Price forecast from 30 September to 4 October 2024

Grain market:

So: “market share.” Saudi Arabia wants to regain share, and it will do it in one single way: by increasing production. Well, that was always the scenario. The prince ran out of patience at the wrong time. Apparently, someone helped him make that decision.

There is also cocoa futures on the Moscow Exchange. It’s strange why there are no futures on palm oil. That’s what we buy, not cocoa. Okay, whatever you say… To cocoa!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Domestic prices for grains are not growing yet. At the same time, exports from ports continue. September may become a record-breaking month: 5.5 million tons of wheat will find their owners abroad. At the same time, it is rumored that wheat is being paid for with anything. Bitcoins, tugriks, and promises. They pay with dollars and euros, but also with banana skins. It’s all mixed up.

Will domestic price increases for all classes of wheat resume in a month or two? Most likely yes, as inflation will be taken into account in pricing. However, we should not expect a strong increase in domestic prices. It will be very problematic to further expand the geography of supplies, so there is a threat not of a drop, but of growth of final stocks, which means that there will be no increased demand on the part of grain traders.

In general, in conditions when large corporations satisfy any commodity demand, people have to fight in narrow niches in order to earn something. And one of those niches is agriculture. What are you looking at? Plant a dill on your balcony. There, you see! You’re a farmer now. The trend of producing food for yourself locally will gain momentum. Then governments will stimulate the story too. Look at what the Turks did this year. They banned wheat imports until October 15th. Why? To assess their crop, the capacity of their flour mills and take from the foreign market exactly how much they need. Such currents will only grow year by year all over the world. Pragmatism.

Energy market:

We see that so far Brent is not able to return above 75.00, which creates prerequisites for a second attempt to consolidate below 70.00, which could lead to a move to 60.00. At the same time, the market cares little about the conflict in the Middle East. It is clear that there is some premium for the riot there, but it is clearly less than the preconditions for the start of a new round of struggle for market share on the part of OPEC.

At the same time, if we take the opinions of solid analysts and agencies, they all talk about the current supply shortage, the question is only in the estimation of its size, but it is about to happen… Just like in China, demand will fall, then the market will have a surplus and based on this we should instantly fall to 55.00. This whole story can be interpreted as the market is flooded with bears looking for a reason to go short.

Yes, Europe will probably stop faster than the US, but America won’t avoid a GDP drop from its 3% to a token 1% either. But that’s only ever going to happen there! And the market is already ready to bury oil. Then why don’t you bury the SP500?! If there is a crisis ahead let’s kill the stock market first, not oil. But, no. Stocks are at highs no one has ever seen, but oil is only going down on the fear that 1 cup more oil will be produced than spent from mid-25. That’s weird.

USD/RUB:

Let’s give the rate of 50%! For now, maybe it will be 23% by the end of the year with official inflation of 8%, but if citizens don’t carry 20% on deposits, they will carry 50%. That’s so great! What an interesting game of business. Every grandmother is now a rentier. It is desirable that grandpa has already done everything… and would leave behind something that can be quickly sold now and the proceeds deposited. No one knows how the banks will pay the depositors interest. Nobody. Not even the banks themselves. But the game is on, the wheel of fortune is turning. It’s cooler than a casino in Monte Carlo. It’s mesmerizing.

We are anxiously waiting for October 12, when new sanctions will be imposed on MICEX, after which, very likely, but let’s see, we will lose the CNYRUB pair and then only the interbank market. And then only estimation judgments of some specialists.

It should be noted that if a full-scale withdrawal from foreign currencies starts in the country due to some next sanctions package, the ruble exchange rate may get stronger at the moment. For example, it will fly to 60.00 for a couple of days or hours.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 3 thousand contracts. Buyers reduced their positions. Sellers maintained their volumes. Bears retain control.

Growth scenario: we consider December futures, expiration date December 13. On downward pullbacks, it is possible to buy.

