Price forecast from 3 to 7 of October 2022

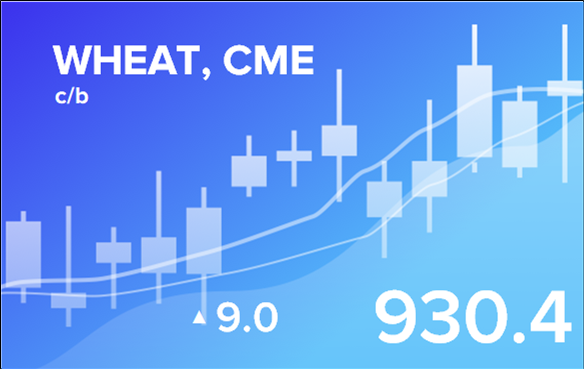

Grain market:

It is possible that Russia will ban operations with its grain to "unfriendly" countries.

Food is a strategic resource and must be treated wisely. Obstacles to enrichment of foreigners in the current situation look natural, however, it is necessary to assess the losses for our agriculture from the shortfall in revenue here and now.

By removing large Western grain traders from Russian grain, you can be left without orders for some time, which will lead to an even stronger drop in prices within the country against the backdrop of overstocking on the domestic market. At the same time, in the future, when building up our own ties, the gain from conducting independent trade will be higher. You just need to live to see this beautiful tomorrow.

Domestic grain prices have risen somewhat, but remain at low levels. So grain of the 3rd class is traded at the level of 13,000 rubles per ton in the middle lane and up to 15,000 rubles in the south, grain of the 4th class is traded at the level of 11,000 rubles in the middle lane and 13,000 rubles in the south. This is already not bad, but there is potential for growth by 20 percent, provided that exports from the country continue.