Price forecast from 22 to 26 of November 2021

22 November 2021, 11:57

-

Grain market:

At the level of psychology, grain traders pushed the buyers, and these are mainly the state structures of the importing countries. We do not know how the punching process took place, we can only assume that certain work was carried out. Egypt pays more and more with each new tender, the price approached the level of $ 350 per ton.

A significant increase in grain prices could be justified in the event of a crop failure, but the harvest is record-breaking. Yes, demand has grown by 3% compared to last year, but here it is worth revealing a terrible secret: the demand for wheat is growing following the volumes produced year-on-year in the foreseeable historical perspective.

When the amount of grain is not big, then the demand also falls, since the price for it rises, but in this case, we see a rise in price with a record harvest. Unfortunately, this fact creates the foundation for high grain prices for the next couple of years.

Note that if the administrations of large ports by the fall of next year capture and vaccinate, finally, all the movers who live at the berths, thereby preventing the closure of enterprises for quarantine, then the logistical risk, which is now partly attributed to the rise in prices, will be removed from the pricing equation.

Energy market:

Good day to all. A lockdown in Europe awaits us. Those who do not want to use vaccines will be forcefully injected, after which the injected person will be allowed to return to the dream of some kind of democracy and individual rights. It is possible that the violent will be chipped.

Biden doesn’t like oil at $ 80 a barrel. Cries for help are heard from the White House. Japan, China and India are offered to rectify the situation by printing out their reserves. There are no such appeals to the Europeans, but Europe will help the derailing Biden rating in a different way: it will simply freeze by the end of December for a couple of weeks, or maybe a month.

Drilling activity continues to grow in the United States, which should ultimately allow the Americans to increase oil production by 1.5 million barrels per day in 2022 to almost 13 million barrels in 24 hours.

Most likely, the oil market will be under pressure for the next week. If OPEC sees the threat of a significant drop in quotations, this could lead to the fact that the agreement on a gradual increase in production may be revised in early December. The Crown Prince of Saudi Arabia sees oil in his nightmares for $ 20, as it was in the 20th year. And he hardly wants his dreams to come true again.

By reading our predictions, you could have made money in the soybean market by moving down from 1400 to 1280 cents per bushel.

USD/RUB:

I like the ruble less and less every week. The couple began to scratch their claws into the wood floor at 75.00. Despite the rise in interest rates, a surplus budget and high oil prices, a grandfather with a mallet is wandering around the skulls and frightening either inflation or confrontation with the West. All this reminds of a saying: we’ve never lived well so there’s no use in starting now.

Rates against the ruble are growing, and the Russian Ministry of Finance is leading the campaign, buying up dollars at 25 billion rubles a day. From this surrealism, the analyst weeps into the fifth handkerchief. But what about the rate of 65 rubles per dollar? Now this will not happen or what? What about fighting inflation by strengthening the ruble? The strong ruble should have led to a decrease in the cost of imported goods on store shelves.

Apparently, we will have to endure a little more. New Year’s tours to Turkey and Egypt are already sold out. We will overcome and massively cope with the horrors of the modern economy there, under the light intoxication of tobacco and alcohol.

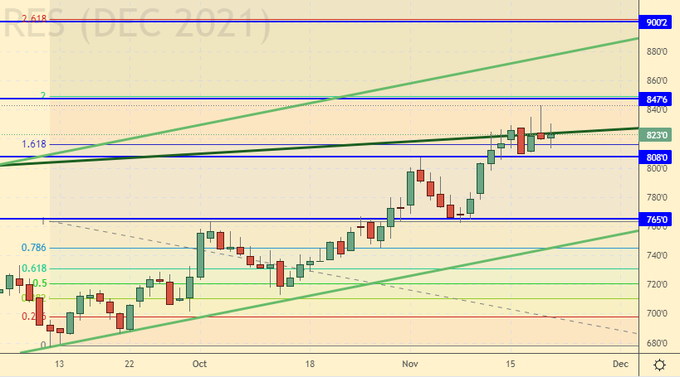

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 14.5 thousand contracts. The bulls have completely regained control of the market.

Growth scenario: December futures, expiration date December 14. We expect a pullback to 770.0 for a new round of buying. The current levels are not interesting for entering longs on daily intervals.

Falling scenario: for a good short we need the level 900.0. While we are out of the market. Recommendation:

Purchase: when approaching 770.0. Stop: 750.0. Target: 900.0.

Sale: when approaching 900.0. Stop: 930.0. Target: 810.0.

Support — 808.0. Resistance — 847.6.

