Price forecast from 1 to 5 July 2024

Grain market:

Arab Emirates citizens are being warned about the high number of thefts in Europe. They should have just been advised not to take anything with them. I mean, not at all. There they have all things made of gold, and in Europe gold is loved and valued. In London, where they steal it from tourists, there is even a metal exchange.

Understandably, with the high number of thefts, it is surprising for UAE citizens to see a large number of people with two hands on the streets of Paris. Hello!

This issue was prepared with the direct participation of analysts of trading platforms eOil.ru and IDK.ru. It provides an assessment of the situation on the global and Russian market.

A new crop has arrived, which reinforced the bearish sentiment in the markets. Corn just collapsed on Friday, which was not a surprise, we wrote about it last week. The collapse merely demonstrated its projected significant supply in the market already this fall. Soon everything will be made from corn: bread, alcohol, fuel, pants, socks, houses, Why not?

Wheat, unlike corn, fell off a bit earlier and is now above 560.0 cents per bushel. This crop is expected to see some, but not critical, supply reduction in the 24/25 season, so we may see an upward correction. Perhaps, if the economic situation in the world worsens, which may happen, for example, this fall, it will lead to a reduction in consumption of both bread and meat, which will create an even greater surplus of grain on the market and we will not see 700.0 cents per bushel in the coming months.

As long as Russia is able to work with Asia and Africa, exchanging its food for their food, or for their rags or money, it will keep prices at current levels. There will be no strong reason for growth. But if Russia stops trading for obscure currencies, it could create a supply shortage. The Central Bank’s deputy is sounding the alarm and demanding to use any form of export-import settlements. So there is a problem of non-payments.

Energy market:

Brent is holding around 85.00 and does not want to pull back to 80.00. Oil is growing even amid rising inventories in the US. Traders see that demand will continue to remain high. It is not excluded that only in the fall, when the results for the third quarter in the U.S. GDP will come, and when it will become clear that the high rate still strangled economic activity, we will see a pullback.

Russia continues to supply the external market with its standard volumes for this year, which suggests that the supply-demand balance has not yet been disrupted by the sanctions.

The decline in drilling activity in the US is noteworthy, which may become a reason for further demand strengthening, as the US will not keep at the level of 13.2 mln bpd and its production will fall. It is not excluded that the companies themselves hindered and are hindering further growth of production. They simply did not want to give too much oil to the market. The investigation that has begun, and the whole American Senate has taken up the case, about artificial maintenance of prices at a high level by local companies together with «comrades» from the Middle East confirms this idea.

USD/RUB:

Inflation in Russia is not slowing down. The 8.6% annual interest rate has already led to the fact that the Central Bank has already assured everyone that they will raise the rate to 18%. Such expectations are also reflected in the RGBI index, which is still more dead than alive. Russian debt securities want to be taken on more interesting terms.

The ruble exchange rate will most likely be shifted to 90.00 by manual methods (e.g., reducing the volume of foreign currency sales to 60%). In fact, at a rate of 16%, the demand for rubles should be epic to put them on deposit, but it is not there, and the exchange rate is not 60.00. At the same time, people are actively borrowing at a high rate and demanding goods on the shelves, which shows that part of society is inclined to satisfy its own needs every minute. People do not believe in a ruble in their account, they believe in a washing machine in their apartment.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers increased by 14.3 th. contracts. Buyers were entering the market a little bit at a time. Sellers were increasing volumes much more actively. Bears strengthened their control.

Growth scenario: we consider September futures, expiration date September 13. We have stopped the fall. However, it is better to buy here on «hourly» intervals.

Downside scenario: without upward correction, medium-term sales are not safe. Outside the market.

Recommendations for the wheat market:

Buy: only when touching 455.0. Stop: 440.0. Target: 600.0.

Sale: no.

Support — 556.6. Resistance — 627.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 86.9 thnd contracts. Sellers have torn up the market, buyers have fled. The bears have stepped up their control again.

Growth scenario: we consider September futures, expiration date September 13. Against the background of good expectations for the harvest, we do not buy yet.

Downside scenario: we continue to keep shorting. The 390.0 mark is already looming in front of us.

Recommendations for the corn market:

Buy: when approaching 393.0. Stop: 380.0. Target: 445.0.

Sell: no. Those who are in position from 463.0, move the stop to 438.0. Target: 393.0.

Support — 391.6. Resistance — 427.2.

Soybeans No. 1. CME Group

Growth scenario: we consider September futures, expiration date September 13. Do not buy. Expectations for gross soybean harvest are excellent.

Downside scenario: we will keep the previously opened short. There is a feeling that the market is heavy and ready to fall heavily.

