Price forecast from 17 to 21 June 2024

Grain market:

We lived somehow before: shells, beads, stones, teeth of rare animals, tusks of elephants, skulls of famous people. In the historical perspective, most of the time mankind did without the dollar. And there was no Moscow Exchange. Let’s not be sad. Let’s hope for a narrow spread of banks on currency for those who need it. And those who don’t need it, let’s just hope for the best.

I don’t even want to buy yuan anymore. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

The June forecast for gross harvest in the 24/25 season has been released. After reading the document, we see that for wheat the gross harvest was reduced by 4 million tons to 798 million tons, which leaves this volume at record levels. For corn, there were no changes at all. All are at their highest levels since May. Thus, the grain market has no fundamental reasons to grow. Some surges cannot be ruled out, but it is more likely that we will go down.

It should be noted that the gross harvest of wheat in Russia has been reduced from 88 to 83 million tons, which may create tension in the Black Sea region. In addition, one cannot ignore the prolonged SWO, which does not allow farms to function normally, and this is also a drop in the gross harvest.

Russia will have to compete this year with Ukraine and Romania, especially since Ukrainian agricultural products are not welcome in Europe. This means that we may meet at tenders outside Europe, for example, at Egyptian tenders. It is unlikely that we will be able to overcome the level of $300 per tonne FOB in such an environment.

Energy market:

Brent rose above 80.00. On one side of the scale we have the probability of OPEC’s supply growth in the fall, on the other side the demand growth up to 1 million barrels by the end of the year. Probably, the cartel will try to close this growing demand. If it does everything carefully, we will stay around 80.0, if there will be sharp steps, dancing with sabers, frontal attacks on camels, then 50.00 may be waiting for us. Much will also depend on the GDP figures of the leading countries of the world. If there will be hints of life, i.e. growth, then we will have to wander around 80.00 for more than one month. Even on holidays we will go up to 90.00.

The West continues to be in a furious state. But it cannot do too much. One topic is making it harder to trade oil by sea. If, for example, our millet or barley can be discarded, oil is not so easy. There will be a buyer. It’s a question of price. Now the great Gabon earns money on its flag, under which about a hundred of our ships sail around the world. If Gabon doesn’t exist, someone else will.

The departure of Western oilfield service companies has already given an impetus to import substitution. It does not matter if at first the samples are not too efficient, the main thing is its own design thought, which is capable of making revolutionary leaps. Again, Russian heads will think for rubles, not for dollars.

USD/RUB:

Washington imposed sanctions against MICEX and NCC. Now trading in the dollar/ruble pair has become impossible. There are futures, there is the interbank, which will give the Central Bank a benchmark for determining the exchange rate.

In general, if the inflow of currency into the country continues, it should force the Central Bank to create some transparent mechanism for determining the exchange rate. Otherwise, banks will collude, if they have not already colluded, and keep the spread at 10%, robbing both importers and exporters.

The future of the pair, which will now be projected to us via the yuan as long as it flows into the country, looks not that wild, due to the potentially large spread, but rather unreliable, not elastic due to a significant reduction in the number of participants in the trade.

We will take a break for a week to forecast further developments. After all, the situation is non-standard.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 14.2 th. contracts. Buyers are fleeing from this market. Sellers are not increasing volumes yet. Bears have strengthened their control.

Growth scenario: we consider the July futures, expiration date July 12. Tough story. Buying from 590.0 is interesting. Otherwise out of the market.

Downside scenario: nothing new, shorting from 750.0 will be a good solution. True, it is not clear where we will end up there. Unless it is another intrigue of the West.

Recommendations for the wheat market:

Buy: at touching 592.0. Stop: 580.0. Target: 750.0.

Sell: when approaching 750.0. Stop: 770.0 Target: 600.0.

Support — 605.4. Resistance — 633.2.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 0.4 thousand contracts. Speculative activity on this market was absent last week. Bears again strengthened their control.

Growth scenario: we consider July futures, expiration date July 12. On the background of good expectations for the harvest, do not buy.

Downside scenario: given the good forecasts for the gross harvest, we will hold a short that opened from the 460.0 area.

Recommendations for the corn market:

Buy: no.

Sell: No. Those in position from 458.0, move stop to 457.0. Target: 360.0.

Support — 436.6. Resistance — 460.4.

Soybeans No. 1. CME Group

Growth scenario: we consider July futures, expiration date July 12. We got nothing on the upside. We are out of the market for now.

Downside scenario: soybean gross yield forecasts are good. It is possible to sell.