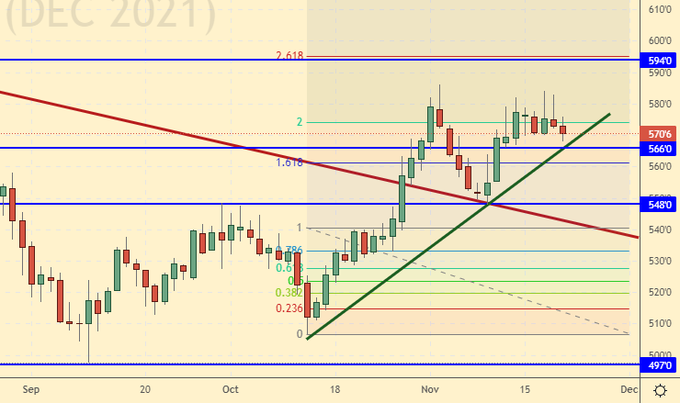

We are looking at the volumes of open interest of corn managers. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent one that is published by the CME Group exchange.

Over the past week, the difference between long and short positions of managers increased by 23.6 thousand contracts. The bulls are in complete control of the situation. Nobody expects cheap corn.

Growth scenario: December futures, expiration date December 14. We continue to hold longs with the target at 593.0. At this stage, the rollback to 540.0 cannot be denied; one must be mentally prepared for this.

Falling scenario: can be sold now. The chances of a move down are not great yet, so reduce your capital risk on this trade.

Recommendation:

Purchase: no. Those who are in the position from 538.0, move the stop to 554.0. Target: 593.0.

Sale: when approaching 600.0. Stop: 607.0. Target: 562.0. Or now. Stop: 583.0. Target: 543.0.

Support — 566.0. Resistance — 594.0.

Soybeans No. 1. CME Group

Growth scenario: January futures, the expiration date is January 14. Buying from current levels is interesting, albeit somewhat provocative. As long as the crops do not fall, soybeans will receive support from them.

Falling scenario: we exited the falling channel upwards. It’s a pity, but our sales didn’t reach the target below. We earned less than we could. Recommendation:

Purchase: when approaching 1240. Stop: 1230.0. Target: 1400.0.

Sale: no.

Support — 1240.6. Resistance — 1314.0.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 28. We continue to believe that you can buy only after a rise above 20.70. The second option is to enter long after falling to 18.15.

Falling scenario: here you can enter short. Movement to 18.15 remains possible.

Recommendation:

Purchase: when approaching 18.15. Stop: 17.40. Target: 23.20. Or after a rise above 20.70. Stop: 20.20. Target: 23.20.

Sale: now. Stop: 20.71. Target: 18.20.

Support — 19.31. Resistance — 20.71.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 20. We almost reached our goal at 246.0. The market should touch our target next week. We are waiting.

Falling scenario: when approaching 246.00, we will definitely sell. Only small sales volumes can be made from the current levels.

Recommendation:

Purchase: no. Whoever is in the position from 192.00, move the stop to 210.00. Target: 244.00. Sale: when approaching 246.00. Stop: 266.0. Target: 166.00 ?!

Support — 215.20. Resistance — 246.05.

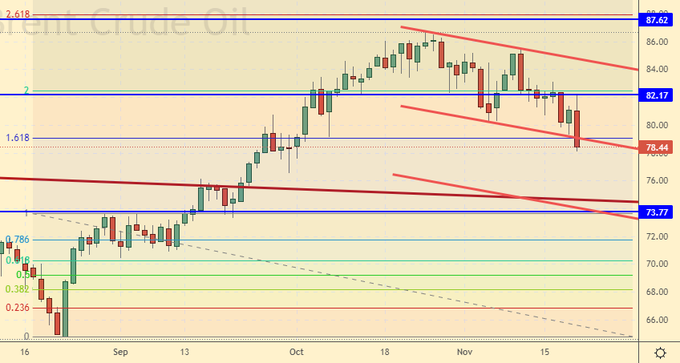

Brent. ICE

We’re looking at the volume of open interest of Brent managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 18.6 thousand contracts. Sellers have been building up pressure for three weeks in a row, which ultimately led to the current fall in prices.

Growth scenario: November futures, expiration date November 30. We don’t buy yet. Around 75.00 it will be possible to enter the long, provided that no general lockdown is introduced in Europe.

Falling scenario: keep the shorts open earlier. We can not only reach 75.00, but there are options that we will visit and the level of 60.00.

Recommendation:

Purchase: think when approaching 75.00.

Sale: no. Anyone in the position from 82.00, move the stop to 84.30. Target: 74.60. (60.00?)

Support — 73.77. Resistance — 82.17.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 7 units and is 461 units.

Commercial oil reserves in the US fell by -2.101 to 433.003 million barrels, while the forecast was +1.398 million barrels. Gasoline inventories fell by -0.708 to 211.995 million barrels. Distillate stocks fell -0.824 to 123.685 million barrels. Inventories at the Cushing storage facility rose 0.216 to 26.598 million barrels.

Oil production fell by -0.1 to 11.4 million barrels per day. Oil imports rose 0.083 to 6.191 million barrels per day. Oil exports rose by 0.573 to 3.626 million barrels per day. Thus, net oil imports fell by -0.49 to 2.565 million barrels per day. Refining increased by 1.2 to 87.9 percent.

