Price forecast from 17 to 21 of October 2022

17 October 2022, 12:26

-

Grain market:

The situation is such that it is extremely difficult to find something good in it. The West will conduct exercises on the topic «Nuclear War». Only exercises, nothing more. But the demand for bunkers and other shelters will undoubtedly continue to grow.

And we, despite the approaching end of civilization, continue to analyze the markets.

All health. Hello everybody!

Russia encounters strong obstacles in the conclusion, implementation and support of foreign trade transactions in the food market. It cannot be ruled out that the «grain deal» will be closed in the next couple of weeks, which will lead to a halt in the export of Ukrainian grain.

The USDA gross harvest data did not bring any surprises. Everything is quiet. A lot of cereals and oilseeds were born. For Russia, this is not very good, because even if all our exports are blocked, the rest of the world will calmly cope with the situation and make up for the deficit. Thus, at the moment, the Kremlin will not be able to play the food card in the conflict with the West, unlike the oil and gas card.

The Turks are making the most of the conflict in Ukraine. Not only will they, apparently, be allowed to create a gas hub, they will also help with the organization of a grain exchange. Is it worth it for Russia to feed its southern neighbor like this even in the current difficult situation, given the construction of a nuclear power plant here and the multimillion-dollar flow of tourists and private investors? This is a big question.

At the moment we can talk about price correction in the wheat and corn markets, but we are unlikely to see a move below 750.0 cents per bushel for wheat and 550.0 cents per bushel for corn.

Energy market:

The world is divided into two halves. The West and other consumers need cheap resources. Russia and other exporters need high prices. There is a tough undercover struggle going on in the oil market. The US election is less than a month away. Biden and company need to paint a pretty picture. It cannot be ruled out that American hedge funds are also helping to create it, only the Arabs have so much money that chickens do not peck. The battle between OPEC+ and the Biden administration continues. At the moment, the market for Brent is not seen below $90.00 per barrel.

Moscow said that countries that impose price restrictions will not have oil or gas. Europe is still holding its tail with a gun, because by stopping enterprises that consume gas, it was able to create some reserves for the winter. In the event of real cold weather, we will witness the popular anger of freezing people. Eurobureaucrats should be very scared right now. For them, nothing is more important than the weather forecast.

Iran sneezed at everyone and launched new centrifuges for uranium enrichment, which it was not supposed to put into operation under the terms of the nuclear deal. Thus, we do not expect an additional million barrels per day of Iranian oil on the market in the next 6 months.

These days, seeing how Russia alone, which once again opposes the West, many middle-class states have thought about the need to have something in their arsenal that will cause irreparable damage to the aggressor.

We will announce our forecast for the future of 3-5 years. We cannot avoid an arms race. South Africa, Egypt, Saudi Arabia, Turkey, Indonesia, Vietnam, Chile, Brazil, Mexico, perhaps even the Scandinavian countries, and other countries may consider owning something dangerous and compact at the same time.

Anxious times require a lot of resources. And we will sell them to all who suffer, but only at the market price.

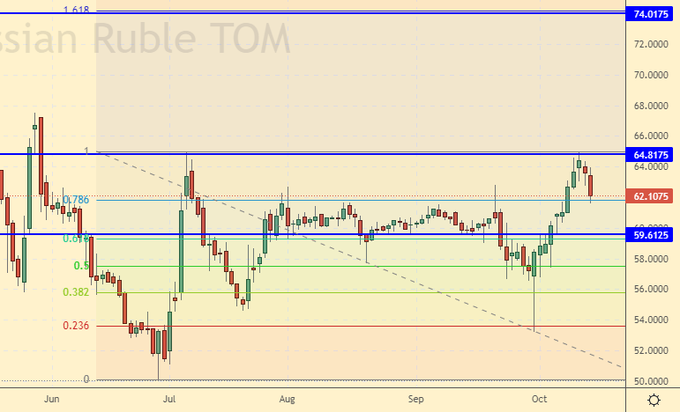

USD/RUB:

In the last review, we talked about the fact that the dollar / ruble pair is a living dead. And it is. But last week, the zombie behaved briskly and even tried to climb over the fence with a mark of 65.00, but caught on 64.80 and could not lift its leg higher. After a brief struggle filled with low growls, the dead man retreated to less significant positions. We have the right to expect a rollback to the level of 60.00 after which the creature will make another attack directed upwards with a long-term target at the level of 77.00.

A strong dollar will force debtors to pay more on their obligations in the future. Demand for the US currency will rise, which could lead to a fall in commodity prices, as many companies will provide discounts on their products, including raw materials, in order to collect the necessary amount of dollars to service the debt.

Note that trading in the ruble may end on any day and hour due to the introduction of new Western sanctions. This is recognized by our Central Bank. Therefore, we urge all traders to once again realize all the possible risks of trading this pair.

