Price forecast from 16 to 20 September 2024

Grain market:

In Moscow they will find out why women don’t want to give birth. Why why? Because everyone is watching interest rates, the dollar and stock prices. It’s nerve-wracking!

To stability, ladies and gentlemen! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

The fall started in an interesting way. For two weeks we wrote about how bad things were in terms of temperature conditions in Europe and the U.S. for cereals, it was hot there, and prices began to accelerate upward. But in fact we see that in the USDA report the gross wheat harvest in the EU fell by 3% compared to August, in the US it was unchanged, and globally it fell by 0.18%. Bulls are unlikely to be able to raise prices much, however, with calm developments taking into account seasonality we should gradually rise. The market is capable of recovering another 10% from current levels for both wheat and corn after a stop or pullback.

The main fodder crop has shown excellent prospects for sustained yields. Most likely it will be the second result in history after the record last year. In such a situation we should not expect strong price growth. There is only one bullish scenario for corn — it is active development of bioethanol production programs. But as long as Brent is below 80 dollars per barrel, we will not see big projects in this direction.

Inside Russia, there is a risk of grain price growth due to inflation, which may reduce traders’ margins, provided the ruble/dollar exchange rate is stable or even strengthening and FOB prices do not rise. In case of calm development of events, we can expect 3rd class prices in the regions at 14200 — 14500, ruble/dollar exchange rate around 95.00 and FOB price around $230/ton by the end of October and $240/ton by the end of November.

Energy market:

After a poorly explained failure below 70.00 Brent is recovering. It is possible that there will be another attempt to break down after prices rise to 75.00, but it is unlikely to succeed. Most likely, OPEC+ will keep its monolithic position and importing countries will not manage to sow strife and panic in the ranks of the organization. The fall in Urals prices in the near future, which Russia’s foes have started to write about intensively against the backdrop of falling prices, is unlikely to occur by any significant amount. This year the world GDP is expected to grow by 3%, which implies a good demand for energy carriers. Urals was sold at 65 and will be sold at 60 dollars per barrel.

Is there a danger of oil prices falling next year? Yes. But it will have to go some way for that to happen. OPEC+ has to collapse, China has to stop growing, and the cost of offshore production has to start falling. There are too many factors and none of them are easy to get, although all of them are possible. For now, we would question the forecasts of a number of banks that Brent crude will cost $55 next year.

USD/RUB:

A meeting of the Central Bank of the Russian Federation was held. The rate was raised by 1% to 19% per annum, which will force entrepreneurs to look for faster forms of cash turnover as money becomes more and more expensive. Trade, where possible, will win out against most manufacturing activities. So far, store shelves do not show prices stabilizing. Inflation will continue to force the Central Bank to understand the interest rate, which may lead to a reduction in long-term investment and an increase in speculation.

Prospects for the ruble on the horizon of 3 — 6 months remain negative. This is due to both the sanctions and the costs of the SWO.

We note separately that the public circulation of rumors, expectations and gossip mixed with facts about granting Ukraine the right to strike deep into Russia with Western long-range weapons does not add optimism.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 13.2 th. contracts. Sellers and buyers were reducing their positions. Bears did it more actively. Bears maintain control.

Growth scenario: we consider December futures, expiration date December 13. On downward pullbacks, it is possible to buy.

Downside scenario: the current upside pullback did not break the bears. However, we need levels above the current levels to sell. The risk of prices falling to 500.0 remains.

Recommendations for the wheat market:

Buy: when approaching 500.0. Stop: 490.0. Target: 650.0.

Sell: on approach to 650.0. Stop: 675.0. Target: 540.0.

Support — 560.2. Resistance — 598.0.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers decreased by 41.4 thousand contracts. The change is significant. Buyers entered the market in small volumes. Sellers were reducing their positions. Bears are still controlling the situation.

Growth scenario: we consider the December futures, expiration date December 13. As long as we are below 445.0, the risk of falling to 360.0 remains. It is interesting to buy from 395.0.

Downside scenario: when approaching 445.0 it is possible to sell. It cannot be ruled out that the price recovery will be short-term.

Recommendations for the corn market:

Buy: when approaching 395.0. Stop: 390.0. Target: 445.0.

Sell: on approach to 445.0. Stop: 465.0. Target: 360.0?!

