Price forecast from 26 to 30 of September 2022

26 September 2022, 12:43

-

Grain market:

Mobilization in Russia. China and India are still in the same team with us, but this is not certain. In Europe they burn garbage to keep warm. In the US, grain will be processed into biofuel. In England, hope is for coal and wind turbines at sea. In Turkey, inflation is very likely to reach 100 percent in a year.

Good day to all, friends!

IGC raised its global grain harvest forecast to 2,256 million tons, up 8 million tons from a month ago. The growth came at the expense of Russia, Canada and Australia, which offset the fall in the US corn crop.

A record grain harvest will be harvested in Russia. Current forecasts are 142 million tons, of which wheat is 95 million tons. With such volumes, the loading of elevators will be 100 percent. I would like to believe that the export will take place without great difficulties, but the reality is that we cannot avoid problems with shipment. On the other hand, it’s okay if there is some surplus of grain inside the country in 2023 in our turbulent times. Grain prices in Russia bounced off the lows last week. All classes of wheat added 5 to 10 percent.

Now the fifth class is difficult to find at a price below 8,500 rubles per ton, the fourth class is sold locally for at least 10,500 rubles, the third class is at least 12,000 rubles per ton.

Reading our forecasts, you could make money on the euro / dollar pair, taking a move down from 1.0350 to 0.9700.

Energy market:

This issue has been prepared with the direct participation of analysts from eOil.ru and IDK.ru trading platforms.

The desire of sellers to turn the situation down began to be seen on the oil market. The only fundamental factor that is currently playing for the bears is the likelihood of a deep recession in Europe. In addition, there is a political factor — these are midterm elections to the US Congress in November.

Lower gas station prices could help Biden and the Democrats at the moment. Against the backdrop of mobilization in Russia, the policies of the current White House administration have begun to raise questions among those Americans who simply want to live day after day and fall asleep in their bed at night. Since there are still a majority of calm and reasonable citizens there, the Republicans can regain control of Congress following the results of the elections. The organizers of the bearish pressure on quotes should not forget that the OPEC oil cartel has not gone anywhere. Sheikhs continue to closely monitor the balance of supply and demand. Prices below $80 per barrel will not suit them in this situation. We have the right to expect the organization to reduce production. The next meeting will take place on October 5th. By this date, the bears will probably be able to push Brent oil to the level of 78.00, but they will not be able to go below.

USD/RUB:

We see that the Bank of Russia keeps the pair under control, preventing speculators from dispersing the market. We have to admit that against the backdrop of current news, we should have gone to the area of 74.00 rubles per dollar, but since there are no Western traders on the market and there is no one to speculate on a large scale, it is not difficult to keep the situation under control.

As long as the trade balance surplus remains, nothing threatens the ruble. But changes may occur in the near future, as gas supplies to Europe will fall by tens of percent in September. And then the same thing will happen with the supply of oil in the event of an embargo on its purchase by the West from December 5th. Then the Central Bank will have to make more efforts to keep the exchange rate at current levels. In the event of an embargo on oil supplies to Europe, one cannot exclude the abolition of exchange trading in the dollar / ruble pair with an artificial fixation of the exchange rate at the level of 60 or 65 rubles per dollar.

Separately, we will say that on Friday, September 30, President Putin can deliver a message to the Federal Assembly. It is worth paying close attention to this event.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers has decreased by 4.5 thousand contracts. Vendors left the market. The buyers didn’t show up. The spread between long and short positions is narrowing, the uncertainty in the market is growing.

Growth scenario: consider the December futures, the expiration date is December 14th. We hold longs. Red Friday is scary, but it’s not enough to knock us out of position.

Fall scenario: don’t want to miss out on a good selling opportunity. Let’s go short.

Recommendations for the wheat market:

Purchase: no. Who is in position from 860.0 and 840.0, keep the stop at 818.0. Target: 945.0 cents per bushel.

Sale: now. Stop: 922.0. Target: 750.0 cents per bushel.

Support — 867.0. Resistance — 930.4.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 8.5 thousand contracts. Buyers were reluctant to enter the market, sellers practically did not take any action. The spread between longs and shorts is widening, and the bulls’ lead is growing.

Growth scenario: consider the December futures, the expiration date is December 14th. We continue to note that there are a lot of bulls in the market. Standing long in such a situation is uncomfortable. We hold old positions, we do not open new ones.

Fall scenario: interesting to sell here. If the market falls below 660.0, we will quickly be in the 550.0 cents per bushel area.

Recommendations for the corn market:

Purchase: no. Who is in position from 680.0, move the stop to 660.0. Target: 750.0 cents per bushel.

Sale: now. Stop: 690.0. Target: 550.0 cents per bushel.

Support — 667.2. Resistance — 699.4.

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. China will reduce soybean consumption. This news may put pressure on quotes. We hold old positions, we do not open new ones.

Fall scenario: if we fall below 1390.0 we will sell again. Those who wish can enter short from the current levels.

Recommendations for the soybean market:

Purchase: no. Who is in position between 1405 and 1430, move the stop to 1403.0. Target: 1600.0 cents per bushel.