Downside scenario: the current upside pullback did not break the bears. However, we need levels above the current levels to sell. The risk of prices falling to 500.0 remains.

Recommendations for the wheat market:

Purchase: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 562.6. Resistance — 596.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 3.7 th. contracts. Buyers and sellers were leaving the market. Bears are still controlling the situation.

Growth scenario: we consider December futures, expiration date December 13. Growth to 435.0 from the current levels is possible, but we, within the given forecasts, will have to skip it. It is interesting to buy from 393.0.

Downside scenario: withdraw any sales recommendations for the time being.

Recommendations for the corn market:

Purchase: when approaching 393.0. Stop: 390.0. Target: 445.0.

Sale: no.

Support — 408.4. Resistance — 435.2.

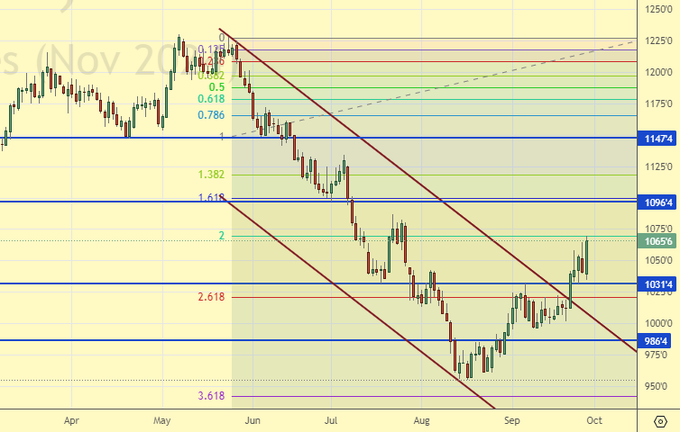

Soybeans No. 1. CME Group

Growth scenario: we are looking at the November futures, expiration date November 14. And we are rising… This is unexpected, given the fundamentals. Don’t buy.

Downside scenario: the market is punishing us. It continues to grow, you can say on nothing. We will sell again from 1095.0.

Recommendations for the soybean market:

Purchase: when approaching 850.0. Stop: 830.0. Target: 1100.0.

Sell: on approach to 1095.0. Stop: 1107. Target: 850.0.

Support — 1031.4. Resistance — 1096.4.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers grew by 27.6 th. contracts. Buyers were entering the market, sellers were leaving it. Buyers were more active. The number of contracts of bulls and buyers is almost the same.

Growth scenario: moved to December futures, expiration date October 31. Buying in this situation is not interesting.

Downside scenario: those who entered the short — stay in it. The continuation of the fall cannot be ruled out.

Recommendations for the Brent oil market:

Purchase: no.

Sell: no. Those who are in the position from 73.69, move the stop to 75.30. Target: 56.50.

Support — 68.30. Resistance — 72.56.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 4 to 484.

U.S. commercial oil inventories fell by -4.471 to 413.042 million barrels, with -1.3 million barrels forecast. Gasoline inventories fell -1.538 to 220.083 million barrels. Distillate stocks fell -2.227 to 122.921 million barrels. Cushing storage stocks rose by 0.116 to 22.827 million barrels.

Oil production remained unchanged at 13.2 million barrels per day. Oil imports rose by 0.134 to 6.456 million barrels per day. Oil exports fell by -0.692 to 3.897 million barrels per day. Thus, net oil imports rose by 0.826 to 2.559 million barrels per day. Oil refining fell -1.2 to 90.9 percent.

Gasoline demand increased by 0.429 to 9.205 million barrels per day. Gasoline production increased by 0.176 to 9.837 million barrels per day. Gasoline imports rose 0.279 to 0.746 million barrels per day. Gasoline exports increased by 0.11 to 0.847 million barrels per day.