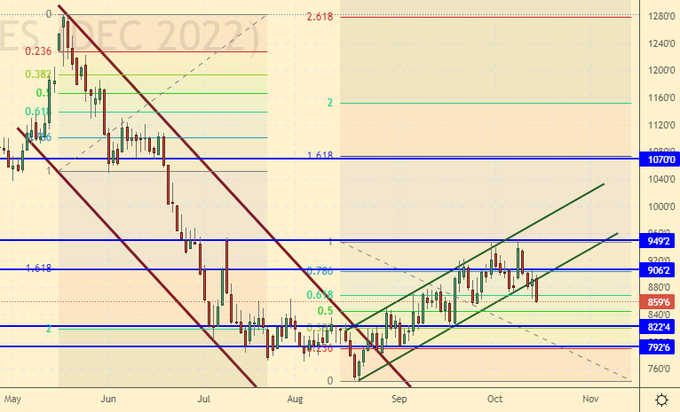

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest of managers in wheat. You should keep in mind that these are data from three days ago (for Tuesday of the last week), they are also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Sellers control the market. Over the past week, the difference between long and short positions of managers increased by 7.2 thousand contracts. Sellers actively entered the market, while buyers’ positions remained unchanged. The spread between short and long positions widened, sellers strengthened their advantage.

Growth scenario: consider the December futures, the expiration date is December 14th. We will continue to refrain from buying, counting on a move to the level of 825.0 cents per bushel. There we will think about entering the long.

Fall scenario: holding shorts. We want not only the level 825.0, but also 750.0. Appetite comes with eating. We will sell.

Recommendations for the wheat market:

Purchase: when approaching 825.0. Stop: 808.0. Target: 1070.0.

Sale: now. Stop: 910.0. Target: 825.0 (750.0) cents per bushel.

Support — 822.4. Resistance — 906.2.

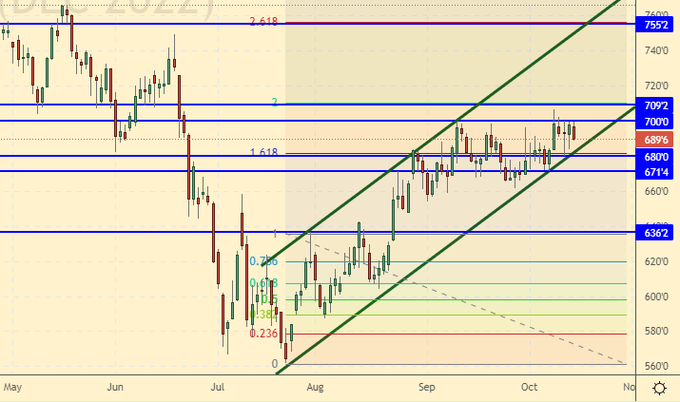

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 25.7 thousand contracts. The change is significant. Buyers entered the market in large numbers. Sellers also increased the number of their positions, but weakly. The spread between longs and shorts widened, and the bulls’ lead increased.

Growth scenario: consider the December futures, the expiration date is December 14th. The intensity of the struggle in the market has increased. We need to rise above the level of 700.0. If this does not happen, then quotes will fall.

Fall scenario: there are a lot of bulls. Fellow buyers could be attacked by two or three hedge funds. Could be very interesting on the market in the next couple of weeks. At current levels, the risk is justified, those who wish can try to go short.

Recommendations for the corn market:

Purchase: no. Who is in position from 680.0, move the stop to 670.0. Target: 750.0 cents per bushel.

Sell: now, add after falling below 670.0. Stop: 717.0. Target: 550.0 cents per bushel.

Support — 680.0. Resistance — 700.0.

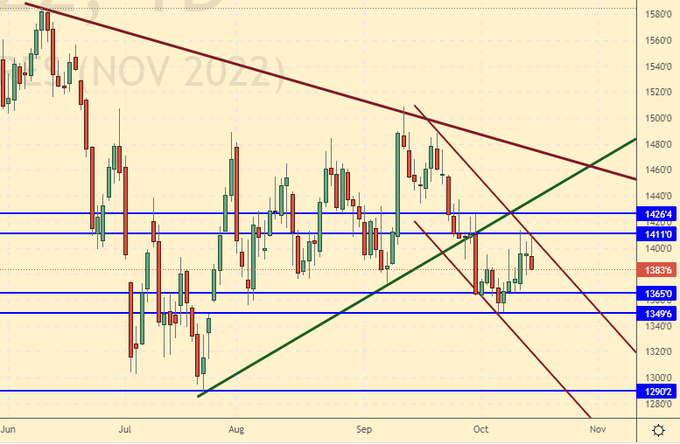

Soybeans No. 1. CME Group

Growth scenario: we are considering the November futures, the expiration date is November 14th. We recommend to refrain from buying soy. She was born a lot.