Recommendations for the soybean market:

Purchase: no.

Sell: no. Those in position from 1150.0, move your stop to 1127.0. Target: 885.0?!

Support — 1096.2. Resistance — 1123.0.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 12.2 th. contracts. Buyers entered the market, sellers remained neutral in the same volumes. Buyers kept control over the market.

Growth scenario: we consider July futures, expiration date July 31. We went somewhere active, but on Friday we failed to consolidate above Thursday’s close. Out of the market.

Downside scenario: sales will have to be abandoned. We are waiting for clarification of the situation.

Recommendations for the Brent oil market:

Buy: no.

Sale: no.

Support — 83.73. Resistance — 86.24.

WTI. CME Group

US fundamentals: the number of active rigs decreased by 6 to 479.

US commercial oil inventories rose by 3.591 to 460.696 million barrels, with a forecast of -2.6 million barrels. Gasoline inventories rose 2.654 to 233.886 million barrels. Distillate stocks fell -0.377 to 121.263 million barrels. Cushing storage stocks fell by -0.226 to 33.896 million barrels.

Oil production was unchanged at 13.2 million barrels per day. Oil imports fell by -0.443 to 6.611 million barrels per day. Oil exports fell by -0.508 to 3.91 million barrels per day. Thus, net oil imports rose by 0.065 to 2.701 million barrels per day. Oil refining fell by -1.3 to 92.2 percent.

Gasoline demand fell -0.417 to 8.969 million barrels per day. Gasoline production fell -0.289 to 9.881 million barrels per day. Gasoline imports fell -0.238 to 0.762 million barrels per day. Gasoline exports fell -0.134 to 0.876 million barrels per day.

Distillate demand fell by -0.441 to 3.536 million barrels. Distillate production rose by 0.142 to 4.902 million barrels. Distillate imports fell -0.017 to 0.133 million barrels. Distillate exports rose 0.373 to 1.553 million barrels per day.

Demand for petroleum products fell by -0.392 to 20.689 million barrels. Petroleum products production rose by 0.088 to 22.689 million barrels. Petroleum product imports fell -0.239 to 1.959 million barrels. Exports of refined products fell -0.282 to 6.279 million barrels per day.

Propane demand increased by 0.315 to 1.027 million barrels. Propane production rose 0.045 to 2.705 million barrels. Propane imports fell -0.002 to 0.075 million barrels. Propane exports fell -0.337 to 1.454 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 44 th. contracts. Buyers were boldly entering the market. Sellers were actively fleeing. Bulls strengthened their control.

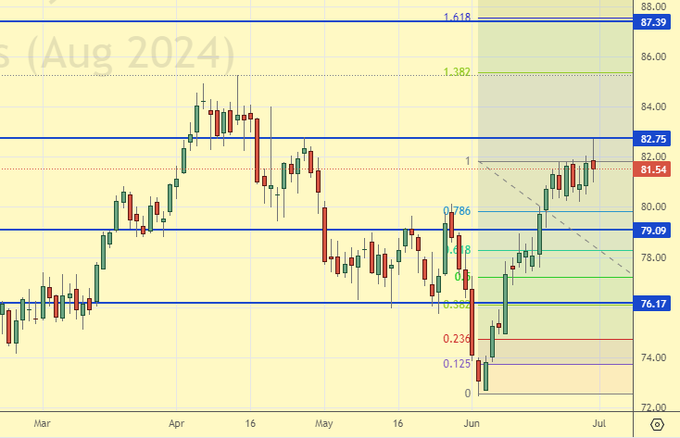

Growth scenario: we consider the August futures, expiration date July 22. There is nothing interesting for bulls here. Out of the market.

Downside scenario: we will refrain from any action in this market for now.

Recommendations for WTI crude oil:

Buy: no.

Sale: no.

Support — 79.09. Resistance — 82.75.

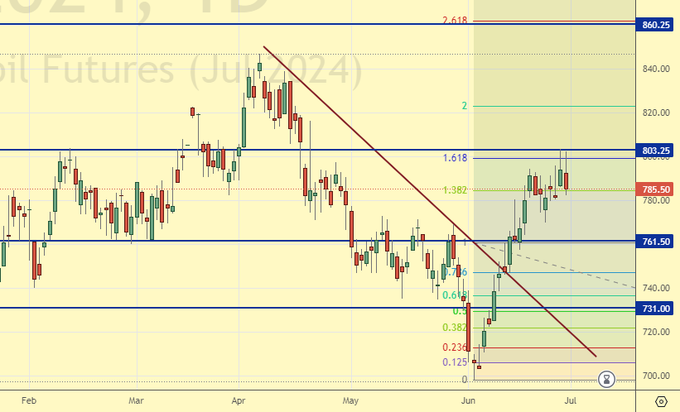

Gas-Oil. ICE

Growth scenario: we consider July futures, expiration date July 11. In case of a pullback to 730.00 it is possible to buy.