Support — 397.0. Resistance — 416.0.

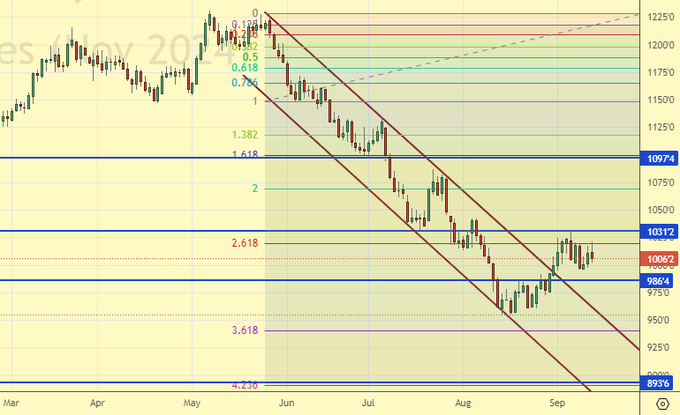

Soybeans No. 1. CME Group

Growth scenario: we are looking at the November futures, expiration date November 14. Given the record gross soybean harvest, it will be very hard for us to grow. Don’t buy.

Downside scenario: sell again despite two previous failures. Oilseeds are plentiful. We should continue to fall.

Recommendations for the soybean market:

Buy: when approaching 850.0. Stop: 830.0. Target: 1100.0.

Sell: now (1006.0). Stop: 1035.0. Target: 850.0.

Support — 986.4. Resistance — 1031.6.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 58.7 thousand contracts. The change is significant. Buyers were fleeing. Sellers actively entered the market in large volumes. Buyers lost control over the market.

Growth scenario: we consider November futures, expiration date September 30. A break below 70.00 may lead to lower levels. Don’t buy.

Downside scenario: the rise to 75.50 can be used for selling. Sellers have an advantage after making a new low.

Recommendations for the Brent oil market:

Buy: no.

Sell: in case of growth to 75.50. Stop: 75.90. Target: 56.00.

Support — 67.72. Resistance — 73.21.

WTI. CME Group

US fundamentals: the number of active rigs rose by 5 to 488.

US commercial oil inventories rose by 0.833 to 419.143 million barrels, with +0.9 million barrels forecast. Gasoline stocks rose 2.31 to 221.552 million barrels. Distillate stocks rose 2.308 to 125.023 million barrels. Cushing storage stocks fell by -1.704 to 24.69 million barrels.

Oil production remained unchanged at 13.3 million barrels per day. Oil imports rose by 1.075 to 6.867 million barrels per day. Oil exports fell by -0.451 to 3.305 million barrels per day. Thus, net oil imports rose by 1.526 to 3.562 million barrels per day. Oil refining fell by -0.5 to 92.8 percent.

Gasoline demand fell -0.46 to 8.478 million barrels per day. Gasoline production fell -0.371 to 9.377 million barrels per day. Gasoline imports fell -0.012 to 0.643 million barrels per day. Gasoline exports rose -0.071 to 0.936 million barrels per day.

Distillate demand fell by -0.439 to 3.558 million barrels. Distillate production rose 0.04 to 5.209 million barrels. Distillate imports rose 0.019 to 0.201 million barrels. Distillate exports rose 0.116 to 1.523 million barrels per day.

Demand for petroleum products fell by -1.158 to 19.383 million barrels. Petroleum products production fell -0.237 to 22.083151 million barrels. Petroleum product imports rose 0.165 to 1.976 million barrels. Exports of refined products fell -0.092 to 7.238 million barrels per day.

Propane demand increased by 0.094 to 0.823 million barrels. Propane production increased by 0.013 to 2.702 million barrels. Propane imports rose 0.036 to 0.115 million barrels. Propane exports rose 0.169 to 1.833 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 19.4 th. contracts. There were no buyers. Sellers were building up positions. The bulls are still in control.

Growth scenario: we switched to November futures, expiration date is October 22. Bears came to the market. Do not buy.

Downside scenario: rise to 73.50 can be used for selling. Based on the current picture we have to assume a fall to 60.00.

Recommendations for WTI crude oil:

Buy: no.

Sell: when approaching 73.50. Stop: 74.60. Target: 61.30.

