Price forecast from 2 to 6 September 2024

Grain market:

In Chinese writings, or maybe in reality, there is such a story: if a person is drowning, it is not necessary to help him, it is his fate, let him go to the bottom. It is clear that for the sake of a poor person one does not want to wet one’s feet in the sea. And if the state is sinking, should we help it? Probably not, it’s his fate too. But, there is a question, who will help China itself when it starts to sink, for example, in 2025? Yes, who will save it, it’s the whole China. Let it sink.

To buoyancy and survivability! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The wheat market is in pretty good shape for September. We don’t see the 500.0 level we were thinking about earlier. Despite good, but hardly record volume, prices are in no hurry to please us, as future buyers, with low levels, which makes us want to start the process of gradually loading the bullish position now. As we have repeatedly noted, the grain market, and wheat in particular, is far from saturated. If we do not see an increase in gross harvest volumes every year, the stagnation could already cause prices to rise, as demand is growing all the time.

It has been reported that the quality of the current wheat crop in Russia is better than last year. There may be a drop in gross yield, but in terms of the value of the crop the losses will be insignificant.

There is no doubt that Russia will add 40 million tons of wheat this season. Most likely the demand will be good. And buyers surely understand now that to take Black Sea wheat below 220 dollars per ton, when French wheat costs 240, is a great luck. We do not expect further price drops at FOB, and we may see short-term dips at the Chicago exchange, but unfortunately the chances of them appearing are small.

Energy market:

There are no fears on the market at the moment. We cannot break away from the 80.00 area and go higher. The market is not frightened by the cessation of oil supplies from Russia, while many are waiting for China to suddenly stop and kneel down. It may stand up, but it will continue to buy resources. Beijing is already doing this, collecting more resources from the external market than it can process. When will it be satiated? Given that the dollar, and other fiat money, is worth less and less, never. If there are fools in the world who can give you a bar of copper, aluminum, gold for an electronic record, not even a piece of paper, for a virtual yuan, give them that yuan. Take the gold and give them the virtual yuan again, and buy gold or oil again. It’s profitable. You give nothing, and they give you everything.

Ukraine will stop transit of Russian resources through its territory in 2025. Whether the transit of third-country resources piped through Russia and through Ukraine will take place is still a question. If the infrastructure will be blown up by one of the parties, then no. And if it is not, then maybe yes, maybe no. Against the background of this fact in Europe, no one is already hysterical. Is it possible to live in an apartment at +12? Probably yes.

USD/RUB:

Is there a dollar/ruble pair? If you take dollars and go to an exchange office with them and get rubles for them, then yes, there is such a pair. And if you can buy dollars for rubles, then there is definitely a pair. And where do we need them now? Unless someone needs to go to Bali for a week, or somewhere else.

On September 13 at 13:13 Moscow time, the Central Bank of Russia will announce its next rate decision. And something tells us, after the appearance of 1 trillion rubles of profit in the pipe (aka GAZPROM) in the classified report for 6 months of the 24th year and the instantaneous growth of GDP by another 1.5% from 2.3% to 3.8%, for three days, that the rate will remain at the current level. Since they were told to give growth and fight inflation. But here’s Zabotkin… he… suddenly he doesn’t agree with the red line drawn and will continue to rub inflation with the rate. And that’s when it’s 20%. It’s a pity, but this action or inaction will have no effect on the dollar/ruble pair. The pair is almost dead. But we have Sberbank. We will race it in the terminal… until it is not so….

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 6 th. contracts. Sellers and buyers entered the market, but sellers did it more actively. Bears keep control.

Growth scenario: we consider December futures, expiration date December 13. So far, we do not buy from current levels, but if you are ready to tolerate significant drawdowns, you can consider taking a bullish position.

Downside scenario: we remain in sales. We want to see the level of 500.0.

Recommendations for the wheat market:

Buy: when approaching 495.0. Stop: 490.0. Target: 680.0.

Sell: no. Who is in position from 553.0, keep stop at 562.0. Target: 500.0 (400.0).

Support — 538.4. Resistance — 560.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 8.6 th. contracts. There were no buyers. Sellers were leaving. Bears are controlling the market.

Growth scenario: we consider December futures, expiration date December 13. We unexpectedly found support at 385.0. We don’t buy yet, but morally we are ready for it.

Downside scenario: we will keep the existing short. If the market can consolidate above 400.0 next week, it will be an unpleasant surprise for sellers.