Distillate demand rose by 0.224 to 4.022 million barrels. Distillate production fell by -0.158 to 4.898 million barrels. Distillate imports fell -0.036 to 0.102 million barrels. Distillate exports fell -0.081 to 1.297 million barrels per day.

Demand for petroleum products increased by 1.594 to 21.386 million barrels. Petroleum products production fell by -0.045 to 22.124 million barrels. Petroleum product imports fell -0.238 to 1.405 million barrels. Exports of refined products rose by 0.101 to 6.762 million barrels per day.

Propane demand rose 0.725 to 1.332 million barrels. Propane production fell -0.033 to 2.672 million barrels. Propane imports rose 0.025 to 0.103 million barrels. Propane exports fell -0.185 to 1.664 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 28.3 th. contracts. Buyers entered the market. Sellers kept their volumes. Bulls keep control.

Growth scenario: we consider November futures, expiration date October 22. For now, forget about buying.

Downside scenario: current levels can be used for selling. However, you will have to count on a small pullback for a good position entry.

Recommendations for WTI crude oil:

Purchase: no.

Sell: on a pullback to 70.00. Stop: 71.70. Target: 54.00.

Support — 64.52. Resistance — 72.45.

Gas-Oil. ICE

Growth scenario: we consider October futures, expiration date is October 10. Buying in this situation is not interesting.

Downside scenario: current levels for short entry are undervalued. Chances for a fall remain, but the capital risk should be halved.

Gasoil Recommendations:

Purchase: no.

Sale: now (657.50). Stop: 678.00. Target: 505.00.

Support — 626.50. Resistance — 664.25.

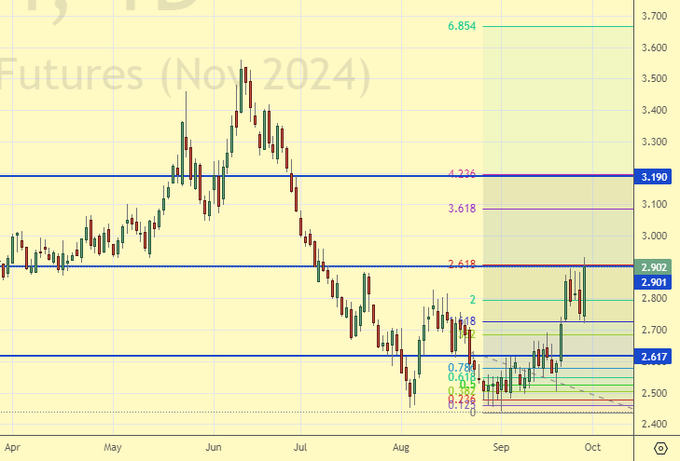

Natural Gas. CME Group

Growth scenario: we consider November futures, expiration date is October 29. We continue to hold longs. The target at 3.190 seems interesting on the eve of winter.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Purchase: no. Those who are in position from 2.480 move the stop to 2.700. Target: 3.190 (3.600).

Sale: no.

Support — 2.617. Resistance — 3.190.

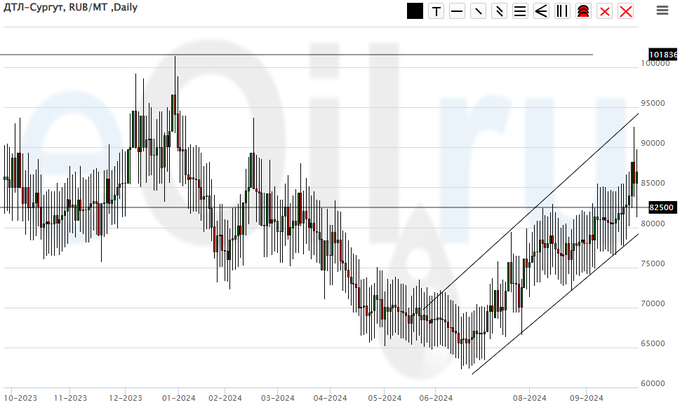

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Purchase: No. Those in position from 65000, move your stop to 73000. Target: 100000!

