Price forecast from 14 to 18 February 2022

Grain market:

What is happening is not clear, what will happen next is not clear. Only one thing is known: salt, sugar, matches and canned food producers are feeling the increase in revenue.

Hello everybody! May common sense not leave you this week.

Wheat could not help but react to the unwinding of hysteria about the outbreak of hostilities in eastern Ukraine. On Friday, prices moved to active growth. Speculators, having assessed the export potential of both Russia and Ukraine, which is 28% of the total world supply of wheat on the foreign market, preferred to play it safe.

Rocket attacks, hundreds of thousands dead, tank hordes on and on, all this really impresses a horde of loose people, for many of whom crossing the road and buying a can of Coca-Cola is an act of the day. Impressed by the propaganda of the Washington doctor, every trader considers it his duty to buy contracts just in case.

If horror stories continue to circulate in the English-language media on Monday, it cannot be ruled out that grain prices will continue to rise. We can see by March and 1000 cents per bushel.

Attention is drawn to the fact that the first American person personally deals with stuffing. The date was set: February 16th. I would like to ask: «What about Comrade Xi, what about the Olympics?»

Maybe start 21st February, not 16th?

Energy market:

On Friday, when it was evening in Moscow and many had already gone to drink, for example, beer, the hysteria across the ocean reached such a level that the faces of many politicians turned red. Seeing such a case, traders decided to play it safe and staged an attack on the Russian ruble, not forgetting to raise oil prices, as many firmly believe in the scenario of a ban on the export of Russian hydrocarbons in the event of hostilities.

There is a high probability that aircraft of all airlines in the world will stop flying over Ukraine from Monday, the airliners themselves will be moved to the airfields of other states, as insurers will refuse to cover risks. This information will be played on Monday morning in Asia. It is unlikely that against its background, oil prices will go down. In fact, the world plunged headlong into the information war. Provocations and stuffing cannot be ruled out, as the now no longer respected Bloomberg did last week, as well as the appearance of footage of the beginning of active hostilities. It will be impossible to separate the lies from the truth in the first hours after the release of the news.

Trading in the following days will be extremely volatile. If you do not have strong nerves and are not in a situation where you do not need money, leave trading until the foreign policy situation is clarified.

USD/RUB:

After receiving inflation data of 7.5% per annum, the US Federal Reserve will urgently meet on Monday to send a cruise ship called «America», which produces real goods only 20% of GDP, to the iceberg called «Stagflation» by raising the rate.

There will be no more cheap money. After the Fed rate goes up, many firms in the US will cease to exist. Of course, some will be helped, but hardly all.

A big economic upheaval is brewing. And that is why the White House needs so much that somewhere, albeit far from America, something begins that can be attributed to all the miscalculations.

The market is ready for the tightening of the Fed’s policy, so the rate increase will not have a strong effect on traders.

But what about the ruble? And the ruble on Monday and Tuesday, and so on until the end of the week, if not a month, it will not matter what the Fed rate is now. And even what the rate of the Bank of Russia, we recall that on Friday it was raised by 1% to 9.5% and became higher than the official inflation.

It cannot be ruled out that Russia will simply be dragged into the war through provocations, after which sanctions will follow, counter-sanctions will follow, and how it will all end is not clear. It is possible that the price level is 120 rubles for one US dollar. True, then an alliance will follow along the Moscow-Berlin line, and the sirs and peers in London will weep.

We will believe in the best. This is the very essence of the investor and trader. However, we consider it premature to sell dollars and buy rubles. It is necessary to behave like the Ministry of Finance, and he again buys the currency from the market.

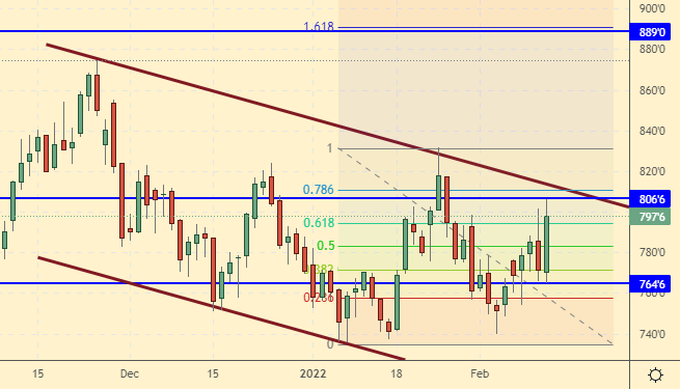

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers increased by 2.8 thousand contracts. At the same time, there are more sellers in the market than buyers. Changes are insignificant, the market needs new drivers.

Growth scenario: March futures, the expiration date is March 14. We will keep longs. Friday’s upward thrust may turn into a rise to 890.0.