Recommendations for the corn market:

Buy: when approaching 360.0. Stop: 340.0. Target: 460.0.

Sell: no. Those in position from 391.0, keep stop at 403.0. Target: 310.0.

Support — 385.0. Resistance — 402.6.

Soybeans No. 1. CME Group

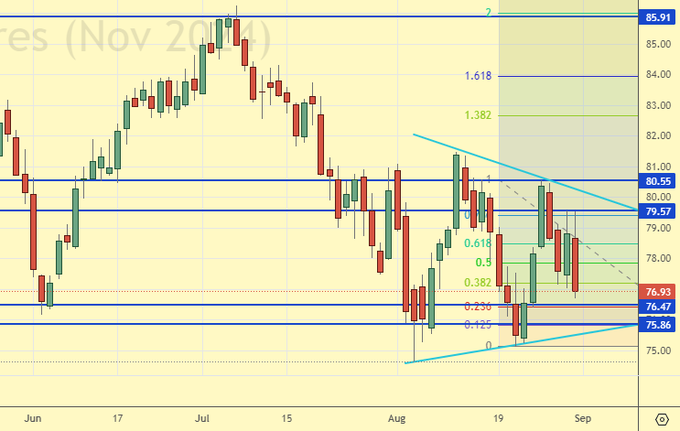

Growth scenario: we consider November futures, expiration date November 14. Paused the fall. We do not buy yet, as sellers are unlikely to have fully expressed themselves.

Downside scenario: sell now with a close stop order. There are a lot of oilseeds. We should continue to fall.

Recommendations for the soybean market:

Buy: at touching 850.0. Stop: 830.0. Target: 1100.0.

Sell: now (1000.0). Stop: 1015.0. Target: 850.0.

Support — 947.6. Resistance — 1009.0.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 17.4 thousand contracts. Buyers entered, sellers reduced positions in small volumes. Buyers hold control over the market.

Growth scenario: we consider November futures, expiration date September 30. For now, we can look for buying opportunities. It is worth recognizing that a fall below 75.00 will lead to a descent to 70.00.

Downside scenario: sellers managed to draw consolidation, but the fact that we should go exactly down is not a fact. Commercial oil inventories in the US continue to fall.

Recommendations for the Brent oil market:

Buy: when touching 76.40. Stop: 74.90. Target: 100.00. Those in position from 78.15, keep stop at 74.90. Target: 100.00.

Sell: to think in case of falling below 74.90.

Support — 76.47. Resistance — 79.57.

WTI. CME Group

US fundamental data: the number of active drilling rigs is unchanged at 483.

U.S. commercial oil inventories fell -0.846 to 425.183 million barrels, with a forecast of -2.7 million barrels. Gasoline inventories fell -2.203 to 218.394 million barrels. Distillate stocks rose 0.275 to 123.086 million barrels. Cushing storage stocks fell by -0.668 to 27.536 million barrels.

Oil production fell by -0.1 to 13.3 million barrels per day. Oil imports fell by -0.092 to 6.56 million barrels per day. Oil exports fell by -0.374 to 3.671 million barrels per day. Thus, net oil imports rose by 0.282 to 2.889 million barrels per day. Oil refining rose by 1 to 93.3 percent.

Gasoline demand rose by 0.114 to 9.307 million barrels per day. Gasoline production fell -0.156 to 9.612 million barrels per day. Gasoline imports rose 0.336 to 0.867 million barrels per day. Gasoline exports rose 0.086 to 0.817 million barrels per day.

Distillate demand increased by 0.246 to 3.822 million barrels. Distillate production increased by 0.11 to 5.002 million barrels. Distillate imports rose 0.157 to 0.22 million barrels. Distillate exports fell -0.492 to 1.361 million barrels per day.

Demand for petroleum products increased by 1.17 to 21.592 million barrels. Production of petroleum products increased by 0.155 to 22.706 million barrels. Petroleum product imports rose 0.085 to 1.96 million barrels. Exports of refined petroleum products fell -0.74 to 6.567 million barrels per day.

Propane demand increased by 0.598 to 1.027 million barrels. Propane production increased by 0.051 to 2.701 million barrels. Propane imports rose 0.014 to 0.087 million barrels. Propane exports fell -0.39 to 1.619 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 10.1 th. contracts. Buyers entered the market, sellers reduced positions in small volumes. Bulls keep control.