Downside scenario: let’s be persistent and sell again. Technical analysis supports the sellers.

Gasoil Recommendations:

Buy: on a pullback to 730.00. Stop: 720.00. Target: 950.00.

Sell: Now (785.50). Stop: 806.00. Target: 650.00!

Support — 761.50. Resistance — 803.25.

Natural Gas. CME Group

Growth scenario: we consider August futures, expiration date July 29. Oh, we got beat up. Good thing we didn’t lose anything. The deal made a penny. Out of the market.

Downside scenario: when approaching 3.500 we will think about selling.

Natural Gas Recommendations:

Buy: no.

Sale: no.

Support — 2.557. Resistance — 2.719.

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we will keep longing. There are chances for growth.

Downside scenario: we won’t sell as we can’t believe there is no need for diesel right now.

Diesel Market Recommendations:

Buy: no. Who is in position from 65000, keep stop at 60000. Target: 100000!

Sale: no.

Support — 62354. Resistance — 70732.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: we will keep longing. The first impulse was long, which may lead us to high levels. We see consolidation from which an upward exit is possible.

Downside scenario: if there will be a hiccup with growth around 30000 we can think about selling. Out of the market for now.

PBT Market Recommendations:

Buy: no. Who is in position from 11000, keep stop at 13000. Target: 35000.

Sale: no.

Support — 13516. Resistance — 21094.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see growth from 1000. Nevertheless, still out of the market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: no.

Sale: no.

Support — 1037. Resistance — the area of 1535.

Growth scenario: we consider the August futures, expiration date August 28. For purchases we continue to want a correction. Buying from 2120 will be interesting.

Downside scenario: we have to be patient. We’re kind of ready to fall, but in fact it doesn’t happen. We’re holding shorts.

Gold Market Recommendations:

Buy: when approaching 2120. Stop: 2070. Target: 2650?!

Sell: no. Who is in position from 2325, keep stop at 2380. Target: 2120.

Support — 2303. Resistance — 2351.

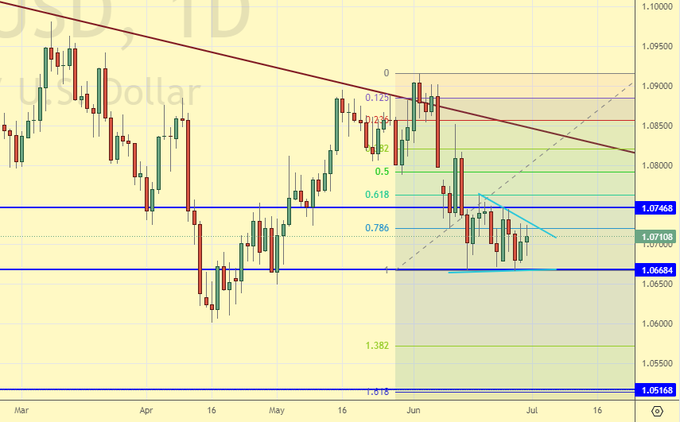

EUR/USD

Growth scenario: bulls may reverse the situation, but until that happens we remain out of the market.

Downside scenario: a downward exit from consolidation is possible. Sell.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.0710). Stop: 1.0752. Target: 1.0260.

Support — 1.0668. Resistance — 1.0746.

USD/RUB

Growth scenario: we consider September futures, expiration date September 19. The level of 89000 is key. As long as we are below it, we do not buy. However, from 74000 we will definitely buy.

Downside scenario: failed to pass above 89000, with very modest successes of sellers during the week. Let’s put a stop order on the open short.

Recommendations on dollar/ruble pair:

Buy: when approaching 74000. Stop: 72000. Target: 100.00.

Sell: No. Those who are in position from 86984, move the stop to 87300. Target: 76000.

Support — 84151. Resistance — 88941.

RTSI. MOEX

Growth scenario: we consider September futures, expiration date September 19. So far, we do not believe in the growth in dollars of the Russian market. Do not buy.

Downside scenario: the convenient situation for sellers has not completely disappeared. Enter short. Expectations of rate hike should bring down the stock prices. If we fall, it makes sense to add to the position on the way down on corrections.

Recommendations on the RTS index:

Buy: no.

Sell: now (115200). Stop: 118600. Target: 99000.

Support — 113040. Resistance — 118060.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.