Sale: no.

Support — 82500. Resistance — 101830.

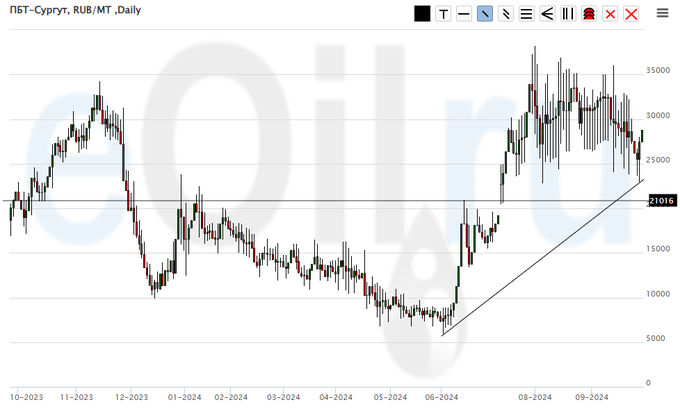

Propane butane (Surgut), ETP eOil.ru

Growth scenario: continuation of growth from current levels is not excluded. A pullback to 20000 is needed for good purchases. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Purchase: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 21016. Resistance — 35000.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Purchase: no.

Sale: no.

Support — 1010. Resistance — 1528.

Growth scenario: we consider the December futures, expiration date December 27. We need a correction to 2570. Then we will think what to do with it.

Downside scenario: this aggressive bullish story has gone long. Shorting from 2720 will be interesting.

Gold Market Recommendations:

Purchase: not yet.

Sell: on approach to 2720. Stop: 2740. Target: 2200?!

Support — 2648. Resistance — 2719.

EUR/USD

Growth scenario: further upward movement cannot be ruled out, but there are no interesting levels for long entry. Out of the market.

Downside scenario: the story looks quite confusing. Bulls have a minimal advantage. Out of the market.

Recommendations on euro/dollar pair:

Purchase: no.

Sale: no.

Support — 1.1122. Resistance — 1.1301.

USD/RUB

Growth scenario: we consider December futures, expiration date December 19. Nothing new. The market is able to go higher. We hold the long.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Purchase: no. Those who are in position from 85976, move your stop to 89900. Target: 100000 (200000. Yes, yes, it is possible).

Sale: no.

Support — 90530. Resistance — 94411.

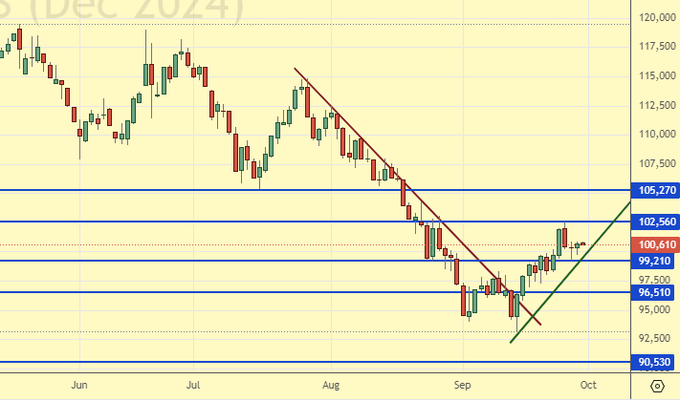

RTSI. MOEX

Growth scenario: we consider December futures, expiration date December 19. We will buy when approaching 90600. Failure under 90600 will lead to panic dumping of shares.

Downside scenario: if the market gives, the entry to short from 105000 will be ideal. Taking into account the negative external background we have to work out the level of 100000.

Recommendations on the RTS index:

Purchase: when approaching 90600. Stop: 90300. Target: 105000.

Sell: on approach to 105000. Stop: 107000. Target: 90600.

Support — 99210. Resistance — 102560.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.