Sale: now and after falling below 1390.0. Stop: 1470.0. Target: 1000.0 cents per bushel. Count the risks.

Support — 1372.4. Resistance — 1489.2.

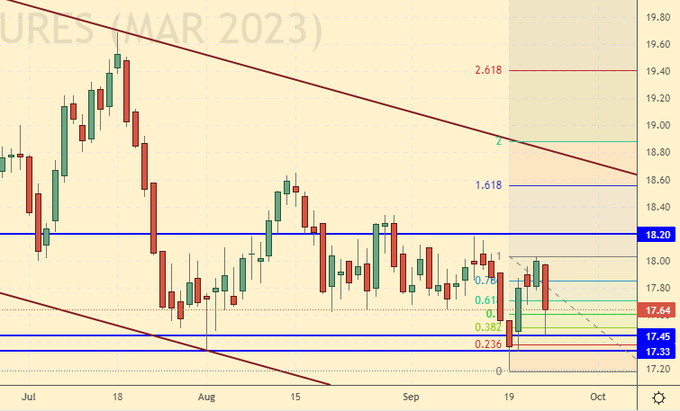

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. We will try to catch the long. So far, the market cannot convince us that the fall will continue.

Fall scenario: we are in a falling channel. We continue to keep the previously opened short, we do not open new positions.

Recommendations for the sugar market:

Purchase: now. Stop: 17.43. Target: 21.00 cents per pound.

Sale: no. Who is in position from 17.80, keep the stop at 18.10. Target: 15.20 cents a pound.

Support — 17.45. Resistance — 18.20.

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. We continue to count on the growth of the market. Failure to go below 200.0 indicates a possible upside.

Fall scenario: A down is unlikely, but you need to go short here. We will sell.

Recommendations for the coffee market:

Purchase: no. Who is in positions from 210.0, 221.00 and 235.00, keep the stop at 200.00. Target: 350.00 cents per pound.

Sale: now. Stop: 227.00. Target: 150.00 cents per pound.

Support — 217.35. Resistance is 235.90.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 4.9 thousand contracts. Buyers and sellers left the market, but sellers closed their positions more actively. The spread between longs and shorts is widening, and the bulls’ lead is growing.

Growth scenario: consider the October futures, the expiration date is October 31. The bulls failed to hold above $90.00 per barrel. Until we buy.

Fall scenario: sellers step up pressure. You can sell from current levels.

Recommendations for the Brent oil market:

Purchase: think when approaching the level of 78.00 dollars per barrel.

Sale: now. Stop: 91.20. Target: $78.60 per barrel.

Support — 78.35. Resistance — 90.72.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 3 units and now stands at 602 units.

Commercial oil reserves in the US increased by 1.141 to 430.774 million barrels, with the forecast of +2.161 million barrels. Inventories of gasoline rose by 1.57 to 214.61 million barrels. Distillate inventories rose by 1.23 to 117.25 million barrels. Inventories at Cushing rose 0.343 to 24.991 million barrels.

Oil production has not changed and is 12.1 million barrels per day. Oil imports rose by 1.155 to 6.947 million barrels per day. Oil exports rose by 0.025 to 3.54 million barrels per day. Thus, net oil imports rose by 1.13 to 3.407 million barrels per day. Oil refining increased by 2.1 to 93.6 percent.

Gasoline demand fell by -0.172 to 8.322 million barrels per day. Gasoline production increased by 0.006 to 9.459 million barrels per day. Gasoline imports rose by 0.253 to 0.775 million barrels per day. Gasoline exports rose by 0.119 to 1.189 million barrels per day.

Demand for distillates rose by 0.277 to 3.409 million barrels. Distillate production increased by 0.217 to 5.236 million barrels. Distillate imports fell -0.018 to 0.107 million barrels. Distillate exports rose by 0.349 to 1.758 million barrels per day.

Demand for petroleum products fell by -0.375 to 18.938 million barrels. Oil products production fell by -0.324 to 22.335 million barrels. Imports of petroleum products rose by 0.411 to 2.035 million barrels. The export of oil products increased by 0.355 to 6.656 million barrels per day.

Demand for propane rose by 0.337 to 0.852 million barrels. Propane production fell -0.003 to 2.442 million barrels. Propane imports rose by 0.006 to 0.073 million barrels. Propane exports fell by -0.27 to 1.19 mb/d.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 6.7 thousand contracts. Buyers were reluctant to enter the market, sellers were reluctant to leave it. The spread between longs and shorts is widening, and the bulls’ lead is growing.

Growth scenario: we are considering the November futures, the expiration date is October 20. We will buy only when approaching 68.00. The market has every chance to continue falling.

Fall scenario: those who wish can enter short from current levels, but we will not recommend this deal directly. If there is an increase to 84.00, then it can be sold there with little risk.

Recommendations for WTI oil:

Purchase: when approaching 70.00. Stop: 67.00. Target: 90.00.

Sale: when approaching 84.00. Stop: 86.80. Target: $68.60 per barrel.