Fall scenario: here you can open shorts or increase old positions. It will not be surprising that we will fall down to the level of 1000.0.

Recommendations for the soybean market:

Purchase: no.

Sale: now. Stop: 1440.0. Target: 1000.0. Those who are in positions from 1420.0, 1400.0 and 1390.0 keep the stop at 1440.0. Target: 1000.0 cents per bushel.

Support — 1365.0. Resistance is 1411.0.

Sugar 11 white, ICE

Growth scenario: we consider the March futures, the expiration date is February 28. It’s a pity, but the market didn’t give us a chance to buy. We do not buy at current prices.

Fall scenario: while we remain outside the market. Prices may rise to the level of 19.37 cents per pound.

Recommendations for the sugar market:

Purchase: on rollback to 18.20 and 18.10. Stop: 17.60. Target: 19.37 cents a pound.

Sale: think when approaching 19.37.

Support — 18.54. Resistance — 19.37.

Сoffee С, ICE

Growth scenario: consider the December futures, the expiration date is December 19. Very strong drop down. A rollback is requested. We will buy at current levels.

Fall scenario: continue to hold shorts. On the rise to 210.0, it is worth increasing the shorts.

Recommendations for the coffee market:

Purchase: now. It can be aggressive. Stop: 193.0. Target: 350.00 cents per pound.

Sale: no. Who is in position from 220.0, move the stop to 218.00. Target: 150.00 cents per pound.

Support — 192.15. Resistance — 200.15.

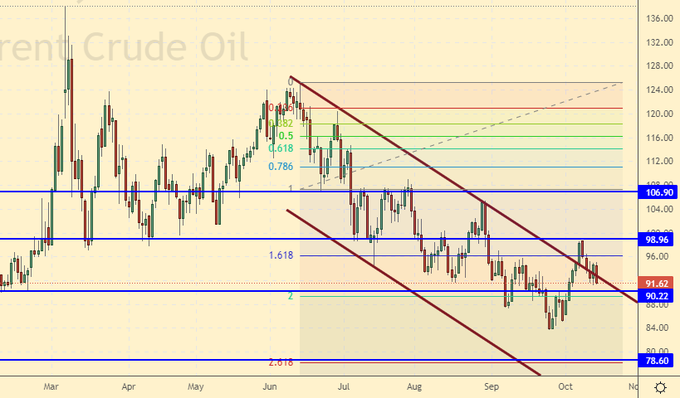

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Over the past week, the difference between long and short positions of managers increased by 13,000 contracts. Buyers entered the market, sellers closed positions. The spread between long and short positions widened. The bulls continue to tighten their grip on the market.

Growth scenario: consider the October futures, the expiration date is October 31. The current levels are attractive for purchases. The market is unlikely to go below $88.00 per barrel.

Fall scenario: we continue to refrain from selling. Judging by the open interest, speculators are building up longs.

Recommendations for the Brent oil market:

Purchase: now. Stop: 87.00. Target: 110.00. dollars per barrel.

Sale: no.

Support — 90.22. Resistance is 98.96.

WTI. CME Group

US fundamental data: the number of active drilling rigs increased by 8 units and now stands at 610 units.

Commercial oil reserves in the US rose by 9.879 to 439.082 million barrels, with the forecast of +1.75 million barrels. Inventories of gasoline rose by 2.022 to 209.482 million barrels. Distillate inventories fell -4.853 to 106.063 million barrels. Inventories at Cushing fell -0.309 to 25.647 million barrels.

Oil production fell by -0.1 to 11.9 million barrels per day. Oil imports rose by 0.116 to 6.063 million barrels per day. Oil exports fell by -1.679 to 2.872 million barrels per day. Thus, net oil imports rose by 1.795 to 3.191 million barrels per day. Oil refining fell by -1.4 to 89.9 percent.

Gasoline demand fell by -1.189 to 8.276 million barrels per day. Gasoline production fell -0.846 to 9.168 million barrels per day. Gasoline imports rose by 0.219 to 0.699 million barrels per day. Gasoline exports rose by 0.256 to 1.052 million barrels per day.

Demand for distillates rose by 0.265 to 4.37 million barrels. Distillate production fell -0.325 to 4.863 million barrels. Distillate imports fell -0.002 to 0.079 million barrels. Distillate exports fell -0.39 to 1.266 mb/d.

Demand for petroleum products fell by -1.56 to 19.271 million barrels. Production of petroleum products fell by -1.777 to 20.768 million barrels. Imports of petroleum products rose by 0.49 to 1.862 million barrels. Exports of petroleum products increased by 0.995 to 7.056 million barrels per day.

