Price forecast from 26 to 30 August 2024

Grain market:

It’s bad enough when tyrants, subordinate-eaters and similar personalities come to power, but it’s very bad when the French come to power. Durov’s detention at the heart of the blue circus with the tower in the middle opens the way for the insatiable rulers to deal not only with Bezos or Jack Ma, but also with slightly smaller stars. In such a situation, many people’s motivation to mold their company will simply fall away. This is the path to grayness.

To Pasha, for the ability to open his mouth! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Fears of expensive fuel and fertilizer shortages have disappeared. Two years ago we were yelling so much that we did not need dynamics. As a matter of fact, we see that everyone is getting everything, otherwise, why is there a record harvest on a global scale? Yes, it is possible to find a country in which a particular field was burned in the sun and make a tragedy out of it. In fact, everything is fine: the gross harvest of corn, rice and soybeans will be record-breaking, the second in history for wheat. Therefore, we are not surprised by the price decrease. If they stop giving birth, there will be a strong surplus, while there is none and everything that is harvested is consumed by mankind. That makes this market thin.

In the long run, drones will help maintain plants. This revolution is already underway, but it has not yet spread worldwide. Those who invest in flying helpers will get 10 — 15% more output from the same area.

Wheat and corn are behaving according to the current season. We are approaching the lows of the year, which we plan to meet on September 12th. After that, it will start to rise. For the beauty of the picture, we need to fall by 4% in wheat and 8% in corn.

Energy market:

Sellers cannot convince us of their ability to push the market lower. We see an extremely attractive picture from a technical buying point of view. It could easily be broken now, but the longer we stay above 75.00 Brent, the better the chances are that bullish news will come and we will move $15 up. It is alarming that China is being buried so loudly in the press that it gives the impression that oil will be given away for free tomorrow. But it really isn’t! China grew by 5.3% in FY23; in the second quarter of FY24, the rate fell to a 4.8% annualized rate. But, everyone should be so down. This is growth on the back of OPEC’s control of the oil market. It’s a guarantee of demand for resources.

It is worth noting that despite the growth of wind and solar power generation, oil demand is not falling. In China, electric cars have reduced demand by 0.5 mln barrels per day, but overall energy demand has continued to grow. Hence, the fears, including those of our oil producers, are unfounded. Still Indians are in poverty, still Argentina has not stopped dancing, still Indonesia has not felt itself the center of the world. There is a lot of interesting things ahead. And everyone needs oil.

USD/RUB:

The plans to launch crypto exchanges in Russia to circumvent sanctions in settlements are interesting from a theoretical point of view for “friendly countries”. But in practice, we are heading towards a simple ban on trade with Russia. Those who bend to Washington will stop trade, while the rest will buy something and give something back. With the West we are definitely going to the scheme “oil in exchange for medicines and tomographs”, with the East: “oil in exchange for tea”, and also for Vietnamese coffee. The usefulness of a round dance with the long-dissolved clay-and-sand empires of the past: Persian, Egyptian and everything in between is unlikely to be great.

It should be noted that the exchange rate of the ruble to the Chinese yuan differs by 10% between the exchange in Moscow and platforms outside the country. There is no point in counting anything to the dollar. If someone needs to go to Bangladesh, they will write a certificate at the company: “Issue Ivanov I.I. half a kilo of tarred tugriks for a vacation trip with his family.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 21.1 th. contracts. Buyers entered the market, sellers fled. Bears are maintaining control.

Growth scenario: moved to December futures, expiration date December 13. Until September 10, sellers will be pushing. How deep will we be by this date? Let’s see.

Downside scenario: stay in sales. We see the acceleration of the price decline. 400.0 is certainly a bit extreme, but everything happens on the stock exchange. More reasonable target is 500.0. If we approach this level, we can close 25% safely.

Recommendations for the wheat market:

Buy: when approaching 495.0. Stop: 490.0. Target: 680.0.

Sell: no. Who is in the position from 553.0 (taking into account the transition to the new futures), move the stop to 562.0. Target: 500.0 (400.0).

Support — 496.2. Resistance — 560.0.

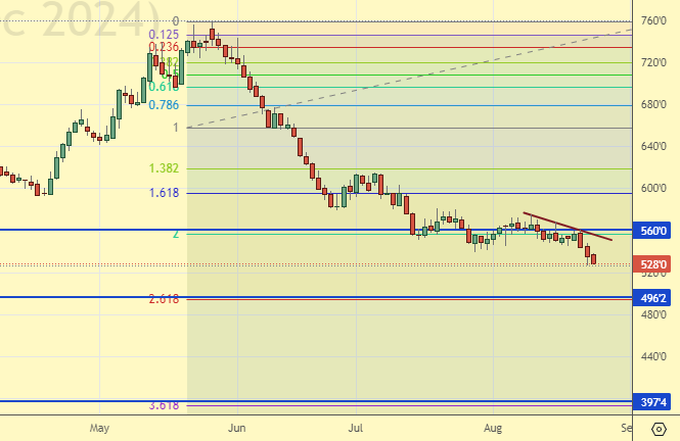

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 4.2 thousand contracts. Buyers were leaving. There were no sellers. Bears are controlling the market.