Gasoline demand fell by -0.018 to 9.241 million barrels per day. Gasoline production fell by -0.132 to 9.922 million barrels per day. Gasoline imports rose 0.236 to 0.823 million barrels per day. Gasoline exports fell by -0.002 to 0.831 million barrels per day.

Distillate demand rose 0.07 to 4.35 million barrels. Distillate production fell by -0.026 to 4.842 million barrels. Distillate imports fell by -0.039 to 0.239 million barrels. Distillate exports rose 847.761 to 849 million barrels per day.

The demand for petroleum products increased by 2.339 to 21.629 million barrels. Production of petroleum products increased by 2.093 to 22.370 million barrels. Imports of petroleum products rose by 0.576 to 2.433 million barrels. Exports of petroleum products fell -1.053 to 5.143 million barrels per day.

Propane demand rose 0.045 to 1.194 million barrels. Propane production rose 0.026 to 2.442 million barrels. Propane imports fell by -0.007 to 0.117 million barrels. Propane exports fell by -0.19 to 1.392 million barrels per day.

We are looking at the volumes of open interest in WTI. You should take into account that this is data from three days ago (for Tuesday of the last week), it is also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 24.5 thousand contracts. A significant exit of bulls from long positions led to a fall in prices. Speculators see no reason to buy at the moment.

Growth scenario: January futures, the expiration date is December 20. The prospect of a move to 70.00 has become quite real. We are waiting for the price movement to this level.

Falling scenario: keep the shorts open earlier. We are capable of reaching 70.00 by the end of next week. Recommendation:

Purchase: think when approaching 70.00.

Sale: no. Whoever is in positions between 82.00 and 80.00, move the stop to 80.60. Target: 70.60.

Support — 69.71. Resistance — 77.16.

Gas-Oil. ICE

Growth scenario: December futures, the expiration date is December 10. We are waiting for the arrival of prices in the area of 615.00, and there we will think about purchases.

Falling scenario: keep the shorts open earlier. The move to 615.0 is quite real.

Recommendation:

Purchase: no.

Sale: no. Whoever is in positions from 750.00, 720.00 and 700.00, move the stop to 703.00. Target: 615.00.

Support — 618.75. Resistance — 688.75.

Natural Gas. CME Group

Growth scenario: January futures, expiration date December 29. We will buy here. Who bought last week — keep longs.

Falling scenario: we don’t believe in short. There is no balance in the energy market. The signing of a new agreement between the EU and Gazprom is being delayed.

Recommendation:

Purchase: now. Stop: 4.600. Target: 8.777. Those who are in the position from 4.900, move the stop to 4.600. Target: 8.777.

Sale: no.

Support — 4.759. Resistance — 5.490.

Gold. CME Group

Growth scenario: most likely we will roll back to 1820. Then we will go to 1920. Then we will wait for what the Fed will say at the meeting on December 15th. This is the plan.

Falling scenario: only those who believe the US administration do not like the depreciation of their debts can make sales. The guys got a taste. It is unlikely that rates will rise despite inflation. Recommendations:

Purchase: when approaching 1820. Stop: 1803. Target: 2060. Who is in position from 1815, move the stop to 1803.0. Target: 2060.

Sale: no.

Support — 1814. Resistance — 1923.

EUR/USD

Growth scenario: the euro is bent due to a new wave of infections. In the United States, there are full stadiums and there are no strict restrictions, in Europe everything is much worse, although if you believe the news, then 70% of the population is vaccinated in Germany, but at the same time 65 thousand people are infected per day. We do not buy.

Falling scenario: keep the shorts open four weeks ago. Who closed at 1.1310, return to position. We are waiting for 1.1060.

Recommendations:

Purchase: no.

Sale: no. Those who are in positions between 1.1900 and 1.1650, move the stop to 1.1410. Target: 1.1060.

Support — 1.1066. Resistance — 1.1616.

USD/RUB

Growth scenario: if oil continues to fall next week, and there are preconditions for this, then the pair will go up. We risk approaching the 75.00 level by Thursday evening. For the national currency, the seemingly good macroeconomic situation is developing very sadly.

Falling scenario: the situation has lost its attractiveness for entering the short within a week. We are out of the market.

Recommendations:

Purchase: think after rallies above 74.00.

Sale: no.

Support — 72.22. Resistance — 74.00 (75.40).

RTSI

Growth scenario: December futures, expiration date December 16. The index could not hold above 176000 and went down. It is possible that Western investors are dumping Russian securities, as they are preparing for problems at home. We do not buy.

Falling scenario: as well as two weeks earlier, we do not open new sell positions, we keep the old ones. Move to 150,000 is possible. Who wants to take profit, close 25% of the volume in the event that the market stops falling in the first half of the day on Monday.

Recommendations:

Purchase: no.

Sale: no. Who entered between 192700 and 190,000, move the stop to 181700. Target: 150,000.

Support — 168470. Resistance — 180890.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|