Recommendations for the soybean market:

Buy: no.

Sell: Now (1179.0). Stop: 1207.0. Target: 960.0.

Support — 1144.6. Resistance — 1204.2.

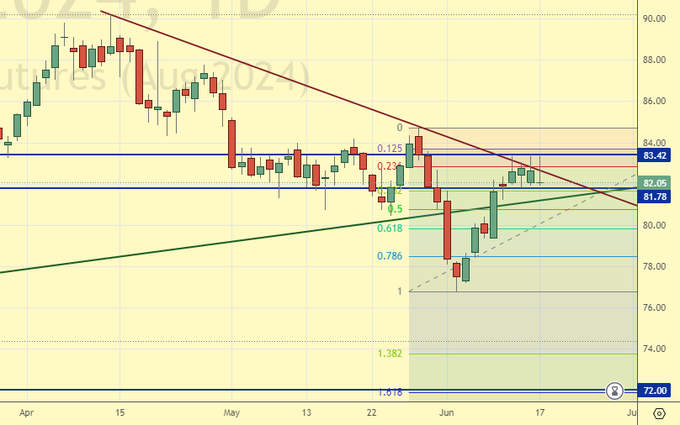

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 31.4 th. contracts. There were no buyers. Sellers were leaving the market in large volumes. Buyers strengthened their control over the market.

Growth scenario: we consider July futures, expiration date June 28. We don’t think about buying until we get above 84.20.

Downside scenario: it would be interesting to sell from the 83.00 area.

Recommendations for the Brent oil market:

Buy: no.

Sell: no. Those in position from 83.00, keep stop at 84.20. Target: 70.00.

Support — 82.05. Resistance — 83.42.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 4 units to 488.

U.S. commercial oil inventories rose 3.73 to 459.652 million barrels, with a forecast of -1.2 million barrels. Gasoline inventories rose 2.566 to 233.512 million barrels. Distillate stocks rose 0.881 to 123.366 million barrels. Cushing storage stocks fell by -1.593 to 33.815 million barrels.

Oil production increased by 0.1 to 13.2 million barrels per day. Oil imports increased by 1.246 to 8.304 million barrels per day. Oil exports fell by -1.313 to 3.188 million barrels per day. Thus, net oil imports rose by 2.559 to 5.116 million barrels per day. Oil refining fell by -0.4 to 95 percent.

Gasoline demand increased by 0.094 to 9.04 million barrels per day. Gasoline production increased by 0.602 to 10.086 million barrels per day. Gasoline imports rose 0.213 to 0.912 million barrels per day. Gasoline exports fell -0.033 to 0.858 million barrels per day.

Distillate demand rose by 0.282 to 3.649 million barrels. Distillate production fell by -0.029 to 5.032 million barrels. Distillate imports fell -0.051 to 0.091 million barrels. Distillate exports fell -0.032 to 1.348 million barrels per day.

Demand for petroleum products fell by -1.291 to 19.219 million barrels. Petroleum products production fell by -0.965 to 21.759 million barrels. Imports of refined petroleum products fell -0.221 to 1.82 million barrels. Exports of refined products rose by 1.426 to 7.502 million barrels per day.

Propane demand rose by 0.171 to 0.865 million barrels. Propane production fell -0.007 to 2.767 million barrels. Propane imports rose 0.021 to 0.096 million barrels. Propane exports rose 0.066 to 1.858 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 41.4 th. contracts. Buyers were sluggishly entering the market. Sellers were fleeing. Bulls strengthened their control.

Growth scenario: we switched to August futures, expiration date July 22. Now purchases make sense after growth above 80.00.

Downside scenario: selling from 78.50 will be interesting.

Recommendations for WTI crude oil:

Buy: no.

Sell: now (78.05). Stop: 79.30. Target: 67.90.

Support — 72.49. Resistance — 79.09.

Gas-Oil. ICE

Growth scenario: we consider July futures, expiration date July 11. We won’t do anything upwards. Out of the market.

Downside scenario: we see a «pincer» on the dailies. It is possible to sell.

Gasoil Recommendations:

Buy: no.

Sell: Now (763.75). Stop: 782.0. Target: 650.0.

Support — 733.75. Resistance — 779.75.

