Price forecast from 13 to 17 of September 2021

Grain market:

The USDA has delivered another regular report to the people. The gross harvest of wheat is planned for the planet in the amount of 780.279 million tons, which is 0.43% more than the August forecast. The data was perceived by the crowd as modest. The market preferred to rise slightly on Friday, immediately after the release of data from the US Department of Agriculture.

For corn, the situation with gross harvest improved more than for wheat, the forecast increased by 0.98% compared to the previous report. They plan to collect 1197.767 million tons.

Note that the market may still fall for a week or two, but already from the current levels it is worth looking for opportunities for purchases, since the success of the current harvesting company is already in the price, and the demand for food, due to the lessons learned from quarantines and lockdowns, will high.

Energy market:

Last week we saw a wild fight in the oil market between buyers and sellers, and some of the traders took part in it. Judging by how the market at the end of the week was easily pushed and raised by two dollars in a few hours, the amounts were spinning considerably.

The rate in a fight taking place in a narrow corridor is either a move up to 95.00 or a new fall to 60.00 dollars per barrel of Brent oil. It is clear that an up move looks more attractive for speculators, because few people are waiting for it. Bearish sentiment was thrown into the crowd by the virtual press, writing about the slowdown in growth rates and new rounds of the pandemic, as well as the real decisions of OPEC + on a gradual increase in production, which was stolen by the bidders through their own thinking boxes, boxes, malachite boxes, so whoever was in luck.

If on the 22nd the FRS still does not say anything in favor of the dollar, then the commodities market may indeed take a spurt upward. It cannot be ruled out that the path of price growth for the commodity group will be chosen in advance, that is, right from Monday, from September 13th.

USD/RUB:

Elvira Nabiullina raised the rate on Friday by 0.25 percentage points to 6.75 percent. The market was waiting for this rise. Those who were eager to get their money back from under the pillow back to bank deposits were eager for 0.5% growth, but the Bank of Russia did not bet above current inflation, but reserved the right to fight price increases further by tightening credit policy.

Most likely, the rise in prices for goods, components and components coming from abroad will continue for several more months. So in Europe, producer price inflation is only gaining momentum, the last value is 12% year-on-year. In the United States, wholesale prices rose 8.0% from September 20 to August of this year.

Developing economies will be more affected by inflation in developed countries, as the purchasing power of the population is at significantly lower levels. The percentage of spending on food, utilities and basic necessities is incomparably higher than in advanced economies, which will increase social tensions in societies that are either walking or limping on the path to developed capitalism.

Wheat No. 2 Soft Red. CME Group

We’re looking at the volume of open interest of wheat managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 5.7 thousand contracts. At the same time, a small number of sellers left the market, and the number of buyers barely increased.

Growth scenario: December futures, expiration date December 14. The market nevertheless deigned to decline. If prices return above 715.0, we will buy. It cannot be ruled out that wheat prices will go to the area of 900.0.

Falling scenario: the fall is not aggressive, which is not typical for recent seasons. Strong demand keeps prices afloat. We do not sell. Recommendation:

Purchase: after rising above 715.0. Stop: 677.0. Target: 925.0.

Sale: no.

Support — 677.2. Resistance — 705.0.

We’re looking at the volume of open interest of corn managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the CME Group.

Over the past week, the difference between long and short positions of managers decreased by 43.5 thousand contracts. Speculators sharply increased their sell positions, while the bulls were running away, which led to a fall in prices. It will not be easy for the bulls to lift the market above 550.0 cents a bushel. We are monitoring the situation.

Growth scenario: December futures, expiration date December 14. If prices rise above 556.0 we will buy. The second option for buying is a drop in prices to 430.0.

Fall scenario: keep short from 584.0. USDA’s good August forecast for corn was improved by almost a percentage point on Friday. Recommendation:

Purchase: think after rising above 556.0.

Sale: no. Those who are in positions between 570.0, 560.0 and 584.0, move the stop to 556.0. Target: 430.0.

Support — 490.2. Resistance — 528.0.

Soybeans No. 1. CME Group

Growth scenario: November futures, expiration date November 12. So far, buyers have not been able to turn the tide. We keep the old longs, don’t open the new ones.

Falling scenario: continue to stand in shorts. Focusing on the level 1111.0. We will count on the continuation of the fall, as there was a way out of the consolidation downward.

Recommendation:

Purchase: no. Whoever is in the position from 1290, keep the stop at 1244.0. Target: 1880.0 ?! Sale: no. Those who are in positions between 1400.0 and 1350.0, move the stop to 1343.0. Target: 1111.0.

Support — 1267.6. Resistance — 1338.4.

Sugar 11 white, ICE

Growth scenario: October futures, the expiration date is September 30. Unfortunately, the bulls were unable to reach 21.66. A fall by 17.00 cannot be ruled out. Out of the market.

