Price forecast from 6 to 10 December 2021

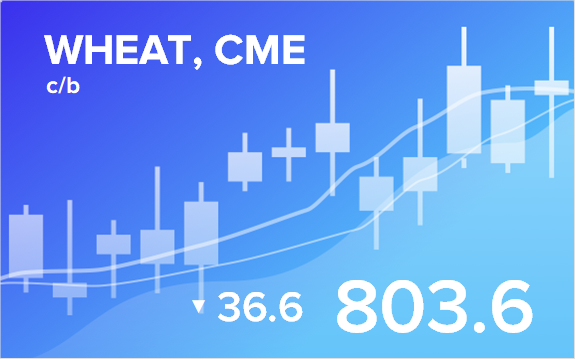

Grain market: Heavy rains in Australia improved the country's wheat harvest forecast by 1.8 million tons to 34.4 million tons, which was greeted positively by traders. Wheat prices on the Chicago Stock Exchange tried to go below 780 cents a bushel, but traders greeted the market with active buying, which again brought quotes back above 800.0.

Wheat demand is fueled by large purchases by frightened importers. The same Egypt acquired 600 thousand tons in one fell swoop at a price of around $ 355 per ton. They have strange tenders there, all sellers submit bids in the corridor plus or minus 2 dollars. What precision. What a calculation. Analysts are our envy.

Soybean prices remained around 1200 cents per bushel, which can be explained by the expectation of an increase in demand for oilseeds in the next season, as private entrepreneurs go bankrupt due to restrictions and quickly become poor, we hope that only for a while, but nevertheless less, their consumption structure is changing dramatically. Instead of animal fats, you have to consume vegetable fats. They are still cheaper. High prices for soybeans will prevent fodder crops, such as corn, from dropping. We don't expect cheap beef on the market.

Reading our forecasts, you could make money on the EUR/USD pair by taking a move down from 1.1900 to 1.1330.