Growth scenario: we switched to December futures, expiration date December 13. Most likely, we will fall further. We need lower marks to buy.

Downside scenario: selling again. The market is on the verge of collapse (so it seems to us).

Recommendations for the corn market:

Buy: when approaching 310.0. Stop: 290.0. Target: 410.0.

Sell: Now (391.0.). Stop: 403.0. Target: 310.0.

Support — 360.6. Resistance — 401.0.

Soybeans No. 1. CME Group

Growth scenario: switched to November futures, expiration date November 14. We are waiting for low prices. The market is able to go deeper on the background of the new harvest.

Downside scenario: we will keep shorting. Those who wish can enter the sale from 1030.0.

Recommendations for the soybean market:

Buy: at touching 815.0. Stop: 790.0. Target: 1090.0.

Sell: No. Those in position from 1060.0, move your stop to 998.0. Target: 815.0!

Support — 947.6. Resistance — 1030.6.

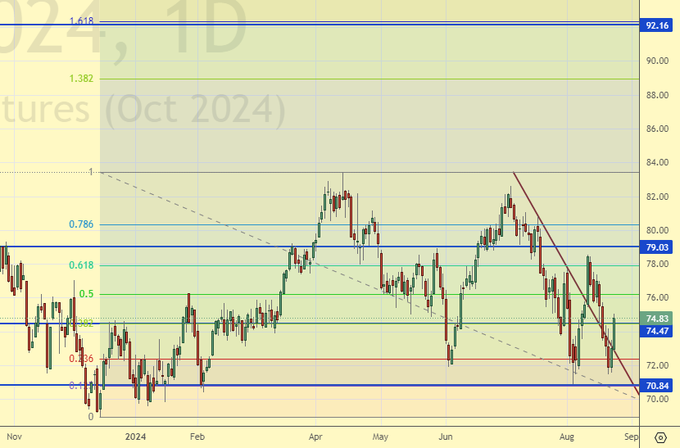

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 7.9 th. contracts. There were few buyers. Sellers were entering the market. Buyers are keeping control over the market.

Growth scenario: we consider November futures, expiration date September 30. Let’s buy. I would very much like to do it, purely from a technical point of view.

Downside scenario: it will be extremely difficult for us to break down further. We don’t listen to old Internet screamers paid by the West. “Oil at 55.00.” That’s a deathbed delusion.

Recommendations for the Brent oil market:

Buy: now (78.15). Stop: 74.90. Target: 100.00.

Sale: no.

Support — 75.09. Resistance — 79.88.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 483.

U.S. commercial oil inventories fell by -4.649 to 426.029 million barrels, with a forecast of -2 million barrels. Gasoline stocks fell -1.606 to 220.597 million barrels. Distillate stocks fell by -3.312 to 122.811 million barrels. Cushing storage stocks fell by -0.56 to 28.204 million barrels.

Oil production increased by 0.1 to 13.4 million barrels per day. Oil imports increased by 0.367 to 6.652 million barrels per day. Oil exports rose by 0.289 to 4.045 million barrels per day. Thus, net oil imports rose by 0.078 to 2.607 million barrels per day. Oil refining increased by 0.8 to 92.3 percent.

Gasoline demand increased by 0.148 to 9.193 million barrels per day. Gasoline production rose 0.046 to 9.768 million barrels per day. Gasoline imports fell -0.047 to 0.531 million barrels per day. Gasoline exports fell -0.142 to 0.731 million barrels per day.

Distillate demand increased by 0.027 to 3.576 million barrels. Distillate production rose by 0.123 to 4.892 million barrels. Distillate imports fell -0.018 to 0.063 million barrels. Distillate exports rose 0.313 to 1.853 million barrels per day.

Demand for petroleum products fell by -0.101 to 20.422 million barrels. Petroleum products production increased by 0.069 to 22.551 million barrels. Petroleum product imports rose 0.535 to 1.875 million barrels. Exports of refined products increased by 0.508 to 7.307 million barrels per day.

Propane demand fell by -0.438 to 0.429 million barrels. Propane production rose 0.027 to 2.65 million barrels. Propane imports rose 0.002 to 0.073 million barrels. Propane exports rose 0.492 to 2.009 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 21.9 th. contracts. Buyers were fleeing. Sellers were entering the market. The bulls are maintaining control.

Growth scenario: we consider October futures, expiration date September 20. Let’s buy. We are very excited about the last two green candles.

Downside scenario: out of the market. We could not go below 70.00.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 70.84. Resistance — 79.03.

Gas-Oil. ICE

Growth scenario: we consider September futures, expiration date September 12. Let’s buy. The odds are not great yet, but if oil goes up, fuel will head north.