Support — 68.35. Resistance — 86.67.

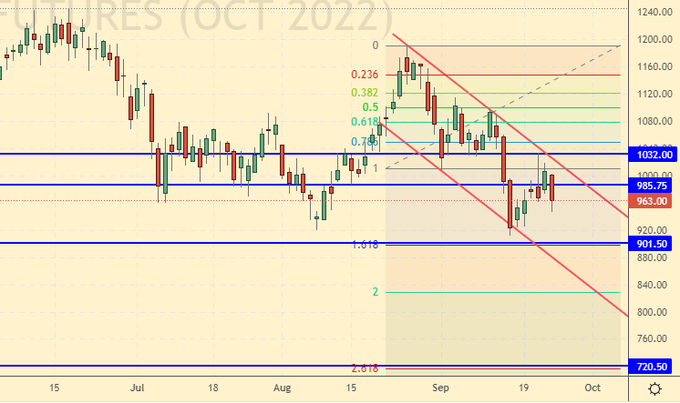

Gas-Oil. ICE

Growth scenario: consider the October futures, the expiration date is October 12. The market is likely to continue its decline against the backdrop of a recession in the US and Europe. Until we buy.

Fall scenario: it is worth continuing to hold positions from 1115.0. The Biden administration may put pressure on the market to improve its situation before the congressional elections.

Gasoil recommendations:

Purchase: no.

Sale: no. Who is in position from 1115.00, move the stop to 1055.00. Target: 720.00!!! dollars per ton.

Support — 901.50. Resistance is 1032.00.

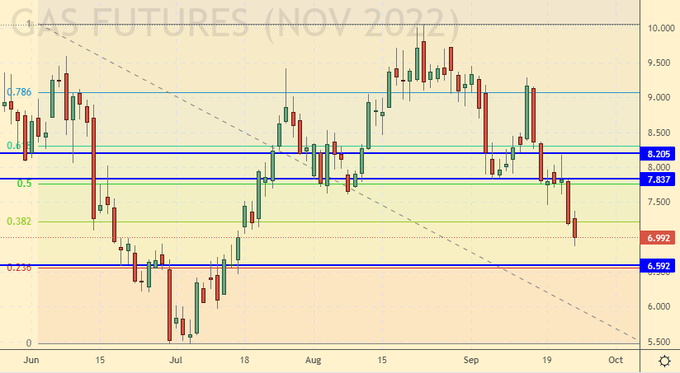

Natural Gas. CME Group

Growth scenario: switched to the November futures, the expiration date is October 27th. A total disappointment, not a bull market. From 6.592 a long suggests itself, but we will not recommend it.

Fall scenario: there are no opportunities to enter shorts. Out of the market.

Recommendations for natural gas:

Purchase: no.

Sale: no.

Support — 6.592. Resistance is 7.837.

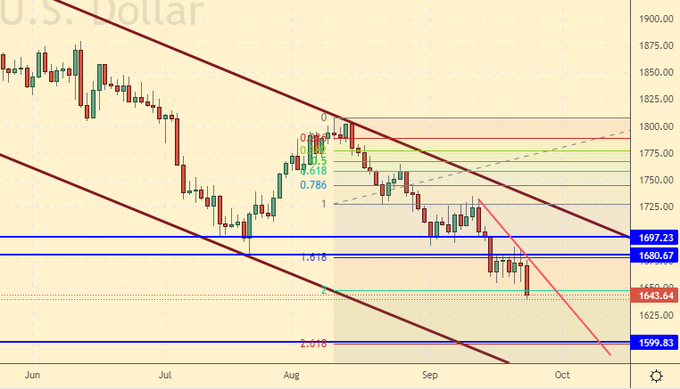

Gold. CME Group

Growth scenario: we continue to refuse to buy gold, but from the level of 1600 it can be done.

Fall scenario: keep short. Our target level is 1600. We have every chance to achieve our target set a few weeks ago.

Recommendations for the gold market:

Purchase: when approaching 1600. Stop: 1570. Target: $1,700 per troy ounce.

Sale: no. For those in position from 1802, move the stop to 1718. Target: $1,600 a troy ounce.

Support — 1599. Resistance — 1680.

EUR/USD

Growth scenario: purchases from current levels are interesting. Let’s go long.

Fall scenario: We hit our target at 0.9700. All with a profit. Until we open the shorts.

Recommendations for the EUR/USD pair:

Purchase: now. Stop: 0.9630. Target: 1.0000.

Sale: no.

Support is 0.8600. Resistance is 1.0051.

USD/RUB

Growth scenario: Wednesday, Thursday and Friday were active. We went above 62.00, but then the quotes fell below the level of 60.00 dollars per ruble, which came as a surprise. We don’t buy.

Fall scenario: entry into shorts is not recommended. There is no evidence, but there is a feeling that the couple is regulated. Most likely we will remain in the range of 55.00 — 60.00 rubles per dollar.

Recommendations for the dollar/ruble pair:

Purchase: no.

Sale: no.

Support — 56.66. Resistance — 60.26.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|