Growth scenario: we consider October futures, expiration date September 20. We will continue to recommend buying. The market leaves chances for bulls at the moment.

Downside scenario: if it manages to pass below 70.00, it is a reason to think about a fall. Will it be strong? Only if oil prices are used as a weapon against Russia. Will the Arabs agree? They will be asked to be patient in the name of “democracy”.

Recommendations for WTI crude oil:

Buy: now (73.55). Stop: 71.80. Target: 100.00.

Sale: no.

Support — 71.41. Resistance — 77.58.

Gas-Oil. ICE

Growth scenario: we consider September futures, expiration date September 12. It is interesting to hold a long here. Will the attack on the Moscow refinery resonate in Europe? Probably not, as the export of oil products from Russia is prohibited. But traders may pull the market up a bit just on the news feed on Monday.

Downside scenario: nothing of interest to sellers here.

Gasoil Recommendations:

Buy: No. Those in position from 708.25, keep stop at 683.00. Target: 955.00.

Sale: no.

Support — 683.50. Resistance — 728.50.

Natural Gas. CME Group

Growth scenario: we consider October futures, expiration date September 26. Technically, you can buy. Winter is near!

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: now (2.127). Stop: 1.980. Target: 5.000?! Count the risks!

Sale: no.

Support — 1.987. Resistance — 2.431.

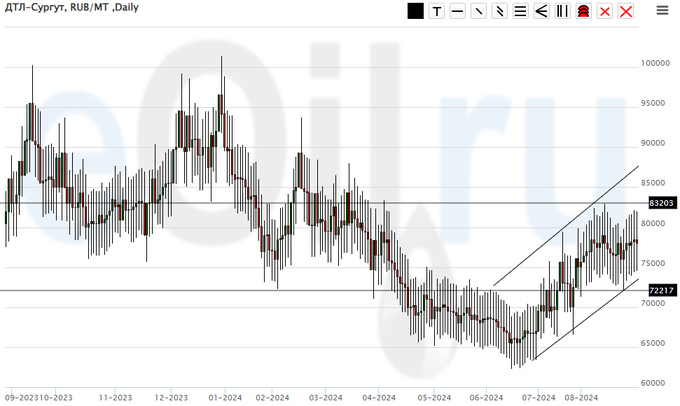

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 69000. Target: 100000!

Sale: no.

Support — 72217. Resistance — 83203.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 21172. Resistance — 33750.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1018. Resistance — 1525.

Growth scenario: we consider December futures, expiration date December 27. Nothing new. The bulls cannot convince us of their power yet. We don’t buy, but we are watching carefully.

Downside scenario: keep selling. We are unlikely to see a fall to 2120, but who knows. First we need to get a pullback to 2400.

Gold Market Recommendations:

Buy: no.

Sell: Now (2527.0). Stop: 2572.0. Target: 2120.

Support — 2506. Resistance — 2564.

EUR/USD

Growth scenario: the current pullback is appropriate, but since we were knocked out of the long, and the future is very vague, we will take a pause in trading for a week.

Downside scenario: could the dollar surprise with its strengthening? It could. And if we fall under 1.0900, we will have to look for short entry opportunities.

Recommendations on euro/dollar pair:

Buy: no.

Sale: no.

Support — 1.1014. Resistance — 1.1200.

USD/RUB

Growth scenario: we consider the September futures, expiration date September 19. Nothing new. The market is able to go higher. Let’s hold the long.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Those who are in position from 85976, move your stop to 85900. Target: 100000 (200000. Yes, yes, it is possible).

Sale: no.

Support — 87331. Resistance — 90434.

RTSI. MOEX

Growth scenario: we consider the September futures, expiration date September 19. We continue not to believe in the growth of the Russian market in dollars. Yes, a long from the 87000 area is possible, but we need to weigh everything very well for such a step. There will be no explicit recommendation from us on this purchase yet.

Downside scenario: we will keep shorting. We’ve consolidated under 97600. We should go to 87000. Note that a fall below 87000 may cause panic and dumping of securities. Prospects for 2025 are better not to announce. Why? Because there are none. GDP growth of 0.5% is nothing. That’s nothing.

Recommendations on the RTS index:

Buy: no.

Sell: no. Those who are in the position from 115200, move the stop to 97600. Target: 87600.

Support — 91150. Resistance — 97570.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.