Falling scenario: you can enter short here. The chances of success are slim, but if the tension in the world subsides, prices will quickly go down. Recommendation:

Purchase: no. Who is in position from 777.0, move the stop to 762.0. Target: 1180.0.

Sale: now. Stop: 817.0. Target: 700.0.

Support — 764.6. Resistance — 806.6.

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Last week the difference between long and short positions of managers decreased by 34.4 thousand contracts. We see the outcome of some of the bulls, but in general, buyers continue to maintain control over the market.

Growth scenario: March futures, the expiration date is March 14. We hold previously open longs. We do not open new positions.

Falling scenario: when approaching 685.0, it is mandatory to sell. Sales from current levels are perceived as premature.

Recommendation:

Purchase: no. who is in position from 625.0, move the stop to 617.0 Target: 685.0.

Sale: when approaching 685.0. Stop: 716.0. Target: 600.0.

Support — 642.6. Resistance is 686.0.

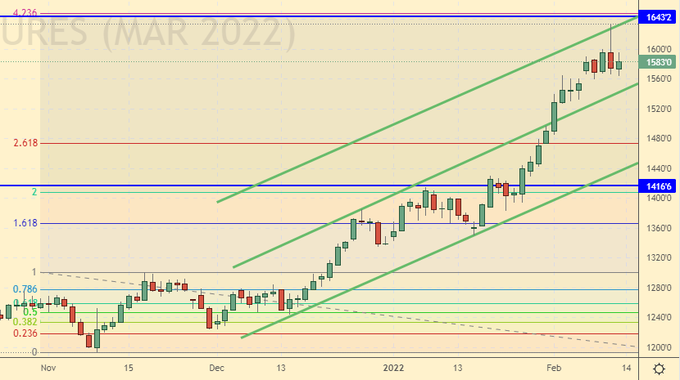

Soybeans No. 1. CME Group

Growth scenario: March futures, the expiration date is March 14. We don’t buy. The market has fulfilled its target to move up. We need a rollback.

Falling scenario: when approaching 1640.0, sell. A sharp pullback is likely.

Recommendation:

Purchase: no.

Sale: when approaching 1640.0. Stop: 1670.0. Target: 1480.0. Who is in position from 1630.0, move the stop to 1670.0. Target: 1480.0.

Support — 1416.6. Resistance — 1643.2.

Sugar 11 white, ICE

Growth scenario: March futures, the expiration date is February 28. Here you can buy. In case of growth above 18.70, you can add to the longs.

Falling scenario: our opinion remains the same — only around 20.00 will we think about shorts. The current levels for entering shorts are not interesting. Recommendation:

Purchase: now. Stop: 17.70. Target: 23.20. Who is in position from 18.20, keep the stop at 17.70. Target: 23.20.

Sale: think when approaching 20.00.

Support — 17.43. Resistance — 18.70.

Сoffee С, ICE

Growth scenario: March futures, the expiration date is March 21. The market did not turn down and moved higher. We hold a long open last week.

Falling scenario: still out of the market. We are waiting for signals of a reversal down.

Recommendation:

Purchase: no. Who is in position from 247.0, move the stop to 243.0. Target: 300.0?!

Sale: no.

Support — 244.85. Resistance is 280.45.

Brent. ICE

We’re looking at the volume of open interest of managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 9.3 thousand contracts. As prices rise, buyers ease up on pressure. At current levels, a downward reversal is possible.

Growth scenario: February futures, the expiration date is February 28. The level of 96.00 in Brent is the last level of hope for a downward reversal. If there is no reversal, then we will go to the level of 112.00.

Falling scenario: here you can go short. News noise is ignored. Only technique.

Recommendation:

Purchase: in case of growth above 96.30. Stop: 92.30. Target: 112.00.

Sale: now Stop: 96.90. Target: 80.00. Who is in position from 93.80 and 93.00, keep the stop at 96.90. Target: 80.00.

Support — 90.02. Resistance is 111.94.

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 19 units and now stands at 516 units.

Commercial oil reserves in the US fell by -4.756 to 410.387 million barrels, while the forecast was +0.369 million barrels. Inventories of gasoline fell -1.644 to 248.393 million barrels. Distillate inventories fell -0.93 to 121.814 million barrels. Inventories at Cushing fell -2.801 to 27.727 million barrels.

Oil production increased by 0.1 to 11.6 million barrels per day. Oil imports fell -0.696 to 6.389 million bpd. Oil exports rose by 0.724 to 3.1 million barrels per day. Thus, net oil imports fell by -1.42 to 3.289 million barrels per day. Oil refining increased by 1.5 to 88.2 percent.

