557.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. The chances for growth are already clearly visible. Go ahead, let everything be worth a billion!

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no. Who is in position from 65000, keep stop at 60000. Target: 100000!

Sale: no.

Support — 62568. Resistance — 75029.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will keep longing. We are waiting for the growth to continue. Hold longs.

Downside scenario: until the 30000 mark, let’s not even think about selling anything.

PBT Market Recommendations:

Buy: no. Who is in position from 11000, keep stop at 13000. Target: 35000.

Sale: no.

Support — 13438. Resistance — 21094.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1018. Resistance — 1535.

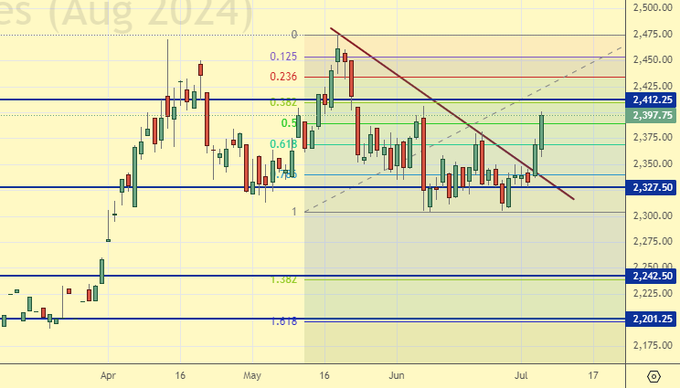

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2120 will be interesting. We need at least 2250. What is happening is not terrible, but the bulls are showing their strength here.

Downside scenario: knocked out of the shorts. One of the worst trades in recent memory. Out of the market. Who would have thought…

Gold Market Recommendations:

Buy: when approaching 2120. Stop: 2070. Target: 2650?!

Sale: no.

Support — 2327. Resistance — 2412.

EUR/USD

Growth scenario: if we get above 1.0900, it may lead to an upward market reversal. Don’t buy yet.

Downside scenario: sellers have the last chance (of the beautiful ones) to go down. Sell.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.0838). Stop: 1.0890. Target: 1.0260.

Support — 1.0775. Resistance — 1.0852.

USD/RUB

Growth scenario: we consider the September futures, expiration date September 19. Let’s give sellers another chance to send the market down. In case of a rise above 93000, the bulls will return to the market. And even the ones that didn’t know they were bulls until now.

Downside scenario: the technician does not deny further strengthening of the ruble. It will be interesting to sell from 90800, and we will recommend it.

Recommendations on dollar/ruble pair:

Buy: when approaching 74000. Stop: 72000. Target: 100.00.

Sell: on approach to 90800. Stop: 91800. Target: 76000.

Support — 86326. Resistance — 89824.

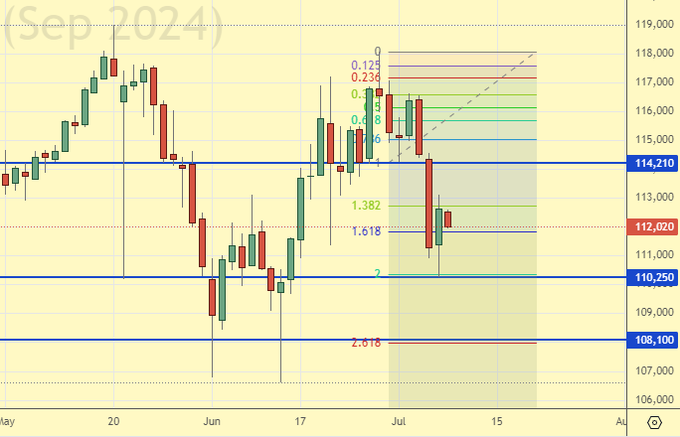

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: keep shorting. Growth to 114000 is not denied, but a stronger rise is unlikely to be possible. After growth to 114000 the fall is likely to resume. Targets below: 108000; 102000.

Recommendations on the RTS index:

Buy: no.

Sell: no. Who is in the position from 115200, move the stop to 115500. Target: 102000 (revised).

Support — 110250. Resistance — 114210.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.