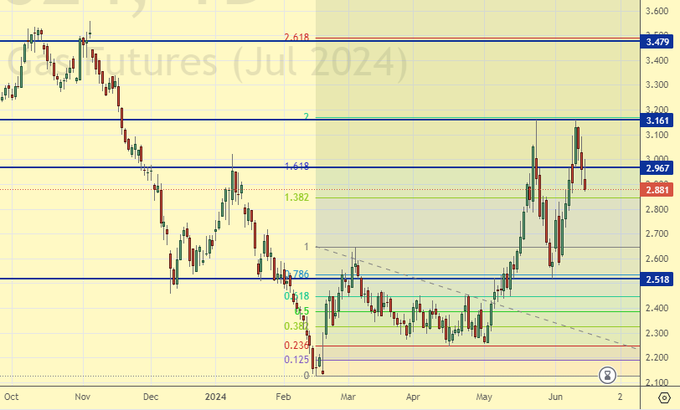

Natural Gas. CME Group

Growth scenario: we consider July futures, expiration date June 26. We hold long. The level of 3.400 is realistic.

Downside scenario: when approaching 3.500 we will think about selling. Out of the market for now.

Natural Gas Recommendations:

Buy: no. Those in position from 2.300, move your stop to 2.700. Target: 3.400.

Sale: not yet.

Support — 2.518. Resistance — 2.967.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: until we are above 75000, we don’t think about buying. At the same time: purchases from 62000 are welcome.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: on approach to 62000. Stop: 58000. Target: 100000!

Sale: no.

Support — 63965. Resistance — 72344.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will keep the opened long. It is not excluded that this is not the end of the growth story.

Downside scenario: if there will be a hiccup with growth around 30000 we can think about selling. Out of the market for now.

PBT Market Recommendations:

Buy: No. Who is in position from 11000, move stop to 12000. Target: 35000 (revised).

Sale: no.

Support — 16563. Resistance — 23906.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see growth from 1000. Nevertheless, still out of the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1047. Resistance — 1535 area.

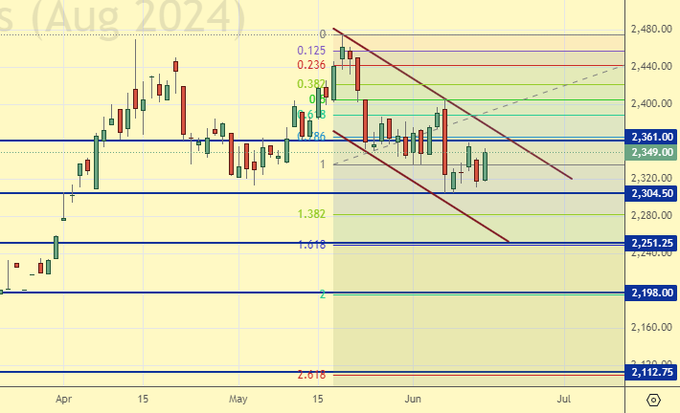

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2120 will be interesting.

Downside scenario: hold shorts. Exciting. It is not excluded that we will test the area of 2370. Those who wish can enter short, or build up a position at the level of 2370.

Gold Market Recommendations:

Buy: when approaching 2120. Stop: 2070. Target: 2650?!

Sell: No. Those who are in position from 2325, move the stop to 2390. Target: 2120.

Support — 2304. Resistance — 2361.

EUR/USD

Growth scenario: the bulls may reverse the situation, but until that happens we remain out of the market.

Downside scenario: it is interesting to try to sell from 1.0800. If the dollar continues to dominate, we can expect the pair to descend to 1.0200 on the growth of the interest rate differential.

Recommendations on euro/dollar pair:

Buy: no.

Sell: when approaching 1.0800. Stop: 1.0900. Target: 1.0200.

Support — 1.0668. Resistance — 1.0744.

USD/RUB

Growth scenario: we consider the September futures, expiration date September 19. No ideas for now. It is necessary to realize the new reality. However, in case of growth above 95000, we should think about buying.

Downside scenario: one thing is clear, if the volume of currencies coming into the country is insufficient to buy imports, then… what a fall in the dollar can there be.

Recommendations on dollar/ruble pair:

Buy: no.

Sale: no.

Support — 88975. Resistance — 92137.

RTSI. MOEX

Growth scenario: we switched to September futures, expiration date September 19. So far, we do not believe in the growth in dollars of the Russian market. We do not buy.

Downside scenario: if there will be a rise to 116000, it will be possible to sell. Current levels are undervalued. However, on «hours» we can sell in the current area carefully licking downward signals while we are below 113000.

Recommendations on the RTS index:

Buy: no.

Sell: when approaching 116000. Stop: 116800. Target: 99000 (revised).

Support — 106670. Resistance — 113090.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.