Falling scenario: you should have entered short after falling below 19.35, as we recommended earlier. Prices may go to the lower border of the aggressive ascending channel in the area of 18.00, we cannot exclude a stronger fall by 17.00. Recommendation:

Purchase: think when approaching 17.00.

Sale: no. Those who are in the position from 19.35, move the stop to 19.87. Target: 17.10.

Support — 17.78. Resistance — 19.78.

Сoffee С, ICE

Growth scenario: December futures, the expiration date is December 20. There are doubts about continued growth. However, we keep the old longs.

Falling scenario: we are already on sale. If there is a fall below 180.00, you can increase aggression and add to the shorts.

Recommendation:

Purchase: no. Whoever is in positions from 190.00, 180.00 and 170.00, keep the stop at 183.00. Target: 245.00.

Sale: no. Anyone in the position from 190.00, move the stop to 196.00. Target: 162.00.

Support — 177.05. Resistance — 202.25.

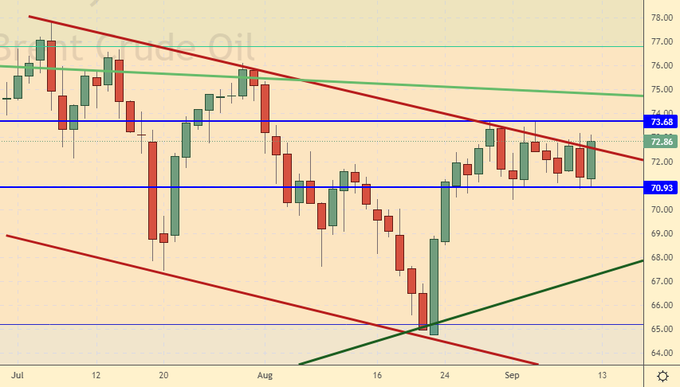

Brent. ICE

We’re looking at the volume of open interest of Brent managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers increased by 4.6 thousand contracts. This was due to the outflow of sellers, not the influx of buyers. In general, the market situation remains uncertain.

Growth scenario: September futures, expiration date September 30. We continue to believe that it is worth thinking about buying only after a rise above 74.00, and it is desirable that not an hour, but a day closes above this level.

Falling scenario: neither side has an advantage in this situation. We do not open new positions, we keep the old shorts.

Recommendation:

Purchase: think after rising above 74.00.

Sale: no. Anyone in the position from 71.80, keep the stop at 73.87. Target: 61.50.

Support — 70.93. Resistance — 73.68.

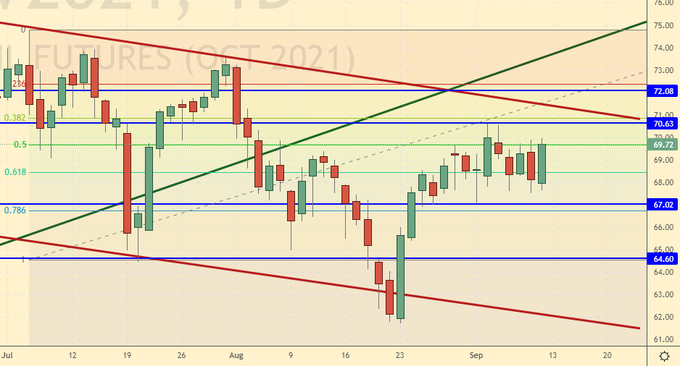

WTI. CME Group

Fundamental US data: the number of active drilling rigs increased by 7 units and is 401 units.

Commercial oil reserves in the US fell by -1.528 to 423.867 million barrels, while the forecast was -4.612 million barrels. Gasoline inventories fell by -7.215 to 219.999 million barrels. Distillate stocks fell by -3.141 to 133.586 million barrels. Cushing’s stocks rose 1.918 to 36.419 million barrels.

Oil production fell -1.5 to 10 million barrels per day. Oil imports fell by -0.53 to 5.81 million barrels per day. Oil exports fell by -0.698 to 2.342 million barrels per day. Thus, net oil imports rose by 0.168 to 3.468 million barrels per day. Refining fell by -9.4 to 81.9 percent.

Gasoline demand rose 0.03 to 9.608 million barrels per day. Gasoline production rose 0.237 to 10.122 million barrels per day. Gasoline imports fell by -0.239 to 0.899 million barrels per day. Gasoline exports rose 0.268 to 0.734 million barrels per day.

Distillate demand fell by -0.705 to 3.685 million barrels. Distillate production fell -0.625 to 4.185 million barrels. Distillate imports fell by -0.222 to 0.142 million barrels. Distillate exports rose 0.058 to 1.09 million barrels per day.

The demand for petroleum products fell by -2.866 to 19.954 million barrels. Production of petroleum products fell -1.793 to 20.766 million barrels. Imports of petroleum products fell by -0.611 to 2.507 million barrels. Exports of petroleum products rose by 0.877 to 5.783 million barrels per day.