Gasoline demand rose by 0.9 to 9.126 million barrels per day. Gasoline production increased by 0.74 to 9.39 million barrels per day. Gasoline imports rose by 0.081 to 0.514 million barrels per day. Gasoline exports fell -0.334 to 0.306 million barrels per day.

Demand for distillates fell by -0.373 to 4.296 million barrels. Distillate production increased by 0.097 to 4.699 million barrels. Distillate imports rose by 0.19 to 0.44 million barrels. Distillate exports rose by 0.449 to 0.976 million barrels per day.

Demand for petroleum products rose by 0.471 to 21.881 million barrels. Production of petroleum products increased by 1.001 to 21.495 million barrels. Imports of petroleum products increased by 0.316 to 2.045 million barrels. The export of petroleum products increased by 0.009 to 4.353 million barrels per day.

Demand for propane rose by 0.181 to 2.106 million barrels. Propane production fell by -0.043 to 2.33 million barrels. Propane imports fell -0.039 to 0.144 million barrels. Propane exports fell -0.608 to 0.641 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE.

Last week, the difference between long and short positions of managers decreased by 8.5 thousand contracts. The reduction is insignificant. A large group of speculators continues to look up.

Growth scenario: March futures, the expiration date is February 22. The levels are high for buying, but going long here is possible with a close stop order. Falling scenario: if the market falls below 88.00, you can sell.

Recommendation:

Purchase: now. Stop: 88.30. Target: 107.40.

Sale: if it falls below 88.00. Stop: 92.80. Target: 74.10. Or from 107.40. Stop: 109.70. Target: 85.60.

Support — 88.36. Resistance is 107.48.

Gas-Oil. ICE

Growth scenario: March futures, the expiration date is March 10. We continue to climb up. We will keep long from 800.0.

Falling scenario: you can sell only after falling below the level of 790.0.

Recommendation:

Purchase: no. Who is in position from 800.0, move the stop to 792.0. Target: 926.0.

Sale: after falling below 790.0. Stop: 827.00. Target: 660.00.

Support — 795.50. Resistance is 926.25.

Natural Gas. CME Group

Growth scenario: March futures, the expiration date is February 24th. Volatility is scary, but since our stop order survived, we must be patient and keep longs.

Falling scenario: we will not sell. Not the situation in the world to short natural gas.

Recommendation:

Purchase: no. Who is in position from 3.875, keep the stop at 3.730. Target: 8.777.

Sale: no.

Support — 3.356. Resistance is 4.365.

Gold. CME Group

Growth scenario: due to the growth of geopolitical tensions, gold has moved to growth. We hold longs.

Falling scenario: shorting gold will be possible after falling below 1770 while out of the market.

Recommendations:

Purchase: no. Those in positions between 1780 and 1790 move the stop to 1785. Target: 2300.

Sale: think after falling below 1770.

Support — 1780. Resistance — 1877.

EUR/USD

Growth scenario: the market fell on fear of a US rate hike on Monday. We are tightening stop orders, but we continue to keep the long.

Falling scenario: it is possible that the dollar will go to 1.0600. We go short.

Recommendations:

Purchase: no. Who is in position from 1.1130, move the stop to 1.1320. Target: 1.2100.

Sale: now. Stop: 1.1470. Target: 1.0600.

Support — 1.1330. Resistance is 1.1521.

USD/RUB

Growth scenario: strong growth on Friday suggests a slight pullback on Monday, after which the pair will continue to rise. It is unlikely that the panic in the minds of traders subsided over the weekend.

Falling scenario: it is still difficult to come up with a scenario in which the dollar will lose its attractiveness. Just not in the coming months. However, if the Fed members meet on Monday and the rate is not raised, this could lead to a strong weakening of the US currency at the moment. Otherwise, why urgently gather? Why make people nervous?

Recommendations:

Purchase: now. Stop: 74.20. Target: 87.00.

Sale: no.

Support — 74.26. Resistance — 80.28.

RTSI

Growth scenario: it will be extremely difficult for us to grow. It cannot be ruled out that the money of the oligarchs will enter the market to give a decent picture of what is happening. When the interest rate rises, the stock market falls. If it grows, then what is happening is artificial. In a calm situation, one could buy here, but we do not recommend entering the market against the hysterical background of the Western press, which for some reason is diligently broadcasting all sorts of «Yandexes».

Falling scenario: downward movement remains the most likely scenario. Not a single investor in their right mind will now buy Russian papers on a drawdown. Only someone with some sort of bullish insider can throw money into the long right now. So far we are only looking at shorts.

Recommendations:

Purchase: no.

Sale: now. Stop: 156000. Target: 103000 (80000).

Support — 136080. Resistance — 155210.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.