Downside scenario: close the short at current levels. Don’t sell yet.

Gasoil Recommendations:

Buy: Now (708.25). Stop: 683.00. Target: 955.00.

Sale: no.

Support — 685.00. Resistance — 744.50.

Natural Gas. CME Group

Growth scenario: we consider October futures, expiration date September 26. We continue to refuse to buy.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 1.987. Resistance — 2.431.

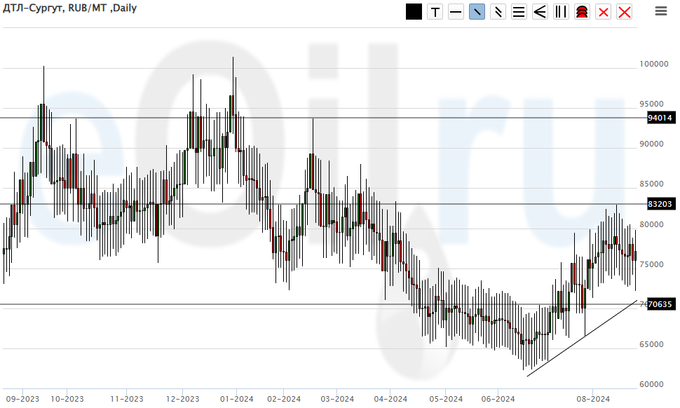

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no. Who is in position from 65000, keep stop at 67000. Target: 100000!

Sale: no.

Support — 70635. Resistance — 83203.

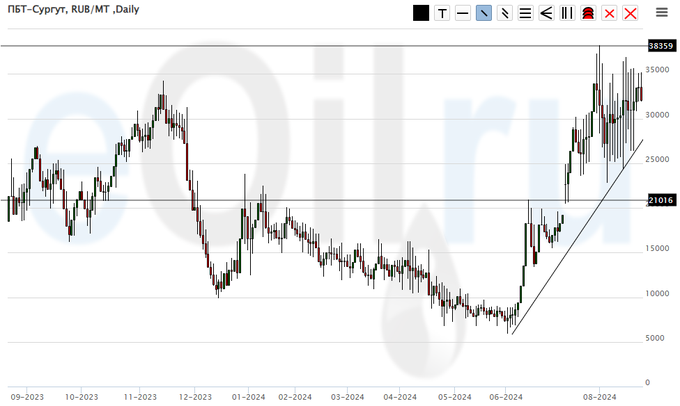

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 21016. Resistance — 38359.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1018. Resistance — 1516.

Growth scenario: we consider the December futures, expiration date December 27. Bulls cannot convince us of their power yet. We don’t buy, but we are watching carefully.

Downside scenario: keep selling. Reduce risk when selling. There may be fanatical upside spikes until September 18 (Fed meeting).

Gold Market Recommendations:

Buy: no.

Sell: Now (2546.0). Stop: 2558.0. Target: 2120.

Support — 2506. Resistance — 2569.

EUR/USD

Growth scenario: we will continue to stand in longs in the expectation that the market will spin up to 1.2000.

Downside scenario: bulls consolidated their positions over the week. Don’t sell. We note overbought, but will not do anything.

Recommendations on euro/dollar pair:

Buy: no. Who is in position from 1.0908, move your stop to 1.1090. Target: 1.2000.

Sale: no.

Support — 1.1100. Resistance — 1.1227.

USD/RUB

Growth scenario: we consider September futures, expiration date September 19. The market is able to go higher. We hold long. Those who wish can buy from 86.00, if the market gives such an opportunity.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Those in position from 85976, keep your stop at 84900. Target: 100000 (200000. Yes, what do you want).

Sale: no.

Support — 87331. Resistance — 89915.

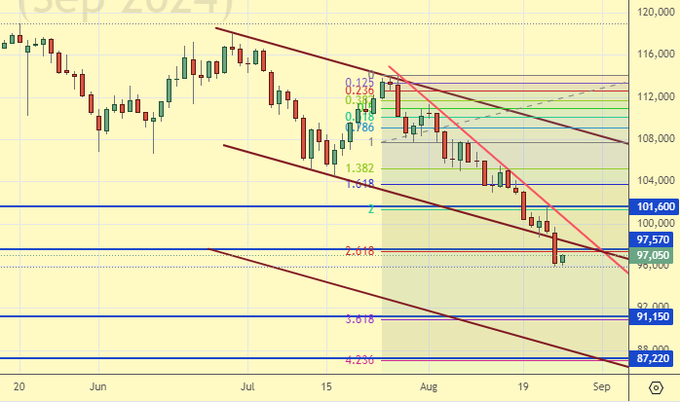

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Do not buy.

Downside scenario: we’ll keep shorting. Somehow we broke through 97600. Now it’s resistance. Good for the bears.

Recommendations on the RTS index:

Buy: no.

Sell: no. Those who are in position from 115200, move the stop to 101700. Target: 87600.

Support — 91150. Resistance — 97570.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.