Propane demand fell by -0.455 to 0.861 million barrels. Propane production fell by -0.099 to 2.294 million barrels. Propane imports rose 0.014 to 0.095 million barrels. Propane exports rose 0.33 to 1.412 million barrels per day.

We’re looking at the volume of open interest of WTI managers. You should keep in your mind that these are data from three days ago (for Tuesday of the past week), they are also the most recent of those published by the ICE exchange.

Over the past week, the difference between long and short positions of managers decreased by 3.5 thousand contracts. There was a slight outflow of buyers and an influx of sellers. The market is in equilibrium.

Growth scenario: October futures, expiration date September 21. While we are below 73.00 we will refrain from shopping. Green Friday gives a slight advantage to buyers, but there is no certainty that the bulls will win in this situation.

Falling scenario: nothing happened in a week. The current levels are attractive for selling, but it cannot be ruled out that prices will rise to 72.10, therefore, we will wait for confirmation of a downward reversal before selling.

Recommendation:

Purchase: think after the market rallies above 73.00.

Sale: after the appearance of a red candle with a long body. Stop above the high of this candlestick. Target: 58.33.

Support — 67.02. Resistance — 70.63.

Gas-Oil. ICE

Growth scenario: bulls are trying to break above 625.0, but so far their actions have not been crowned with success. We are waiting for a season of growth in fuel reserves, so we will question the further growth of quotations.

Falling scenario: the market was unable to close below 595.0 last week, and this event should drag us into a sell. We wait.

Recommendation:

Purchase: not yet.

Sale: after the market closes below 595.0. Stop: 614.0. Target: 510.00.

Support — 592.50. Resistance — 619.00.

Natural Gas. CME Group

Growth scenario: October futures, expiration date September 28. Gas price in Europe is breaking records. $ 700 per thousand cubic meters, this is three times the price of Gazprom’s long-term contracts. We’ll get to 5.444 for sure. And then the Nord Streams will be launched at full capacity and growth will stop.

Falling scenario: don’t sell yet. If we look at the trading history, we will see that gas can go up intensively.

Recommendation:

Purchase: no. Those who are in the position from 3.650, move the stop to 4.140. Target: 5.400.

Sale: not yet.

Support — 4.226. Resistance — 5.444.

Gold. CME Group

Growth scenario: gold is in no hurry to fall. The hopes of some players that the dollar will become strong may not come true. When approaching 1760, we will buy.

Fall scenario: the place for the short is not bad from a technical point of view. Let’s sell at the current levels.

Recommendations:

Purchase: when approaching 1760. Stop: 1740. Target: 2060.

Sale: now. Stop: 1807. Target: 1650?

Support — 1781. Resistance — 1832.

EUR/USD

Growth scenario: it is not clear yet whether the market will be able to break below 1.1750. It is possible that the pair will remain in the range until the Fed meeting on September 22nd. From 1.1750 you can buy with little risk.

Falling scenario: it is impossible to guarantee the continuation of the fall, as the Fed’s policy may remain soft for a long time. We keep the old short, do not open new positions.

Recommendations:

Purchase: when approaching 1.1750. Stop: 1.1730. Target: 1.2100. Whoever is in the position from 1.1800, keep the stop at 1.1770. Target: 1.2100 (1.2800)?

Sale: no. Those who are in the position from 1.1900, move the stop to 1.1906. Target: 1.1060. When approaching 1.2100. Stop: 1.2140. Target: 1.1050.

Support — 1.1776. Resistance — 1.1910.

USD/RUB

Growth scenario: we see that the rate hike by the Bank of Russia on Friday did not make a strong impression on the market and the ruble did not strengthen further, as the decision was in line with traders’ expectations. The purchase of currency by the Ministry of Finance for 15 billion rubles a day will support the dollar. Here you can enter long.

Falling scenario: we will continue to hold the short opened three weeks ago from 73.90. The target at 67.60 remains in sight. Strengthening the Fed’s policy in the near future is questionable.

Recommendations:

Purchase: now. Stop: 72.40. Target: 80.00.

Sale: no. Anyone in the position from 73.90, move the stop to 73.77. Target: 67.60.

Support — 72.54. Resistance — 73.53.

RTSI

Growth scenario: the US stock market falls for four days in a row and is inclined to draw us a corrective move. The rise of equity securities in America dragged on indecently. Correction by 10 — 15% is long overdue. Let’s tighten stop orders for previously opened longs.

Falling scenario: sales from current levels raise some doubts, but in general, if we are talking about a strong global correction ahead of the Fed meeting, then we can carefully enter the short with a small risk. If the stock starts to fall, more can be sold later. In particular, after falling below 164,000.

Recommendations:

Purchase: no. Who is in the position between 165000 and 167000, move the stop to 167800. Target: 175000 (200000).

Sale: now. Stop: 173200. Target: 151000.

Support — 166920. Resistance — 172090.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.