Propane demand fell by -0.035 to 0.895 million barrels. Propane production increased by 0.037 to 2.494 million barrels. Propane imports fell -0.007 to 0.075 million barrels. Propane exports rose by 0.133 to 1.518 million barrels per day.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

At the moment, there are more open long positions of asset managers than short ones. Buyers control the market. Last week the difference between long and short positions of managers increased by 18.6 thousand contracts. The change is significant. Sellers reluctantly left the market, buyers entered positions massively. The spread between longs and shorts widened, and the bulls’ lead increased.

Growth scenario: we consider the December futures, the expiration date is November 21. It is possible to buy from the current levels and in case of a rollback to 82.00. The market is unlikely to go below the 80.00 level.

Fall scenario: The market turned up. Until we sell.

Recommendations for WTI oil:

Buy: now and when approaching 82.00. Stop: 79.00. Target: 103.00.

Sale: no.

Support — 82.05. Resistance is 92.50.

Gas-Oil. ICE

Growth scenario: we are considering the November futures, the expiration date is November 10. We will buy based on continued growth. The fuel situation, especially in Europe, will be tense.

Fall scenario: we will not sell. There are big doubts about the ability of the energy market to turn down.

Gasoil recommendations:

Purchase: now. Stop: 1030.0. Target: 1320.0. Who is in position from 1055.00, keep the stop at 960.00. Target: 1320.00.

Sale: no.

Support — 1043.00. Resistance is 1168.50.

Natural Gas. CME Group

Growth scenario: look at the November futures, the expiration date is October 27th. The picture entices us. We continue to recommend purchases. You have to be ready to pierce down and bounce up.

Fall scenario: We are too low for our troubled times. We do not enter shorts.

Recommendations for natural gas:

Purchase: now. Stop: 6.200. Target: 15.000!!! Who is in position between 6.500 and 6.800, keep the stop at 6.200. Target: 15.000!!!

Sale: no.

Support — 6.303. Resistance — 7.169.

Gold. CME Group

Growth scenario: the levels are interesting for tactical buying. It can be aggressive. If something happens and the market turns up, these longs will be front row tickets in our eternal movie theater.

Fall scenario: persistence in shorts pays off. It is possible that the market will visit the level of 1480.

Recommendations for the gold market:

Purchase: now. Stop: 1627. Target: 2400?!!!

Sale: no. If you are in position from 1700, move your stop to 1703. Target: $1480 per troy ounce.

Support — 1616. Resistance — 1660.

EUR/USD

Growth scenario: nothing good for the euro so far. Expensive energy will hit Europe extremely hard in 2023.

Fall scenario: we will continue to build up shorts. We need a mark of 0.8600. A positive difference in interest rates between the dollar and the euro will drive the European currency into the basement.

Recommendations for the EUR/USD pair:

Purchase: no.

Sale: now. Stop: 0.9840. Target: 0.8600. Who is in position from 0.9720, p move the stop back to 0.9840. Target: 0.8600.

Support is 0.9531. Resistance is 0.9833.

USD/RUB

Growth scenario: purchases from the level of 61.00 can be kept. If the market gives you the opportunity to buy from 60.00 and 59.00, then you need to do it. Given that the market evaluates not only the present, but also the future, we can safely say that against the backdrop of sanctions, there are no fundamental prerequisites for strengthening the Russian currency on the horizon of two to three months.

Fall scenario: we do not deny that surprises are possible, and the ruble in the thin market can get stronger up to 55.00. But if a gigantic foreign trade surplus did not affect the ruble against the dollar in September, then why should the strengthening happen now, when it is clear that Russia will reduce its profits from the sale of resources by the end of the year amid sanctions? We will not go long on the ruble against the dollar.

Recommendations for the dollar/ruble pair:

Purchase: When falling to 60.00 and 59.00. Stop: 57.40. Target: 74.00. Who is in position from 61.60, keep the stop at 57.40. Target: 74.00.

Sale: no.

Support — 59.61. Resistance is 64.81.

RTSI

Growth scenario: consider the December futures, the expiration date is December 15th. Against the backdrop of the eighth package of sanctions from the European Union, the index is in the range. As winter approaches, the West is losing interest in what is happening in Ukraine, preferring to distance itself somewhat from the conflict. Although this does not happen in all directions, there is a feeling that they will try to somehow slow down the situation. If there are hints of an agreement with Kyiv, the market will rush up. However, at this day and hour we have no positive news.

Downside scenario: If we rise above the 105000 level, we may need to rethink our bearish outlook on the current situation. In the meantime, this has not happened, we will continue to hold shorts from 118,000. Targets for 80,000 and 50,000 points remain.

Recommendations for the RTS index:

Purchase: think in case of growth above 105000.

Sale: no. Who is in position from 118000, move the stop to 106000. Target: 80000 (50000).

Support — 95140. Resistance — 102590.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.

Ваш комментарий

|

|

|