Support — 64.52. Resistance — 70.25.

Gas-Oil. ICE

Growth scenario: we consider October futures, expiration date October 10. Prices may recover to the level of 740.00. You can buy.

Downside scenario: it is possible to sell only after market recovery. The 740.00 area looks interesting for selling.

Gasoil Recommendations:

Buy: Now (652.75). Stop: 637.00. Target: 740.00.

Sell: on approach to 740.00. Stop: 760.00. Target: 550.00.

Поддержка – 626.50. Сопротивление – 689.00.

Natural Gas. CME Group

Growth scenario: we consider October futures, expiration date September 26. We continue to hold longs with the target at 2.830.

Downside scenario: nothing interesting. Off-market.

Natural Gas Recommendations:

Buy: no. Who is in position from 2.127, move your stop to 2.050. Target: 2.380 (5.000?!).

Sale: no.

Support — 1.987. Resistance — 2.419.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. Chances for growth are not bad.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: No. Those in position from 65000, move your stop to 71000. Target: 100000!

Sale: no.

Support — 76787. Resistance — 85752.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: for new purchases we need a pullback to 20000. Waiting.

Downside scenario: we will not sell, there is a risk of further price growth.

PBT Market Recommendations:

Buy: at touching 20000. Stop: 17000. Target: 40000.

Sale: no.

Support — 24297. Resistance — 36250.

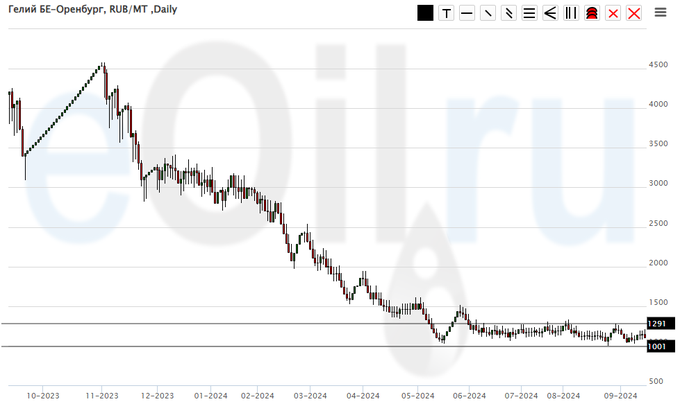

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see stagnation. Outside the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1001. Resistance — 1291.

Growth scenario: we consider December futures, expiration date December 27. After coming out of consolidation upwards, buy on pullbacks.

Downside scenario: the sellers’ position has completely collapsed. Not selling.

Gold Market Recommendations:

Buy: when approaching 2560. Stop: 2540. Target: 3140.

Sale: no.

Support — 2571. Resistance — 2650.

EUR/USD

Growth Scenario: The market is likely to stand still until the Fed meeting on the 18th. As long as we are above 1.1000 it is better to favor the bulls, if we are below 1.0900 we will sell.

Downside scenario: it is interesting to sell from current levels. If the dollar strengthens by the end of the week, it will be impossible to get such a favorable position.

Recommendations on euro/dollar pair:

Buy: on a pullback to 1.0900. Stop: 1.0870. Target: 1.2000.

Sell: now (1.1072). Stop: 1.1130. Target: 1.0000!

Support — 1.1001. Resistance — 1.1101.

USD/RUB

Growth scenario: switched to December futures, expiration date December 19. Nothing new. The market is able to go higher. We hold the long.

Downside scenario: no interesting ideas for sales. Out of the market.

Recommendations on dollar/ruble pair:

Buy: No. Those who are in position from 85976, move your stop to 87900. Target: 100000 (200000. Yes, yes, it is possible).

Sale: no.

Support — 89400. Resistance — 91318.

RTSI. MOEX

Growth scenario: we switched to December futures, expiration date December 19. We will buy when approaching 90600. Failure under 90600 will lead to panic dumping of shares.

Downside scenario: given the significant amount of profit from shorting, we close the position. It is possible to enter short on December futures from 105000. If there is no approach to this level, we look for opportunities to trade in other markets.

Recommendations on the RTS index:

Buy: when approaching 90600. Stop: 90300. Target: 105000.

Sell: thinking when approaching 105,000.

Support — 93170. Resistance — 98230.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.